A Guide to Choosing the Right Business Accounting Software for Your Small Business

Life as a business owner is not all glitz and glamour. After you’re done keeping the global economy functioning, employing people and creating and delivering a product or service, you still have to sweep the floors, make payroll, and get things done. It doesn’t matter the task, at the end of the day, you’re responsible – even for the less glamorous aspects.

We are going to focus on one of those tasks everyone has to do but no one likes to focus on – accounting software for small businesses like your accounting firm! We’ll introduce you to the plethora of options available to you and give you our recommendation.

What is Small Business Accounting Software?

Business accounting software is built to ensure you record your firm’s accounting data effectively with minimal mistakes and good auditing. Additionally, most accounting firm owners do not want to spend all or most of their time generating their invoices or creating financial reports for their own firm. Enter accounting software. It will help minimize the time spent on invoicing, categorizing, and auditing.

You still need to use the tool properly to get the benefit.

If you’re reading this, you’re probably an accountant. We probably don’t have to sell you on the value of accounting software. You know you need it.

If you’re not an accountant, you may be thinking “But can’t I use Excel for that?”

No. No you can’t.

If you tried to use Excel, you’d be more open to manual errors, complicated formulas, and fraud. Think about it, anyone could edit anything in an Excel spreadsheet and you wouldn’t have an audit trail! Excel is also agnostic and not opinionated about how you should run your business. It’s a blank canvas which doesn’t hold your hand through proper business accounting.

You need a CPA software to run your business properly.

Why Trust Us?

Jetpack Workflow is the leader in project management software for accountants. We work with thousands of accountants in nearly 20 countries and have built up an expertise in the realm.

Moreover, we have personally trained and consulted with over a thousand accounting firms to optimize and improve their workflows from initial lead contact to product fulfillment. In all that time and contact, I’ve seen the tech stack of thousands of firms and can tell you, with absolute certainty, the lay of the land for accounting firms.

We live, breath, and sleep the accounting industry. We know what firms use and we help them choose the tools they need to do the work they need to do.

Who Is This Guide For?

This article is for two main audiences. The first is accounting firms looking to make a switch in business accounting software and solo practitioners looking to establish their practice on a solid foundation.

Let’s dive into a little more detail with each:

- Accounting Firms Looking to Switch: Chances are your firm has 3 – 20 employees and you’re thinking the grass is greener using another platform. Each software is going to have benefits and drawbacks. But each firm is unique too. The challenge is finding the software for your firm where the benefits far outweigh the drawbacks.

- Sole Practitioners: You probably spent some time at the big four and thought “There has to be a better way?” So you left and you started you own firm. Your initial customers were your friends and family. Now, with word of mouth and referrals, you have a nice small business that gives you the freedom to work when you want and where you want. This is probably also your first business and you’d like to get on level footing.

Who We Tested

Quickbooks Online is the standard for online accounting software. It is used by every type of business under the sun – especially accounting firms! Their tagline is “Simple accounting software. Shockingly easy to use.”

Quickbooks Online is a cloud based tool. This means you can access from any computer that has access to the internet. Because it is a cloud based tool, if your customers also use QBO, then you can get access to their account from your QBO account. This is a huge benefit.

Quickbooks Desktop does not live in the cloud, it is only available from the computer it is installed on. This means you must have access to the computer it is installed on to be able to use Quickbooks Desktop.

QB Desktop has some diehard fans in the accounting world. Accounting firm owners swear by it. But, it has quite a learning curve for new users. It also has a number of drawbacks. You can’t really have multiple employees use it to its full capability at the same time. You have to log out to let another employee login and use it.

Despite these limitations, It’s endlessly customizable and complex. Once you know how to use it, you will swear by it but it has limited functions for interacting with your clients.

Sage is another cloud based accounting software for your CPA firm. Sage tends to skew towards larger firms. It doesn’t matter your firm size, the sky is the limit for Sage and the tools it offers. If you’re reading this, chances are that you’re not an enterprise or mid market size. Sage does offer a smaller firm option called Sage for Small Business.

Xero is a relative newcomer and direct competitor to QBO. If you’ve been looking for an alternative to QBO, you’d do well to start with Xero. Xero bills itself as “Beautiful Business and Accounting Software” with a heavy emphasis on the beautiful. If you find QBO clunky, then Xero is probably your choice.

Wave is the free option on the block. It’s perfect for a startup or young small business that doesn’t want to add yet another subscription to their bottom line. While Wave lacks a monetary cost, it generously offers enough features to get the job done. Wave’s target market is entrepreneurs. So, if you’re a solo practitioner reading this, Wave is a good alternative to QBO.

LessAccounting’s tagline is “Accounting Software for business owners who hate bookkeeping!” And who doesn’t hate bookkeeping? We all do! LessAccounting also offers to do your bookkeeping for you if you don’t want to tackle it yourself. This feature certainly helps to eliminate a problem the other’s on this list don’t.

Freshbooks loves to highlight their invoicing capabilities. Generally speaking, every software on this list (except Excel) is going to have some sort of out of the box invoicing option. Invoicing is just too important to ignore for accounting software! But Freshnbook’s invoicing is a step above the others on this list for ease of use. Account receivable suck. If this is a large pain of yours, consider Freshbooks to solve it.

Zoho is the online office suite of tools. Imagine it as an alternative to Google Suite of Microsoft Office. It’s a cheap option that includes a CRM which can be ideal for solo practitioners just getting started. Zohobooks is an addon to Zoho which will help you keep your business finances in order. If you’re already a Zoho users, then this is a great option for you because of how it integrates with the Zoho system.

I can hear you thinking it. “Go Daddy? Is John having a stroke? Doesn’t Go Daddy do domains?” Yes! Go Daddy does domains but they also do bookkeeping. Go Daddy bookkeeping is designed for solo proprietors or single member LLCs exclusively. With that in mind, I’d still look at the solutions above as they were created specifically for your needs, not as an add-on, but exclusively with you in mind.

Excel

Don’t do it. I know you want to! But don’t even think about it. Excel is a wonderful tool. You can literally do anything in Excel. So yes, you could do your business accounting using Excel. But you shouldn’t. Just because you can, it doesn’t mean it’s a good idea.

Excel lacks opinions. It will do exactly what you tell it do and only if you ask it nicely. You don’t want software like that for your business accounting. You want something which is dedicated to business accounting to run your firm’s finances. Use Excel for what it excels at (I know, it’s a horrible joke but I couldn’t resist!) and find an alternative to run your firm’s books.

Our Methodology

We approached reviewing each product listed above using lenses that captured both what pain point they are solving for and where they best delivered.

- Cloud-based

- You want to be able to access your work from anywhere, which is what makes cloud-based applications so useful for small business owners. Cloud-based applications allow you to log in from wherever you have a secure internet connection.

- Expense Classification

- At the core of each tool is the ability to quickly and easily classify expenses. Many of them may classify expenses automatically, allowing you to edit as you need.

- Invoicing

- Being able to get paid? Yeah, that might be a requirement! This functionality should be easy to execute and user-friendly.

- Payments

- Once your invoice is out, you want to make it easy for your clients to pay you. We looked at if the business accounting software offered this and how easy it was so set up and use.

- Multi user interface

- In a practice larger than 1? You might need the advanced functionality of a tool that offers multiple logins at once and different access permissions.

- Simplicity

- Being an accountant doesn’t mean everything should be needlessly complex. Find a tool that is simple to use and doesn’t require a huge amount of time and investment in training and knowledge to effectively run.

- Target firm size

- If you are a larger firm, you might have entirely different needs than a smaller one and vice-versa. Ask your peers for feedback. Look at the support that the tool offers based on your company size.

- Client communication

- A key part of a tool is going to be communicating directly with a client. Ideally, they’d be able to communicate back to you as well, making the experience seamless.

- Integrations

- Take stock of what actions you would need to do accomplish your work. If there are other tools that you use, note them down. See if the tool offers integrations with those tools (or replaces them) to make your job easier.

- Customer management

- It’s inevitable that you’d be managing multiple clients or even multiple clients within a larger client umbrella. The right tool for you should be something that allows you to cateogrize, view and organize customers.

- Document management

- The right document management system should offer a robust security system to protect and secure the data and documents you store.

- Price

- We also looked at the overall pricing of the software to give you a birdseye view of what you might expect.

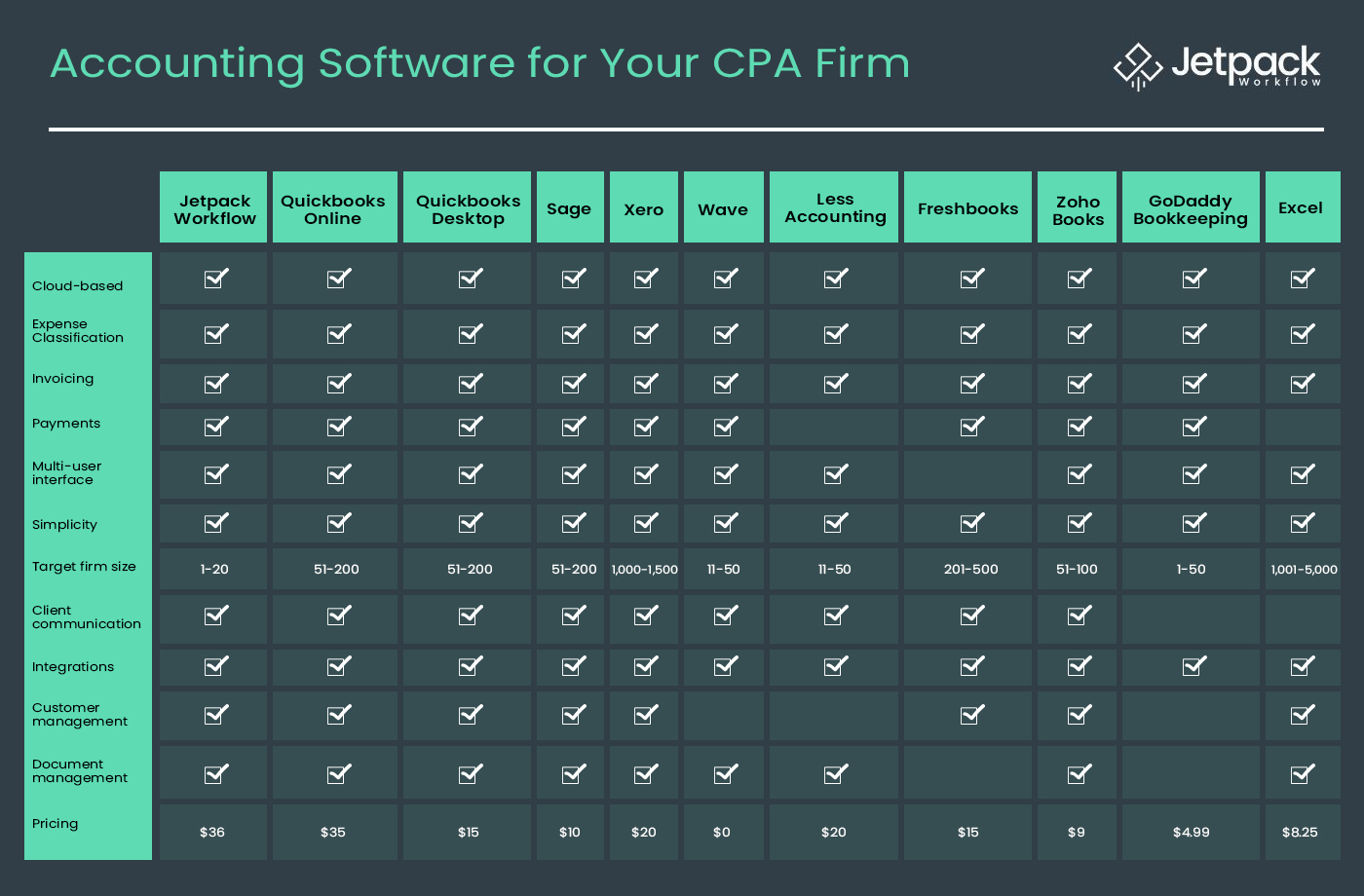

Feel free to use our handy chart for a quick comparison:

Final Recommendation

It should come as no surprise that we recommend QBO. I know what you’re thinking, “But QBO doesn’t include payroll out of the box and you have to pay an extra fee!” or “QBO is not for beginners, the learning curve is too steep!” or “You have to be connected to the internet to use it!”

All those things and more are true. But QBO is still the best. It is the standard in the industry for a reason. No other accounting software package will fit for our readers AND your clients will use it more than any other accounting package. This means, if you are an accounting in 2020, then you need to know how to use QBO. In fact, you should be an expert at it.

Sometimes, it pays to be different, but this is not one of those times. Plus, QBO offers a more robust feature set, integrations, and scalability than any other software package we reviewed.

If you are a growing firm in 2020, then you need to be using QBO. If you’re looking at a tool that can help you streamline your accounting practice workflow as well, Jetpack Workflow is a great option that integrates directly with QBO as well.