What is CAS Accounting? Services, Benefits & Growth

Key Takeaways

- CAS accounting (Client Accounting Services) is a bundled model of bookkeeping, payroll, reporting, and advisory delivered on a subscription basis.

- It helps firms move beyond compliance into year-round advisory, creating recurring revenue and stronger client relationships.

- Successful CAS practices use standardized workflows, tiered packages, and automation to scale efficiently.

- Tools like Jetpack Workflow make CAS delivery consistent, track recurring deadlines, and provide visibility across teams.

Introduction: What Is CAS Accounting?

CAS accounting, short for Client Accounting Services, is a service model where firms provide clients with outsourced accounting support beyond tax filings. It combines bookkeeping, payroll, financial reporting, bill pay, and CFO-level insights into a single, subscription-based service.

In simple terms: CAS accounting transforms traditional compliance work into an advisory-first, year-round relationship between accountants and clients.

Why Is CAS Accounting Growing So Quickly?

Firms across the U.S. are adopting CAS because client expectations have shifted. Small businesses want real-time financial data and strategic advice without hiring full-time staff. According to the latest AICPA and CPA.com Benchmark Survey, Client Accounting Services practices grew by 17%, a double-digit trend that continues to outpace growth in traditional tax and audit services.

Unlike one-off tax prep, CAS creates predictable recurring revenue, something most firms need to stabilize cash flow.

What Services Are Included in CAS Accounting?

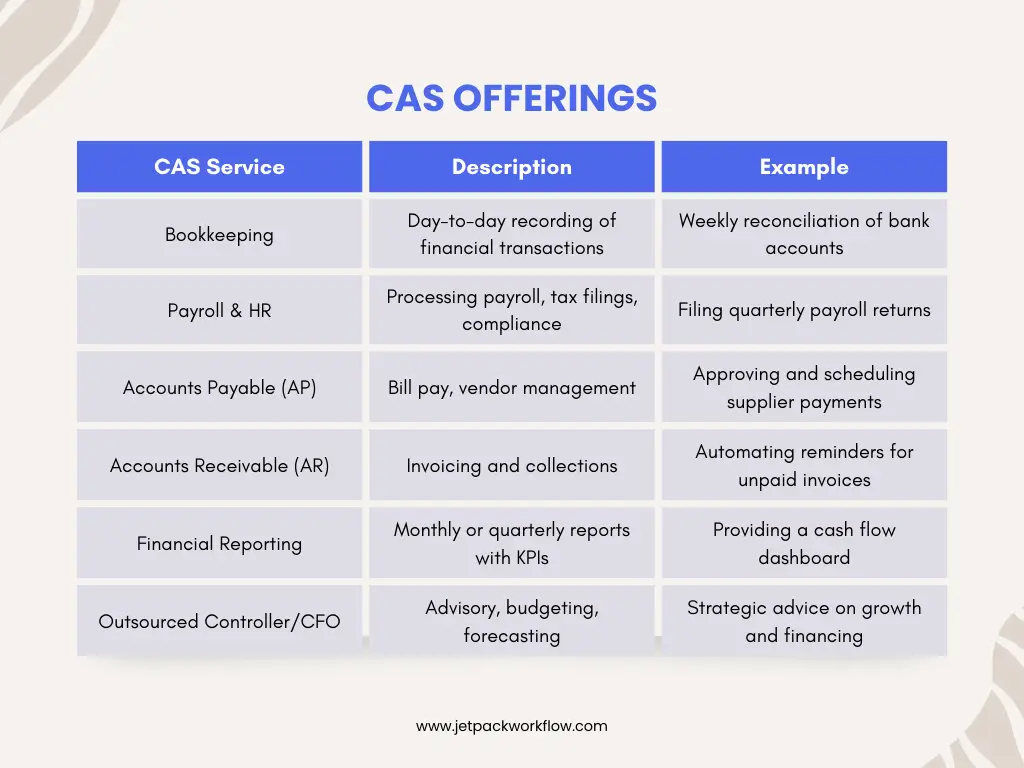

Here is a breakdown of common CAS offerings:

Many articles only list services but do not explain how firms should package and price them. The most successful firms use tiered CAS packages such as basic, growth, and advisory to align with different client needs.

How Does CAS Differ from Traditional Accounting?

Traditional accounting is compliance-driven, focused on tax returns, audits, and one-off tasks. CAS accounting is an ongoing partnership with real-time updates and proactive insights.

Benefits of CAS Accounting for Clients

-

Year-Round Support – Clients get continuous insights, not just annual filings

-

Cost-Effective – Outsourcing avoids hiring full-time in-house accountants

-

Better Decision-Making – Real-time data enables faster business moves

-

Scalable Solutions – Services adapt as the business grows

-

Peace of Mind – Compliance deadlines are never missed

Benefits of CAS Accounting for Firms

-

Recurring Revenue Model – Predictable monthly income vs. seasonal spikes

-

Client Stickiness – Advisory creates deeper relationships and lowers churn

-

Upsell Potential – Firms can move clients from basic bookkeeping to CFO services

-

Operational Efficiency – With the right tools, firms standardize and automate repetitive work

-

Competitive Advantage – CAS differentiates firms from compliance-only providers

Challenges Firms Face When Launching CAS

-

Workflow Chaos: Without automation, tracking recurring deadlines is messy

-

Pricing Confusion: Many firms underprice and erode margins

-

Staff Training: Team members must shift from task doers to advisors

-

Tech Overload: Too many disconnected tools create inefficiency

The key solution is centralized workflow management, and this is where Jetpack Workflow can help.

Best Practices for CAS Implementation

-

Start with Existing Clients – Offer CAS upgrades to trusted clients first

-

Bundle Services – Create clear, tiered packages instead of custom quotes

-

Standardize Processes – Document repeatable workflows for payroll, AP/AR, reporting

-

Leverage Technology – Use workflow automation, dashboards, and secure portals

-

Communicate Value – Position CAS as strategic, not clerical

Technology’s Role in Scaling CAS

CAS cannot scale without automation. Manual spreadsheets break down once you manage dozens of clients.

Why Workflow Automation Is Critical

-

Tracks recurring deadlines automatically

-

Provides visibility into team workload

-

Standardizes client processes

-

Reduces errors from manual tracking

Jetpack Workflow was designed specifically to solve these pain points. Unlike general project management tools, it is tailored for accounting and bookkeeping firms, ensuring no client deadline slips through the cracks.

Example: CAS Workflow in Action

Scenario: A firm manages 40 CAS clients. Each requires:

-

Weekly bookkeeping

-

Monthly financial statements

-

Quarterly payroll filings

With manual tracking, staff juggle hundreds of deadlines. Using Jetpack Workflow, the firm:

-

Sets up recurring tasks once, which auto-populate for all clients

-

Uses dashboards to see workload by staff member

-

Delivers financial reports faster and with fewer errors

Result: The firm reduced admin time by 35% and grew CAS capacity without hiring additional staff.

Future of CAS Accounting

Trends shaping CAS over the next 5 years include:

-

AI-driven insights that surface anomalies and trends

-

Client portals for document sharing and reporting

-

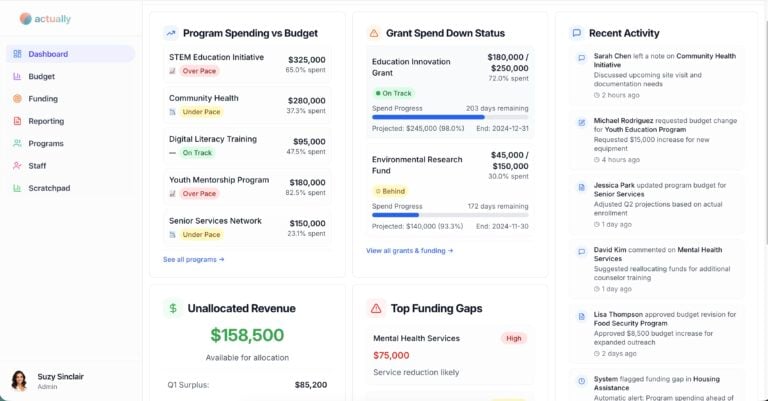

Vertical specialization such as CAS for dental, e-commerce, nonprofits or law firms

-

Advisory-first positioning, where firms lead with CFO services rather than bookkeeping

If you do specialize in a vertical (recommended), you’ll want to look at industry specific, advisory focused on solutions. For example, if you focus on nonprofits, there are specific budgeting and financial reporting platforms for nonprofits.

FAQs About CAS Accounting

What is CAS accounting in simple terms?

CAS is when an accounting firm provides outsourced bookkeeping, payroll, and advisory services on an ongoing basis.

How does CAS benefit small businesses?

It gives small businesses real-time financial data and expert advice without hiring full-time staff.

How do firms price CAS?

Most firms use monthly subscription models, often with tiered packages like basic bookkeeping, growth, and advisory.

What software do CAS firms use?

Tools like QuickBooks or Xero for bookkeeping, paired with workflow platforms like Jetpack Workflow for task management.

Is CAS right for every firm?

Not all firms need CAS, but those seeking recurring revenue and deeper client relationships find it highly effective.

Conclusion

CAS accounting shifts firms from compliance-only work to advisory-driven partnerships. It benefits both firms and clients, but success depends on efficient workflows, standardized processes, and smart technology adoption.

If your firm is considering CAS, the question is not should you, but how quickly can you implement it effectively.

Ready to Launch or Scale Your CAS Services?

Jetpack Workflow helps accounting firms deliver Client Accounting Services without missed deadlines or messy spreadsheets.

Automate recurring tasks, manage client work, and give your team full visibility in one platform.

Try it free for 14 days. No credit card required.