A 10-Step Checklist for Starting a Bookkeeping Business

You’re an expert bookkeeper ready, willing, and able to help other businesses keep their accounts in balance.

However, before you begin tracking client transactions, you need to build the foundation of your own bookkeeping business. That requires several steps, including filing the proper permits, calculating your rates, and attracting your first clients.

After interviewing dozens of successful bookkeepers and firm owners on our podcast, Growing Your Firm, we know what it takes to launch a new bookkeeping business. Drawing from their practical tips and suggestions, we created this helpful step-by-step checklist to get your bookkeeping venture up and running.

Step 1: Choose Your Target Market

First, narrow down your target market and the types of clients you plan to serve. Doing so helps guide the rest of the setup process and how you plan to operate your business. It informs which bookkeeping services you offer and how to market yourself.

Here are a few things to consider when selecting your target market:

- What’s your area(s) of expertise?

- What are your existing skills?

- What are the demographics of your local market?

- What are the growth prospects of your desired market?

- What types of clients do you enjoy working with?

Limiting who you work with by niching down may sound counterintuitive when launching your business. However, it allows you to hone your skills in your area of expertise and focus your attention on the clients you’d like to serve.

Over time, you also build credibility with that specific type of client and distinguish your bookkeeping business from others in your area.

Step 2: Form an LLC

Make your bookkeeping business official by forming a limited liability company (LLC). Other legal business structures you can use include a sole proprietorship, a partnership, or a corporation, but an LLC is typically one of the most common for bookkeepers.

Among the many benefits of forming an LLC is that it establishes your business as a separate legal entity and offers liability protection for your personal assets.

As a result, if your business makes an error for a bookkeeping client or is found liable for some wrongdoing, creditors can only target your business assets.

Plus, the LLC membership and management structure is flexible, so it’s easy to scale and add employees or new members as your business grows. Operating as an LLC may give your business more credibility with prospective clients than a sole proprietorship or partnership.

To make your bookkeeping business an LLC, these are the essential steps to complete:

- Choose the state where you’ll form your LLC, which doesn’t necessarily need to be the state where you do business

- Select a name and registered agent for your LLC

- Create an LLC operating agreement

- File LLC formation documents with the proper Secretary of State’s office

Step 3: Get Applicable Business Licenses, Permits, and Banking

On top of forming your LLC, there’s some additional administrative paperwork to handle before opening your doors. This step can be tedious, but ensuring you’re operating as a legitimate business is vital.

Check with local and state guidelines to see whether you must file for a business license. This requirement can vary depending on your location.

You technically don’t need specific credentials or a certain level of education when offering bookkeeping services.

However, if you have a professional certification or license (e.g., certified public bookkeeper), make this known to potential clients to demonstrate your skills and expertise.

You should also set up a business bank account to separate your personal and business finances. The bank you use for your personal accounts may offer business banking services.

You can also shop around to see which bank offers better options to support your operations, like business credit cards or small business loans.

Step 4: Decide Where You’ll Set Up Shop

Where will you run your day-to-day operations?

A home office could keep start-up costs low. When you need to meet with clients, you can choose a setting you both prefer, such as a virtual meeting or at their place of business.

If you’d prefer not to work from home, consider sharing an office with other professional service providers or coworking spaces.

As you expand and add more employees, you could hire remote workers or find a workplace with room to accommodate your growing team.

Initially, where you decide to run your business will likely depend on the startup costs you’re willing to invest. If you’re bootstrapping operations and want to invest more in your client acquisition and software programs, maybe a home office is the safest bet.

Once you begin onboarding clients and generating cash flow, you can reassess your working situation to determine whether renting another type of office is affordable.

Step 5: Get Bookkeeping and Business Software

Before you start on client work, be sure you have the proper bookkeeping and business software to help you manage your client-facing and back-office tasks effectively.

First, your business needs bookkeeping software like QuickBooks Online or Xero to manage clients’ books. Both are popular options for small and large businesses, though plenty of alternatives are available.

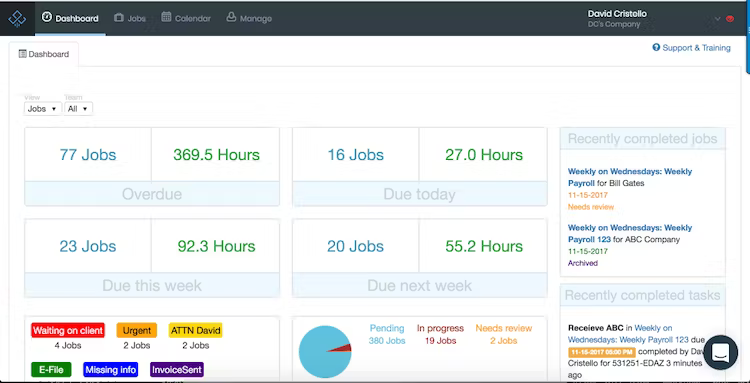

A bookkeeping workflow and project management tool like Jetpack Workflow can help standardize client work and automate critical deadlines.

When overseeing a team, this can be especially beneficial since it gives you visibility over what each team member is working on and what still needs to be done before a deadline arrives.

Consider other software options like an invoicing app to make client billing easier or a file-sharing app to collect and manage client documents and e-signatures.

As your client roster grows, a dedicated customer relationship management (CRM) tool could help you manage client relationships and nurture prospects to keep your pipeline full.

Step 6: Standardize Your Workflow Processes

Client bookkeeping typically requires completing recurring workflows and tasks. Standardizing these processes with custom templates can help you be more efficient.

It lets you spend less time on tedious and repetitive administrative tasks and focus your energy on billable client work.

Building your own custom workflows and process templates is very time-consuming.

Instead, check out our 32 free pre-made accounting workflow templates for standard bookkeeping projects and tasks to keep you organized and on track.

Step 7: Work Out Your Pricing Model

It can feel intimidating to set the initial prices for your bookkeeping services.

You want them to be high enough to cover your overhead expenses and earn a profit and reasonable enough for potential clients to start working with you.

In our guide on how to price bookkeeping services, we looked at how you could price your services to maximize revenue.

You can choose from a few pricing models for your services: hourly, a per-project rate, or tiered service packages.

Whichever pricing model you choose, consider these points as you set your exact rates:

- What are your overhead costs?

- How big are your clients’ businesses?

- What types of services and value do you offer?

- How much time does it take to complete client work?

- What’s your experience level and expertise?

- What’s the average market rate your competitors or other contractors charge for similar services?

We spoke about bookkeeping pricing with Meryl Johnston, a chartered accountant and founder of the bookkeeping business Bean Ninjas, on our Growing Your Firm podcast.

She shares how a recurring revenue approach can be a great model for earning predictable monthly revenue and keeping work levels consistent throughout the year.

Step 8: Build Your MVP Marketing Funnel

Just because you’re open for business doesn’t mean clients immediately come knocking at your door.

You need a strategy for attracting potential clients in your target market and effectively demonstrating the value you offer them through your services.

Building a solid marketing funnel helps generate interest in your business and grow your client roster. That means identifying your value proposition or minimum viable product (MVP).

Essentially, your MVP is what you can promise your clients if they work with you. It drives the rest of your marketing efforts and helps you connect with your target market.

You should have a professional-looking website that interested small business owners can visit to learn more about you and your services.

Your site can highlight your expertise and offer free value with bookkeeping tips. You can also nurture prospective clients through an email list where you send relevant content to your contacts throughout the year.

Be sure your mission and value proposition are clear in your messaging and marketing materials. Always include a call to action (CTA) or a simple way for interested leads to contact you for further information.

For more guidance on expertly advertising your services, check out our in-depth guide on effective strategies for marketing a bookkeeping business.

Step 9: Mine Your Network for the First 10 Clients

Often, the first clients for a new business come from within your network.

That’s because you’ve likely already built some level of trust with one another, so you don’t have to spend as much time and resources converting them into a client.

Josh Bauerle, founder of CPA on Fire, offers evergreen insights on his Growing Your Firm podcast episode on getting the initial clients for your new business. He attracted his earliest clients by tapping into his network of other business owners.

When taking this approach, you don’t want to be too pushy and damage the professional relationships you’ve built.

However, you can still assess who in your network falls in your target market and inform them about your new business and services.

Based on their current needs, they can decide whether they’re interested. If they don’t need your services, they may know of someone else who does and refer them to you.

Once you’ve onboarded your initial clients, we have an in-depth guide with helpful tips on getting more clients for your business.

Step 10: Build a Presence in Online Communities

Building an online presence offers several benefits as your bookkeeping business grows. It lets you showcase your expertise and can be a great source of client acquisition.

This step ties into your overall marketing strategy.

You can use your presence in online communities or social media to generate interest in your firm and connect with potential leads in your target market.

Meryl Johnston drove this point home during her interview on our podcast. She explains how being part of several paid communities and Facebook groups helped her expand her network and grow her client base significantly.

Try joining groups within your target market and with other business owners in your field.

Actively participate in these communities; interact with and educate others to build genuine relationships.

Instead of immediately offering your services, focus on relationship-building because that’s how you convert contacts into clients over time.