What is Fractional Accounting and Is It a Legit Service?

Fractional accounting services have been around for centuries, dating back to the early days of commerce.

In the past, businesses would contract with accountants to keep track of their financial affairs on a part-time basis. This allowed businesses to save money on overhead costs while also tapping into the expertise of experienced professionals.

Today, fractional accounting services are still used by many businesses for the same reasons. As a result, fractional accounting services play an important role in the business world.

What is Fractional Accounting?

Fractional accounting services are a type of professional accounting service that provides part-time or project-based assistance to businesses with their financial needs. This can include bookkeeping, preparing and filing taxes, and other financial tasks.

Fractional accounting services can be a great solution for new startups and established businesses that don’t have the need or resources for a full-time accountant. They can also be a convenient option for businesses experiencing a period of growth or transition and needing extra help to manage their finances.

Fractional accountants provide more services than a standard bookkeeping contract but without the commitment and expenses of a full-time finance team.

Typical Responsibilities of a Fractional Accountant/CFO

The role of a fractional accountant or CFO can vary depending on the client’s needs. However, there are some common responsibilities associated with this position.

Typically, a fractional accountant or CFO will help to prepare financial statements, maintain records of income and expenses, and reconcile bank accounts. In addition, they may also provide advice on tax planning and compliance issues, as well as assist with the development of budgeting and forecasting tools.

Fractional accountants will participate in company meetings and may act as company representatives for external meetings with investors or lenders. A fractional accountant will be well-versed in the company’s activities and able to speak intelligently about how upcoming events will affect the company’s finances.

By working with a fractional accountant or CFO, small business owners can free up time to focus on other aspects of their business while still ensuring their finances are in order.

What Companies Usually Pay for a Fractional Accountant

When hiring a fractional accountant, companies usually look for someone with years of experience and a high level of expertise. However, they also want someone willing to work for a lower rate than what they would pay for a full-time accountant. Fractional accountants usually only work a few hours each week and do not receive benefits such as health insurance or a retirement plan.

Fractional accounting services are usually performed for a flat monthly fee. The monthly fee includes specified accounting functions and usually places a cap on the number of hours devoted to the company. Some fractional accountants provide unlimited hours to their clients as part of the contract. Clients appreciate knowing what they will be paying each month. Most fractional CFOs charge $2,500-$8,000/month for their services.

Other fractional accountants choose to bill hourly. They track the time spent working for or with each client and submit an invoice at the end of the month. This requires careful time tracking and time management to ensure that you still provide quality services at a reasonable price.

With hourly pricing, clients will only pay for the time you are actually performing services for them, although the bill will vary each month. Fractional accountants often charge $200-$400/hour when billing hourly.

Deciding If You Should Offer This Service

Deciding whether or not to offer fractional CFO services can be tricky.

When it comes to providing accounting services, there are a few things you should consider.

First of all, what type of accounting do you specialize in? If you’re primarily focused on corporate accounting, providing fractional services may not be the best use of your time.

However, if you’re comfortable working with individual taxpayers and small businesses, offering fractional services could be a good way to grow your business.

Another thing to keep in mind is what your clientele is looking for. If they’re primarily interested in getting their taxes done quickly and efficiently, they may not be willing to pay for the extra services that come with fractional accounting.

On the other hand, if they’re looking for someone who can provide more comprehensive advice and guidance, they may be willing to pay a premium for your services.

How to Stay Organized as a Fraction CFO

As a fractional accountant, it’s important to stay organized in order to maintain a good workflow. One of the best ways to do this is to create a system for yourself and stick to it.

For example, you might create a folder for each client and then sub-folders for each type of document. You can also create a color-coding system to help you keep track of what needs to be done and when.

Once you have a system in place, make sure to put everything back in its proper place after you’re finished with it. This may seem like a lot of work, but it will pay off in the long run by helping you save time and stay organized.

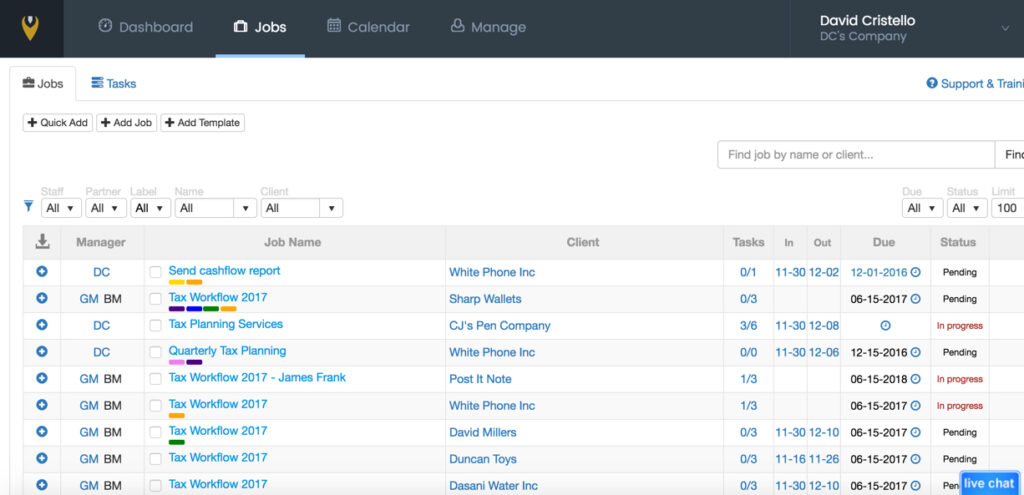

Consider a product such as Jetpack Workflow. It was designed from the ground up with accountants in mind. It helps you stay organized, monitor your projects, and ensure nothing falls through the cracks. If you work with a team, it will help you monitor workloads and assign tasks – especially if using fractional support to allow you to see what the team is working on at any time.

Being a fractional accountant means that your clients rely heavily on your accounting expertise, and you’ll be juggling multiple clients and priorities. A workflow system will help you make sure you’re tracking all the demands on your time.