How To Make Your Firm Acquirable & Retire

C3 Consolidated has a simple mission: acquire firms or create partnerships. With years of accounting firm background and experience, they apply what they’ve learned about process workflow, business organization, and growth to make those firms more profitable and better organized so clients and employees are happy.

Needless to say, they are very good at what they do. But what makes them choose one firm over another?

If you seek to sell your firm one day, you’ll be very interested in seeing what Orin Wilson, Dave’s guest for this week, has to say about profitability in accounting firms. His insights can help any firm hoping to be acquired or sold.

In this episode, Dave and Orin talked about:

- What C3 Consolidated does

- Low and high performing firms

- The quality of a firm’s staff as a factor of purchase

- Workflows to improve a firm’s profitability

Links:

- https://www.linkedin.com/in/orin-wilson-cma-cpa-90186a39

- https://jetpackworkflow.com/time-tracking-software-accountants-cpa-firm-bookkeepers/

- owilson@ideabusinesssystems.com

Would Your Firm Be Acquired by C3 Consolidated?

Very few of us imagine ourselves ever doing what Orin Wilson and his people over at C3 Consolidated do, acquiring and partnering with firms, making them more profitable, and selling them at a higher value. So what juicy meat can we get from Orin in this episode?

Low Performing vs High Performing Firms

Orin tells us that when C3 first began the acquisition game, the assumption was that they’d be better off partnering with low-performing firms, companies that obviously needed help to really succeed. After all, such companies would be valued lower and be easier to buy, and there seemed to be the biggest potential for profit.

His determination for performance was how much profit margin a potential acquisition had. His metric was:

- Low performers – 25-35% margin

- Average performers – 36-44% margin

- High performers – 45-50% margin

Only the top 5% of firms have a margin higher than 55%. As it turned out, choosing low-performing firms to turn around wasn’t the best option. Why? First, low-performing firms needed so much help that they took a lot more time to straighten out. These firms would take 100 days or more in turnaround, while mid-or-high-performing companies could be ready in 30 days or less.

Second, low-performing firms usually had deeper problems, issues that were previously unforeseen. The owners would often sweep problems under the rug instead of addressing them upfront. These unsettled issues would continue to linger below the surface, causing mayhem.

The lesson was that high-performing firms were more valuable for purchase. How do you avoid being labeled as low-performing? To start, look for real solutions to problems instead of short-term fixes and avoid sweeping problems under the rug. They can lead to huge profit losses in the long-run and make you look like a poor or cheap buy for another firm.

Staff Relations

Another huge issue Orin noticed in low-performing firms was the relationship management had with the staff. Employees are the life-blood of a business. If they are not working together well, or if they are resistant to management’s directives, the company is sure to fail, or at least lose out on large amounts of profit.

Orin puts employees into three categories: engaged, indifferent, and resistant. Are those that are indifferent or resistant doomed to always be that way? Or can management help them become more engaged? While it’s true that some employees will always be indifferent or resistant, many become that way because they are not happy with something happening in the company. Or they may feel that they are not really being heard by their bosses.

Good communication and leadership skills can help staff become much more engaged. That’s why C3 looks at the leaders and management first before trying to help a firm. The lesson is easy to see: Communicate with your employees. Make them feel you are listening to them. Be a great leader, and you’ll have great followers.

Assessing Business Workflow

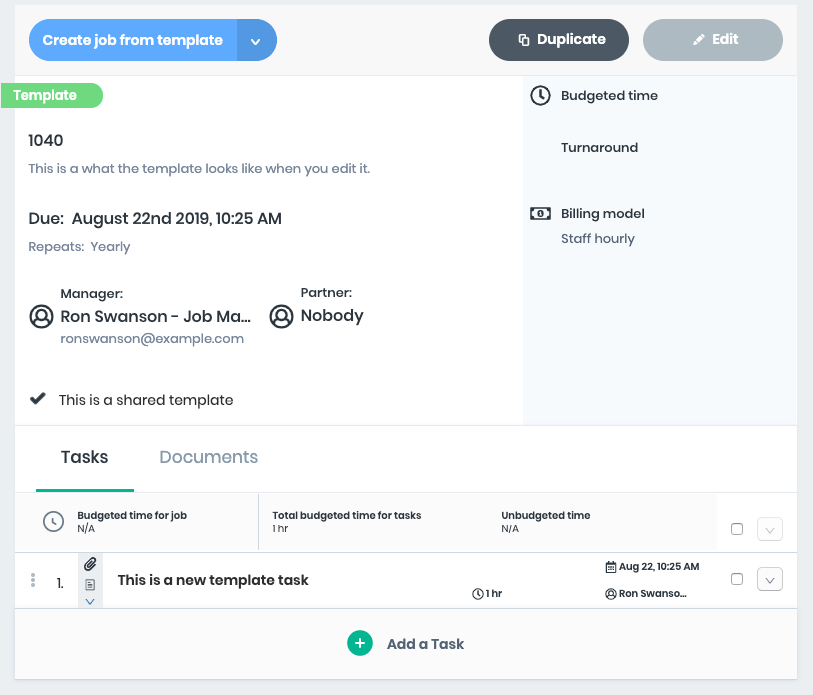

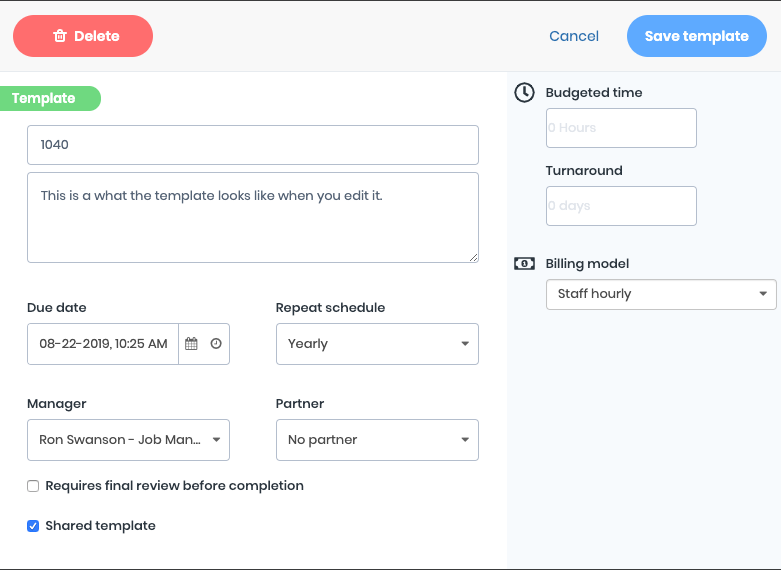

One of the first things Orin and the others at C3 do after buying a new firm is to apply a workflow system to their organization. While they may consider other solutions, typically they recommend and begin implementing Jetpack Workflow. Why? Because many firms, even those that look high-performing, often have little to no workflow in place.

In fact, once systems are put into writing and reinforced through practice, companies often increase their efficiency in a big way.

On top of that, when workflows are written down and organized, it’s easier to see where things can be improved and made more efficient. Waste can hide in a system that is unclear. But a written system makes it easier to find small issues and fix them quickly.

For example, Orin and his team make sure all communication is done through Jetpack Workflow. Then, when a task is late, he can go back and see where things got off the rails. Can a change be introduced to prevent that delay from happening in the future? Such critical problem solving would be impossible without a written workflow system.

There is another great benefit to using Jetpack Workflow to record workflows. Many companies will have the same people work in the same department for years and years. But what if that one person the firm can’t live without is unable to continue to do the work? Who will take over, and how will that person know what to do?

If such tasks are written down in simple steps, anybody could step in and take over in the event of an unexpected change in staff.

The lesson? Write down and organize the workflow for each task, big and small. You’ll easily be able to fix errors, improve efficiency, and protect your firm if a staff member leaves for another opportunity or has some extended vacation.

Orin and his team have perfected taking accounting firms and making them much more profitable. You may want to be acquired by C3 or another similar company, or you may simply want to become more profitable and efficient. Whatever the case may be, you can learn many great lessons from Orin’s perspective regarding accounting firm acquisition.

RELATED LINKS: