A Free Bookkeeping Invoice Template (+32 Other Templates)

Invoice templates are a useful tool to help to streamline the billing process, making it faster and easier for you to get paid for your services.

With so many different free invoice templates available online, how do you know which one is right for you and your business? This post will detail some of the key features to look for in a good invoice template and provide a link to the bookkeeping invoice template.

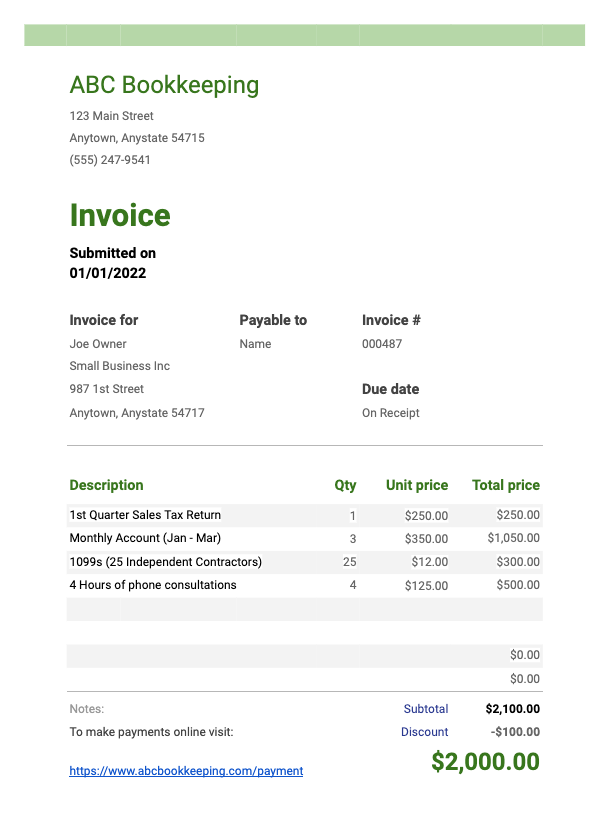

Free Bookkeeping Invoice Template

To get you started, Jetpack Workflow created a bookkeeping invoice template for you to use and adapt for your needs. You can insert more lines in the template if you need to add additional services.

You can also find this invoice template as a Google Sheet to download here.

BONUS: 32 Other Free Templates for Bookkeeping Firms

There’s no reason to start from scratch when you’re invoicing your bookkeeping clients. Jetpack Workflow knows there’s also no reason to start from scratch on many common tasks necessary to run your firm!

Jetpack Workflow created a set of 32 workflow templates to get you started. The templates are fully customizable for your workflows.

What to Include in Your Invoice Template

When you create an invoice template, you’ll need to include certain information to ensure it’s accurate and clear to your clients. Below are outlined the basics of what should be included.

Contact Information

Include your full name, business name, address, and contact information. This will help your clients identify who they need to pay and make it easy for them to get in touch if they have any questions about the invoice.

Recipient Information

Include the full name, business name, and address of the recipient. This will help ensure the invoice is sent to the correct person or business. If your client has an accounts payable department, the invoice should be addressed to them.

Invoice Number

Each invoice should have a unique number. This helps you keep track of payments and helps your clients reference specific invoices if they have any questions. If your clients tend to have several outstanding invoices, ask them to put the invoice number on their payment memo line, so it’s clear which invoices are being paid.

Invoice Date

Include the date that the invoice was created. This will help you keep track of payments and ensure your invoices are paid promptly. You will also use this date to create invoice aging reports.

Payment Terms

Be sure to include your payment terms. This will let your clients know when they need to pay the invoice. Common payment terms include “Net 30” (payment is due 30 days from the invoice date) or “Due on Receipt” (payment is due when the invoice is received).

Services Provided

Include a detailed list of the bookkeeping services you provided. Be sure to include the date, location, and any other relevant information. If you are billing for any goods or subscriptions such as QuickBooks, those products should also be included as a line item on your invoice.

Price

Include the price of each service provided. Be sure to include any discounts or promotions that may apply. Any item with a different price should be included on a separate line.

Total Due

Include the total amount due, including any taxes or fees. Be sure to list the currency in which payment is to be made if you have international clients.

Payment Method

Include your preferred payment method (e.g., PayPal, bank transfer, credit card). This will make it easy for your client to pay you. If you accept online payments, you should include a link to the website where the payment can be made.

Miscellaneous Information

Any other relevant information, such as your tax identification number or a note about shipping costs. Including your tax ID on your invoice will make it easier for your clients to issue you a 1099 at the end of the year (although most bookkeepers will handle issuing 1099s).

When you’re ready to create your invoice template, be sure to use a program that supports customization allowing you to add or remove information as needed. This will help you create a professional-looking invoice that meets your specific business needs.

How Often Should You Invoice Your Clients?

Keeping track of your invoicing will help you stay organized and ensure you’re getting paid on time. How often should you invoice your clients?

There’s no hard and fast rule. Generally, the best option is to invoice each client after completing a project or deliverable. This could be weekly, monthly, or on some other schedule that makes sense for your business. If you invoice too frequently, your clients may feel overwhelmed; if you invoice too infrequently, they may forget about your invoices or have difficulty keeping track of them. Ultimately, finding the right balance for your business is up to you.

Invoicing is just one part of running a successful business. It’s also important to keep track of your expenses, manage your time effectively, and provide quality products or services to your clients. As long as you stay organized and keep up with your invoicing, you’ll be ahead of the game.

Need Help Managing Client Projects?

Invoicing your clients is just one of the many steps you need to take for every bookkeeping engagement. If you find that you have several clients and it’s becoming difficult to track, you should consider implementing a workflow management tool for your firm.

There are several options for workflow management, from paper-based to-do lists to full workflow management systems. Jetpack Workflow was built with bookkeepers and accountants in mind.

The cloud-based workflow management system comes with predefined workflows for common bookkeeping tasks such as financial statement preparation and monthly accounting. By using a system designed for bookkeeping firms, you’ll be able to hit the ground running and ensure nothing is falling through the cracks.