Solving the Pricing Problem for Accounting Firms

Solving the Pricing Problem for Accounting Firms

This chapter preview comes from the Double Your Accounting Firm book (Amazon)

Janice’s firm was in a rut. They were gaining new clients, but had a hard time maintaining profitability. It struck him as odd, as this 30-year-old accounting firm hadn’t changed much in their practice. They continued to have a similar size staff and good client growth, so what was causing the drop in profits?

At their monthly C-level meeting, Janice asked his technology lead why, given all the improvements in their technology infrastructure, profitability was actually going down.

Upon digging into the numbers, and—most critically—talking with staff, he realized one thing:

Staff was incentivized to get maximum billable hours without going over budget, so they commonly skipped work or duplicated the tools that were automating their practice.

Your profits ride on whether your team members are willing to sit at their desk just a bit longer. In today’s climate as a CPA, it doesn’t need to be this way. You simply can’t afford it.

If Janice’s story resonates with you, you’re not alone. The idea of “billing for time” has been around for a while. In fact, the only common scenario we hear is that firms simply do not adopt useful and efficient applications because of they decrease billable time. What inevitably happens is that a competitor will charge a lower price for equal—or often greater—service, and your firm will no longer be competitive in the modern market.

With the push of automation and ongoing efficiency, a firm focused solely on the billable hour is one that seemingly continues to struggle in today’s marketplace.

Now, I’m not saying to move entirely to a value-based, zero- timesheet practice tomorrow; absolutely not. Always think strategically about your pricing model before jumping ship. Instead, I’ll walk you through the alternatives you can choose for your firm, plus the benefits you will see. You will also learn how to move your current and new clients into this pricing model without running into issues.

Price. It’s such an emotional and psychological topic for many business owners. Price has many elements, but before we dive into tactics, let’s dive into one thing first: mindset

Mindset

If you do not value the service you provide to your clients and understand the ROI of the services you offer, it’s extremely hard to make price increases or transitions.

Or if you do not believe little ole’ me can ever demand a higher price point, simply because you believe you’re not supposed to, then these pricing strategies will not make an impact.

In fact, while things like market positioning, price positioning, proper sales consulting, and marketing all go into demanding a higher fee, many firm owners never start the process. Or nearly as bad, they take one small action, fail, and then never return.

So before we dive into price, let’s complete the following exercise:

- If you and all other accounting firms were to go under today, and individuals and small business owners had to do their accounting themselves, what would happen? What would happen to their time? Their cash flow? Their profitability? Their sanity?

- For those firms who do charge more, what allows them to ask for more? Note: you cannot point to location, years in business, size of staff, office type, etc. The question is: how are they perceived by a market that expects either a higher price or different pricing model?

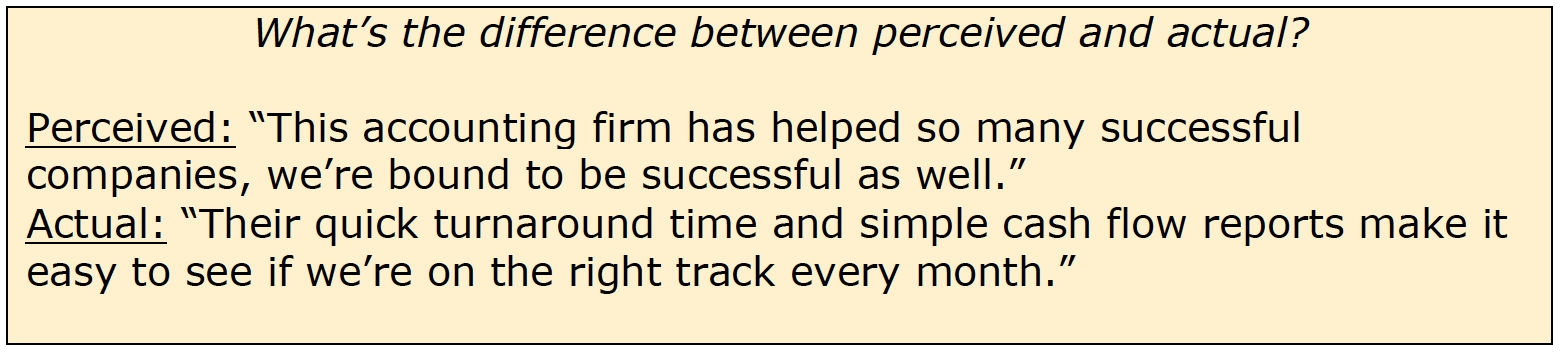

The reason we start with mindset is because, without the belief in your product or service, a pricing strategy will not work. Whether it’s an hourly increase or a move to fixed or value-based pricing, you need to become grounded in the value—both perceived and actual—that you bring to a client.

If no one else has, I give you permission to think outrageously high of your service and ability to help clients. I give you permission to ask for higher fees and experiment with new billing models.

In this chapter, we’re going to highlight practitioners who made the exact same journey and what they did to make the transition. We’re going to look to thought leaders who have helped hundreds of firm owners make the transition. Big and small, new and old, “hip” and conservative.

Remember, price is about a transfer of value, both perceived and actual.

You play in the world of both, and therefore pricing does as well. Take these next chapters as permission to review and update your pricing model. At the end of the chapter, you’ll find links to the interviews we’ve referenced throughout this section.

Why Move Away from the Billable Hour?

The emergence of the Internet has disrupted every industry. You knew that. But in professional services, it turned your service offering on its head because your expertise is more valuable than ever before.

When you don’t know something, you whip out your smartphone and google the answer. Even your older clients take full advantage of having intelligence in their hand 24/7. When they wish to tap into your intelligence, they want to feel they aren’t taking a massive risk.

The billable hour works such that: “I charge you for my time. Period.”

Suddenly, you evolve into a time-punching machine. “Lawyer Bob is calling… David, you are now on the clock…”

Don’t you believe, deep down, you are worth more than your hours?

Of course.

You spent years, maybe decades, developing your craft. You spent late nights studying for certifications. You’ve done your time of messing up client work and now know better.

Those are all valuable! You become a better partner, CPA, and accounting expert with all of this experience downloaded and backed up in your head. You deserve payment for it.

As you get better, the common idea is to simply peg your time as more valuable. You go from $200 per hour to $215 per hour. Think about it. Over 100 hours, you make an extra $1,500.

Woopie!

Malcolm Gladwell’s Outliers, proposes the famous 10,000-hour rule. In other words, it takes 10,000 before you become an expert. When you become an expert, you know more than 99% of people in the world.

That’s worth something. But, it’s not worth it in the currency of time.

When you go to the doctor, you are seeking counsel. You get the bill in the mail. What do you see? Nowhere does it say: “Dr. Bill Able saw you for one hour; your charge is $X.” No. You are charged for what they did. The more valuable the service, the more they charged.

A routine check-up bills out at the lowest tier. It’s the least valuable. Cancer treatment and life-saving surgery—no matter how short it was—can cost tens of thousands of dollars.

As you harvest the more specialized knowledge of a doctor, the fee skyrockets. Unfortunately for them, insurance companies will negotiate some of their fee away. Fortunately for you, you don’t have to deal with insurance at your firm.

The point is, the shift away from the billable hour has happened because your expertise is more valuable than ever. Your clients are paying for outcomes; they aren’t paying for how long you spend on a project.

Let me be more blunt: they don’t care how long it takes you.

If it took five minutes, great. If it took your whole weekend and you missed your child’s school play, sorry.

I do the same thing now for all the work I do and hire other people for. I negotiate the price upfront. When a plumber comes to my house, I ask, “What’s this going to cost?”

The buyer now has power because of the Internet. I know, roughly, how much a leaky faucet is going to cost.

The plumber is now strapped because it may take him three hours or it could take him three minutes. This is the issue both you and your clients face with the billable hour: you’re incentivized to take as long as you can.

In my plumbing example, the plumber, to match online competitors, lowballs himself to get the job. He’s afraid if he does a bad job, I’ll post it on Yelp. So he takes his time, does the job, and gets paid the bottom of the barrel for his work.

This is where CPA firms struggle in terms of getting the most revenue per client. If your client sees you as a commodity to be bargained with, you will lose. It’s up to you to demonstrate the value you bring to the table.

Your value is your expertise! If that plumber said, “As a free bonus, let me do an audit of your house, I can see where you might be able to add some value,” he would be positioning himself as more valuable and would be able to charge more. Do you see the difference?

Heck, if he knew me more, he would know to dig deeper and say, “I know you’re selling your house soon, there are a few things you can do to add some profit to the bottom line.” This just keeps getting better! Value, value, value. No longer is this plumber a commodity; he is a trusted expert.

This is what your clients are quietly screaming for. This is why the billable hour continues to go the way of the dinosaur. The landscape has changed forever. Your clients signed with you, not for your time, but for a partnership. They receive full access to your database of knowledge, you get paid, and your firm grows. Your clients open their wallets for outcomes, not time.

This is a massive mindset shift. It requires a bit of boldness, as well. Becoming a firm of the future starts with charging for outcomes. It’s how you will differentiate yourself from your competitors.

The Difference between Time, Fixed and Value Pricing

According to Ron Baker, world-renowned expert on value pricing for CPA firms, “Billable hours breed uncertainty.”

Your clients are often scared to give you new projects because they are afraid of the bill. Ironically, you have the same fear going to the ER, but unfortunately for you, a client’s taxes aren’t directly life or death.

As a vendor, you should be taking on the risk for a project, but with the billable hour, the risk rests on your client’s shoulders. Every phone call, whether you have an answer for them or not, they still get billed. Every project that takes 20 hours longer than originally budgeted, they still get billed.

Soon, your client is afraid to call you for fear of paying for wasted time. They then pull up a search engine and try to locate the answer themselves. That doesn’t lead to problems, does it…?

The most successful companies in the world take the risk on their shoulders every day. Apple builds a new iPhone each year. If it’s not what people want, nobody buys it and they lose billions in development and manufacturing. Google gives its search engine away for free. If they don’t give great results and improve it every day, no one will click on their ads and all other projects, like Google maps, Android, and Chrome will suffer and cease to exist. Zappos, a billion-dollar shoe company, will ship shoes to you for free. If you don’t like them, you ship them back for free. Zappos loses money. Your local grocery store wholesales select goods and puts them on the shelves for you to browse for free. If no one buys a certain brand of milk, your grocery store loses money.

That’s how businesses become trusted, household names: they take the risk.

Imagine if you are in the market for a house and at every house you walk through, your realtor charges you. Buying a house is a massive decision and you don’t want to be rushed, but you are cramped for time because your realtor has you on the clock.

The real estate industry would implode as more homebuyers would take on the risk of buying a home on their own, without an expert. This is why realtors are paid on commission. We pay them thousands in commission for their expertise and the result, not for their time.

Why wouldn’t you do the same?

Articles to Go Deeper

- How To Implement Value Pricing with Ron Baker

- How to present value pricing and advisory service to clients?

- How to Implement Value Pricing, Why This Owner Wants to Change The Industry, and More

- Pricing On Purpose

- LINKEDIN – Ron Baker

- If Time-Based Billing is Dead, How do We Come Up With a Price?

Related Articles