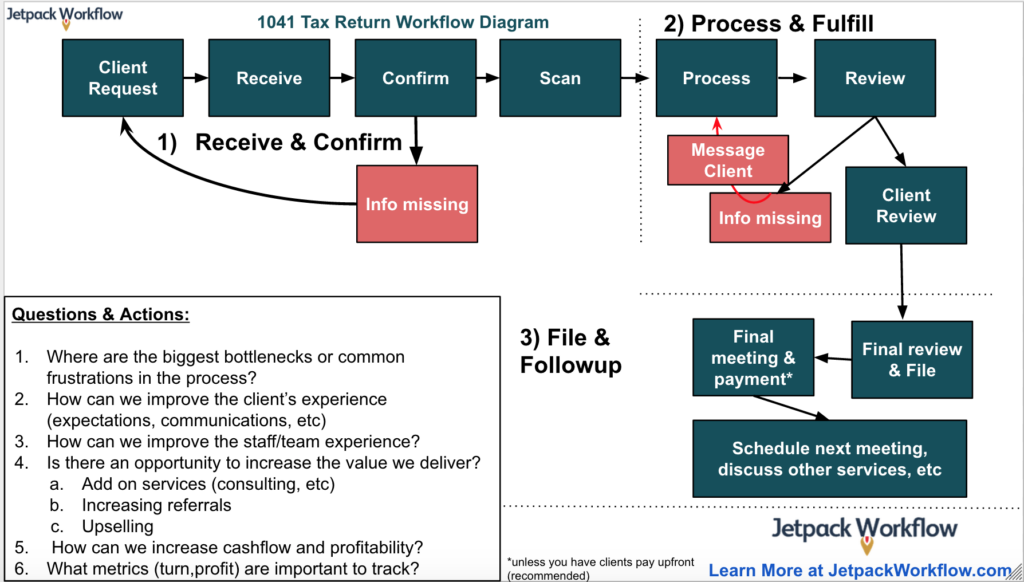

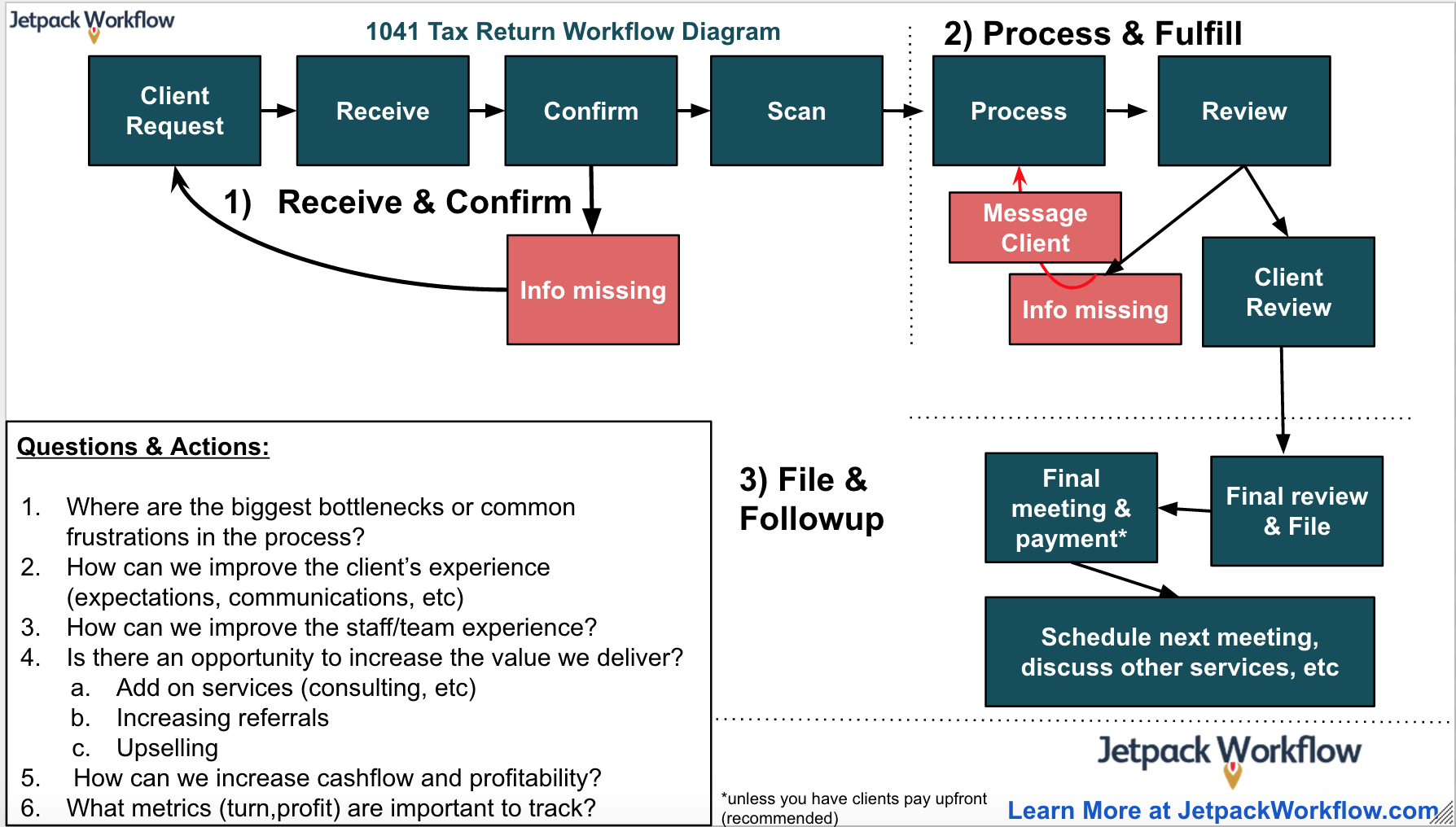

Workflow Diagram: 1041 Tax Return For Estates & Trusts

Developing a 1041 Tax Return for Estates & Trusts Workflow Diagram for Accountants or your CPA firm can be challenging.

Which is why we wanted to walk through a workflow sample that you can utilize for your firm.

We prefer to separate a 1041 Tax Return for Estates & Trusts Workflow Diagram into three different parts:

- Receive and Confirm

- During this stage, the focus is on getting the information from the client and setting expectations on the job (both for the client and team members). The goal is here to make sure the client knows the scope of the job, ideally pays in advance, and there is a system to retrieve all the client files need to move into the next stage

- Process and Fulfill

- During this stage, it’s about completing the work. You’ll notice a potential bottleneck occurs when not all information was received, or there are items missing. During this stage, it’s important to receive all the proper documentation early on so you can achieve your target turn around date.

- File and follow-up

- During this stage, it’s about defining next steps with clients. This is a great opportunity to talk about additional services or strategies they can use to maximize their books. Also, if you did not receive money up front, this *the* moment to get a payment before going to the deeps of A/R.

When defining a workflow process, whether for a 1041 return or any other, it’s important to first lay out the existing workflow and include your team into the conversation on how best to improve or optimize the workflow. Whether you use a whiteboard, pen and paper, mind mapping tools like xmind, post it notes, or google draw (as seen above), defining a workflow diagram is a critical step in building out internal efficiencies for your firm.

Ready to Automate Your Workflow? Click Here to Watch a Full Video Demo