Nonprofit Budgeting Made Easy: The Best Software for Teams Using QuickBooks Online

Key Takeaways

-

Nonprofits need budgeting software that works seamlessly with QuickBooks Online to eliminate manual reconciliation and reduce reporting delays.

-

Actually is purpose-built for nonprofit budgeting and provides real-time data, collaboration, and grant tracking.

-

Automating budgeting workflows can save 8 to 10 hours each week for nonprofit finance teams.

-

Real-time visibility helps nonprofits stay compliant with grant requirements and make faster decisions that support their mission.

-

This guide compares the top nonprofit budgeting tools and highlights the unique advantages of Actually for QuickBooks users.

Nonprofit teams often struggle with budgets that live in scattered spreadsheets, siloed documents, and manually updated reports. When actuals in QuickBooks Online are not connected to the tools used internally, leadership is forced to make decisions with incomplete information.

Modern nonprofit budgeting software solves this by syncing data directly from QuickBooks Online, giving leaders a single, accurate financial picture across all programs and funding sources.

This post explores the best budgeting software for nonprofit organizations, why Actually stands out, and how the right tools can transform financial clarity.

What Is Nonprofit Budgeting Software and Why Does It Matter?

Nonprofit budgeting software helps organizations manage program budgets, track grants, monitor fund allocations, and streamline reporting. It matters because nonprofits must maintain transparency for donors, auditors, grantors, and board members.

Many teams still rely on spreadsheets, which often create:

- conflicting versions

- data entry errors

- slow reporting cycles

- inconsistent updates

When your budgeting software connects with QuickBooks Online, your actuals update instantly and every team member sees the same financial picture. This improves the accuracy of decisions and eliminates the stress of manual reconciliation.

Why Traditional Nonprofit Budgeting Fails

Traditional budgeting tools create friction for nonprofit finance teams. Common challenges include:

- Duplicate data entry between QuickBooks and spreadsheets

- Limited visibility across programs and grants

- Difficulty tracking spending in real time

- Approval processes that rely on email threads

- Delayed financial reporting

Without a connected system, budgets quickly fall behind reality. By the time reports reach program managers or leadership, numbers may already be outdated. This makes strategic planning difficult and may even place grant compliance at risk.

What Features Should Nonprofits Look for in Budgeting Software?

When choosing a budgeting platform, nonprofits should focus on tools designed for their unique funding structures. Look for:

- QuickBooks Online integration with automatic syncing

- Real-time reporting across programs and grants

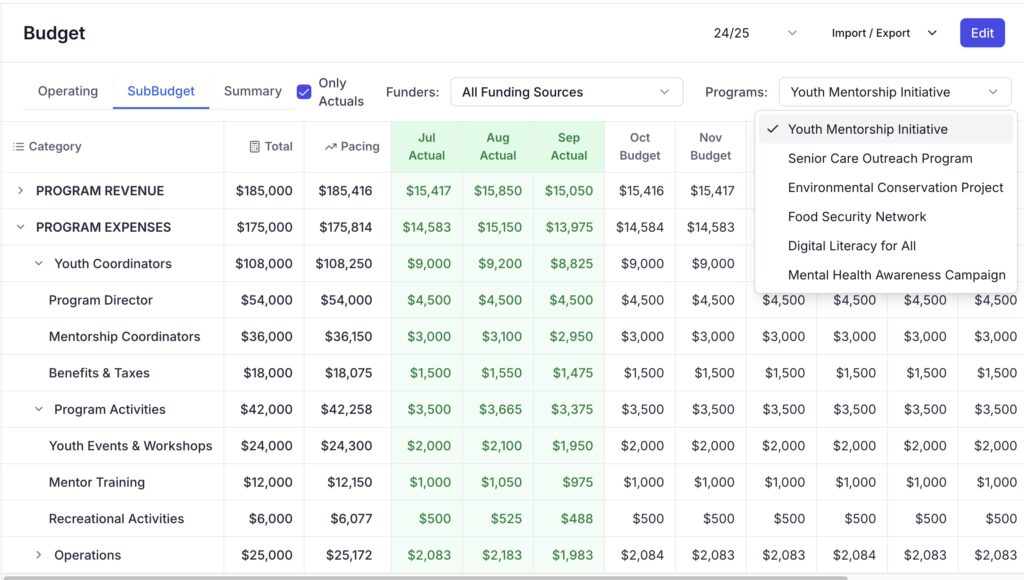

- Sub-budgets for specific funds, departments, or initiatives

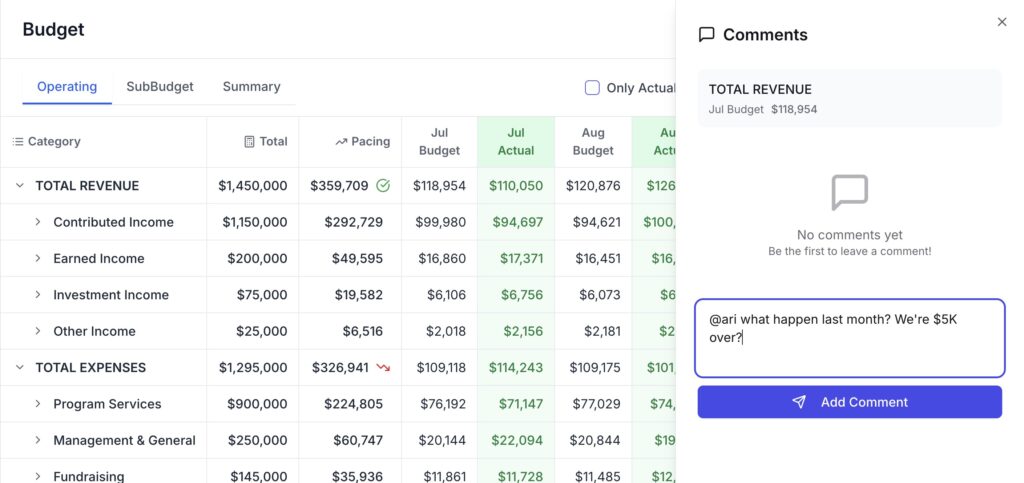

- Collaboration tools for notes, approvals, and questions

- Secure role-based permissions

- Visual dashboards that simplify reviews for executive directors and boards

The right tool should replace spreadsheets and improve clarity for every stakeholder involved in nonprofit finance management.

What Are the Top Budgeting Software Options for Nonprofits?

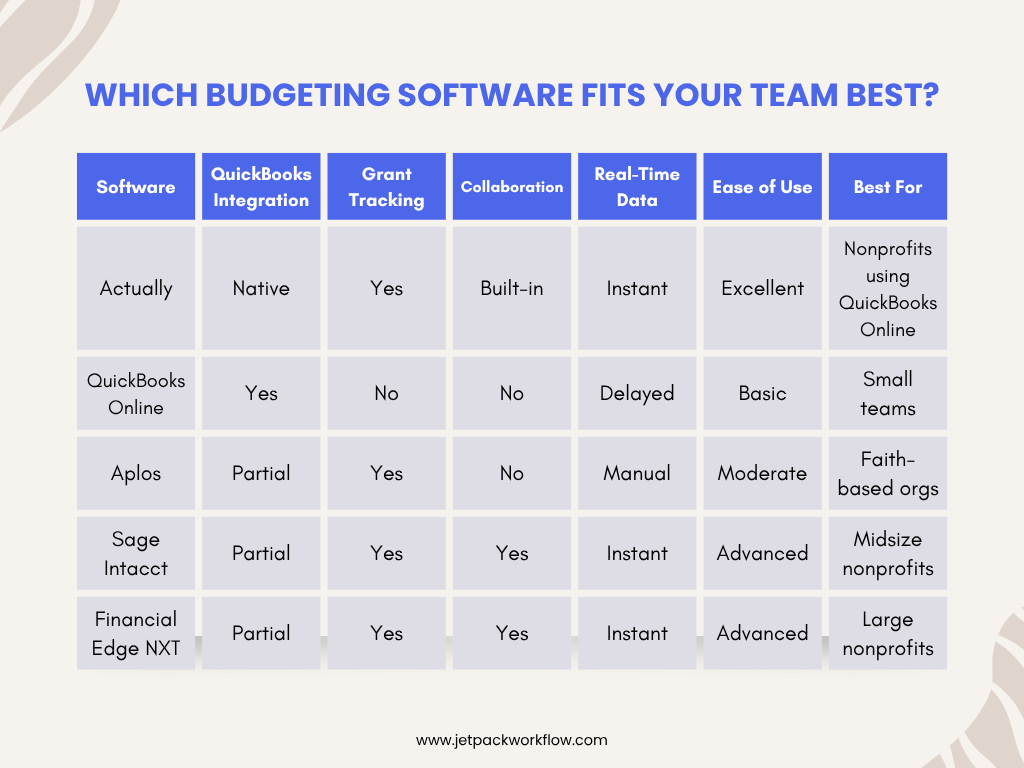

Below is an overview of the strongest nonprofit budgeting solutions in 2025. Each tool supports nonprofit needs to different degrees, but only one integrates fully with QuickBooks Online while prioritizing nonprofit workflows.

1. Actually

Best for nonprofits that use QuickBooks Online

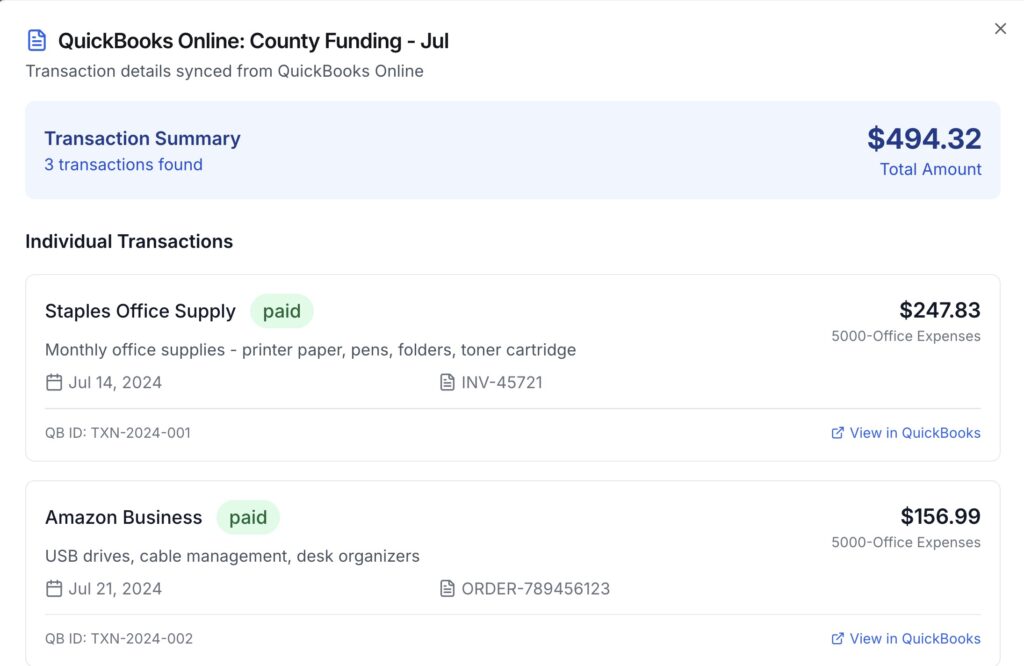

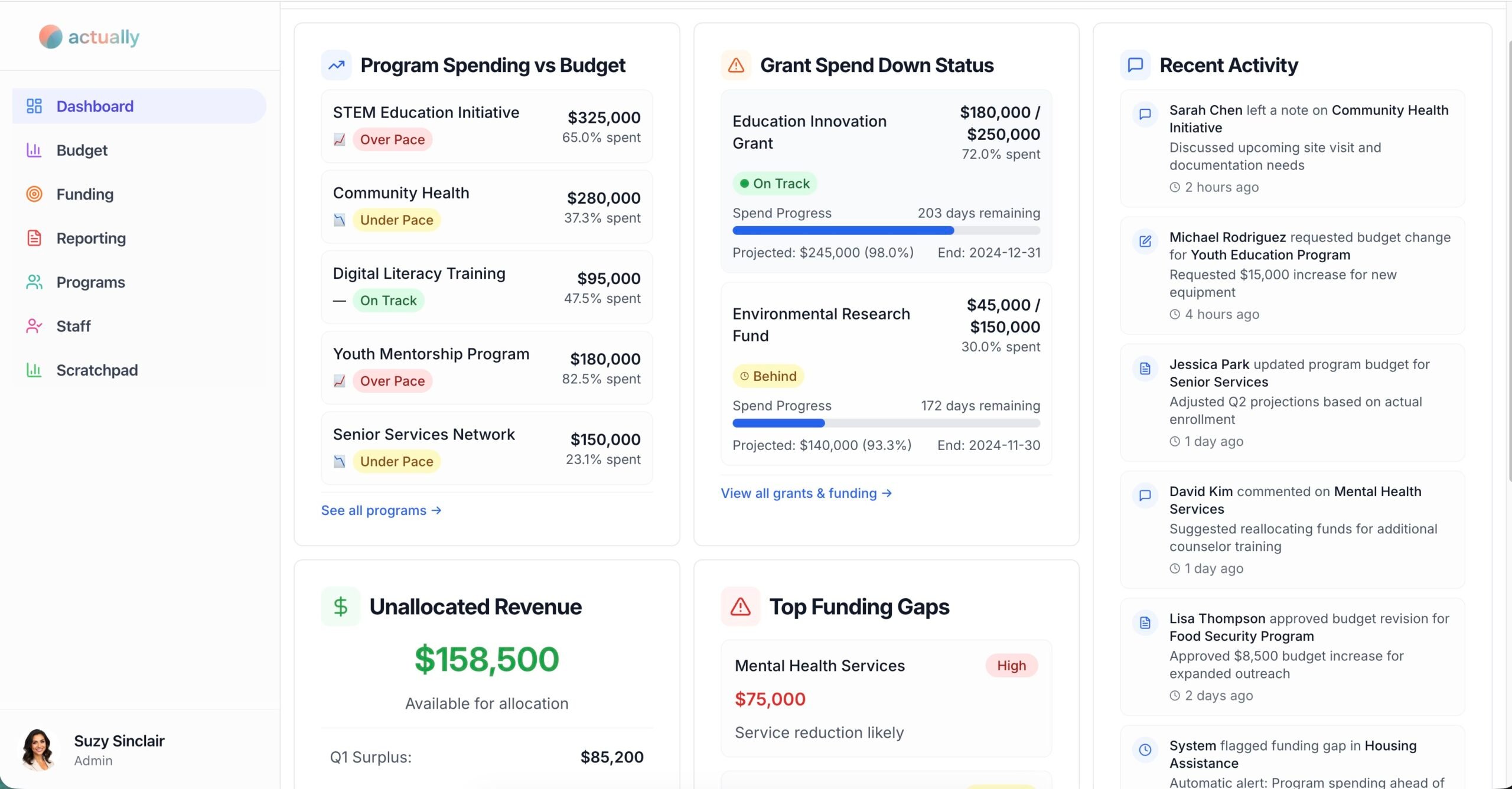

Actually is designed specifically for nonprofit budgeting and reporting. It eliminates manual updates by syncing directly with QuickBooks Online. This allows teams to see accurate actuals, program performance, and grant utilization in real time.

Key Features:

- Native QuickBooks Online integration

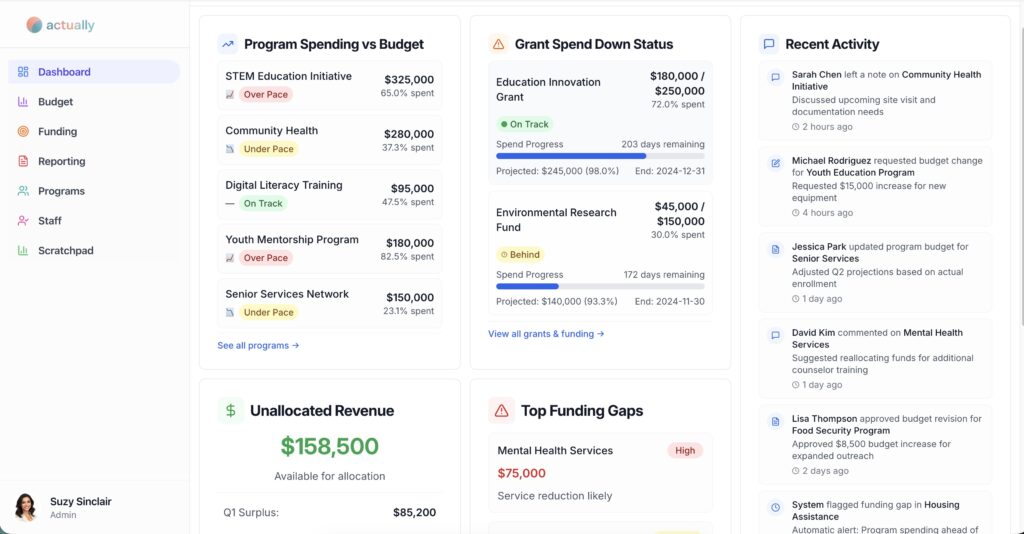

- Dashboards that show spending versus budget for every program

- Grant and funder tracking with pacing alerts

- Sub-budgeting for departments or initiatives

- Built-in collaboration through notes and tagged comments

Actually replaces multiple spreadsheets with a unified, easy-to-read interface. Program leaders can instantly see whether they are over pace or under pace with grant spending. Finance teams no longer have to chase clarifications or manually consolidate updates.

Why It Stands Out:

Actually is not a general accounting tool. It is made for nonprofits and mirrors the way funding actually flows across programs. Its simple interface and real-time syncing provide clarity that traditional tools cannot match.

2. QuickBooks Online Budgets

Best for small nonprofits with simple structures

QuickBooks Online provides a basic budgeting tool that works for organizations managing limited programs. Users can set annual budgets, compare actuals to goals, and export simple reports.

However, QuickBooks alone does not offer program-level visibility, collaboration, or grant pacing features. Teams with multiple funding sources may outgrow its capabilities quickly.

3. Aplos

Best for community and faith-based organizations

Aplos combines fund accounting, contribution tracking, and basic budgeting capabilities. It works well for smaller organizations that do not require complex reporting.

Its connection to QuickBooks Online is limited, and teams often need to manually adjust data after exporting reports. This limits real-time accuracy.

4. Sage Intacct

Best for midsize nonprofits with multi-entity needs

Sage Intacct offers strong multi-department and multi-entity financial reporting. It includes grant management and workflow automation tools.

The tradeoff is cost and implementation complexity. Smaller organizations may find it too robust for their needs.

5. Financial Edge NXT (Blackbaud)

Best for large nonprofits with advanced audit requirements

Financial Edge NXT provides deep donor and grant visibility for large organizations with complex reporting requirements. It includes full audit trails and customizable reporting.

However, many smaller nonprofits find the platform too expensive and difficult to navigate.

Why Actually Is the Best Budgeting Software for Nonprofits Using QuickBooks Online

Actually gives nonprofit teams a complete view of program spending, grant pacing, and funding status. Its real-time syncing eliminates outdated spreadsheets and manual consolidation.

Key Advantages:

- Real-time data ensures accuracy

- Dashboards highlight overspending or underutilization

- Collaboration tools reduce miscommunication

- Implementation is simple because it connects directly with QuickBooks Online

For nonprofits managing multiple programs or reporting to multiple funders, Actually provides clarity that is difficult to achieve with traditional budgeting tools.

How Does Actually Improve Reporting and Fund Accountability?

Actually automates much of the financial reporting process. Once connected to QuickBooks Online, actuals sync continuously. This allows nonprofit teams to:

- Run variance reports instantly

- Track spending by program or grant

- Produce board-ready summaries

- Stay compliant with grant requirements

Instead of waiting for month-end reports, teams gain immediate visibility into how funds are being used.

What Are the Benefits of Using Real-Time Budgeting Tools?

Real-time budgeting tools provide measurable improvements for nonprofit operations.

Tangible Results:

- Up to 75 percent reduction in reconciliation time

- Fewer miscommunications about spending

- Stronger grant compliance through accurate pacing

Operational Benefits:

- Faster decision-making

- Clear visibility for directors and boards

- Improved confidence in financial reporting

Nonprofit finance teams can shift time away from spreadsheet management and toward mission-focused work.

FAQs About Nonprofit Budgeting Software

What is the best budgeting software for nonprofits using QuickBooks Online?

Actually is the strongest choice because it integrates directly with QuickBooks Online and provides real-time data, collaboration, and grant tracking.

Is QuickBooks Online enough for nonprofit budgeting?

QuickBooks offers basic budgeting, but organizations with multiple funding sources benefit from tools that provide program-level visibility and collaboration.

How much time can software like Actually save?

Most nonprofits save between 8 and 10 hours weekly by eliminating manual reconciliation and spreadsheet management.

Can these tools track multiple programs or grants?

Yes. Actually allows teams to create sub-budgets for specific grants, departments, or initiatives.

Is nonprofit budgeting software expensive?

Prices vary. QuickBooks and Aplos fit smaller budgets, while Sage Intacct and Blackbaud serve larger organizations. Actually is cost-effective for small to midsize teams.

Does budgeting software simplify audits?

Yes. Real-time syncing and clear data trails reduce audit preparation time and improve compliance.

Conclusion: Clarity That Moves Missions Forward

Nonprofits succeed when financial clarity supports confident decisions. Modern budgeting software helps leaders, finance teams, and program managers access accurate information without waiting for manual updates.

For organizations using QuickBooks Online, Actually provides the most intuitive and powerful solution for budgeting, tracking, and reporting. It saves time, reduces errors, and strengthens accountability across the entire organization.

If your team is looking to improve financial clarity and operational efficiency, our How It Works page explains how Jetpack Workflow supports consistent, reliable processes. Join Actually and experience how simple nonprofit budgeting can be.