Process Sheets for Accountants & CPA Practices

This article was originally published July 7, 2015. We have updated some of the language and graphics for the newer edition of the article.

—-

This week, we’re throwing it back to 2015 with an oldy-but-goody article, video, and free downloadable for creating your own process sheet for your firm.

The importance of having a process sheet? It gives you control and transparency over all of the recurring work items, jobs, or projects that you have to track inside of your firm. The process sheet is a simple way to see some of the stats, tasks, dates, and labels or statuses inside of a client job.

Want to download your own version of the free process sheet? Click here to make a copy of your own in Google Sheets.

Travel back in time: In this video, David offered an overview of the process sheet recommendation.

Walkthrough of the Process Sheet

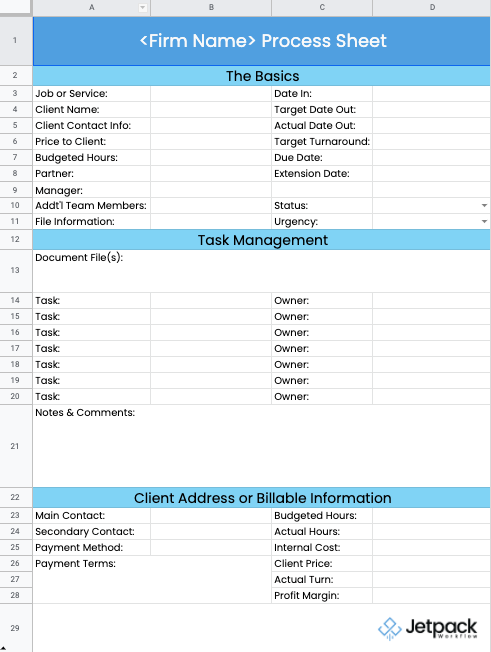

The Basics

At the top of the process sheet are foundational elements: the job name, client name, client contact information, and price to client. Note: The “price to client” is the external price.

Then, there are budgeted hours, which are tracked internally so you can understand your profit margin afterwards.

Next are the partner review, manager review, and space for any additional team members. David’s suggestion is to ask for initials in these sections.

Get everything you need to manage projects and meet deadlines.

Subscribe to our weekly newsletter, and get 32 free accounting workflow templates today!

sign me up!

These next pieces are critical to helping you track turnaround time, a metric that helps you to optimize your internal efficiency and to evaluate how well your process is doing. The pieces in this section include date in, target date out, actual date out, target turnaround, due date, and extension.

Example: Your turnaround time is 15 days. So in the Target Turnaround space, you’d write “15 days.” The Date In would be the first of the month, then Target Date Out would be the 16th.

The final lines include the Due Date for the project and an optional Extension Date, in case the project involves taxes with an extended deadline.

Status and Urgency

For the Status section, you can define whether the project is Reviewed, Needs Review, In Progress, or Waiting on Client.

Urgency can be categorized in a 1, 2, 3 scale like red, yellow, green.

Task Management

In this section, you can link out to any other systems you use for tracking relevant documents. If you don’t use a separate task management system, you can also use this space for recording tasks and owners for each task.

Client Address or Billable Information

In this final section, collect the billing information for your client and any notes on specific payment terms for the client. It’s also the place to track billable hours from Budgeted to Actual, the Internal Cost, Client Price, Actual Turn, and the resulting Profit Margin.

How to Choose Your Metrics

There are some important points about how the process sheet was put together. First, whether you’re tracking tax returns, bookkeeping, general accounts, or payroll inside your accounting firm, it’s important to define the metrics that you will optimize for. These metrics are critical for running a successful firm or practice.

Turnaround Time and Profitability

In the video, we chose to optimize around turnaround time and profitability. As an accountant, these are two critical metrics to keep in mind. Turnaround time helps us determine how well we operate internally via the systems and processes we have in place.

The profit margin helps us determine if a firm is financially on the right track.

Possible Third Metric

Some firms also want to add a third metric centered around team and/or client satisfaction. We recommend using a variation of the NPS (Net Promoter Score) inside your firm. Every month or quarter (you can also do it once or twice yearly, depending on how many new clients come in), you can send out a quick 30-second survey on how likely your customers are to recommend others to your accounting firm or practice.

The Foundation

When setting up a process sheet, the foundation is an important component for your accounting practice (example of a 1040 process sheet here). You’ll notice David highlights the target turn vs. actual turn, as well as budget hours. This is helpful when determining staff and team schedules. Reviewing the report will help us understand capacity and profitability better.

Whether you’re looking to create your first process sheet or improve the one you currently have, building out the systems and processes in your accounting firm or practice will help you maintain quality control over your product. Your product, or service delivery, drives referrals, word of mouth growth, and profitability.

Optimize More Processes In Your Firm

Want more ready-to-use templates to make your firm run more smoothly? Download our free 32 workflow templates, and automate more of your business so you can spend more time getting stuff done for your clients and less time reinventing the wheel.