A Simple Accounting Policies and Procedures Template for 2024

Does your accounting firm have a policies and procedures manual for your business or your clients? Or have you avoided creating a manual because it requires too much time and involves too many technical details?

There are bookkeeping and accounting business owners who put off assembling a manual and wing it instead. However, not having a defined set of policies and procedures can cause significant problems for your clients and make your work more difficult, especially as your company grows or during client audits.

The good news is you don’t have to spend hours constructing a manual from scratch. You can use a simple template as a guide.

This article will walk you through the essential elements of an accounting policy and procedure manual and provide a template to help you create one for your firm.

Benefits of an Accounting Policies and Procedures Manual

A detailed accounting policy and procedure manual is necessary for all companies, from big corporations to small businesses. Relying on unwritten rules, where perhaps only one or two employees are aware of the policies and procedures, is often a recipe for disaster.

If one of those employees were to leave the firm, they would take all that policy knowledge with them. They might not pass that information along to the next employee, or details may be missed or forgotten if they do train their replacement.

The lack of a reliable policy and procedures manual creates uncertainty and confusion within your team. Policies may be applied arbitrarily and favor one client over another or leave you vulnerable to fraud, accounting mistakes, and unreliable financial reports.

You want everyone in your firm to be in the know and on the same page regarding best practices for managing the business and working with clients. A comprehensive accounting policy and procedure manual accomplishes that and benefits your firm in other ways.

- You’ll know the completion timelines of every accounting task, such as monthly reconciliations, yearly reports, and deadlines for end-of-month closing processes.

- You’ll have written documentation of internal control procedures, which are helpful for internal stakeholders and outside parties such as external auditors during the annual audit periods.

- You’ll have a clear understanding of every employee’s role and responsibilities.

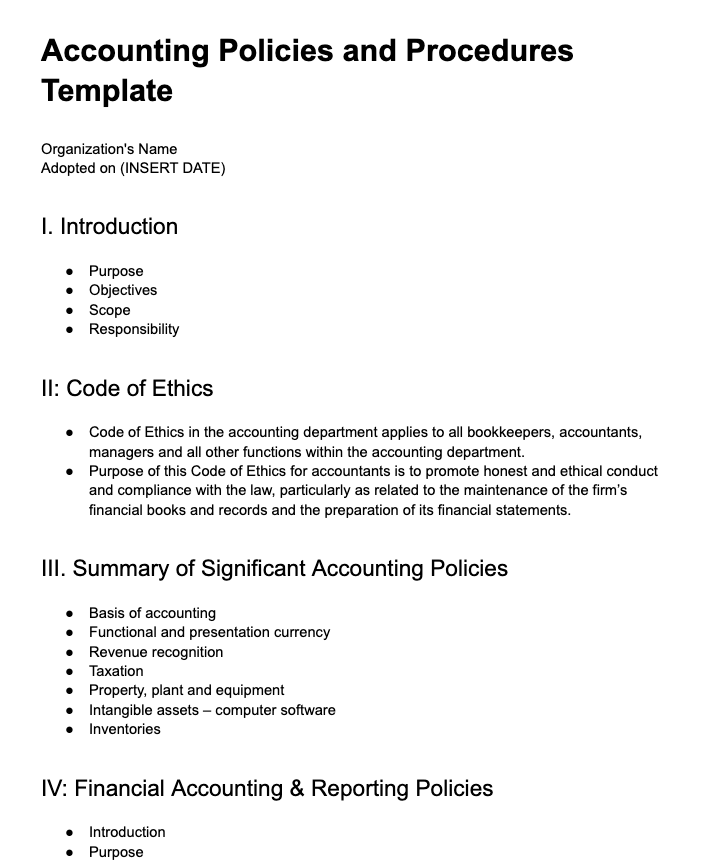

A Free Accounting Policies and Procedures Template

To help you get started on your manual, we’ve got a free accounting policies and procedures template to help outline and streamline your firm’s processes and those of your clients.

Download our free manual template and customize it to meet your needs. After clicking the link, select “File” at the top left-hand corner of the page, select “Download,” and choose your preferred document format.

Accounting Policies and Procedures Template (Google Doc)

Things to Include in Your Firm’s Policies and Procedures

There is no one-size-fits-all accounting policy and procedure manual. Each one varies depending on your firm as well as the industry, size, and general processes of your clients.

However, there are standard items every accounting manual must have, which you can customize to suit your business (or that of your clients).

1. Accounting Manual Components

Although various elements of an accounting procedures manual may differ between organizations, at their core, all will include the components listed here.

Introduction

The introduction outlines the manual’s scope, purpose, and objectives.

Organization and Department Overview

In this section, write a brief description of the organization and list details such as industry, size, and management levels. Then, describe the department in question (e.g., accounting or finance), including its structure, management, and responsibilities.

Accounting Policies

There are two main topics to cover in this section. First, explain the core accounting processes of the organization as well as the interactions within its accounting sub-processes. Second, detail the required accounting resources, such as accounting software and the minimum number of employees in the department.

Chart of Accounts

In this section, you’ll list the company’s general ledger account names and numbers. This written record enables you to easily assign and maintain the company’s chart of accounts, which helps you eliminate duplicates while controlling a large volume of accounts.

The chart of accounts also ensures consistency in your general ledger structure, cost collection, and financial reporting.

2. Accounting Procedures Components

In this section, you detail the core steps of the organization’s accounting cycle. Since the accounting department may contain several sub-departments, each division must document its processes and procedures for every sub-process in the accounting cycle.

Fiscal Policy Statement

A fiscal policy statement outlines an organization’s financial practices and procedures. It generally includes information about budgeting, accounting, investments, cash management, borrowing, and reporting. The fiscal policy should be tailored to the organization’s specific needs and consider its operations and strategic objectives.

Financial Reporting

This section explains how the company expects its team to handle accounting transactions during the normal course of business. It provides a framework for tasks such as data entry into the accounting system, transaction processing, and steps taken to assure the accuracy and reliability of financial reporting.

Closing Periods

Every accounting cycle has accompanying closing processes, the primary ones being end-of-month and year-end closing processes. This section details when these periods end, the closing processes, deadlines for the closing periods, and required reports.

For instance, end-of-month closing is work performed at the end of a posting period. On the other hand, year-end closing includes an annual balance sheet, profit and loss, and cash flow statement, all generated in compliance with legal and reporting standard requirements.

Budgeting

Describe your budgeting processes, such as preparing the annual budget, the role of the budget committee, and the budget period length.

Tax Filing

Detail the applicable tax regimes for the organization, the filing process, and the unit heads responsible for the filing process. This section also describes the components of the company’s income tax (e.g., what comprises its current taxes and deferred taxes).

Revenue

In this section, you’ll define the types of revenue sources for the organization, the recognition, and the measurement.

Cash

Explain the processing of cash receipts, banking of cash, cash disbursements, expense allocations, accounts transfers, and account reconciliations.

Assets

This section sets out procedures for handling assets, such as the acquisition, transfer, retirement, and disposal of assets like property, equipment, and bonds in the organization.

In addition, it specifies the duties of departmental or unit managers regarding fixed asset management, control, accounting, and record keeping. Plus, it provides criteria and guidelines for the initial recognition of fixed asset capitalization.

Payables

Detail payments made by the company to vendors, employees, statutory bodies, and all other external parties in this section.

Credit Control

Document the processes and procedures to follow that ensure the collection of accounts receivable in a timely, fair, and cost-effective manner.

Inventory

In this section, you’ll define the type of inventory the organization carries. Examples include assets held for sale in the ordinary course of business, assets currently in production for such sales, or assets in the form of materials or supplies consumed in the production process or the rendering of services.

Payroll and Personnel Records

When completing this section, be sure to identify key tasks, including:

- Required personnel documents and proper storage.

- Correct payment of salaries for time or overtime worked.

- The proper statutory and other salary deductions.

- Accurate charges of labor costs to the appropriate cost center.

- Internal control over labor costs by division of duties and reconciliations.

General and Administrative

General and administrative (G&A) procedures help ensure the efficient and effective management of the organization. These include budgeting, hiring, training, financial analysis, and strategic planning, in addition to others specific to your organization.

Need Help Managing Your Firm’s Tasks and Projects for Clients?

Tired of spending endless hours manually creating and building workflow and process templates for your firm?

Simplify your workload with our collection of 32 customizable accounting workflow templates and checklists.

This free resource includes a ton of the most popular accounting templates including monthly bookkeeping, weekly accounting analysis, client onboarding procedures, and common tax return forms.