How To Turn Accounts Receivable Into Cash In 30 Days

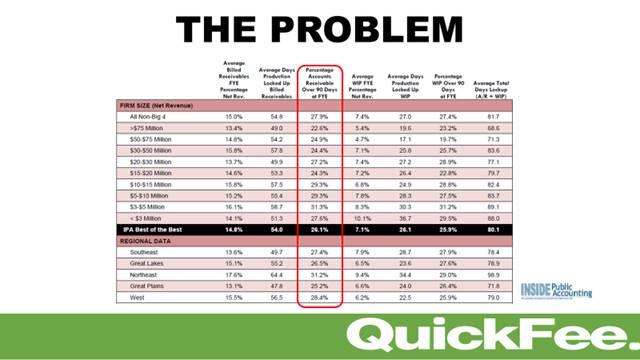

Jeff Brandeis, Chief Revenue Officer of QuickFee, says “cash is king” in any business, not just accounting firms. Unfortunately, it was reported that firms under $3 million in billing had around 30% of their accounts receivable outstanding for over 90 days!

That means you have less money to pay the bills, employees, and grow your company. It’s time to change that.

In this episode of the Growing Your Firm Podcast, David Cristello and Jeff Brandeis discuss:

- What you’re doing wrong with your billing (it’s causing a loss of cash)

- How team members can get involved

- The #1 way to begin cutting down your receivables in the next 30 days

ADDITIONAL LINKS:

“Cash is King”:

Jeff Brandeis works at QuickFee — a payment portal for businesses to collect revenues — helping businesses and firms cut down on accounts receivable.

“Cash is King”, Jeff says. It’s an old saying, but it’s worth repeating when you think about it. Cash pays the bills. You can’t pay your employees with accounts receivable. Not to mention, having more cash in the bank means you have more “soldiers” for growth, as you can deploy your capital into marketing.

Unfortunately, accounting firm owners have resigned themselves to waiting for 90 days to pass before collecting. Your business can’t grow this way.

Inside Public Accounting did a study. It reported that firms under $3 million in billing had around 30% of their accounts receivable outstanding for over 90 days. Out of all firms, the average is close to 26.1%, which is around the same. One-third of the money you earned is floating out there and not in your bank account.

Jeff even sees firms who don’t practice what they preach. These firms teach their clients the importance of cash flow, yet they are twice as worse in their firm.

At QuickFee, Jeff says his goal is to help each client chop their accounts receivable in half. (There will typically always be accounts receivable, FYI). Thus, Jeff shoots for a 15% accounts receivable pattern in the numbers.

If you’re curious about what causes these cash flow problems, that’s what we will cover next.

The Problems Causing Sickely Cashflow Issues:

None of us like to admit having a problem, especially if we’re not collecting the money that is due to us. However, Jeff sees the same problems happening again and again.

The reason most firms have cashflow issues stems from not getting your invoice out the door fast enough. That’s right. We are shooting ourselves in the foot.

Here’s what’s going on: We finish work on a client, we wait 1-2 weeks to send the bill, we draw up the bill, give it to our admin staff, they wait 1-2 weeks to send it out. Then, the client gets it. It sits on their desk for 30-45 days. Then, they forget about the bill or pay it much later. Meanwhile, you are trying to run the business.

In essence, the workflow is the main predictor of accounts receivable issues. Right now, firms average around 66 days to get paid after a project is completed. Jeff works with his clients to get them down to 45 days if not lower.

Another issue isn’t workflow, it’s fear. Fear of actually sending out a bill and getting pushback from the client. None of us like to lose clients. So, every time we send a bill, we pray it’s not the bill that ends the relationship.

Yet, when you think about it, the accounting industry is the most different out of all industries in terms of how we collect fees.

Look at the plumbing business. If you have a leaky pipe, they come to fix it. Then, what do they do in the end? That’s right, they give you the bill to pay ASAP. There’s no delayed payments, no hesitations, just cash in the bank for their plumbing business. Why is it not the same for accounting firms? The bill is part of every service or product.

Why are we timid?

There are a few things to start trying out now so you can turn your accounts receivables into cash.

Give Your Team Members the POWER:

Right now, owners have their sticky fingers in too many pots in firms. One of the big ones is the billing side. It’s not uncommon to see only partners prepare billing sheets and bill out.

Firm owners and partners are busy. They are trying to bring in more business, they’re managing employees and workflow, the list goes on. Guess how far up the priority list is preparing invoices? Very low.

That’s why owners need to start empowering their team members to be able to bill. Not to mention, team members should know the billable rate of the firm, so it shouldn’t be too difficult. If you undercharge one time, it’s not a huge issue. Those small things can be corrected and learned. Leaving thousands if not millions of receivables uncollected is much, much worse.

If you run a ‘fixed fee’ firm, which is becoming more popular, there are zero reasons your team can’t send out bills themselves. Get it off the plate of the owners, it’s a waste of their time and it’s not helping with collections.

Here is the #1 Tip for Lowering Your Accounts Receivable:

The best way to begin lowering accounts receivables is by having the conversation with new and renewing clients. Explain in clear specifics on how you expect to get paid and when they should pay.

DAVID’S TIP:Having these types of conversations during the onboarding process does two things: 1) It’s an easier conversation than having one with a long-time client. 2) You set expectations so there are no surprises.

Some firms put ‘late fees’ on their invoices as a scare tactic to pay on time. Yet, Jeff notices almost 100% of the time, when a client asks for a waiver of the fee when they pay late, it just piles onto the notion that you allow late payments. That’s why, instead of focusing on scare tactics, focus on having those conversations and setting expectations.

Perhaps the best tip of all…

There are so many ways to get paid today — online, ACH, Paypal, and, of course, straight check, and now a payment plan that is financed through QuickFee No longer can we simply wait for a check to get sent. Sometimes clients would prefer electronic payment and in a payment plan.

When you have the flexibility in how you get paid, it makes the sale easier, and it makes it easier to stay paid.

Jeff actually says: If you break up payments into payment plans, you can actually charge more because you can add more services that they need each month. So, in the end, it’s a win-win.

If you’d like to hear more from Jeff and what he does with QuickFee to get you paid, email him at jeff@quickfee.com. Or, call him at 310-584-1141.

RELATED ARTICLES: