5 Smart Ways to Boost Your Accounting Firm’s Productivity

According to a recent study, workers have about three productive hours in a day. A lot of time is spent on office chit-chat, coffee and smoking breaks, and employees surfing the Internet looking for better opportunities.

However, it’s still possible for accounting business owners to salvage much of this wasted time and save your firm thousands of dollars from unproductive hours.

Whether it’s the busy tax season or not, an accounting firm’s success hinges on the productivity of its workers. Unproductive employees cost your firm money and leave a lot of room for mistakes, missed deadlines, and projects falling through the cracks.

This article will cover five ways to boost your accounting firm’s productivity, including tips on the best tools to ensure you’re running efficiently, organized, and up to date all year round.

1. Do a Time Audit, Then Cut or Delegate

Are you one of those accounting professionals trying to do everything on your own? Do tasks like sales and advertising, onboarding new clients, managing existing customers, and processing payments fall under your purview, too?

If so, you’re donning a superhero cape every day!

When starting a small business, you may juggle multiple responsibilities with few resources and clients. As your company develops, your workload increases, which can be overwhelming as you try to balance running the business with managing your team.

Being consumed by mundane tasks takes time away from pursuing growth opportunities for your enterprise. Instead, you want to invest in innovative solutions to help streamline your processes so you can achieve success faster.

That’s where a time audit exercise comes into play. It helps you account for every working minute, giving you a comprehensive outlook of where your time goes.

With this, you can easily see what tasks need delegating or cutting out altogether. One of the best systems to use is the XDS time audit process by Austin Netzley.

The XDS system requires a detailed account of every hour you worked in the past week. For example, if you expect to spend 20 hours on payment processing and approval tasks, you must provide an itemized list of all completed activities.

This list includes tasks such as invoice verification, transaction data entry, vendor account reconciliation, addressing vendor errors, loading payments into the banking system, and issuing checks. You then code these activities with X, D, or S.

- X: Activities you can cut

- D: Tasks you can delegate

- S: Activities you can systemize

With this process, you gain insight into the amount of time required by various tasks. You can then decide on accounting software tools or outsourcing options that bring greater efficiency to your firm.

2. Get Your Team on a Good Workflow Solution

Workflow systems like spreadsheets, written checklists, and project management software such as Trello, ClickUp, and Asana allow you to assign tasks and communicate easily with your team.

These solutions increase productivity at many workplaces. They enable managers to track the progress of any high-priority tasks or make needed changes to improve collaboration within one centralized platform.

Nonetheless, tasks can still be overlooked and mismanaged due to the absence of a customized workflow system. The ability to tailor an accounting firm workflow system to your specific needs is essential for avoiding missed deadlines and confusion within your firm.

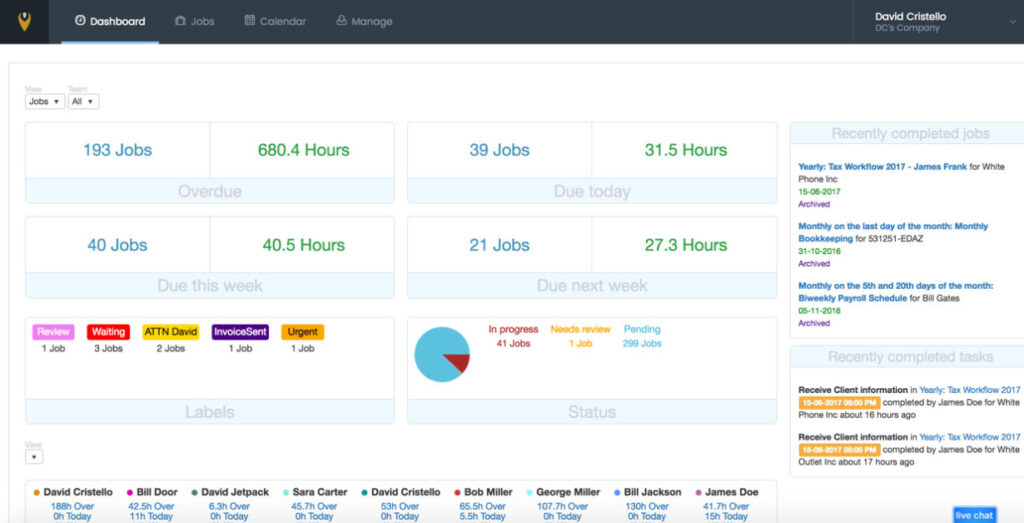

Jetpack Workflow is one excellent accounting practice software solution. Their customizable system can help your firm stay organized as it grows, and their customer reviews reflect their successful results.

Learn more about Jetpack Workflow and start your 14-day free trial by visiting our website.

“We moved from spending 35% of our time on admin/non-billable client work to only spending 15% of our time (across the entire team!). We were also able to streamline new client onboarding and easily see updates and statuses across our team. Jetpack Workflow allows us to look at reporting in real-time and assess our process instantly.”

— Gianna Nguyen

Manager, Nguyen & Company CPA

“It’s been amazing. I love Jetpack Workflow! We left a clunky system, and now that we’re set up, I no longer miss deadlines. Now I have a birds-eye view of what’s going on in my firm, so I know what my team is doing, and what’s the status and updates for our clients.”

— Monica Hodgson-Daniels, CPA

Owner and CEO of Garnett and Gold Financial Corporation

“Since using Jetpack Workflow, we’ve seen a 4% increase in gross profit, resulting in a $280,000 increase to our firm!”

— Jody Grunden, CPA

Co-Founder & CEO, Summit CPA

3. Conduct a Retrospective with Your Team

Think of a retrospective as an audit or review strategy for a given period. For instance, tax season is a hectic period for many accounting firms, with several critical deadlines to meet and a truckload of client work to get through.

What if it didn’t have to be that way year after year?

Holding a retrospective session with your team will help you identify the tasks, activities, and systems that need improvement. It also allows team members to brainstorm ways of streamlining the processes that previously held them back.

While there are software tools for agile retrospectives, you can easily create a template on a spreadsheet.

| Went Well | Votes | Can Improve | Votes | Action Items | Votes |

4. Run a Redundancy Review

If an employee tendered their resignation today, how would their exit affect the workflow in your firm? Perhaps a worker called in sick or needs time off for a family emergency. Would your firm’s workflow stall?

A redundancy review will help you look at the overall structure of your firm, its critical services and capabilities, client needs, and employee skills and tasks. This review assists your productivity in a few ways.

- It determines the essential activities in your firm (e.g., client management during busy periods).

- It identifies the employees who meet these essential services and client needs, leading to cross-functional training of other employees.

- It helps you select and train other employees who can pick up the slack whenever necessary, leaving little to no room for delayed workflows.

The best method for completing a redundancy review is to use a training grid. It allows you to identify and track the tasks each employee has the skills and training to accomplish.

Luckily, you do not need to spend money on software tools. A simple spreadsheet form like the one below can help you with this task.

| Employee 1 | Employee 2 | Employee 3 | Employee 4 | |

| Task 1 | P | S | ||

| Task 2 | P | S | S | |

| Task 3 | P | S | S | |

| Task 4 | P | P | ||

| Task 5 | S | S | P | |

| Task 6 | P | S |

P = The employee with the primary responsibility for completing a task.

S = The employee with secondary responsibility (i.e., your backup).

5. Manage Clients Correctly

Choosing and managing clients is essential for an accounting company’s success. Without proper client selection or management, businesses may face decreased profits, weary employees, business disorganization, and fewer growth opportunities.

Client relationship management (CRM) software like Zoho CRM and Hubspot can be invaluable in maximizing your firm’s efficiency and productivity. Plus, you can combine these tools with other applications you may already have, allowing for an automated, effortless process, even for beginners.

When selecting clients for your firm, an onboarding process is vital. By thoroughly sifting through all possible prospects, you can choose those who meet your criteria and can afford your services.

This method of careful selection ensures you attract and welcome ideal customers to your firm. Clients will also know from the start what to expect from your firm and what you require of them.

Before diving into the onboarding process, there are three steps you should take first.

- Create an onboarding checklist.

- Define your ideal client.

- Standardize and centralize your onboarding process.

These steps give your process consistency. All prospective clients respond to the same questions, and everyone in the organization follows a uniform procedure for bringing new clients on board.

Finally, remember to manage your clients by taking a step back and measuring revenue per client. If that value doesn’t match the amount of work, consider letting those clients go to make room for more productive work.