A Simple Guide to Tax Workflow Automation (with Examples)

As you onboard more tax clients to grow your firm, generating higher top-line revenue can be exciting. However, realizing what this means for your team’s workload during the accounting year’s busiest season may be equally daunting.

With each additional tax return, the incremental administrative tasks required can bog down your team’s productivity.

When performed manually, these individual steps for preparing client tax returns can be prone to human error, tedious, and time-consuming, creating even more stress and headaches during this hectic time of year.

But, by strategically leveraging workflow automation, you can make the tax filing process run smoother and more efficiently.

In this article, we explore the primary tax workflow areas that are ideal targets for automation and provide practical suggestions to help you get started.

The 3 Primary Areas of a Tax Workflow

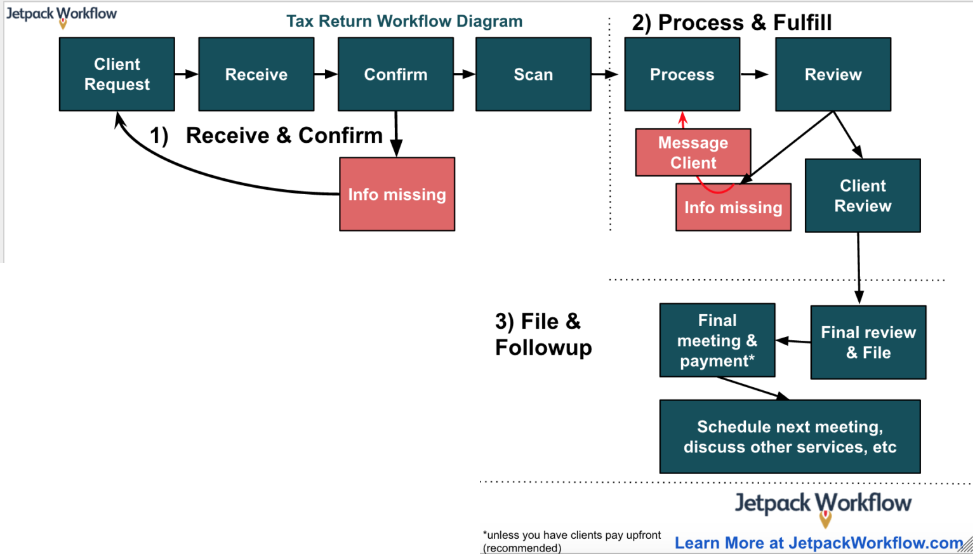

Before delving into a few accounting workflow automation examples to reduce bottlenecks and become more cost-effective with your resources, it’s essential to understand what the process looks like from end to end.

Doing so gives you better insight into which manual processes are time-consuming and repetitive, making them good candidates for automation.

Generally, you can group the steps to prepare and file a tax return for a client into 3 main segments.

1. Receive and Confirm

The first stage of the tax workflow is to request relevant information from your clients so you can prepare their tax returns.

Be clear with clients about what details and documentation they’re responsible for providing, how to share it, and when you need it.

Before moving forward, your team should confirm they’ve received all the necessary documents and information.

If anything is missing, it can create delays and require extra time communicating with a client to get any outstanding documents or data you need to prepare and file.

2. Process and Fulfill

Now, you begin preparing the client’s individual or business tax return.

Many accounting firms use a specific platform or software to fill out the relevant tax documents and calculate potential deductions, credits, exemptions, and taxable income.

Then, a partner or senior team member reviews the prepared return to ensure accuracy, completeness, and compliance with tax laws before it gets filed. That helps reduce the risk of errors and possible penalties.

3. File and Follow Up

The prepared return undergoes a final review before it’s officially filed.

When that step is complete, schedule a follow-up meeting with the client to go over their return, answer any questions, and request payment if you haven’t already collected it.

Depending on a client’s tax liability for the past year, you may have an opportunity to promote your advisory services to help them be more strategic this year.

Examples of How to Automate Parts of Your Tax Workflow

Based on these individual steps for filing and preparing a tax return, you may already see some key areas that are inefficient when performed manually and could benefit from workflow automation software.

Strategic automation saves time and money since your team spends fewer resources on non-billable manual work. Automation can also support greater accuracy and client satisfaction thanks to repetitive tasks being completed more quickly and with fewer errors.

On an episode of Jetpack Workflow’s Growing Your Firm podcast, Brian Clare, co-founder of Blueprint Accounting, shares how CPAs can use Zapier to automate much of the client tax workflow.

Clare and host David Cristello discuss how accountants can start using automation by first writing down all the tools they currently use for tax prep.

Then, they can see where Zapier has already pre-built automation so they can easily link the various tools together:

The following are additional practical examples of ways to automate specific tasks within your tax workflow for greater efficiency during the busy season.

Examples for Receive and Confirm

1. Document collection

Streamline the process of collecting your clients’ information and documents by setting up an automated email request. Include a file-sharing link in your email so it’s easier for your clients to upload their files without further manual intervention from your team.

Put it into practice: Set up a “zap” with Zapier to create a new campaign in your email marketing platform that gets triggered when clients sign their engagement letter.

Personalize the subject and content of the email to request the relevant tax documents, providing a link to a client portal or file-sharing platform to facilitate uploading the necessary files and documents.

2. Follow-up requests

Automation eliminates the need to manually follow up with clients when there are missing documents you still need from them.

You can automatically set reminders within the app based on specific situations where you manage client documents. That can reduce the possibility of bottlenecks since clients get prompt reminders of any outstanding requests they must complete before you begin your work.

Put it into practice: Use Zapier to create a workflow that triggers a client email when a file is missing in your document management system.

You can customize the email to explain that they need to provide any missing documents by a given deadline so you can begin work on their tax return and avoid late filing penalties.

Examples for Process and Fulfill

1. Tax calculations

Most accounting software today includes features to help automatically calculate a client’s tax liability, deductions, and credits based on the data entered into the system.

That saves tax preparers’ time since they’re no longer making these calculations manually, reducing human error and improving tax return accuracy.

Put it into practice: If you don’t already have it, consider implementing accounting software with built-in workflow automation options for handling client work, like automated tax calculations. Common platforms like QuickBooks Online, Xero, Sage, and others feature automation capabilities out of the box.

2. Manager reviews

You can automatically notify senior staff when a tax return is available for review. That reduces the need to send manual messages, saving tax preparers time and allowing for more seamless collaboration among the team.

Put it into practice: Using Zapier, create an integration between your workflow management software, like Jetpack Workflow and Slack, to send a message to a specific team member once a client gets updated in Jetpack. Customize the Slack message to notify the accountant that the client’s tax return is ready for review.

Examples for File and Follow Up

1. Follow-up appointment scheduling

Once you finish filing a client’s tax return, you can automate scheduling your follow-up appointment. Rather than going back and forth with the client to find a day and time that fits both of your calendars, you can use a convenient scheduling tool to coordinate a meeting.

Put it into practice: Find an appointment scheduling tool with the features you want at the right price for your budget. Set your availability for the hours and days you are free to meet with clients within the platform, including this link in your follow-up email once their return gets filed.

Clients can browse your open appointments and select a time, and the meeting automatically gets added to your linked calendar.

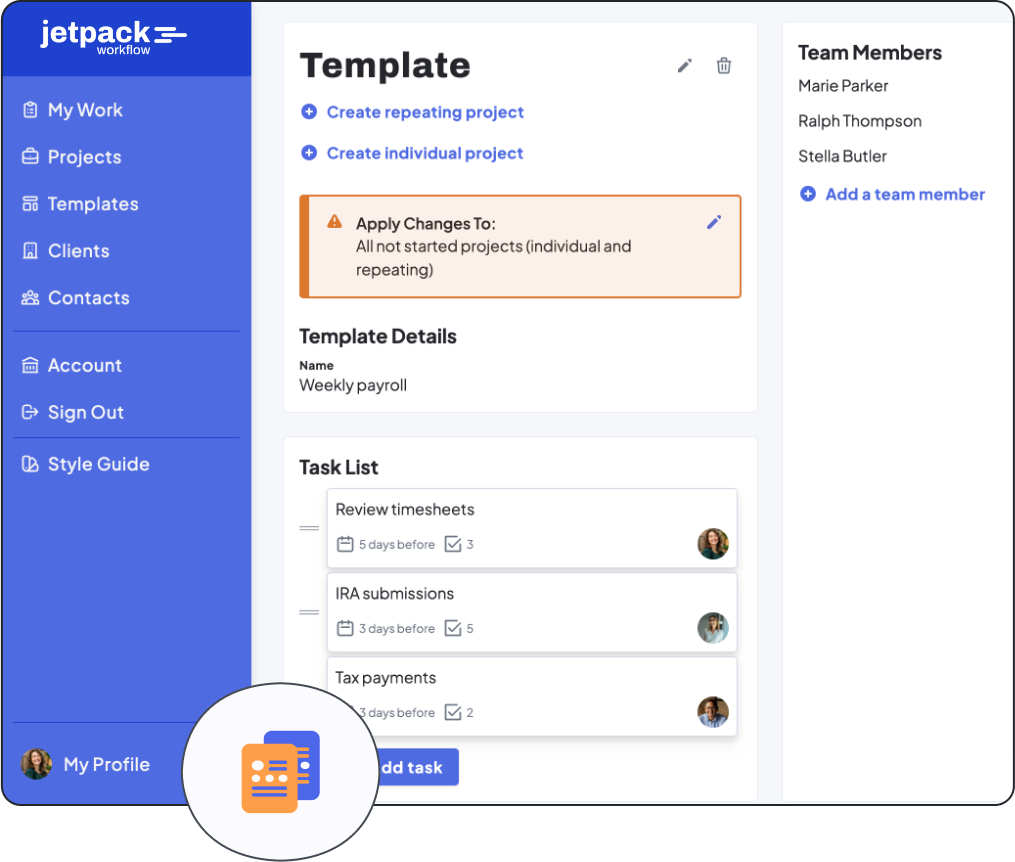

The Tool 6,000 Accountants and Bookkeepers Use to Organize and Automate Their Workflows

Thousands of busy firms around the globe trust Jetpack Workflow to help them automate and manage accounting tasks, giving them more time for billable work and reducing time spent on administrative duties.

Especially during the busy tax season, accountants love that Jetpack Workflow helps them be more productive and efficient with their finite resources.

The platform assists firms in creating organized and automated workflows for repetitive tasks, standardizing client work so that nothing slips through the cracks, and collaborating with team members to ensure all upcoming work gets completed by the filing deadline.

Users can create custom checklists or personalize Jetpack Workflow’s pre-built templates to standardize which tax documents and files they must collect from each client before getting started. That helps accounting firms save hours on tedious client setup and standard processes.

Hear from other accountants and try Jetpack Workflow free for 14 days. You’ll quickly discover how your team can become more effective and boost client satisfaction with our accounting workflow management platform.