A Simple Accounting Client Onboarding Checklist (Free Template)

You did it. Your marketing effort and fabulous sales pitch landed you a brand-new client. And you might think this is the most significant moment in the client relationship. However, it’s the onboarding phase that determines the difference between long-term success and an increased client churn rate.

The onboarding stage is vital for retaining new clients. That’s when they get to see you “walk the walk” from your initial sales pitch.

Onboarding is also when the client gets connected with your team, so it’s essential that everyone within your firm makes a good first impression as well.

You could use manual bookkeeping systems or sophisticated accounting software to set up your client’s accounts more swiftly. Either way, just like bookkeeping, your onboarding method determines whether it’s a tedious, manual process or an efficient, streamlined practice.

When you’re ready to onboard new clients, ensuring they get a proper checklist of the documents you need from them is critical.

This preparedness demonstrates your professionalism and assures the client that one of the most essential functions of their business is being handled properly by your firm.

As you welcome a new client and conduct the onboarding process, you might find different documentation requirements for each client type. This article offers a thorough onboarding checklist to keep you ahead of the game and get you everything you need to begin working with your client.

10 Things to Include on Your New Accounting Client Onboarding Checklist

1. Signed Contract

A signed contract is the first document required for your working relationship to begin. The contract should include details on the scope of your arrangement, and a complete, signed copy should live in your client file, ready to reference if needed.

2. Welcome Email

After the initial kickoff meeting with your new client, send a welcome email. Be sure it clearly outlines the next steps, your expectations of them, and a timeline for the initial scope of the project.

3. Basic Information and Documentation

It’s time to start the information-gathering process. At the early stages of your engagement, it’s the client’s responsibility to ensure you have the documentation you need to be as effective as possible.

Simplify this process by giving them a foundation to stay organized through the information-sharing stage. You can include a questionnaire in your welcome email, providing them with a checklist.

4. Access to Previous Accounting Systems

Whether your client has accounting software, like QuickBooks or Xero, or a manual accounting system, you need access to these programs. You and your employees want to accurately gauge the current condition of the accounting records, even though you may already have a sense of the situation through your previous discussions with the client.

5. Access to Accounts

Next on your client checklist is gaining access to your client’s accounts, including credit cards, loan accounts, and banking accounts. You may also want the client to include information about how they use these accounts.

For example, the client’s firm might use a credit card account for supplier transactions and a banking account for receivables.

This step also includes accessing the most recent account reconciliations to get a better overview of the financial health of the company.

6. Access to Inventory Records

Handling inventory accounts is a complex process that includes supplier payments, wastage, handling expenses, accrued revenues, and order fulfillment ledgers.

You need to ask your client to allow you access to the firm’s inventory records.

This way, you can get a better picture of how previous accounting systems handled inventory and how your accounting firm should now go about it.

7. Previous Invoices

The company’s payment and receivable process should have invoice proof. You need to gather all this documentation to verify the payment of previous invoices and identify any invoices that need to be cleared in the next accounting cycle.

8. Taxation

Information and documentation on prior year tax returns are another essential checklist item. You need to understand the overall accounting health of the company.

9. Gathering Financial Statements

Whether it’s a small business or a scaled one, financial reports on your client’s operations are also crucial documents for your accounting firm.

These reports include balance sheets, financial reporting at a portfolio level, income statements, and cash flow statements.

10. Schedule Meetings

Once you have all the items on the checklist that your firm needs to begin work, schedule regular status updates. Communicate these checkpoints to the client so they know what to expect.

You could also schedule meetings with your client to provide reports on the accounting process. These meetings can be monthly, bimonthly, or weekly, depending on the capacity of your bookkeeping firm and your client’s expectations.All these checklist elements for onboarding new clients may seem overwhelming. However, once your employees get the hang of the onboarding process, it’s just a matter of time before you begin attracting more clients because of your professional approach.

Free Accounting Client Onboarding Checklist

If you’re looking for simple, customizable checklists for onboarding new clients, check out our 32 free workflow templates. They can help you stay atop your customer accounting and onboarding processes and highlight your professionalism.

Best Places to Keep Your New Client Onboarding Checklist

Now that you have the list of documents and other requirements needed for client onboarding, let’s look at ways to manage this checklist effectively as your firm grows and consistently welcomes new clients.

Write It Down

The simplest way to maintain your checklist is to write it down. You can keep separate files for each client, which can help when cross-checking the documents you receive with the ones you don’t have yet.

However, if your employees juggle multiple clients, your lists can get mixed up. Another drawback of this method of maintaining your checklist is that you cannot insert hyperlinks or connect them to other documents.

As a result, you may miss having received essential documents and ask your client for them again. That could reflect poorly on your company’s performance.

Pros:

- Simple method

- Separate physical files for each client, which are safe from cyberattacks

Cons:

- Possibility of human error when handling multiple clients

- Increased probability of missing out on documents, reflecting poorly on your firm’s performance

Google Docs or Spreadsheet

Another way to keep a live documentation record and update your checklist is with platforms like Dropbox, which allows you to share files easily.

You can also maintain your records on cloud-based spreadsheets and documents, which other employees can easily access.

However, none of these methods would alert you to overdue tasks. Assigning work to other employees would require collaboration over email, which might get overlooked and cause delays.

As a result, your accounting firm might miss deadlines, which isn’t a good performance indicator.

Pros:

- Live document

- Accessible and shareable by your whole team

Cons:

- No deadline indication feature

- Assigning work to other employees requires collaborating by email

Jetpack Workflow

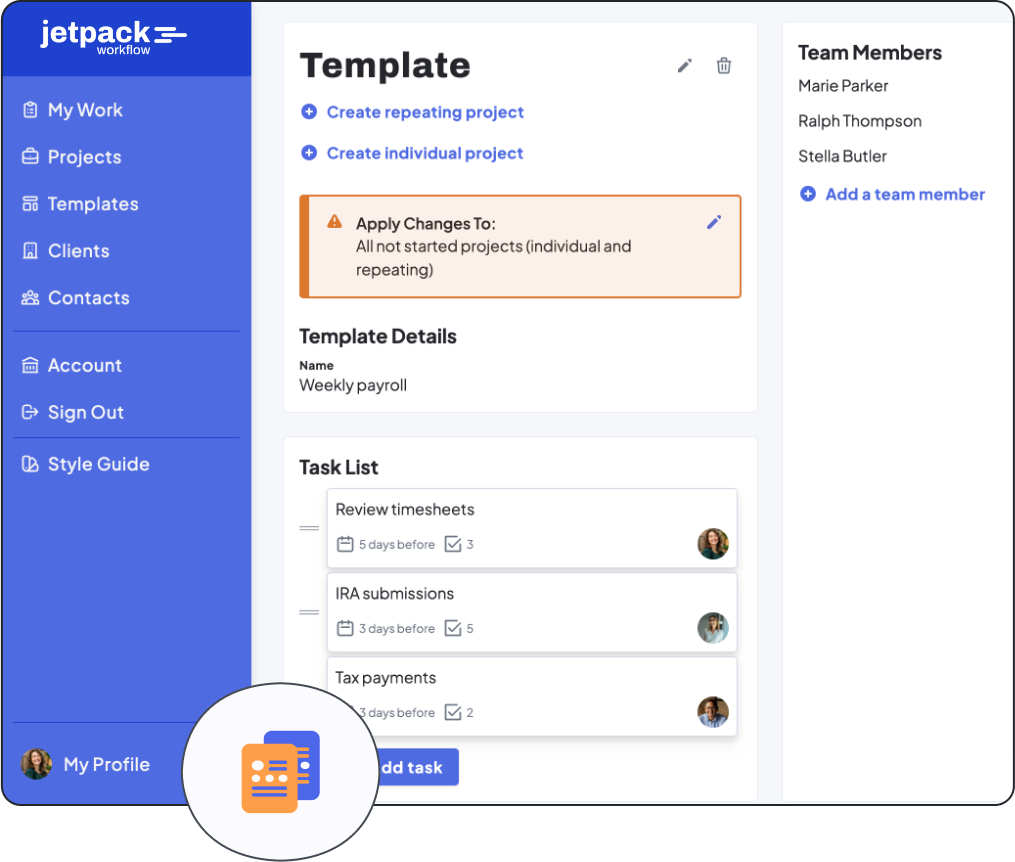

Easy-to-use accounting software like Jetpack Workflow can significantly simplify your accounting firm’s operations.

Gathering information, assigning work to other employees and departments, and keeping track of deadlines through this software is a breeze.

Here are just some of the benefits your accounting firm gains using Jetpack Workflow for efficient client onboarding as well as subsequent account management tasks:

- Easily import client information via a CSV file.

- Add projects, set up a custom recurrence, and duplicate it across all clients.

- Efficiently search for projects, tasks, or clients within seconds.

- See what your staff is working on and view what is overdue, due today, and due this week.

- Effortlessly reassign work to another team member.

- Stay on task with the help of automated summary emails.