A Free Bookkeeping Service Agreement Template for 2024

It’s a great feeling to land a new bookkeeping client. To keep the relationship strong, you and your client must be on the same page regarding your responsibilities.

Below is a free bookkeeping service agreement template you can use as a starting point to make sure you’ve covered the duties included in your engagement.

Free Bookkeeping Service Agreement Template

The template below is also available as a Google Doc. Please note that the template is provided for illustrative purposes and should not be construed as legal advice.

Bookkeeping Services Agreement

This contract is entered into _____________________ by _________________ (“Bookkeeper”) and ____________ (“Client”). This contract will be effective as of ______________.

The Client and the Bookkeeper (“Parties”) agree to the following terms and conditions for the Bookkeeper’s services. The Bookkeeper will remain an independent contractor and will not be considered an employee of the Client.

1. Services To Be Rendered

The Bookkeeper agrees to provide the following services:

- Accounts Payable

- Accounts Receivable

- Bank Reconciliation

- Bill Payment

- Budget Preparation

- Detailed General Ledgers

- Financial Statements

- General Bookkeeping

- Payroll

- Other: ________________________

2. Fees

The client will pay fees for the services above:

- Fixed Amount:$__________

- Monthly Retainer: $_________ per month

- Per Hour: $_____ per hour

3. Client Cooperation and Obligations

The Client will be responsible for providing all the necessary documentation and accounting system access necessary to perform the services outlined in the bookkeeping agreement above. The Client acknowledges that the accuracy of financial information provided is the sole responsibility of the Client, and the Bookkeeper will be held harmless from any liability resulting from the inaccuracy of the financial records provided by the Client.

4. Confidentiality

The Bookkeeper understands that all information provided by the client is sensitive personal and financial information. The Bookkeeper will maintain the strictest level of confidentiality regarding such confidential information. This confidential information will include financial documents, information contained in accounting systems, and information provided orally by the Client. The Bookkeeper will not disclose any information to any third party without the prior written consent of the Client.

5. Termination

- Terminated by Both Parties Period. By providing the other party at least ____days’ written notice.

- Terminated by Client ONLY. By providing the Bookkeeper ____ days’ written notice.

- Terminated by Bookkeeper ONLY. By providing the Client ____ days’ written notice.

Payment of any outstanding invoices is due immediately upon termination of this contract by the Client.

6. Dispute Resolution

All disputes under this agreement shall be settled by binding arbitration in the state under which the agreement was entered into. The arbitration may be commenced at any time by either party and will commence when written documentation is provided to the other party. Any payment awarded by the single arbitrator will be considered binding under this agreement and create a legal obligation for the Party to pay.

7. Limitation of Liability

In no event shall either party be liable to the other party for any damages, including without limitation, business interruption, loss of or unauthorized access to information, damages for loss of profits, incurred by the other party arising out of such services provided under this agreement, even if such party has been advised of the possibility of such damages. In no event will neither party’s liability on any claim, loss, or liability arising out of or connected with this Agreement shall exceed the amounts paid to the Bookkeeper during the period immediately preceding the event giving rise to such claim or action by the Client or the limits of the Bookkeeper’s professional liability policy, whichever is greater of the errors and omissions policy that is in place.

8. Acceptance

The signatures below indicate entire agreement and the Parties entering into this contract.

______________________________ __________________

Bookkeeper Signature Date

______________________________ __________________

Client Signature Date

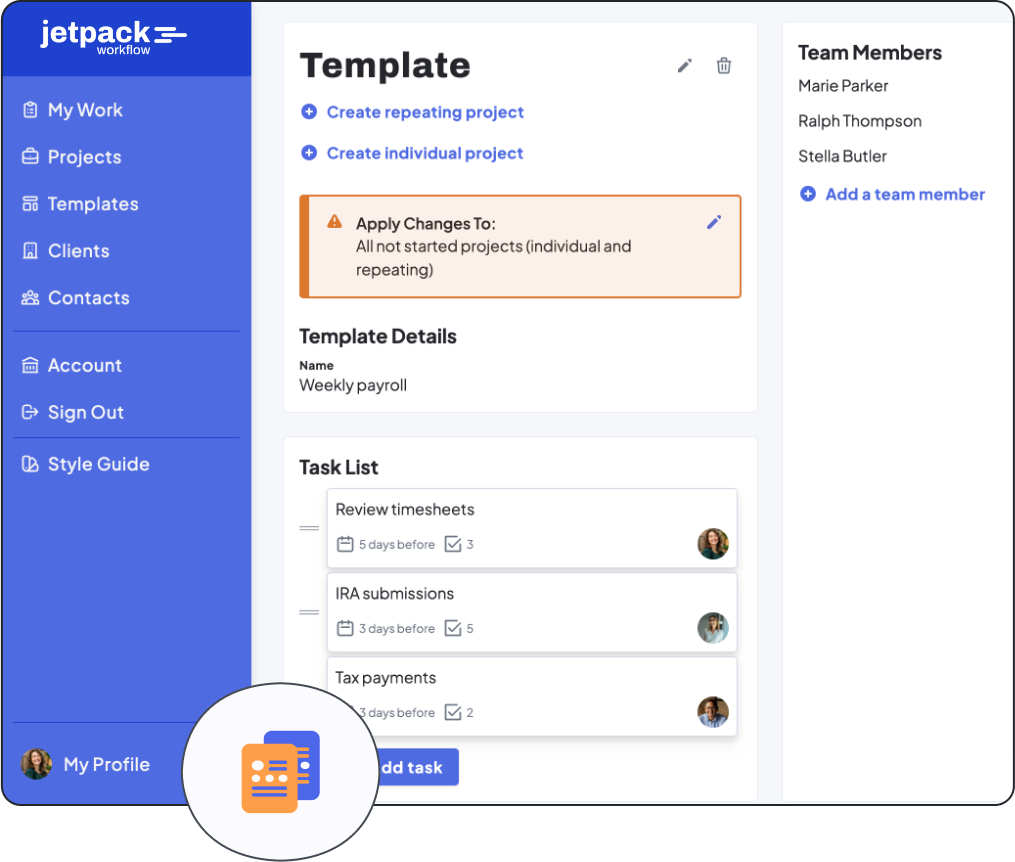

BONUS: 32 Other Free Templates for Accountants

The above bookkeeping services template gives you a starting point for your Bookkeeping Service Agreement so you don’t have to start from scratch. Jetpack Workflow believes that using existing resources can make your practice more efficient and increase profitability.

That’s why we’ve created a free set of 32 accounting and bookkeeping workflow templates to help you standardize your workflows. The templates cover a variety of accounting-related projects, such as bookkeeping, audits, financial statement preparation, tax engagements, and more.

What to Include in Your Service Agreement

Several key items should be included in a Bookkeeping Contract Agreement. State laws and regulations govern contracts. You should also check to see if your state has any specific requirements to make a service contract legal and binding to ensure your agreement is in accordance.

Services To Be Rendered

Your bookkeeping service agreement should include all the services the bookkeeper will perform. This helps avoid scope creep and future misunderstandings from your client. The bookkeeping services should be outlined in as much detail as possible. Standard bookkeeping services include accounts payable, accounts receivable, monthly bank reconciliations, and financial statement preparation. If you offer additional services, they should be carefully explained in the services agreement.

Fees

The discussion of fees should include both the type of billing (hourly, retainer, or flat fees) along with specifications of how often payment is expected. You should also include language explaining who is responsible for paying expenses incurred during the engagement, such as software fees, travel expenses, and other out-of-pocket expenses. The agreement can also include a timeframe for receiving payment (i.e., net 30) and a statement that nonpayment of invoices is a breach of contract and will result in termination of services.

Client Cooperation

As a bookkeeper, you know that one of the main roadblocks in completing the work is obtaining information from your clients. You should include language explaining that it is the full responsibility of the client to provide banking records and other financial information necessary to complete the engagement.

The agreement should also explain that the client is responsible for the accuracy of the information provided. You do not want to be held legally responsible for inaccurate financial statements prepared from inaccurate information provided by the client. If you have specific timeframes for delivery of your work product (such as by the 15th of the month), there should be language stating that delivery of the work product is contingent on the timely receipt of information from the client.

Termination

A bookkeeping service agreement is a binding contract for the parties involved. You need to outline the circumstances under which either party (the bookkeeper or the client) can end the contract term. This usually includes a set number of days required for either party to give written notice to the other that they want to end the contract.

This period is typically 7 or 30 days. The termination clause should also include an explanation of what is required upon termination (i.e., final payment of outstanding invoices or a return of all financial documents.)

Legal Liability Limitations

The bookkeeping services agreement should provide clear language outlining each party’s liability limitations. While bookkeeping doesn’t often lead to legal action (and, of course, you should always maintain professional liability insurance), you should be prepared if an engagement does lead to legal action.

Stating how legal disputes will be resolved (such as through arbitration) will be helpful if the engagement ever leads to legal action. Additionally, stating who is responsible for paying the reasonable legal fees in the event of arbitration can make the process smoother later.

Signatures

The contract should contain signatures by both parties indicating acceptance of the terms of the agreement. Each party should then keep a copy of the contract for their records.

Need Help Managing New Client Projects?

Once you’ve landed your first few clients and placed your work agreements in place, you need to start focusing on getting the work done and providing the highest quality service for them.

The earlier you can integrate a workflow management tool into your practice, the easier it will be to maintain as your practice grows.

If you and your team struggle to keep track of multiple promised delivery dates, it’s time to implement a workflow management tool.

A complete workflow management system such as Jetpack Workflow can help you monitor progress on your client projects, provide valuable insight into your team’s workload, and remind you about upcoming deadlines, so nothing falls through the cracks.