Free Bookkeeping Templates (Excel, Google Sheets & PDF)

Every small business needs accurate, reliable bookkeeping, but setting up a system from scratch can feel overwhelming.

That’s why using pre-built bookkeeping templates is such a game-changer.

They allow you to manage finances, keep records organized, and save time without reinventing the wheel. Whether you prefer Excel, Google Sheets, or printable PDFs, ready-to-use templates can simplify your workflow and reduce errors.

This guide provides free bookkeeping templates, including pricing, agreements, proposals, workflows, and invoices, so you can focus on growing your business instead of struggling with financial paperwork.

Free Bookkeeping Pricing Template

Below you’ll find a free bookkeeping pricing template to assist you in streamlining your bidding process. You can access the Google Sheets version of the template here. Note that the cells highlighted in yellow should be updated with your firm’s pricing.

Bookkeeping Pricing Template

| Payroll Processing | |||

| Service | Number | Price Per | Annual Total Cost |

| Base Rate | 1 | $100.00 | $100.00 |

| Number of Employees | 26 | $2.50 | $65.00 |

| Total Price Per Payroll | $165.00 | ||

| Payroll Processing | |||

| Service | Number | Price Per | Annual Total Cost |

| Weekly Payroll Processing | 52 | X | $0.00 |

| Biweekly Payroll Processing | 26 | $165.00 | $4,290.00 |

| Semi-Monthly | 24 | X | $0.00 |

| Monthly | 12 | X | $0.00 |

| Quarterly | 4 | X | $0.00 |

| Annual Payroll Processing | $4,290.00 | ||

| Monthly Bookkeeping Services | |||

| Service | Number | Price Per | Total Cost |

| Bank Account Reconciliation | 2 | $75.00 | $150.00 |

| Credit Card Reconciliation | 2 | $75.00 | $150.00 |

| Journal Entries | 5 | $15.00 | $75.00 |

| Financial Statement Preparation | 1 | $150.00 | $150.00 |

| Monthly Phone Support (Hours) | 5 | $100.00 | $500.00 |

| $0.00 | |||

| Total Monthly Charge | $1,025.00 | ||

| Quarterly Bookkeeping Services | |||

| Service | Number | Price Per | Total Cost |

| Sales tax Return | 1 | $250.00 | $250.00 |

| Payroll Tax Return | 1 | $300.00 | $300.00 |

| Total Quarterly Charge | $550.00 | ||

| Annual Bookkeeping Services | |||

| Service | Number | Price Per | Total Cost |

| Coordination with CPA on Tax Prep | 1 | $500.00 | $500.00 |

| Workers Compensation Audit | 1 | $350.00 | $350.00 |

| Total Annual Charge | $850.00 | ||

| Total Annual Charge | $19,640.00 | ||

| Monthly Flat Fee | $1,636.67 | ||

| Discount | 0% | ||

| Adjusted Total Annual Charge | $19,640.00 | ||

| Adjusted Monthly Flat Fee | $1,636.67 |

Free Bookkeeping Service Agreement Template

The template below is also available as a Google Doc. Please note that the template is provided for illustrative purposes and should not be construed as legal advice.

Bookkeeping Services Agreement

This contract is entered into _____________________ by _________________ (“Bookkeeper”) and ____________ (“Client”). This contract will be effective as of ______________.

The Client and the Bookkeeper (“Parties”) agree to the following terms and conditions for the Bookkeeper’s services. The Bookkeeper will remain an independent contractor and will not be considered an employee of the Client.

1. Services To Be Rendered

The Bookkeeper agrees to provide the following services:

- Accounts Payable

- Accounts Receivable

- Bank Reconciliation

- Bill Payment

- Budget Preparation

- Detailed General Ledgers

- Financial Statements

- General Bookkeeping

- Payroll

- Other: ________________________

2. Fees

The client will pay fees for the services above:

- Fixed Amount:$__________

- Monthly Retainer: $_________ per month

- Per Hour: $_____ per hour

3. Client Cooperation and Obligations

The Client will be responsible for providing all the necessary documentation and accounting system access necessary to perform the services outlined in the bookkeeping agreement above. The Client acknowledges that the accuracy of financial information provided is the sole responsibility of the Client, and the Bookkeeper will be held harmless from any liability resulting from the inaccuracy of the financial records provided by the Client.

4. Confidentiality

The Bookkeeper understands that all information provided by the client is sensitive personal and financial information. The Bookkeeper will maintain the strictest level of confidentiality regarding such confidential information. This confidential information will include financial documents, information contained in accounting systems, and information provided orally by the Client. The Bookkeeper will not disclose any information to any third party without the prior written consent of the Client.

5. Termination

- Terminated by Both Parties Period. By providing the other party at least ____days’ written notice.

- Terminated by Client ONLY. By providing the Bookkeeper ____ days’ written notice.

- Terminated by Bookkeeper ONLY. By providing the Client ____ days’ written notice.

Payment of any outstanding invoices is due immediately upon termination of this contract by the Client.

6. Dispute Resolution

All disputes under this agreement shall be settled by binding arbitration in the state under which the agreement was entered into. The arbitration may be commenced at any time by either party and will commence when written documentation is provided to the other party. Any payment awarded by the single arbitrator will be considered binding under this agreement and create a legal obligation for the Party to pay.

7. Limitation of Liability

In no event shall either party be liable to the other party for any damages, including without limitation, business interruption, loss of or unauthorized access to information, damages for loss of profits, incurred by the other party arising out of such services provided under this agreement, even if such party has been advised of the possibility of such damages. In no event will neither party’s liability on any claim, loss, or liability arising out of or connected with this Agreement shall exceed the amounts paid to the Bookkeeper during the period immediately preceding the event giving rise to such claim or action by the Client or the limits of the Bookkeeper’s professional liability policy, whichever is greater of the errors and omissions policy that is in place.

8. Acceptance

The signatures below indicate entire agreement and the Parties entering into this contract.

______________________________ __________________

Bookkeeper Signature Date

______________________________ __________________

Client Signature Date

Free Bookkeeping Workflow Template

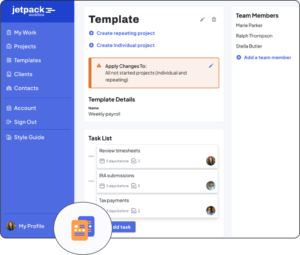

Beyond just bookkeeping, templates can simplify tracking of all your recurring projects, from tax audits to financial health assessments. Jetpack has made it easy to get started with workflows by giving you 32 workflow templates here for free. This package includes bookkeeping, tax engagements, audits, and financial statement compilation checklist templates that will help you standardize your projects in no time. By implementing standardized project procedures, your team will clearly understand the expectations, timelines, and budgets. A well-made workflow template doesn’t need to be a budget buster, and once implemented, can preserve resources for your firm, helping you scale to the next level of growth.

Free Bookkeeping Proposal Template

Below is a sample template. You can also find a standalone copy of the sample proposal here.

(Insert Name)

(Insert Street Address)

(Insert City, State Zip Code)

(Insert Phone Number)

Dear (insert name),

It was so nice meeting with you last week to discuss your new business venture. You’ve found a great location for your new restaurant, and I’m sure your decade of restaurant management experience means you will find success.

While you are running your business, we’ll be setting up your books and ensuring your records are kept up to date. Our goal is to manage your bookkeeping so you can free up your time to manage your business. We will be updating your books on a weekly basis, running your payroll, preparing sales tax returns, and providing quarterly financial statements.

We want this process to be seamless and stress-free for you. We will use online access to your QuickBooks file and receive your bank statements directly from the bank.

Thank you for the opportunity to bid on your bookkeeping work. We would welcome the opportunity to help you grow your business!

Sincerely,

(insert name(s))

Our Services

Included in our initial proposal are the following services:

- Initial setup of your general ledger and recording of your start-up expenses, including build-out for the restaurant.

- Payroll processing for up to 15 employees, including direct deposit of paychecks and manual checks when necessary.

- Monthly bank reconciliation for your two bank accounts and credit card. We require you to allow direct bank feeds from your financial institutions and allow us to access your statements.

- Quarterly financial statements and meetings to review variations from prior quarters

- Quarterly sales tax return preparation and submission

- Coordinating with your tax preparer

- Two hours of meetings or phone consultations

Cost Summary

Initial Setup: $(insert here) The initial setup includes the preparation of your general ledger and a review of expense accounts. We will also review initial expenditures outside of the business accounts to ensure all start-up expenses are properly categorized. This stage also includes payroll setup, assistance registering with taxing authorities, and meetings as necessary. Ongoing Monthly Fee: $(insert here) The ongoing monthly fee includes the services listed above for the next 12 months. After 12-months we will assess our fees. Any significant change to the number of accounts, employees, or transactions may result in an earlier reevaluation of our monthly fee. Additional Services: $(insert here)/hour For services rendered outside of the items outlined above, we will bill at our standard hourly rate, which is listed above.

Acceptance

By signing below, you are accepting the terms and conditions outlined above. Any changes to the agreement must be in writing and accepted by both parties. Bookkeeping Service Start Date: (insert date here) ______________________________________ (Insert Name) ______________________________________ Date ______________________________________ (Insert Name) ______________________________________ Date

Free Bookkeeping Invoice Template

To get you started, Jetpack Workflow created a bookkeeping invoice template for you to use and adapt for your needs. You can insert more lines in the template if you need to add additional services. You can also find this invoice template as a Google Sheet to download here.

Tips for using Jetpack Workflow’s printable bookkeeping templates

Pick the Right Template for Your Business

Every business has different financial needs, so the first step is choosing a bookkeeping template that fits your situation. For example, a freelancer might only need a simple bookkeeping spreadsheet to track income and expenses, while a small business with employees may require a payroll-ready template. Selecting the right tool from the start helps avoid confusion and ensures you’re capturing the right financial data.

Customize for Accuracy

Templates are a great starting point, but they must be adjusted to match your unique business operations. Update category names, adjust tax rates, and add any specific fields you need to reflect your industry. By tailoring the spreadsheet to your exact requirements, you’ll ensure that reports and records are accurate and relevant.

Use Consistent Formats

Sticking to a single format—whether in Excel, Google Sheets, or PDF—makes your bookkeeping process easier to manage. Consistency ensures that your data is easy to read and share with accountants or business partners. It also reduces the chances of errors when transferring figures between different files.

Schedule Monthly Reviews

Bookkeeping works best when it’s done regularly, not just at year-end. Using a monthly bookkeeping template allows you to reconcile accounts, review expenses, and track revenue trends every month. This habit helps you spot discrepancies early and stay financially prepared for tax season.

Integrate With Your Workflow

Templates should fit seamlessly into how you already manage your business. Whether that means syncing with accounting software, saving files in the cloud, or sharing access with your accountant, the goal is smooth collaboration. Integration saves time and ensures your financial records remain up-to-date without extra manual work.

Need Help Managing New Client Projects?

A workflow management system is a great way to keep your bookkeeping firm organized and running efficiently. By automating tasks and keeping track of deadlines, you can be sure that nothing falls through the cracks and your clients are always getting the best possible service.

In addition, a workflow management system can help you to allocate resources more effectively, ensuring your staff is always working on the most important tasks. Ultimately, a workflow management system can save you time and money, making it an essential tool for any bookkeeping firm.

Jetpack Workflow was designed from the ground up with bookkeepers and accountants in mind. The cloud-based workflow management system allows you to start with predefined templates, customize them for your firm, and track progress on all your work.