The Perfect New Accounting Client Intake Form (Free Template)

Sometimes, you chase clients and spend a lot of effort and money looking to win their business. When your firm finally gets that new client, you want to have a system in place to collect information to onboard them quickly and easily.

That’s where a good client intake form comes in.

This article sheds more light on what a client intake form is, the benefits of having one, and how you can create it for your business.

What is a Client Intake Form?

A client intake form is a data collection form that allows accounting businesses to collect information about their new clients during the onboarding process. Think of it as a questionnaire that helps you better understand your new accounting clients, from their primary business activity and type of entity to their revenues and tax status.

Benefits of Having a Client Intake Form for New Accounting Clients

Having a client intake form for new accounting clients is about more than automating and organizing an admin task. It comes with several benefits.

Collect Vital Client Information

A well-designed client intake form provides you with all the information you need about your new client and their business in one place. That means no more searching through file folders for things like a client’s direct phone number, business structure, or method of accounting. Or even worse, having to make an embarrassing phone call to ask for information you should already know.

Provide High-Quality Services

We all know the excitement of obtaining a new client and the increase in revenue they bring. But can you retain them? Customer retention is just as important as acquisition. It is less expensive to retain customers than to bring in new ones. According to studies, acquiring a new client will cost you about 5% to 25% more than retaining an existing one.

There is no better way to retain a client than to understand their needs and give them exactly what they are looking for, and more. That can range from tax planning and ensuring their tax returns are in order to providing impeccable bookkeeping services.

The client intake process provides more information and insights about new clients’ accounting status and needs. Now you can identify their specific accounting needs and strategize how to meet them, like meeting tax deadlines, closing periods on time, and ensuring nothing in their accounting process falls through the cracks.

Make Your Accounting Firm Look Good

Positive first impressions are not just for first dates. In the business world, the first interaction with your client matters. You want to make a great and lasting impression with clients looking for your accounting services.

A seamless onboarding process for new clients can set the tone for a budding relationship. It shows the high level of organization your firm has. It also shows clients how serious you are about knowing and understanding their business. When the process is user-friendly, it assures your clients that you will not take up much of their precious time.

How to Create a New Client Intake Form

First, you have to decide how you will create your client intake form. You can build a basic one yourself using Word, Excel, Spreadsheets, or Google Docs. Alternatively, you could use a template found online (like the one you’ll find in the next section of this article).

If you are looking for something more sophisticated for your firm and know your way around programming or have a programmer, you can create one from scratch. It might be time-consuming and expensive. However, it lets you build your preferred functionalities and designs.

The next step is laying it out. For an accounting client, your intake form layout could include sections such as:

- Contact information: Collect the primary contact information for the personnel in charge of the business, including their email address, phone number, fax, and preferred contact method.

- Company information: Document the business name, primary activity, registration date, and business address. Other details to get are the principal banker and details of the CPA and accounting firm if any. Don’t forget to ask about the entity type. Is the business a sole proprietorship, LLC, C-corporation, or partnership?

- Accounting data questions: Be sure to include whether they already have accounting software like QuickBooks set up for bookkeeping. What is their accounting method, accrual or cash basis? When is their year-end? Do they have payroll software? How many bank accounts and credit cards? What about the volume of their transactions?

- Accounting needs: Capture what accounting services the client needs from your firm. It could range from payroll services to inventory management, vendors, basic bookkeeping, account reconciliations, and preparation of financial statements.

Remember that a new client intake form needs to be user-friendly and straight to the point with no filler questions. Sometimes that’s easier said than done. A long and tedious form could lead to a frustrated new client.

On the other hand, a shallow intake form collects too little information, leaving you grasping at straws. You certainly don’t want to spend the rest of your day or week fishing for accounting information you could have gotten on the intake form.

Free Downloadable Template for Your Client Intake Form

It might be impossible to create a new client intake form for every individual client you onboard. It is even harder to create one from scratch. However, you can customize a template and still manage to gather enough relevant details from all clients. Our free downloadable template allows you to collect accounting clients’ basic and necessary information:

Download your client intake form here

Tools to Make the Intake Process Completely Digital

It only makes sense to digitize your client intake process to avoid paper records that can be easily lost. This also makes the onboarding process more seamless for your clients.

There are several tools to use to make the process digital. One option is using a workflow solution like Google Forms or Typeform to collect the data. Another way to digitize the process is by embedding the intake form on your firm’s website and allowing prospective clients to fill it out online.

Finally, an online message box or prefilled instant messages of the intake process can help save clients from unanswered phone calls and emails.

Need Help Managing Your New Client Workflows?

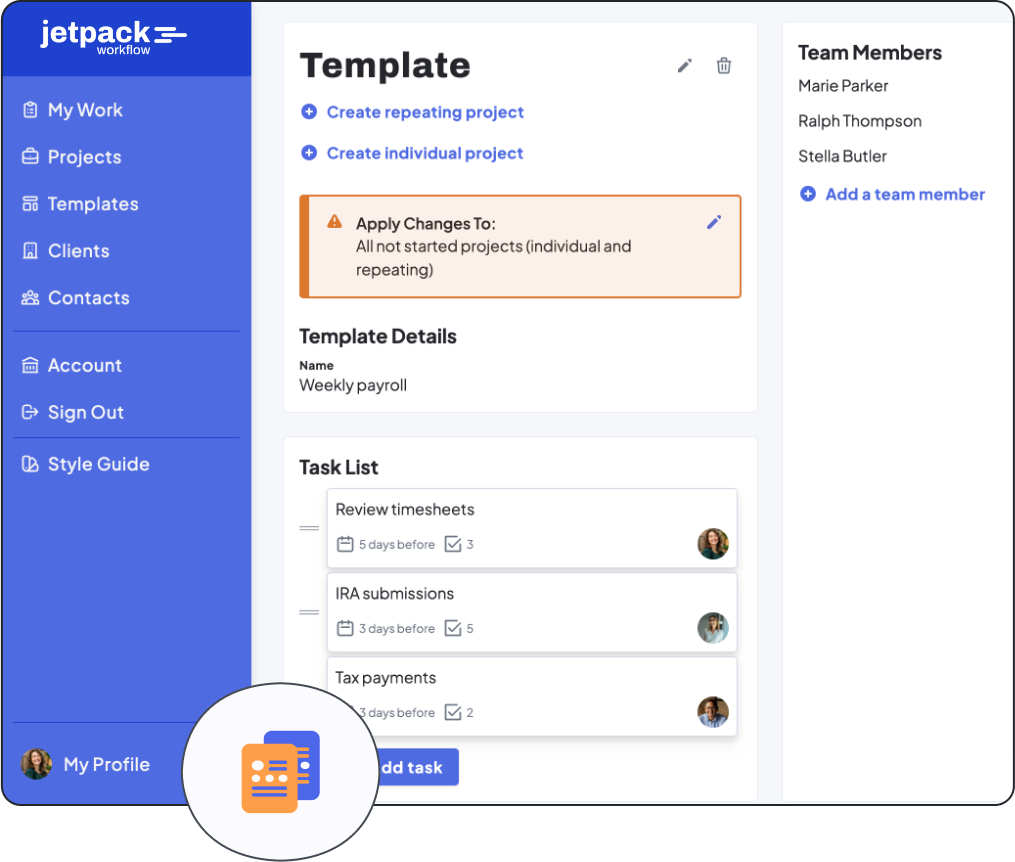

Check out Jetpack Workflow. Our tools help to simplify your accounting firm’s operations by gathering vital client information, delegating work to staff, and keeping track of client deadlines.

With Jetpack Workflow, you can quickly and easily import client information, one-time and recurring projects and tasks, monitor workflows, and much more.