Free Bank Reconciliation Template (Excel, Google Sheets & PDF)

Reconciling your bank statements is one of the most important tasks in maintaining accurate financial records. Without a proper process, it is easy to overlook errors, miss fraudulent transactions, or misstate your cash position.

That is where a bank reconciliation template comes in. Instead of creating one from scratch, you can use a pre-built worksheet that organizes each step.

With our free download, you can access a bank reconciliation in Excel, Google Sheets, or PDF. Each format is simple to use and ensures that your records line up with the bank’s numbers.

This article will walk you through how to do a bank reconciliation using our template, provide helpful tips, and explain how it can support your accounting workflow.

Download Editable Bank Reconciliation Template

To make the process easy, we have prepared a reconciliation worksheet in three formats:

Why Use a Bank Reconciliation

Reconciling your bank accounts ensures that your financial records are both accurate and complete.

The template helps highlight timing differences, such as deposits in transit or outstanding checks, and it makes it easy to adjust your books, as well as ensures:

- Accuracy: Errors or missed entries are quickly spotted.

- Fraud detection: Unauthorized transactions become visible.

- Cash visibility: You know your true available balance.

- Compliance: Many businesses are required to maintain reconciled records.

A bank reconciliation sheet simplifies the task and provides a clear audit trail for your financial data.

How to Do a Bank Reconciliation

Performing a reconciliation can seem tedious, but with a template, the process is straightforward. Here are the main steps.

Step 1: Compare Bank Statement with Your Books

Start by reviewing the ending balance from your bank statement against the ending balance in your general ledger or accounting software. This establishes the starting point for reconciliation.

Step 2: Identify Deposits in Transit

Sometimes deposits appear in your records but not yet on the bank statement. Add these to the bank balance. The simple bank reconciliation template Excel includes space for listing these items clearly.

Step 3: Subtract Outstanding Checks

Checks that you have issued but that the bank has not yet cleared need to be deducted. List each outstanding check in the template until it clears in a future statement.

Step 4: Record Bank Fees and Interest

Your bank may charge fees or pay interest directly. These transactions may not appear in your books yet, so record them during reconciliation. The bank account reconciliation template provides fields for these adjustments.

Step 5: Adjust Your Records

After accounting for timing differences, update your books so that the adjusted balance matches the reconciled bank balance. If they do not match, investigate further.

Features of Our Excel Bank Reconciliation Template

Our template is more than a blank worksheet. It is designed to guide you through each part of the process:

- Pre-built sections for deposits in transit, outstanding checks, and bank adjustments.

- Formulas that calculate totals automatically.

- Customizable layout so you can adapt it to weekly or monthly reconciliations.

- Compatibility with Google Sheets for easy online collaboration.

If you have ever wondered how to make a bank reconciliation statement quickly, this template provides a ready-made solution.

Example: Using the Template

Suppose your books show an ending cash balance of $12,500 while the bank statement shows $13,200.

- You have a deposit of $1,000 recorded in your books that has not yet cleared.

- You also issued a check for $700 that has not cleared the bank.

- The bank charged a $50 service fee.

In the template, you would:

- Add the $1,000 deposit in transit.

- Subtract the $700 outstanding check.

- Subtract the $50 bank fee.

The adjusted balances will now agree, ensuring your records match the bank’s.

Tips for Using Jetpack Workflow’s Bank Reconciliation Statement Template

Here are a few best practices to maximize the template’s effectiveness:

- Reconcile regularly. A monthly bank reconciliation template works well for most businesses, but weekly reconciliations are even better for cash-sensitive operations.

- Keep supporting documents. Save copies of bank statements, deposit slips, and canceled checks alongside your reconciliation worksheet.

- Separate duties. If possible, have one person prepare the reconciliation and another review it to reduce the risk of errors or fraud.

- Stay consistent. Always use the same structure so that each reconciliation is easy to review.

Need Help Managing New Client Projects?

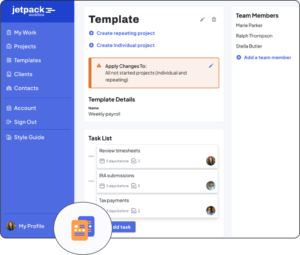

A workflow management system is a great way to keep your bookkeeping firm organized and running efficiently. By automating tasks and keeping track of deadlines, you can be sure that nothing falls through the cracks and your clients are always getting the best possible service.

In addition, a workflow management system can help you to allocate resources more effectively, ensuring your staff is always working on the most important tasks. Ultimately, a workflow management system can save you time and money, making it an essential tool for any bookkeeping firm.

Jetpack Workflow was designed from the ground up with bookkeepers and accountants in mind. The cloud-based workflow management system allows you to start with predefined templates, customize them for your firm, and track progress on all your work.

Jetpack Workflow offers a free 14-day trial which will give you the opportunity to see how much time you could be saving with a full workflow management system.

Final Thoughts

A bank reconciliation template is a practical tool for keeping your books accurate and reliable.

By downloading our free version in Excel, Google Sheets, or PDF, you can simplify the process and maintain confidence in your financial records.

Whether you are reconciling weekly, monthly, or quarterly, the template helps ensure that your accounts reflect reality.

Try the free download today and explore other Jetpack Workflow templates to strengthen your accounting workflow.