How to Start a Successful Virtual Bookkeeping Business in 2024

You’ve decided to open a virtual bookkeeping business, but you might be wondering how to get started. In this article, we’ll outline the steps to build your business so you can get up and running and build a full client roster.

But first, there is one action to take before you do anything else.

Naturally, getting paying customers is the most important part of starting any business, and this is also true for your own bookkeeping business. Getting your first client means you’ll have someone who can back your claims of offering high-quality and cost-effective services.

While the steps outlined below need to be completed at some point as you establish your business, getting your first virtual bookkeeping client should be the first thing you do. This way, you’ll be growing your reputation alongside building your business.

Let’s get started! (You don’t need to complete the steps below in this order.)

14 Steps to Start a Successful Virtual Bookkeeping Business

1. Establish Your Company

You should figure out the business structure you want to create. Many bookkeepers start as sole proprietorships, meaning you work alone and provide all the services yourself. But you may also think about forming a limited liability company (LLC) or corporation.

The ideal business entity type for your virtual bookkeeping services will depend on your long-term goals and revenue expectations. Each state also has different rules for business taxes, so you’ll need to consider how state taxes would apply to your business.

If you are starting the company with a partner, make sure a partnership agreement is part of your business plan. This agreement ensures you are both on the same page concerning business operations.

Lastly, part of this process is picking a business name, which you should do with care. You’ll be using the name for years, so be sure it’s a professional and accurate description of your work.

2. Get the Necessary Licenses and Permits

Permit and licensing requirements vary by state and locality.

If you’ve established a corporation or LLC, the entity needs to get registered with your state. Sole proprietorships do not require formation filings, though they often require business licenses.

Once you’ve formed your entity, you must apply for an employee identification number (EIN) with the Internal Revenue Service (IRS). The EIN identifies your business and is separate from your social security number (SSN). An EIN is optional for sole proprietors, but it allows you to receive 1099s at the end of the year from your clients without giving them your SSN.

You are required to register for a business permit in most locations. Fees vary from a few dollars to a percentage of revenue, depending on your business location. You should consider the licensing fees when deciding where to locate your virtual bookkeeping business.

If you plan on operating under a fictitious business name or several different names, you may need to file a “Doing Business As” (DBA) statement. DBAs can usually be filed with your county or parish.

3. Get Insurance

Business insurance will protect you from claims against your business, but you need the correct types of insurance policies.

One of the most critical steps to take in your virtual bookkeeping business is to invest in professional liability insurance, also known as errors and omissions (E&O) insurance. This insurance will cover you against claims you made a mistake in preparing a client’s books. The amount of coverage you need will depend on your client list.

Professional liability insurance will protect you against errors, negligence, and omissions that may occur during your bookkeeping engagements. Your premiums will vary depending on what type of services you offer and your projected revenue.

For a bookkeeping business just beginning, an insurance policy costs less than your daily cup of coffee. You should request quotes from several agencies to ensure you get a good deal.

You should also consider health insurance as an added expense, especially if you previously had health insurance through your employer. Replacing employer-sponsored coverage can be one of the most expensive costs of going into business for yourself.

Many states require residents to have some level of health insurance coverage. Health insurance is a much sought-after benefit if you plan to hire employees. If your virtual bookkeeping firm has employees in several states, you may want to work with an insurance agent to find coverage that works for all your employees.

4. Create a Web Presence

Websites are essential for virtual bookkeeping firms. Without a website—and since you have no physical office—your business may appear to be fly-by-night.

You do not need an expansive or expensive website to get started. You can create a simple website for less than $50, including the domain name. If you don’t have experience, you can find many predesigned websites online or have one put together for less than $500.

5. Get Equipment

Starting up a virtual business doesn’t require ordering a bunch of office supplies. We no longer need ten keys or ledger paper, especially in a virtual bookkeeping firm.

That doesn’t mean that there aren’t any startup costs. You will need a complete office setup, including a good scanner and possibly a printer. You’ll need a reliable internet connection and a computer that can run accounting software quickly.

Virtual bookkeepers juggle several files constantly. Having multiple monitors is key to working efficiently. You should also consider a reputable webcam and headset for client meetings. Sign up for meeting software such as Zoom or Teams.

6. Pick a Focus

Virtual bookkeeping firms have the benefit of being able to work with anyone regardless of their location. But do you have a specialty? Are you knowledgeable about specific types of businesses?

Picking a focus is optional, but consider choosing a specific niche for your business. It allows you to target your advertising and outreach. You can rank higher in online searches by having a niche.

You can base your niche on a specific location or specific profession. By becoming an expert in a particular area, you will complete your work more efficiently and potentially earn more for your expertise, all of which frees up time for you to work on getting more clients.

Sometimes niches are created organically. If your current clients start referring you to other businesses in the same industry, you might end up in an unexpected niche.

7. Set Pricing

One of the first questions potential clients will ask is about your prices. You need to be ready to answer! Start by deciding how you are going to price your services.

If you got into virtual bookkeeping for the freedom and flexibility, you might want to work off retainers, but you also have the option to bill hourly. You should consider the following questions when picking a billing method.

Do You Want to Track Your Time?

Billing hourly has been standard practice in the bookkeeping industry for decades. It can be a very profitable way to bill your clients. But there is a downside: you need to track how all your time is spent.

There is also no reward for working efficiently since fewer hours means less billing. As a virtual bookkeeping firm, you’ll need to determine a reasonable rate for your clients, even if they’re located in other areas.

How Will You Handle Scope Creep for Fixed Payment Clients?

If you’d prefer not to bill hourly, you can set a fixed fee or retainer bill for each client. This method rewards you for working efficiently as long as you’re getting the work done. When you finish your work, you can stop for the day or focus on getting more clients.

The tricky aspect of this type of pricing is that it’s easy for the scope to expand. You need an engagement letter with your clients that clearly states any request outside the scope of your work comes at an additional cost. This way, your clients don’t monopolize your time.

Do You Have the Time to Bill Your Clients by Hourly Invoices Each Month?

Hourly billing is a lot of work. You need to review the hours billed to each client and invoice based on those hours. Make sure you have time to complete the invoicing each month if you decide to bill hourly.

8. Set Up Your Software

Be ready to do the work. Have all your accounting software subscriptions in place before you get a client. As your business expands and you add team members, you may need to reevaluate your software needs.

Virtual bookkeeping firms also need several non-accounting software subscriptions. You should have PDF editing, presentation, and time management or workflow software. Microsoft Office Suite used to be a requirement, but many virtual bookkeeping businesses use the free Google Workspace products.

For firms planning on holding virtual meetings with clients, you will want to invest in a Zoom Pro subscription to schedule longer meeting times with larger groups of attendees.

9. Track Your Expenses

Don’t forget to maintain your own books. It’s easy to get caught up in client work and neglect yours. Think of all you recommend to your clients and implement those same procedures for your business.

Have an expense log ready, and track expenses paid through personal accounts. Set up separate accounts for your business, just like you’d want your clients to do.

Keeping your books in good shape means you can spend more time working on your client files, especially at the end of the year when you’ll be extra busy!

10. Build Your Team

Most virtual bookkeeping firms start with the owner as the sole employee. But as your business grows, you’ll need more team members to support your clients.

When you launch your business, be aware of people you meet who could add value as employees. Don’t limit yourself to only bookkeepers; you should consider adding administrative assistants or marketing specialists to your team.

To preserve your time for expanding your business, think about how to outsource tasks to other team members. Outsourcing tasks might cost some money upfront but frees up time for running your business, working with your clients, and acquiring new ones.

Don’t wait until the last minute to add a new team member. If you suspect you’re getting close to expanding, start looking! Give yourself time to find the right person and get them up to speed.

11. Implement a Project Management System

Virtual bookkeeping firms can’t rely on physical files to track their to-do lists. If your team is in different locations, you won’t always be able to see what they’re working on, so a to-do list won’t cut it.

Spreadsheets are an option. You could use Google Sheets or a shared Excel file to manage your team and allocate tasks. However, this method isn’t helpful if you have a large team.

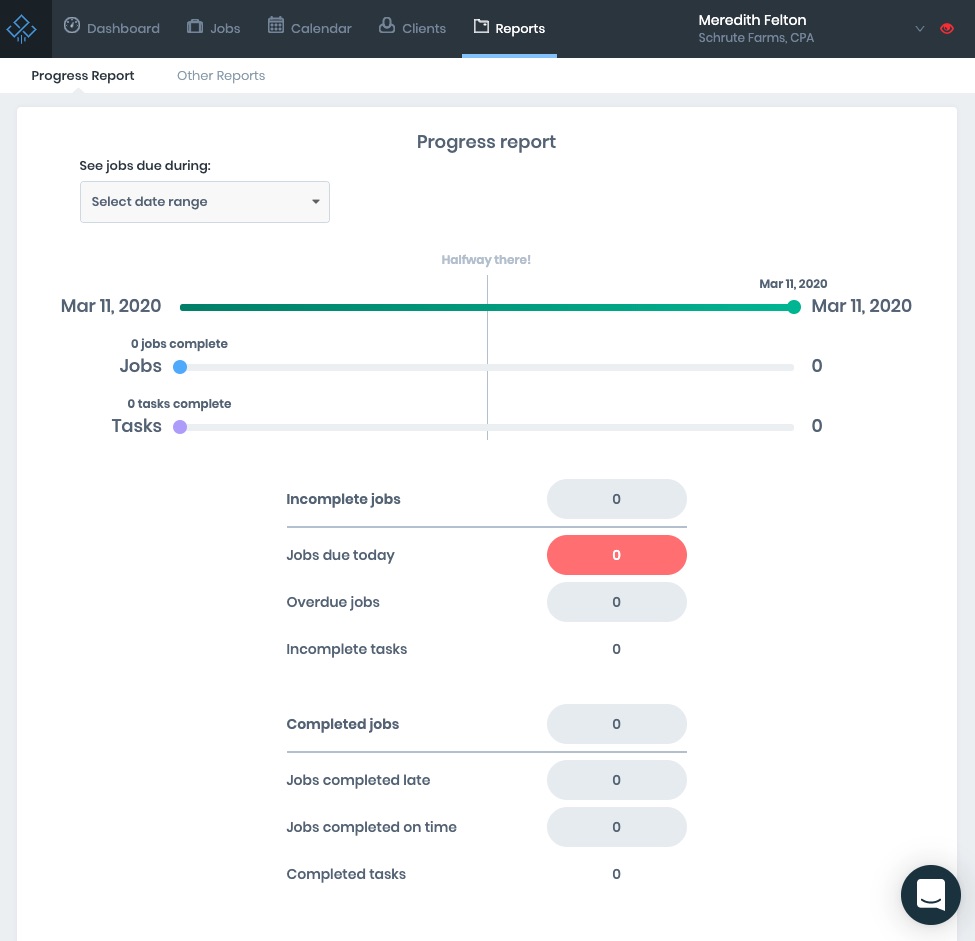

Consider a workflow management system like Jetpack Workflow. The right workflow management system can save you hours and allow you to monitor your team without micromanaging it.

12. Advertise Yourself

A virtual bookkeeping firm can’t rely on signs outside an office building to advertise itself. You need to find a way to put yourself out there.

Think about various ways you can reach out to potential clients or get your business in front of them. Every contact with a business owner is an opportunity to land a new client.

Business cards are a bit old school, but they still work well when trying to land a new client. Cards are great for in-person meetings if you have a local client.

For virtual bookkeeping companies, your focus should be on online advertising. You can use Facebook or Google Ads, but consider social media options such as TikTok, Instagram, Twitter, and Pinterest, which have also proven successful for some firms.

For more ideas, check out Jetpack Workflow’s suggestions on how to market your virtual bookkeeping business.

13. Network

Virtual businesses sometimes forget about networking, but several online platforms help businesses to meet and grow virtually.

Credentials can also help you advertise your business. You should consider joining the American Institute of Professional Bookkeepers (AIPB) or the National Association of Certified Public Bookkeepers (NACPB).

14. Enjoy Your Success… But Keep Hustling

Get excited about your first client, then get back out there and find more. Keep your long-term goals in mind, and keep working towards them. Having a five- or ten-year plan allows you to track your progress and make adjustments along the way.

Keep looking at what’s working and what’s not. Check in with your team, and evaluate your software. Watch out for trends and new opportunities.

Be proud of your success, but keep moving forward!

Get a Head Start on Your Accounting Workflows with This Free Resource

Before you start spending endless hours manually creating and building workflow and process templates for your firm, check out our collection of 32 customizable accounting workflow templates and checklists. This free resource includes a ton of the most popular accounting templates including monthly bookkeeping, weekly accounting analysis, client onboarding procedures, and common tax return forms.