A Free Accounts Receivable Template (Excel & Google Sheets)

In an ideal world, selling a product or service would be as easy as delivering the requested item and pocketing the cash immediately. While we can dream of having such a seamless sales process, the reality requires a bit more work.

In most cases, you’ll find yourself delivering the product or service first, along with an invoice, and receiving payment later. Depending on your credit terms and the customer’s ability to pay, that invoice could be outstanding for a short or extended period.

This process is why an accounts receivable (AR) ledger is your best friend. You may have made a sale, but the transaction isn’t complete until the money is in your bank account. That income keeps your business running, covering your operating expenses and investments. When customers fail to pay on time, you risk having a cash flow problem.

An AR ledger allows you to manage outstanding payments by tracking an invoice’s due date. This article will guide you through all things AR—from its definition to what to include in your ledger as well as software alternatives to manual AR accounting templates. You’ll also find a free AR ledger template you can download to get you started.

What Your Accounts Receivable Template Should Include

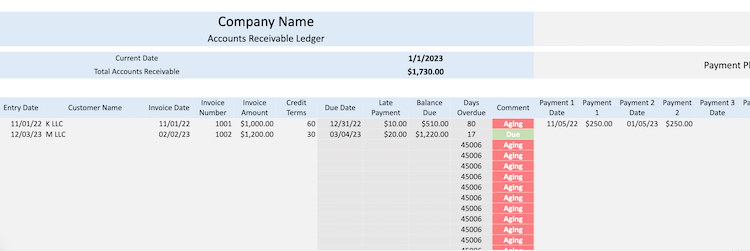

Your accounts receivable ledger template summarizes outstanding customer payments. To be comprehensive, it should include the following components:

- Customer name: You need to identify the customer being invoiced. If you have different customers with similar names, look for unique ways to separate them for easier identification.

- Invoice date: Display the date and/or time you’ve billed a customer and officially record the transaction, which helps keep track of the payment deadlines based on the customer’s payment terms. When sending multiple invoices to the same client, indicate the specific date you billed each item.

- Invoice number: Every invoice needs a unique number to act as its identifier. The invoice number helps track and separate each invoice and makes auditing and filing taxes easier. It can be a number, letters, or a mix of both. Use invoicing software and a sequential series to number your invoices and make the process more manageable.

- Receivable amount due: This is the net amount each customer owes. It should not include partial payments the customer might have made.

- Credit terms: How many days are you giving your customers to make the payment after invoicing them? Your options include a net of 15, 30, or 60 days.

- Due date: This is the date the customer needs to make payment. Including due dates in your AR ledger template lets you spot delinquent payments quickly.

- Payment date: This date indicates when you received payment from the customer for a specific invoice. Include multiple sections in your AR template for customers who make several payments on an invoice. It’s essential to capture each payment date separately for better tracking and financial reporting.

- Payment amount: This section indicates how much you have received for the invoice. If paid partially, break the payment columns down by each specific payment date.

- Outstanding balance: This displays the remaining payment amount, which is especially important when you have partial payments.

- Total outstanding amount: This section reveals the total amount of your outstanding receivables. This summary gives you a quick glimpse of how much your business expects to receive from its customers.

Free Accounts Receivable Template

You can create your own AR template spreadsheet or download one. If you create one, use the details above on essential items to include in your template as a guide.

However, to help you get the AR ball rolling, here’s a free AR template with dynamic formulas to lessen the need for manual calculations. Downloading this free template will get a head start on tracking, managing, and reconciling your receivables more efficiently.

BONUS: Simplify Your Accounting Workflows with This Free Resource

If you’re looking for simple workflow templates to stay on top of your projects and tasks for clients, access our collection of 32 customizable accounting workflow templates and checklists here. This free resource includes a ton of the most popular accounting templates including monthly bookkeeping, weekly accounting analysis, client onboarding procedures, and common tax return forms.

Alternatives to Manually Keeping Track of Accounts Receivables

As your business grows, so does the number of transactions and accounting processes you need to manage, including more manual AR work. It also leaves more room for discrepancies and fraud. Turning to alternative options like AR tracking software makes good business sense when you reach this point. Here are a few accounting software providers to consider.

QuickBooks Online

QuickBooks is an accounting software for small, medium, and large businesses. Since it’s a comprehensive accounting software system, it’s got a dynamic AR feature. It allows you to customize and send quotations and convert them to invoices, invoice clients in multiple currencies, set recurring invoices, and send automatic reminders for outstanding invoices.

Pros

- A user-friendly system, even for a beginner

- Integration option with multiple apps, banks, and credit cards

- Generates financial reports

- Includes a mobile app

Cons

- Additional features require buying pricey plans

- Costly for a small business in need of extra features

- Customer support can be slow

Pricing Plans

- Simple Start: $15/month, 30-day free trial for 1 user and an accountant

- Essentials: $27.50/month, 30-day free trial for 3 users and an accountant

- Plus: $42.50/month, 30-day free trial for 5 users and an accountant

- Advanced: $100/month, 30-day free trial for 5+ users and an accountant

Zoho Books

Zoho Books is accounting software to help you track your business finances, including customer accounts. You can create and send customized quotes and convert them into invoices. You can also send customers reminders for overdue payments and generate an AR aging account.

Additionally, Zoho can assist you in managing other accounting processes, including bank reconciliations, accounts payable, generating financial reports, and integrating with third-party apps and software.

Pros

- Free plan

- More affordable plans for small businesses

- Includes a mobile app

Cons

- Costlier for higher plans

- Limited integration capabilities

- Only premium plans have inventory accounting

Pricing Plans

- Free: for businesses with annual revenues up to $50K, for 1 user and an accountant

- Standard: $20/month for 3 users and an accountant

- Professional: $50/month for 5 users and an accountant

- Premium: $70/month for 10 users and an accountant

- Elite: $150/month for 10 users and an accountant

- Ultimate: $275/month for 15 users and an accountant

Wave

Wave is a free cloud-based software ideal for small business owners and anyone looking for accounting software on a budget. Although free, it still offers powerful features for your accounting, AR, and banking needs. Its invoicing feature allows for invoice customization, recurring billing, setting payment reminders, and generating an AR aging report.

Pros

- Free invoicing, accounting, and banking features

- User friendly

- Includes an app

Cons

- Lacks integration capabilities

- No inventory accounting

- Customer support can be limited

Pricing Plans

- Free accounting, invoicing, and banking capabilities, with tiered payment plans for features like payroll, payment processing, and advisors.

Need Help Tracking Your Team’s Workflows and Deadlines?

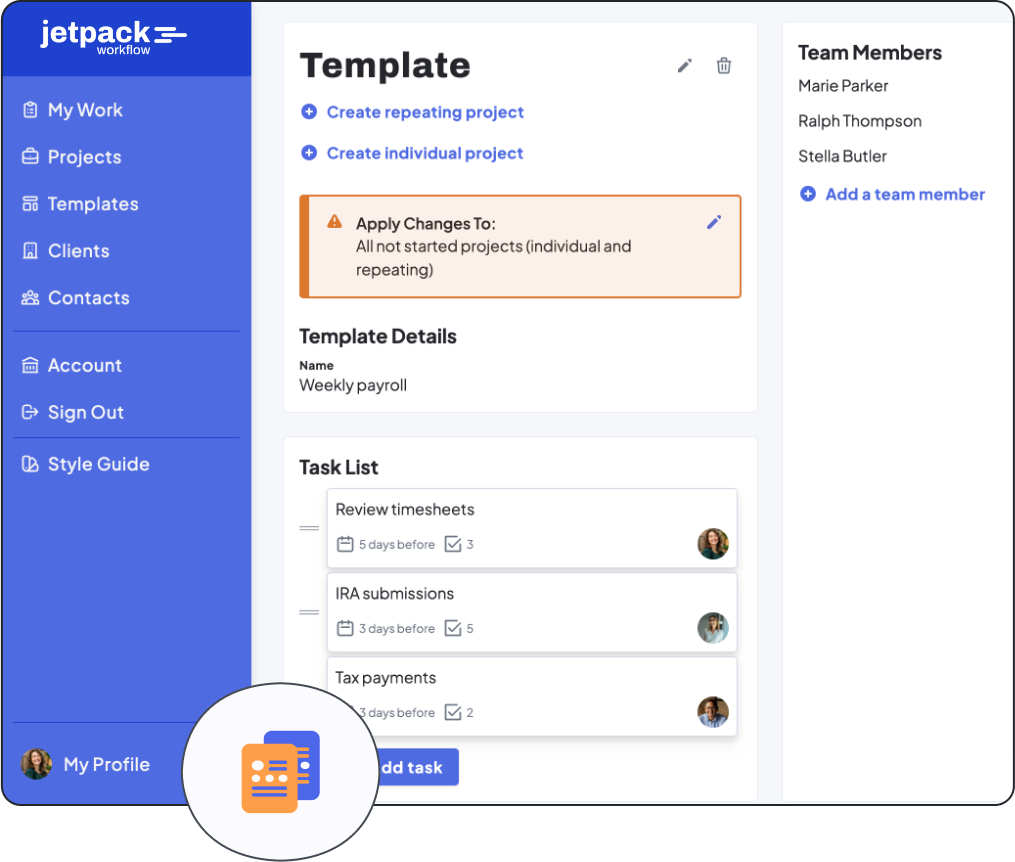

If you’re a bookkeeping or accounting firm needing assistance in tracking your team’s tasks and due dates, Jetpack Workflow could be the perfect solution.

With its easy-to-use interface, automated accounting projects, and workflow management capabilities, Jetpack Workflow can help make managing your team’s workload more efficient than ever before.

Sign up for a 14-day free trial, and start simplifying your bookkeeping and accounting practices with Jetpack Workflow.