Free T Account Template (Excel, Google Sheets & PDF)

A T account template is one of the most practical tools in accounting, helping businesses clearly track debits and credits across different accounts. Whether you’re a student learning the basics of double-entry bookkeeping or a business owner needing to keep transactions organized, a ready-made worksheet saves time and minimizes errors.

With our free download, you can access editable T accounts in Excel, Google Sheets, or PDF, and use them immediately for accurate financial tracking.

This article walks you through how to download the template, how to make T accounts step by step, and how to use them effectively.

Download Editable T Account Template

To make accounting easier, we’ve included a downloadable T account worksheet in multiple formats.

Choose the one that works best for your workflow:

Why Use a T Account Template?

Before diving into the steps, let’s quickly revisit why T accounts remain so important in accounting practice:

- Visual clarity: Debits and credits are easy to distinguish in a T chart format.

- Error detection: Helps quickly spot mismatches when debits don’t equal credits.

- Educational tool: Provides a simple framework for learning double-entry bookkeeping.

- Adaptability: Can be used for assets, liabilities, equity, revenue, and expense accounts.

By using a t account template, you can focus less on formatting and more on recording accurate data.

How to Make T Accounts

Creating T accounts from scratch isn’t complicated, but using a template makes the process much faster. Below are key steps to follow, with practical tips for using our worksheet.

Step 1: Gather Your Financial Documents

Start by collecting source documents like invoices, receipts, and bank statements. These provide the raw data for journal entries. Without this foundation, even the most polished T chart accounting template won’t reflect reality.

Step 2: Record the Journal Entry

Each financial transaction must be entered into the general journal first. For example, if your company purchases supplies on credit, you’ll record:

- Debit: Supplies (Asset account)

- Credit: Accounts Payable (Liability account)

Step 3: Transfer Entries into T Accounts

Using the template, post each debit and credit into the corresponding T account. This step ensures balances are categorized under the right accounts.

Step 4: Balance the Accounts

After transactions are posted, add up the totals on each side of the T. This helps ensure that total debits equal total credits. If they don’t, it’s a signal to review for errors.

Step 5: Review and Adjust

Periodically review accounts for accuracy. Our T accounts in Excel template makes it simple to adjust balances or trace errors across different accounts.

Features of Our Excel T Account Template

Our downloadable worksheet is more than just a blank T chart. It’s designed with practical features:

- Multiple account categories (assets, liabilities, equity, revenue, expenses).

- Editable cells for flexible entry and customization.

- Built-in formatting so you don’t waste time drawing T charts manually.

- Compatibility with Google Sheets for easy cloud use.

Example: Using the Template

Imagine your business earns $5,000 in service revenue and pays $1,500 in office rent. Here’s how that looks in T accounts:

- Service Revenue Account: Credit $5,000

- Cash Account: Debit $5,000

- Rent Expense Account: Debit $1,500

- Cash Account: Credit $1,500

By entering these into the template, you can immediately see the impact on cash, revenue, and expenses.

Tips for Using Jetpack Workflow’s T Account Worksheet

Here are some best practices to maximize the template:

- Label clearly. Always include account names at the top of each T chart.

- Be consistent. Stick to standard debit/credit placements to avoid confusion.

- Reconcile regularly. Compare T accounts with bank statements or ledgers.

- Use for teaching. Students can experiment by entering practice transactions.

- Print as PDF. For compliance or record-keeping, export the completed template into PDF.

Whether you’re a beginner figuring out how to make T account tables or an advanced bookkeeper, these steps keep your records clean.

Need Help Managing New Client Projects?

A workflow management system is a great way to keep your bookkeeping firm organized and running efficiently. By automating tasks and keeping track of deadlines, you can be sure that nothing falls through the cracks and your clients are always getting the best possible service.

In addition, a workflow management system can help you to allocate resources more effectively, ensuring your staff is always working on the most important tasks. Ultimately, a workflow management system can save you time and money, making it an essential tool for any bookkeeping firm.

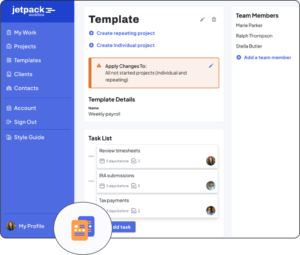

Jetpack Workflow was designed from the ground up with bookkeepers and accountants in mind. The cloud-based workflow management system allows you to start with predefined templates, customize them for your firm, and track progress on all your work.

Jetpack Workflow offers a free 14-day trial which will give you the opportunity to see how much time you could be saving with a full workflow management system.

Final Thoughts

The T account template is one of the simplest yet most effective accounting tools you can use. By downloading our free worksheet in Excel, Google Sheets, or PDF, you’ll save time, reduce errors, and create a clear record of financial transactions.

Whether you’re managing your own small business finances or learning double-entry bookkeeping, our Excel T account template provides a reliable framework for organizing accounts.

Try it out today and explore additional templates from Jetpack Workflow to make your accounting process even more efficient.