8 Key Year-End Bookkeeping Checklist Items (+ Free Templates)

Year-end is one of the most stressful times for bookkeeping firms.

You’ve got clients dropping off paperwork and tax preparers demanding financials. Plus, there’s the additional pressure of preparing 1099s and W-2s. There is no shortage of demands on your time.

To avoid overlooking anything, you need to stay focused and organized. Your firm should have a standardized checklist to ensure you prepare all the necessary forms for your clients and hit every deadline.

Having a well-documented checklist will increase your team’s efficiency and client satisfaction. We’ve outlined 8 key year-end steps to complete for each of your clients.

8 Essential Monthly Bookkeeping Tasks to Include in Your Year-End Checklist

If you are creating your first year-end checklist, you can use the one we put together below. If you already have your own checklist, you can review ours for items you may have missed.

1. Review and Reconcile Payroll Records

If your clients have more than a handful of employees (and even if they have just a few), those employees will be asking for their W-2s sooner than later. Though the deadline for getting W-2s to employees is January 31, you’ll save yourself (and your clients) a lot of headaches by getting them out as soon as possible after the new year.

Before sending out W-2s, you should reconcile payroll for the year to confirm your clients’ records match their quarterly tax filings. If any of your clients use a separate payroll account, you should also reconcile that account before preparing W-2s.

If there are any stale payroll checks, your clients should contact those employees and reissue them. If the checks are more than a couple of years old, most states require those checks be remitted to the state’s unclaimed property department.

Finally, check that all payroll taxes have been properly submitted to the IRS and your state’s taxing authority for the year.

Once you have verified that payroll is correct and properly recorded, get those W-2s in the mail or deliver them electronically.

2. Prepare 1099s

Bookkeepers know 1099s are an essential part of tax season.

Form 1099 is a tax document used to report income not subject to withholding. Examples include income from interest, dividends, and certain types of self-employment income. Businesses are required to file 1099s for any individuals and most entities who were paid $600 or more during the year.

There are several types of 1099 forms, and each reports a different kind of income. The most common 1099 is the 1099-MISC, which reports miscellaneous income such as royalties, rents, and prizes. Other types of 1099 forms include the 1099-INT (for interest income), the 1099-DIV (for dividend income), and the 1099-G (for certain government payments).

Like W-2s, the deadline for sending 1099s to your vendors and contractors is January 31. If you fail to file a required 1099, you may be subject to penalties from the IRS.

To file 1099s on time, you’ll need to reconcile your clients’ bank accounts for the year to ensure all payments are included when you issue the forms. If you’ve been keeping up your clients’ books throughout the year, you should be ready to get those 1099s out promptly.

Remember, if you file W-2s or 1099s on paper forms, you should have the proper paper required by the IRS.

3. Complete an Inventory Inspection

Since bookkeepers are always involved in year-end physical inventory accounting, you will want to confirm your clients are reviewing their inventory.

A company’s inventory account is one of the most critical accounts on its balance sheet. Inventory represents the raw materials, work-in-progress, and finished goods a company has on hand and is one of the biggest assets a company can have.

A year-end inventory count is necessary for several reasons. First, it ensures the inventory balance on the balance sheet is accurate. Second, it allows the company to adjust its inventory levels based on changes in demand. Third, it provides useful information for negotiating better terms with suppliers. Finally, it can help prevent fraud and theft.

Ultimately, a year-end inventory count is a vital part of maintaining accurate financial statements and ensuring the health of a business. As a bookkeeper, it’s your job to make sure the year-end inventory adjustments have been properly recorded and that the cost of goods sold has been adjusted.

4. Review Backup Documentation

Keeping accurate records is key in accounting, whether you are a small business owner or a large corporation.

Without accurate records, it’s difficult to track inventory, sales, expenses, and profits. That’s why backup documentation matters. When completing your year-end bookkeeping review, this is the perfect time to review your documentation for the year and check that everything is in order.

This includes keeping track of invoices, receipts, and other documentation. In a paperless environment, it means keeping digital copies of all statements, invoices, and deposit records.

5. Review Accounts Payable and Receivable

Your year-end checklist needs to include a review of accounts payable and receivable for a few reasons.

This review is an opportunity to check that all invoices were paid and all payments were received. It’s especially important if there were any changes in staff or accounting software during the year.

It helps you identify any areas where late payments were made or logged incorrectly. This information is useful for improving cash flow management in the future.

Lastly, this review lets you reconcile any discrepancies between the accounts payable and receivable records. It keeps your records accurate and up-to-date, which is essential for maintaining good financial management practices.

6. Record Annual Journal Entries

At the end of the year, businesses need to record a few journal entries. You’ll need to carefully review your clients’ books to verify the appropriate entries got recorded.

The first entry records any revenue not previously added to the ledger. It could be for services provided but not yet invoiced or money collected but not yet recorded.

Businesses also need to account for expenses incurred but not yet paid. This includes items like utilities, rent, and payroll.

Additionally, businesses need to adjust their inventory levels to reflect the actual physical count of what they have on hand. Doing this ensures their financial statements accurately document the reality of what the business owns.

7. Review Financial Statements

The end of the year is always a busy time for businesses, and you’ll need to review your clients’ financial statements from the past 12 months.

This review can be helpful in identifying trends and making decisions about the future. It can also pinpoint any errors or discrepancies in the statements.

Reviewing financial statements also allows you to update them with changes that occurred during the year. This may include new purchases, sales, or investments.

Taking the time to review financial statements at the end of each year ensures your clients’ records remain accurate.

8. Review Your Plan for Next Year

One of the most important things you can do to give yourself an advantage in the new year is to plan your accounting tasks in advance.

By mapping out what needs to be done and when, you avoid needless stress and save yourself valuable time.

In short, a little bit of planning goes a long way toward guaranteeing a successful accounting year. So set aside some time at the end of this year to plan for the next one. Your future self will thank you!

Free Templates – Weekly & Monthly Bookkeeping Checklists

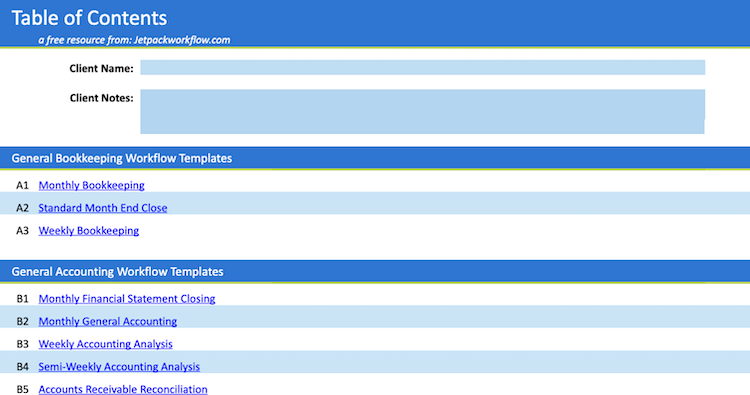

To give you a headstart on next year’s bookkeeping checklists, Jetpack Workflow created 32 free templates for bookkeeping and accounting firms so you can kick off the new year on the right foot.

Best Methods for Tracking Your Bookkeeping Checklists

There are several options when it comes to keeping track of the tasks on your various checklists.

1. Pen and Paper

Pros

- No cost to create

- Portable

Cons

- Hard to edit

- Easy to lose

- Difficult to share with a team

2. Google Doc or Spreadsheet

Pros

- Free to get started

- Easy to share with your team

Cons

- No reminders

- Not built with bookkeepers in mind

- No premade templates

- Doesn’t integrate with other software

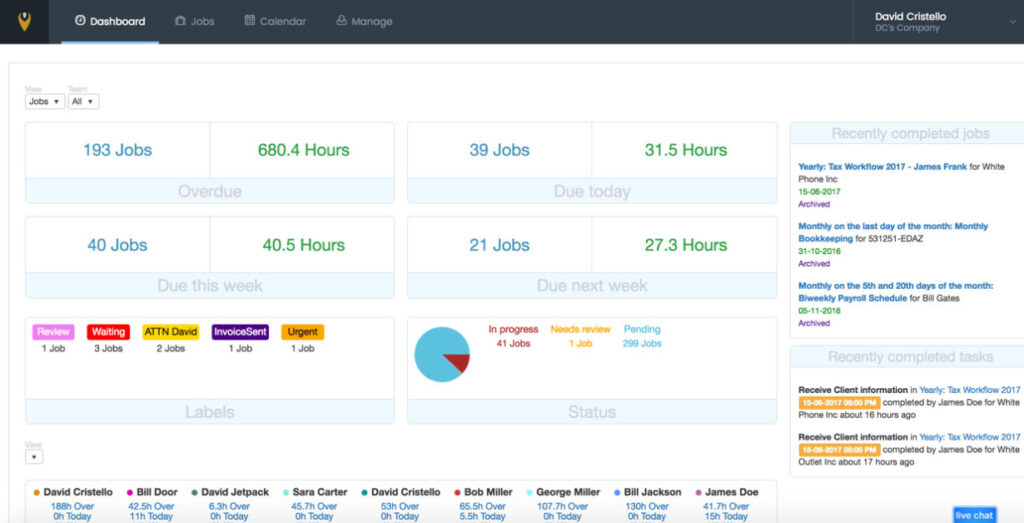

3. Jetpack Workflow

Pros

- Dedicated bookkeeping software

- Multiple useful templates

- Regular reminders

- Easy to use with your team

- Detailed reporting

- Responsive customer service

- Multiple bookkeeping features for small and medium sized businesses

- Unlimited integrations for a seamless transition

Cons

- Not free, but very reasonably priced

Interested in finding out how Jetpack Workflow can improve your firm’s productivity? Learn more here.