Free Balance Sheet Template (Excel, Google Sheets & PDF)

Creating a clear financial picture of your business is crucial for making informed decisions and tracking your growth.

One of the most effective tools for this purpose is the balance sheet, a statement that summarizes what your company owns and owes at a given point in time.

Many small business owners and entrepreneurs struggle with setting up their first financial reports, but a structured balance sheet template can save hours of work and reduce mistakes.

Whether you need a quick overview for investors, lenders, or your internal team, Jetpack Workflow’s downloadable template in Excel, Google Sheets, or PDF makes the process simple.

In this guide, you’ll not only access a free balance sheet template but also learn how to make a balance sheet that truly reflects your company’s financial health.

Free Balance Sheet Template for Any Business

Our free balance sheet template is designed for small businesses, startups, freelancers, and growing companies.

It’s flexible enough to work in industries ranging from retail and consulting to SaaS and professional services.

You can download editable versions in the format that best fits your workflow:

What is a Balance Sheet?

A balance sheet is one of the three core financial statements, alongside the income statement and cash flow statement. It provides a snapshot of a company’s financial position at a specific date.

The balance sheet follows the basic accounting equation:

Assets = Liabilities + Equity

This means everything the business owns (assets) must equal what it owes (liabilities) plus what has been invested by owners (equity).

A well-designed balance sheet template ensures that this equation stays balanced, helping you instantly spot potential red flags like excessive debt, declining equity, or overvalued assets.

Why Use a Template Instead of Building from Scratch?

Creating a balance sheet on your own is possible, but it’s easy to make mistakes—particularly with formulas or accounting categories.

A template:

- Saves time by removing formatting hassles.

- Reduces calculation errors through pre-set formulas.

- Provides a structure that aligns with accounting best practices.

- Ensures consistency across monthly or yearly reports.

For small businesses, the time saved can be redirected to more valuable tasks like growth planning and client service.

How to Use The Balance Sheet Template (Step-by-Step Guide)

Using our free balance sheet template is straightforward.

Follow these steps to create an accurate report of your financial position.

Step 1: Enter Your Assets

Start by listing all current assets, which are items expected to be converted into cash within one year:

- Cash – Funds available immediately

- Accounts receivable – Money owed by clients or customers

- Inventory – Goods you plan to sell

- Prepaid expenses – Payments made in advance, such as insurance

Then add long-term assets, which include:

- Equipment – Machinery, computers, or tools

- Property – Land or buildings owned by the business

- Investments – Long-term financial securities

- Intangible assets – Intellectual property like patents, trademarks, or software

Finally, make use of the Other Assets section. This is where you can record items that don’t fit traditional categories, such as deferred tax items or special investments.

The template automatically calculates the total assets, ensuring no category is overlooked.

Step 2: Record Liabilities

Liabilities represent what the business owes. Start with current liabilities, which are debts due within one year:

- Accounts payable – Money owed to vendors or suppliers

- Credit card balances – Short-term financial obligations

- Short-term loans – Any business loan due within 12 months

Then add long-term liabilities, such as:

- Bank loans – Mortgages or equipment financing

- Lease obligations – Contracts for rented property or vehicles

- Bonds payable – Debt instruments issued by the company

The template automatically separates short-term and long-term obligations, which helps when evaluating liquidity and debt risk.

Step 3: Add Owner’s Equity

Equity is what remains after liabilities are subtracted from assets. In a small business, this often includes:

- Owner’s capital contributions – Money invested by founders

- Retained earnings – Profits reinvested into the business

- Shareholder equity – Ownership stakes in corporations

This section gives insight into how much value the business truly holds for its owners or shareholders.

Step 4: Review and Adjust

The most important check is that assets equal liabilities plus equity. If they don’t, the template helps you pinpoint errors like:

- Missing entries

- Double-counted amounts

- Misclassified transactions

To make analysis even easier, the template includes an automated ratios section at the bottom.

Key metrics such as the Debt Ratio, Current Ratio, and Debt-to-Equity are calculated automatically, giving you instant insights into your financial health.

Tips for Using Our Free Balance Sheet Template

1. Condense Categories

If your business is small, you don’t need dozens of asset or liability lines.

Condensing categories makes the sheet easier to read and interpret while still maintaining accuracy.

2. Use Negative Numbers

For contra-accounts such as accumulated depreciation or discounts, negative numbers help reflect reality.

This ensures your totals aren’t inflated by values that reduce asset worth.

3. Update Monthly

Turning the template into a monthly balance sheet allows you to track financial trends, spot seasonality, and identify growth opportunities or risks before they escalate.

4. Collaborate Online

By using the Google Sheets template, your accountant and management team can review and update figures simultaneously.

This is especially valuable for startups seeking funding, where investors want real-time access.

5. Print Copies

A printable balance sheet template ensures you always have a paper backup for meetings, audits, or compliance requirements.

Many banks and tax professionals still prefer printed documentation.

6. Follow the Color Coding

For clarity, the template uses white or light-gray cells for data entry and blue-shaded cells for automated calculations.

A legend is included so you always know where to type and what’s handled for you.

Examples of Who Should Use This Template

Freelancers & Solopreneurs

Independent professionals can track invoices, expenses, and retained earnings with a simple balance sheet form, providing credibility when applying for business credit.

Small Businesses

From cafés to consulting firms, small businesses can use the template to prepare documents for bank loans, grant applications, or investor presentations.

Growing Startups

Early-stage companies can present their financial position to venture capitalists with clarity.

Nonprofits

Charities and nonprofits can maintain transparency with boards, donors, and regulators by providing a standardized financial statement that demonstrates accountability.

Need Help Managing New Client Projects?

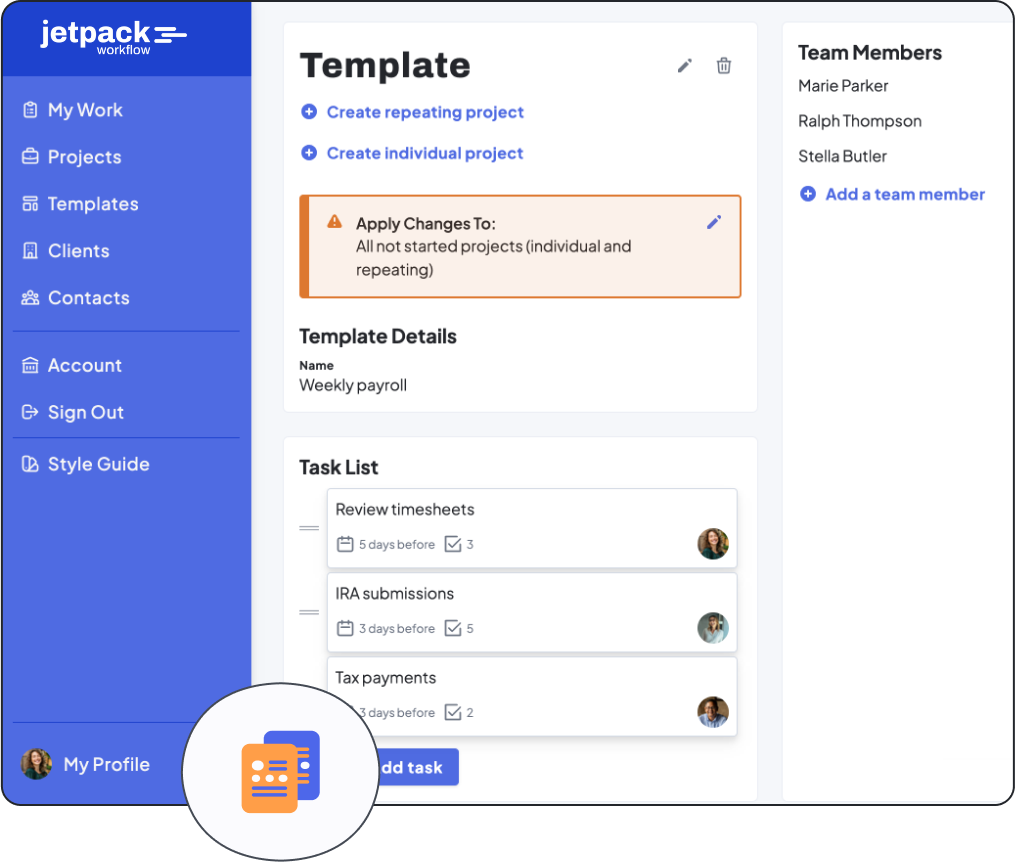

A workflow management system is a great way to keep your bookkeeping firm organized and running efficiently. By automating tasks and keeping track of deadlines, you can be sure that nothing falls through the cracks and your clients are always getting the best possible service.

In addition, a workflow management system can help you to allocate resources more effectively, ensuring your staff is always working on the most important tasks. Ultimately, a workflow management system can save you time and money, making it an essential tool for any bookkeeping firm.

Jetpack Workflow was designed from the ground up with bookkeepers and accountants in mind. The cloud-based workflow management system allows you to start with predefined templates, customize them for your firm, and track progress on all your work.

Jetpack Workflow offers a free 14-day trial which will give you the opportunity to see how much time you could be saving with a full workflow management system.

Final Thoughts

A balance sheet is more than just a financial report—it’s a strategic resource that helps you understand, communicate, and strengthen your business’s financial position.

By leveraging a ready-made template, you eliminate the guesswork of setup, minimize errors, and free up valuable time to focus on growth.

Whether you’re preparing for investors, applying for funding, or simply wanting a clearer picture of your company’s health, having an accurate balance sheet is essential.