How to Finance Accounting Firm Acquisitions: SBA Insights from Sarah Sharp and Shannon Hay

Featuring:

-

Sarah Sharp, Partner at SK&S Law & Founder of Deal Academy

-

Shannon Hay, Senior VP at United Midwest Savings Bank

-

Hosted by: David Cristello, CEO of Jetpack Workflow

Buying an accounting firm can feel like a leap, but the right financing strategy makes it achievable. During the 2025 Jetpack Workflow M&A Summit, Sarah Sharp and Shannon Hay shared how firm owners are using SBA loans and smart deal structures to buy or expand accounting practices, even with limited capital.

They covered how the market has shifted, what buyers should know before signing a letter of intent, and why earnouts have largely disappeared from modern deals.

“You can leverage the equity in your existing firm to acquire another, often with limited capital out of pocket.” – Shannon Hay

Key Takeaways

-

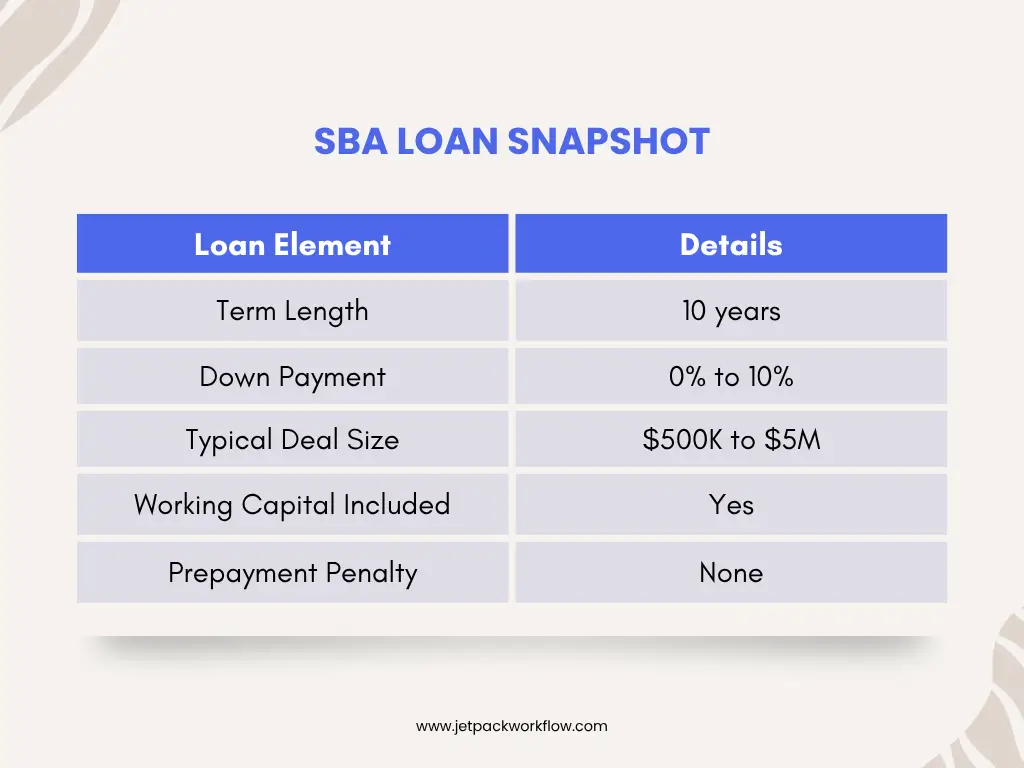

SBA loans are the primary funding tool for firm acquisitions between $500K and $5M.

-

Earnouts are fading as sellers increasingly want upfront payment.

-

Private equity competition has raised valuations but also made deal structures more complex.

-

SBA loans now support internal partner buyouts and successions.

-

Buyers should consult lenders and attorneys before signing Letters of Intent (LOI).

Why Financing Accounting Firm Acquisitions Looks Different Today

Over the past decade, the accounting M&A landscape has shifted. Valuations are higher, transactions close faster, and most sellers expect upfront cash. Shannon Hay explained that SBA lending has become the foundation for small and mid-sized firm acquisitions, helping independent firms compete with larger investors.

“We’ve seen the market move significantly, not just in the last two years, but over the last decade.” – Shannon Hay

The Small Business Administration (SBA) program helps firm owners expand through government-backed loans that reduce lender risk and borrower costs.

Existing firm owners can use their firm’s equity as collateral. First-time buyers typically contribute about 10% of the total project cost, including the purchase price, closing costs, and working capital.

“Structure drives value. Seller participation is a key part of that structure.” – Shannon Hay

Financing Internal Buyouts and Partner Transitions

Internal successions are growing in popularity. With SBA financing, junior partners can buy out senior partners by leveraging existing equity. For example, a partner with 10% ownership in a $1 million firm can use that equity to finance a $900,000 buyout. This allows firms to remain independent while transitioning ownership efficiently.

“People want their money upfront. That’s what’s market now.” – Sarah Sharp

Earnouts, where sellers are paid gradually over time, are less common. SBA loans enable buyers to pay most of the purchase price immediately, giving sellers the clean exit they prefer.

The End of Earnouts

The traditional earnout model, which pays sellers based on future performance, is quickly disappearing. Private equity buyers accelerated this change by offering large upfront payments. SBA loans have made it possible for independent buyers to do the same.

Sellers prefer cash deals for retirement security or reinvestment flexibility. Buyers benefit from clear ownership and a simpler transition process.

“The earnout died immediately, and yes, that’s partly private equity’s fault.” – Sarah Sharp

Working Capital and Deal Structure

Both experts advised firm owners to carefully evaluate working capital adjustments before finalizing a deal. A higher headline offer might seem appealing but could be reduced later once working capital is factored in.

“A $3 million offer reduced by working capital might be worse than a $2.9 million cash offer.” – Sarah Sharp

Shannon explained that working capital built into SBA loans helps bridge cash flow gaps between billing and collections, which often span 30 to 60 days in accounting firms.

SBA vs Private Equity Financing

SBA loans allow independent firm owners to compete directly with private equity buyers. While PE deals may include rollover equity, Sarah warned that not all rollover equity holds real value. Some arrangements include restrictive clauses that allow buyers to buy it back for minimal value or cancel it under certain terms.

“You can get a giant purchase price if it’s made up of nebulous rollover equity, but that might mean nothing.” – Sarah Sharp

When to Involve a Lender or Attorney

Both Sarah and Shannon emphasized that firm owners should engage a lender and an attorney before signing the Letter of Intent (LOI). Even though the LOI is non-binding, it often defines expectations that are difficult to change later.

“It’s not rocket science. It’s pattern recognition. But once you sign, it’s very hard to walk it back.” – Sarah Sharp

Early collaboration with both professionals ensures compliance with SBA guidelines, realistic tax implications, and smoother financing.

SBA Rules on Seller Involvement

Under SBA guidelines, sellers who receive proceeds cannot remain in a key management role for more than 12 months after closing. They can, however, stay on as consultants to ensure client continuity.

“Relationship is the critical element to transition. There needs to be something that keeps the seller engaged.” – Shannon Hay

Key Lessons for First-Time Buyers

-

Plan for a 10% down payment if you are a first-time buyer.

-

Engage your lender before submitting your LOI.

-

Include working capital in your loan structure.

-

Maintain seller involvement for at least the short term.

-

Clarify all tax and legal terms before closing.

“Find the deal first, then bring it to your lender and lawyer to confirm what is feasible.” – Shannon Hay

Conclusion

Buying an accounting firm is one of the fastest ways to grow. SBA loans now make acquisitions and partner buyouts accessible without giving up firm ownership. With guidance from experts like Sarah Sharp and Shannon Hay, firm owners can structure transactions that are both financially sound and sustainable.

Frequently Asked Questions

1. How can existing accounting firm owners use SBA loans to buy another firm?

They can use their firm’s equity as collateral, often allowing them to acquire another business with minimal upfront cash.

2. What are the risks of seller financing or earnouts?

Earnouts delay full payment and add uncertainty. SBA loans give sellers upfront payments and buyers predictable terms.

3. Can SBA loans be used for internal buyouts?

Yes. Partners can leverage their equity to finance buyouts, provided they meet the 10% equity requirement.

4. What should be reviewed before signing a Letter of Intent?

Consult with both a lender and legal advisor to ensure compliance with SBA rules and realistic deal terms.

Plan Your Firm’s Next Acquisition with Jetpack Workflow

After every acquisition, operational alignment is critical. Jetpack Workflow helps accounting firms integrate clients, teams, and systems efficiently to maintain productivity.