Free Workflow Diagrams and Process Sheets for Accountants

Managing recurring client work can be a challenge! Fortunately, free workflow diagrams and process sheets help keep everything in place. Whether you’re an accountant, bookkeeper, CPA firm owner, or a service practice director, these tools and tactics will help you become more productive and profitable. In this post, we’re going to outline the basic foundation for each, as well as provide links for tax returns, bookkeeping, payroll, general accounts, and much more.

With any workflow diagram or process sheet, whether it’s for tax returns, bookkeeping, payroll, or any other process you wish to track, it’s important to outline critical milestones with the service or job you’re tracking.

Let’s cover some of the basic requirements for a workflow diagram, then cover some basics for process sheets.

Workflow Diagrams

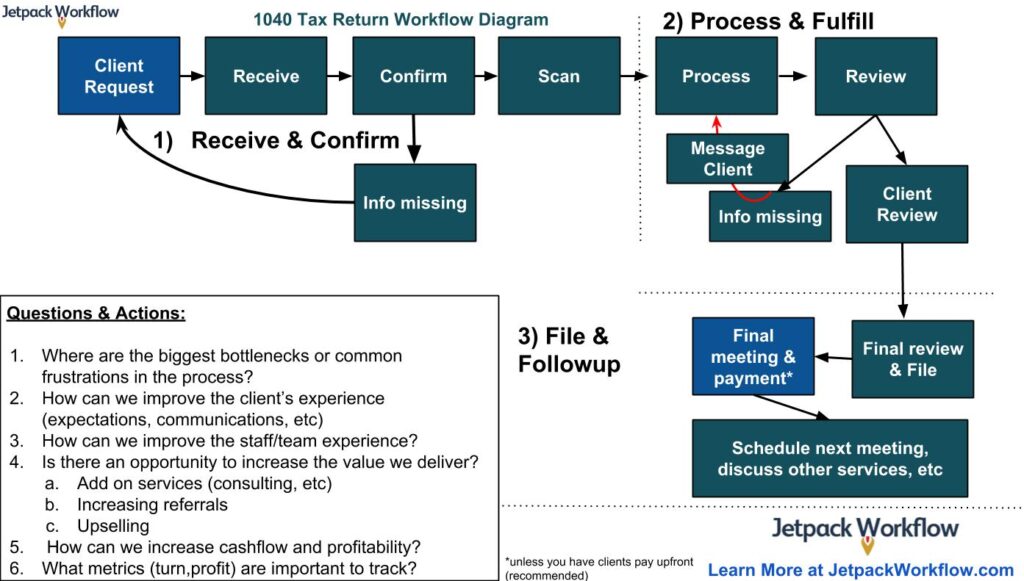

Workflow diagrams, like a spreadsheet, can be as simple or complex as you wish for them to be. A basic workflow diagram will cover the progression of each step, and where applicable, areas where a divergent action might occur. For example, if you’re tracking an individual, 1040 tax return in the United States, you might include a step for “When the client properly submits all work” vs “Client doesn’t submit all work”. This is a very common case, so identify these decision points are critical for properly setting up a robust workflow.

Below is an example of a simple, tax return workflow.

Goals of the Workflow Diagram

Often inside an accounting firm or CPA Practice, getting the workflow diagram setup is the first step. We always recommend including your team in this process, as they can help identify and list steps that might be missing (after all, they’re the ones on the front lines!).

After you have the workflow in place, now it’s time to determine what the goal of the workflow is, and how you’re going to measure success.

For example, your goal may be to deliver a tax return within X days, for Y price, without bottlenecks and confusion.

Metrics for success:

- Target turn around (example: 14 days)

- Target profit margin (XX%)

- Team satisfaction level (at least X out of 10)

- Client experience and overall satisfaction

It’s important to define goals and metrics around your workflow so that you continue to define your process, and ultimately deliver a high quality product (in this case, a return) to your clients.

Get everything you need to manage projects and meet deadlines.

Subscribe to our weekly newsletter, and get 32 free accounting workflow templates today!

sign me up!

How to create your first workflow

This is a common question for those looking to systemize their service. In terms of starting out, we recommend listing out all the steps in a google document or on a white board (or even just pen and paper!). The goal is to list the steps and understand how work moves through your office (whether it’s virtual or brick and mortar!). Only then can you identify parts that can be improved, eliminated, enhanced, or added.

Here’s a brief video on how to create a proper workflow diagram for your accounting firm:

Here are links to more information on workflow diagrams and examples

Mastering the Process Sheet

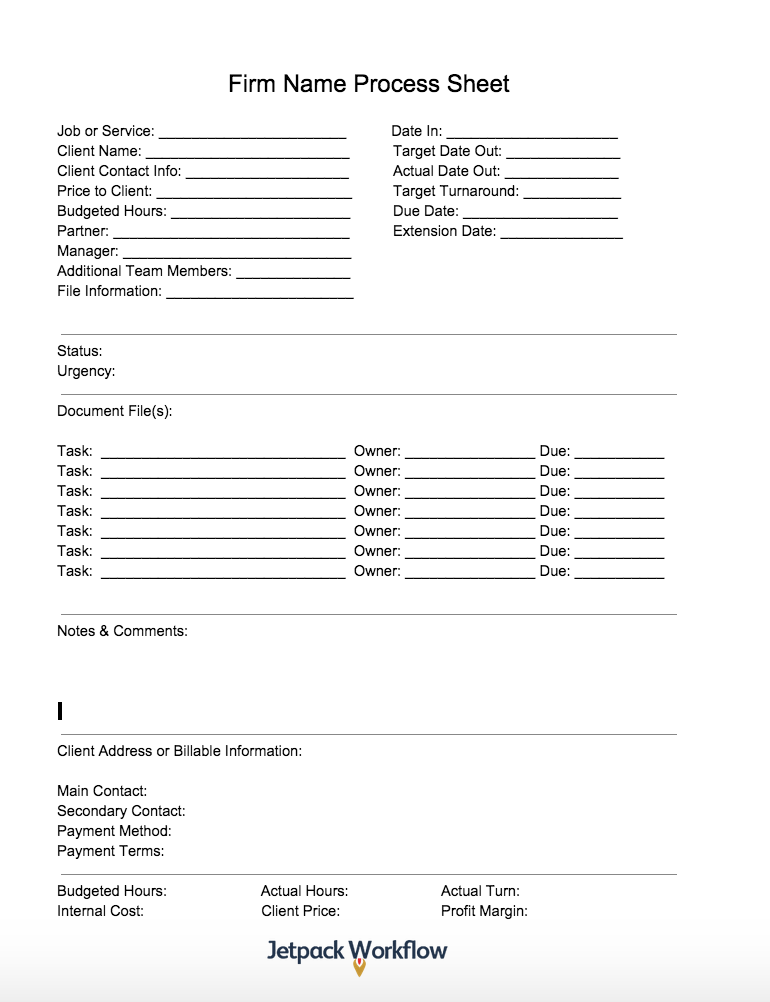

While the workflow diagram helps you understand the steps from a high level, the process sheet was designed to help implement, complete, and track the actual work (of course, I recommend you use workflow software to track your recurring client work!). A process sheet can be very useful in terms of helping you define the steps, metrics, and parties involved. But after that is complete, I highly recommend using a practice management software or client management system!

In terms of creating a process sheet, here are a few important things to keep in mind:

- What metrics are we going to track to help us determine if the job was successful or not

- Turnaround time

- Profitability

- Date Payment received

- Which steps can be removed, enhanced, combined, or added?

- Is there a part of the process where the client feels like or confused?

Whereas the workflow diagram is high level, the process sheet is a great tool to help accountants really dive into the specifics that go into completing that job. Additional information to track might be things like: What are the status we want to track? What’s the estimate hourly time per task? What’s the hourly budget for the job? How can this help us track firm KPI’s as well as assist in team scheduling?

Ultimately, I recommend picking one service of which you want to run through this process with. I recommend a service which either brings in the majority of the revenue (there’s typically one that accounts for the large majority), one that happens most frequently, the most time consuming one, or one that causes the most frustration (and yes, typically one does fit the entire criteria!).