A Free Accounting Invoice Template (+ 32 Other Templates)

Like many accounting processes, billing and invoicing for your accounting services can be repetitive tasks. However, submitting detailed invoices in a timely manner allows you to track and manage receivables easily and makes you look professional.

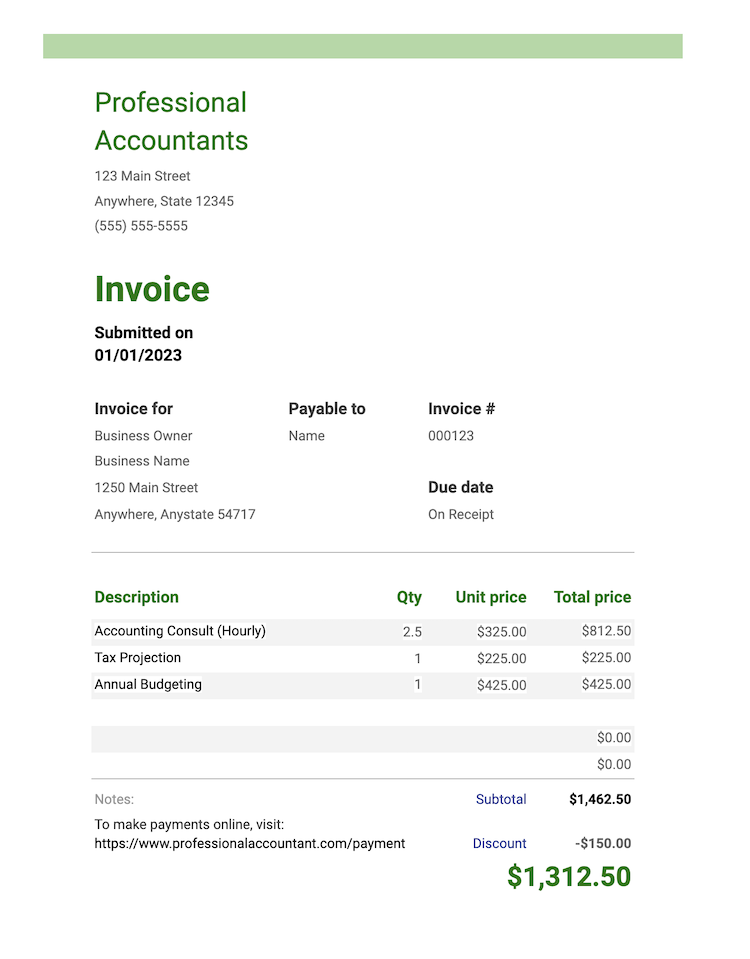

We’ve created an accounting invoice template to help save you time and streamline the process. In addition, below the free invoice template, you’ll find 32 additional templates you can use in your accounting practice.

What to Include in Your Invoice Template

A standard invoice typically includes the following elements:

- Unique invoice number: a distinct identifier for the invoice, which helps both you and your client keep track of payments

- Date: the date the invoice is issued

- Information about the company issuing the invoice: company name, address, and contact information.

- Information about the client: client’s name, address, and contact information

- Description of the goods or services provided: a detailed section clearly describing each charge

- Quantity and price of each item: the number of units (or number of hours) and the cost per unit for each item invoiced

- Subtotal: the cost of the goods or services before any discounts or taxes are applied

- Discounts: any discounts applied to the invoice

- Tax: the amount of sales tax applied to the invoice, if applicable

- Total: the total amount due, including any applied discounts or taxes

- Payment terms: the time frame within which the invoice is to be paid

- Notes: any additional notes or comments about the invoice, such as online payment options

Some invoices may also include fields for shipping information or a list of any additional charges or late fees. Be as clear and detailed as possible when creating an invoice. Your clients should understand exactly what the charges are for and how much they owe.

Hourly vs. Project-Based Billing

There are a few things to consider when deciding between an hourly rate or project-based billing.

- The nature of the work: When the work is well-defined and can be completed within a set time frame, project-based billing may be more suitable. If the work is ongoing or open-ended, hourly billing may be a better option.

- The client’s preferences: Some clients may prefer the predictability of a fixed-price project, while others may be more comfortable with hourly billing. Discuss billing preferences with your client so you can agree on a plan that works for both of you.

- The complexity of the work: If the work is complex and may require a lot of unexpected effort, hourly billing may be more appropriate. An hourly rate compensates an accountant for any additional time spent on the project.

- The accountant’s preferences: Consider your firm’s preferences and business model. Some accountants may prefer hourly billing because it allows them to be paid for their time and expertise, while others may prefer project-based billing because it helps them plan and budget their workload.

Ultimately, the best billing method will depend on the specific needs and preferences of the accounting firm and its clients.

Free Accounting Invoice Template

You can copy the template below or download the Google Sheets version here. To make a copy, click on the “File” tab in the upper right-hand corner and select “Make a copy” from the menu to save it to your personal Google Drive.

To download it, click on the “File” tab in the upper right-hand corner and select “Download” from the menu. You can choose to download it as a Microsoft Excel or PDF file.

BONUS: 32 Additional Free Templates for Accounting Firms

Whether it’s invoicing, client onboarding, or general project management, there’s no need to create your accounting task workflows from scratch.

Jetpack Workflow created a series of templates to help you hit the ground running. Download these 32 workflow templates, and customize them to meet your company’s needs.

Need Help Managing Client Projects?

Are you tired of feeling overwhelmed and disorganized in your practice? Do you struggle to keep track of tasks, deadlines, and client information? If so, Jetpack Workflow could be the solution for your accounting firm.

Jetpack Workflow is a powerful and versatile project management tool specially designed for accounting and finance professionals. Create and assign tasks, set deadlines, and track your progress all in one place. An efficient workflow allows you to focus on delivering high-quality service to your clients.

In addition to being a task management tool, Jetpack Workflow is a great way to keep your client information organized. You can store documents, notes, and contact information in one central location, making it easy to access the information you need when you need it.

Jetpack Workflow can also improve communication and collaboration with your team. You can share documents and tasks, leaving comments and feedback as you work. Everyone stays on the same page, even when you’re not in the same location.

Try Jetpack Workflow today on a free 14-day trial and see the difference it can make in your accounting practice.