Free General Ledger Template (Excel & Google Sheets)

Every business needs a reliable system to track financial transactions. A general ledger template offers a structured way to record debits, credits, and balances across different accounts.

Instead of building a spreadsheet from scratch, you can use a free download that is ready to go in Excel or Google Sheets.

With a general ledger in place, you can see how money flows in and out of your business.

It becomes the central hub for all accounting activity, giving you the clarity needed to prepare reports, monitor profitability, and make better financial decisions.

In this article, we’ll provide a template to get you started and walk you through everything related to the general ledger.

Download This Editable General Ledger Template

To help you get started quickly, we have included a downloadable template in multiple formats:

Why Use a General Ledger

The general ledger is often called the backbone of accounting.

It summarizes all journal entries and organizes them into accounts for assets, liabilities, equity, revenue, and expenses.

Using a pre-built template saves time and ensures accuracy and helps with:

- Consolidation of data: All transactions live in one place.

- Error detection: Easier to identify mistakes when accounts do not balance.

- Historical record: Keeps an ongoing financial story of your business.

- Decision support: Helps analyze cash flow and profitability.

A general ledger sheet makes financial tracking manageable whether you run a small business or handle accounts for a larger organization.

How to Create a General Ledger

Using the template is straightforward, but there are some best practices to follow for accuracy. Here are the main steps.

Step 1: Download the Template

Start by downloading the general ledger template for Excel or opening the Google Sheets version. This provides the structure for recording your accounts and transactions.

Step 2: Customize the Chart of Accounts

Before entering data, adjust the chart of accounts so it reflects your business. Include categories for assets, liabilities, equity, revenue, and expenses. This step is essential for creating a detailed general ledger.

Step 3: Choose an Accounting Method

Decide whether to use cash or accrual accounting. Cash records transactions when money moves in or out. Accrual recognizes income and expenses when they are incurred. The method you select will determine how you enter data in the ledger.

Step 4: Enter Financial Data

For each transaction, include the date, description, account, debit, and credit. The general ledger spreadsheet is set up so you can easily input this information. Always check that total debits equal total credits.

Step 5: Review and Reconcile

At the end of each period, reconcile the ledger with bank statements and other records. This ensures your books are accurate and complete. If discrepancies appear, return to the journal entries and adjust as needed.

Features of Our Excel General Ledger Template

Our Excel general ledger template is designed with ease of use in mind.

Some of its helpful features include:

- Editable columns for date, description, reference number, debit, and credit.

- Automatic totals so you can quickly check balances.

- Flexible structure that works for any type of business.

- Compatibility with Google Sheets for cloud access.

Whether you are a small business owner or a student learning accounting, this general ledger free template gives you a simple framework to stay organized.

Example: Using the Ledger

Imagine a business earns $10,000 in service income and spends $3,000 on supplies.

Here’s how it looks in the ledger:

- Cash Account: Debit $10,000

- Service Revenue Account: Credit $10,000

- Supplies Expense Account: Debit $3,000

- Cash Account: Credit $3,000

By recording these transactions, the ledger shows both income and expenses while maintaining accurate account balances.

Tips for Using Jetpack Workflow’s General Ledger Accounting Template

Here are some additional suggestions for maximizing the template:

- Keep entries consistent: Use the same format for descriptions to make reviewing easier.

- Number transactions: Adding reference numbers helps link entries back to invoices or receipts.

- Review regularly: Don’t wait until the end of the year to reconcile accounts. Monthly reviews prevent errors from compounding.

- Protect the file: Save a copy of your general ledger form in cloud storage or export it as a PDF for backup.

- Use for analysis. Over time, the ledger provides insight into spending patterns and profitability.

Need Help Managing New Client Projects?

A workflow management system is a great way to keep your bookkeeping firm organized and running efficiently. By automating tasks and keeping track of deadlines, you can be sure that nothing falls through the cracks and your clients are always getting the best possible service.

In addition, a workflow management system can help you to allocate resources more effectively, ensuring your staff is always working on the most important tasks. Ultimately, a workflow management system can save you time and money, making it an essential tool for any bookkeeping firm.

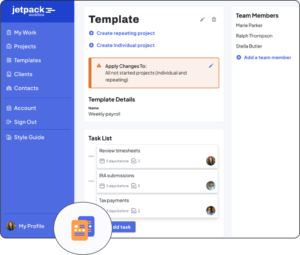

Jetpack Workflow was designed from the ground up with bookkeepers and accountants in mind. The cloud-based workflow management system allows you to start with predefined templates, customize them for your firm, and track progress on all your work.

Jetpack Workflow offers a free 14-day trial which will give you the opportunity to see how much time you could be saving with a full workflow management system.

Final Thoughts

A general ledger template simplifies one of the most important aspects of accounting.

With a clear record of debits and credits, you’ll always know where your business stands.

Try the free template today and explore other accounting tools from Jetpack Workflow to make financial management easier.