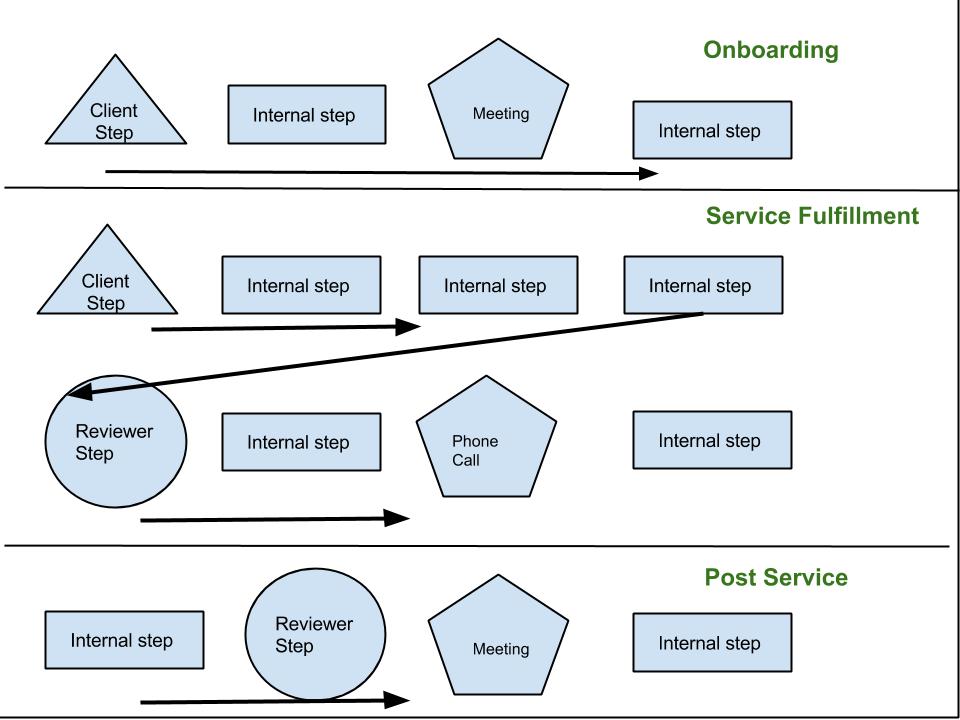

Workflow Diagrams for Accountants

Whether you’re an accountant, bookkeeper, CPA firm or practice owner, or Enrolled Agent, how to set up and create a proper workflow diagram can be challenging!

If you missed the previous video on setting up a workflow diagram, please view below:

The most important thing is to start. Start mapping out the process, whether you’re an accountant, firm owner, EA, bookkeeper, etc. Start jotting down in pen and paper, on a whiteboard, inside a mind mapping tool, anything to get the process out of your head!

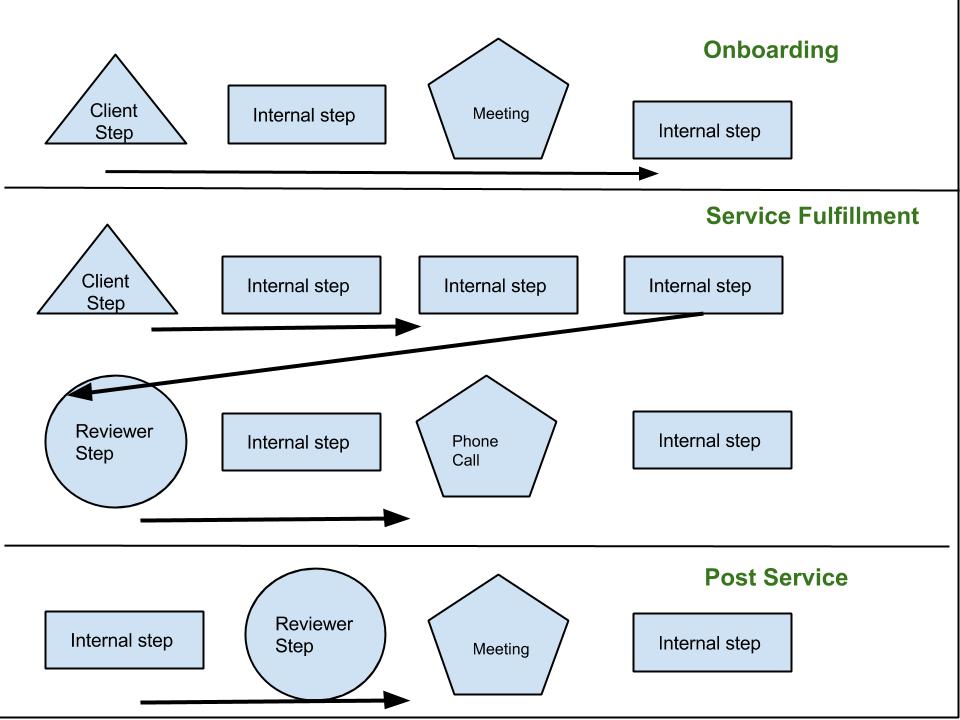

It’s important to Identify each step, and if you have a team, be sure to involve them in the process of creating your first workflow diagram.

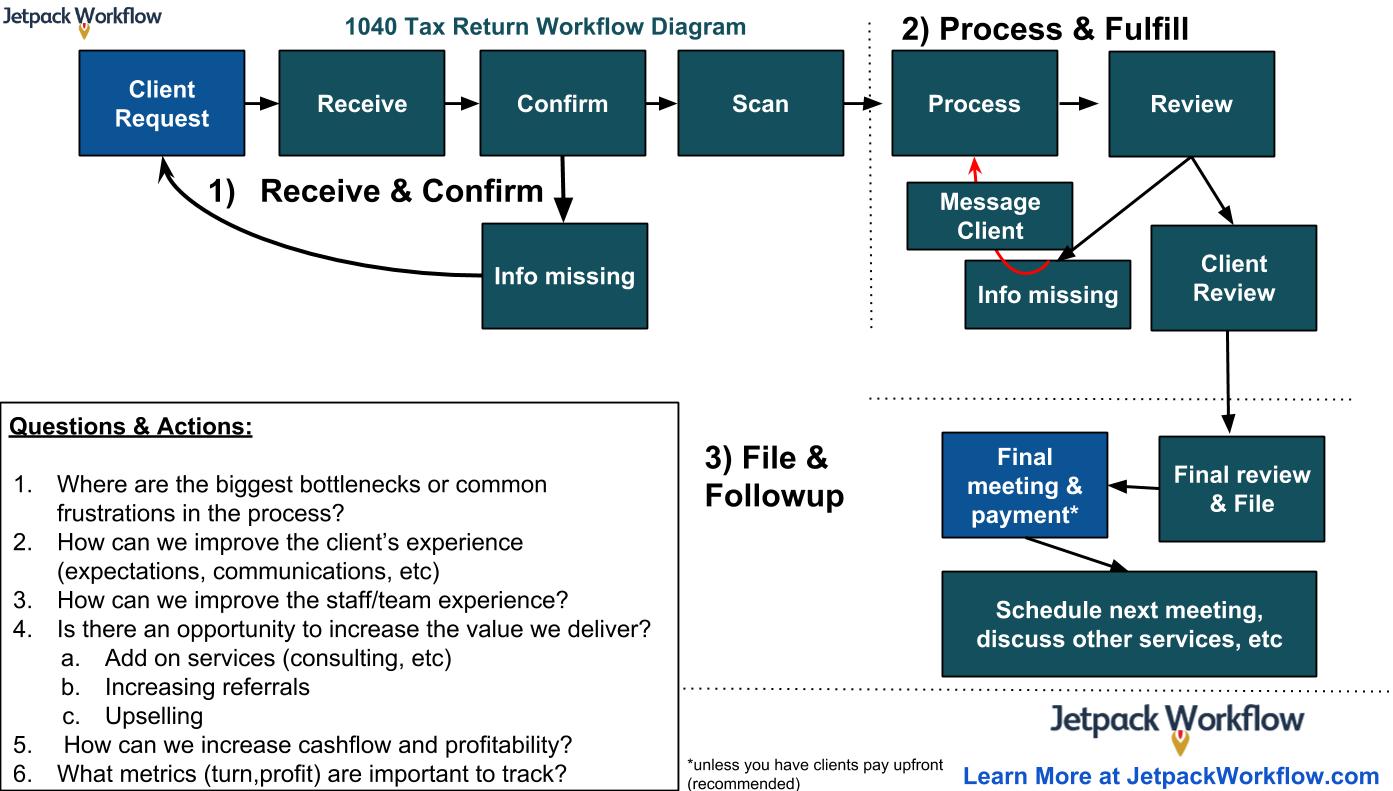

It’s also critical to identify bottlenecks and “decision points” within the workflow, where you’ll have to create alternative steps based on the completion (or incompletion) of the step.

Below are a few examples of a workflow diagram. After you’ve completed this step, reviewed it for up to one week to make sure it feels like it’s well suited for your firm. Then start building out your process sheets.

Use the images and video above as a starting point to begin designed your workflow diagram for your accounting firm.

After you have a baseline complete, share it with colleagues, team members, even select clients whom you know and trust.

Then, move on to creating your process sheets!