[Double Your Firm Book] Ch. 6 Recruiting and Retaining top Talent

Chapter 6 in my book deals with a growing issue in the industry…recruiting and then retaining top talent.

If you’re just joining us, we’re going front-to-back celebrating the audio release of our best-selling book, Double Your Accounting Firm.

To refresh, here are the first three chapters:

Chapter 1: Increasing Workflow Efficiency and Staff Capacity

Chapter 2: Solving the Pricing Problems in Your Firm

Chapter 3: Driving Growth in Your Firm

Chapter 4: Your Sales Appointment from Start to Close

Chapter 5: Get Referrals and Attract the Clients You Want

In this audiobook chapter, you will discover:

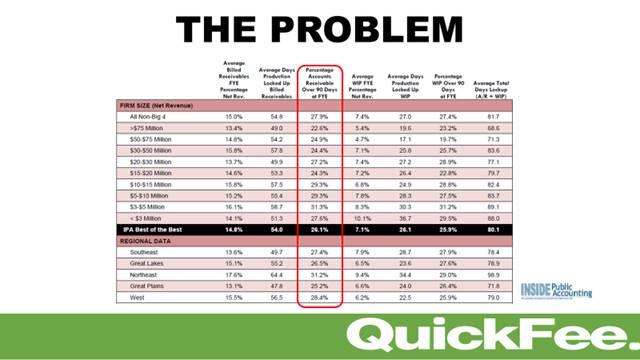

- The big challenges facing retaining top talent in today’s accounting environment

- How to create a culture every employee wants

- The 12 strategies to retain your best employees

ADDITIONAL LINKS:

- How to build a team that fuels growth (interview)

- Transform your CPA firm into a profitable powerhouse (interview)

- 3 steps to building an effective team (interview)

The Challenge Today of Retaining Top Talent

If you’re a smaller firm, you know the crunch of keeping your top employees engaged. Bigger firms have more money, more perks, bigger expense accounts, and parties. A common complaint today is how millennials especially don’t stay at a job for longer than 1-2 years. As we know, it’s cheaper to keep old employees than hire and train new ones.

What if I told you most accountants — especially millennials — aren’t leaving just because of money and perks. More and more, employees want to be involved in the mission of your firm as well as find their place in your culture. As a smaller firm, you can offer more opportunities than those at big firms where employees are just a cog in the wheel.

The first key to retaining top talent is looking at your management circle. Are they buying into the vision and mission of the firm? Are they here for the long haul? Partners are the generals leading the troops into battle. The ‘soldiers’ need to know they can count on their leader.

Because when you have a solid core group of long-term employees, you enjoy a host of benefits including:

- Increased profits as employees become more efficient

- A steady, enjoyable culture

- A succession plan in place

- Happier clients who feel more secure rather than be shuffled around

- Closer relationships with team members as they know and trust each other more and more

The first hurdle you must get over is financial recruiters.

The Cross-Pollination Scheme of Financial Recruiters

Financial recruiters are relentless today. In the past, they were less aggressive and filled roles as firms needed help. Today, there are new schemes popping up. For example, I’ve found one company that has built multiple recruiting firms. Then, they cross-pollinate employees between the different firms. That way they are collecting “finders fees” with each placement that ultimately ends up all in the same place.

The subsidiaries keep their hands clean and the umbrella company gets more and more fees from recycling candidates. It’s nuts.

Another strategy is scouring Linkedin and simply cold-calling the firm office to talk to the potential job-hopper. They have no shame!

There is a way to defend against this. The secret is to start building a strong culture.

Strong Culture = Retaining Top Talent

In the past, you could get away with a bad culture because folks stayed at their job forever. Not anymore. Younger folks want a culture to go to every morning. There’s a stigma in many older firms that the “longer you have been there, the wiser you are.” In most cases, that will be true. However, younger employees want their ideas heard.

Even if you don’t act on their ideas, make them heard.

The marketplace is always changing. The younger employees who are your future can provide valuable insights you never thought before. Here’s the first: retaining top talent goes far beyond a steady paycheck.

Culture is the first piece. Culture is the reason folks enjoy coming to work. It’s not all fun and games either. Culture is also grounded in your mission and values. There must be a “why” you and your team believe in. That all starts with the top brass. Their example dictates what is important for the firm. What’s important guides the culture and how employees interact and work.

Part of the vision is defining your Unique Value Proposition (USP). We’ve talked about that with your ideal client. But, you also need a USP for your firm.

- How big do you want to grow?

- Do you want to expand across state lines?

- What role should each employee strive for?

- What does the firm look like in 10-20 years?

Employees may not directly ask these questions, but they want to know. The reason is so they can see if they buy into that USP and vision. If they don’t want to be a part of it, you’ve lost them already.

Your USP must be unique enough to stick out from other firms. Like your marketing message, it must be specific and compelling. That way you attract the right kind of talent.

Lastly, you must have a rock-solid mission behind your company.

- Why did you start this company?

- Why does your company exist?

Your vision looks ahead at what you want to be in the future. Your mission dives into why that is important to you. I started Jetpack Workflow because CPA firms weren’t efficiently tracking their work. The processes were dated and broken. Jetpack makes sure every one of your accounting clients gets 100% of the work they paid for.

Think about the personal story of your firm. Start telling that to new hires and see who resonates with it.

That brings us to actually figuring out who to hire. Let’s look at that next.

How to Actually Hire Top Talent

When you understand who you’re looking for and what skills they need, it can be easier to sift through job applications. Before each interview, you need to ask yourself “is this person going to be the future of our firm?” That mindset will keep you sharp in the interview.

Finding the right employee can be tough, so here are a few things to learn about the potential hire:

- What motivates them? Growth? Autonomy?

- How do they spend their free time? This gives you a glimpse into their “why” of life

- How do they solve problems? Does that manner blend with your culture

- What kind of work culture are they coming from?

- How do they interact with clients?

Next, you need to understand the employee’s motivation for their compensation. There are many different forms of compensation:

- Cross-train them in different positions as a bonus so they don’t get bored and broaden their skillset

- Provide paid training even tickets to conferences

- Give them autonomy on some projects

- Provide slight bumps in retirement bonuses for performance

These should lead you to whether the person is a good fit or not. After this, the real work begins.

How to Actually Retain Top Talent

Once the interviews are over, the offer is accepted, the employee starts, that’s when the real work begins. Nothing leaves a sour taste in a new employee’s mouth then thinking their job will look one way and its the opposite. If they thought they’d have more time with one of the partners and they don’t, that’s a bigger problem than you think.

Managing expectations is the name of the game when retaining top talent. Here are 12 suggestions to keep an employee engaged:

- Work together at setting goals around their needs

- Provide flexible work hours

- Encourage them with positive feedback

- Create bite-sized, manageable goals

- Create interactive games

- Take team members out individually

- Radiate positivity

- Have an open door policy (really do)

- Give employees the spotlight at different times

- Offer cash bonuses as surprise times

- Plan an outdoors day

- Give a surprise day or even week off!

Start brainstorming ideas around your vision, mission, culture and how to keep your employees engaged. It doesn’t need to be a chore. You’ll notice an energy in your office going forward. A good energy!

RELATED ARTICLES: