How to Start an Accounting Firm & Bank 6-Figures Year One

You might have chosen to start an accounting firm with visions of being your own boss and achieving financial freedom.

However, the journey to launching your firm can also be full of uncertainty:

- How will you market your services to attract new clients?

- What are the legal requirements you need to meet?

- How should you price your services competitively while also being sufficiently profitable?

That said, starting your own firm can be a rewarding endeavor. After speaking with industry experts about successfully launching their firms, we share their tips and guidance in this article. You’ll find a helpful checklist for getting started and a real-world example of what launching an accounting firm entails.

Checklist for Starting Your Accounting Firm

Here are a few formal steps to complete when officially launching your new accounting firm.

#1 Form an LLC

Making your accounting firm a limited liability company (LLC) should be among the first steps you take before opening for business.

An LLC creates a separate legal entity for your firm and offers personal asset protection. You can choose from other legal structures for your firm instead of an LLC, so consider consulting a legal expert to determine your best option.

Based on your business location, you can typically form an LLC through the Secretary of State’s office. You can also contract with an LLC formation company for assistance at a nominal fee.

#2 Secure Permits, Licenses, and a Bank Account

Research the federal, state, and local laws and regulations you’re subject to and apply for the necessary permits or licenses. Doing so keeps you compliant and prevents potential fines or penalties.

You should also set up a business bank account at this point. Connect it to your LLC so your business and personal assets remain fully separated.

#3: Select Your Service Offerings

Do you want to provide tax preparation or payroll services? Would you prefer to work with businesses over individuals? Are you willing to be on call for your clients? How do you feel about handling their receivables?

Answering questions like these helps you zero in on the exact services you’d like to offer and who you’d like to serve. Consider your areas of expertise and work preferences so you feel confident about the services you’re promoting to potential clients.

Consider the time it takes to complete various accounting services and the seasonality of specific projects to try and maintain a steady workload year-round. You can adjust your offerings as you discover what does and doesn’t work for you.

#4: Set Up Your Pricing Structure

Based on the services and packages you choose to offer, you now need to decide how to bill your clients. Your options include a flat fee, retainer, or billable hours.

We cover how to price your accounting services in more detail below (and in even more detail in this article). There are several ways to do this, depending on the nature of your services and personal preferences. Again, you can adjust your pricing later to optimize your margins.

#5: Adopt a System for Tracking Projects and Clients

As you get closer to fully launching your firm, be sure you have proper systems in place to manage client work efficiently and hit critical deadlines. This workflow helps you boost client satisfaction through timely service delivery and earn more referrals from existing clients.

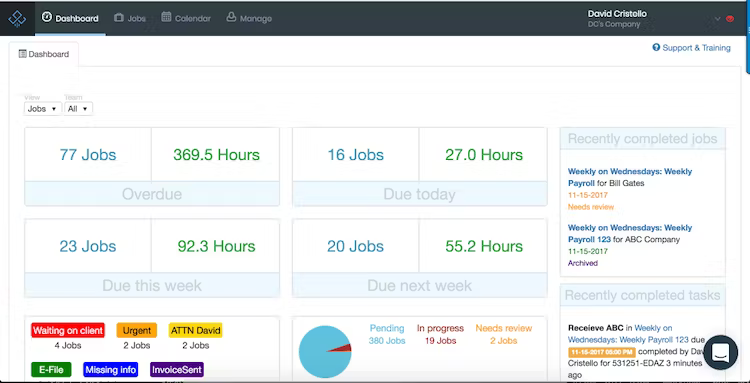

You can use simple spreadsheets, but this method can quickly become convoluted and tedious as you bring on more clients. Instead, an accounting workflow management software like Jetpack Workflow can keep you and your team on track and ensure no task slips through the cracks.

How to Get Started

To highlight a real-world case study, we’re sharing one of our popular podcast episodes detailing our guest’s journey to launching her own firm.

Hannah Stricker always wanted to be her own boss after 25 years in the accounting field. Finally, she gave her notice, leaving to start an accounting firm from scratch.

Within 12 months, she banked 6 figures in revenue. In this podcast, she shows us how she did it.

With a background in accounting, bookkeeping, and taxation, Stricker set her sights on owning her own accounting firm.

Before taking the plunge into entrepreneurship, she built up a healthy savings account that covered 6 months of expenses, giving her several months to see if her business plan worked before needing another job.

Stricker’s 20+ years of accounting experience, a willingness to put herself out there, and a drive to succeed allowed her to hit the ground running. She signed several contracts within the first 6 months of starting her practice.

Through hard work and determination, she landed steady clients and didn’t have to deplete her savings while building her firm. Diving into the deep end as Stricker did may not be for everyone, but the reward was well worth the risk in her case.

How to Find Prospective Clients

Stricker found clients by networking through volunteering. Meeting people at her church events put her in contact with the right individuals. However, even if you don’t have a ready-built network like a church, there are 5 simple ways to identify and connect with new clients.

#1: Ask Friends and Family

There are so many small business owners out there who need help setting up an accounting system. In 2021, a record number of people started a business. Many likely don’t have an accounting background and could use a certified public accountant to help them properly establish their accounting operations.

#2: Find Local New Business Owner Meetups

These groups do exist, although they might be virtual meetups these days. As a new accounting business owner, you’ll fit right in and have a pool of potential clients. It’s a win-win! Just be sure you’re adding to the discussion about the trials and tribulations of starting a small business and not constantly practicing your sales pitch.

#3: Leverage Online Platforms

Online platforms like Upwork or Fiverr are great places to build a client base. They allow you to grow a reputation for quality work, meet clients from a wide geographic area, and set your own pricing.

Getting those first few sales can be challenging because the competition can be fierce. However, once you have a few 5-star ratings, your client base and orders will increase.

#4: Advertise in Your Community and Online

Create a website, post on Craigslist, sponsor a Little League, and ask for some advertising in return.

Build a presence on Facebook and LinkedIn, too. You can run paid ads on these platforms tailored to your target market, whether they’re startups, small businesses, or large, growing organizations.

#5: Talk to Existing Clients

Tread carefully with this approach, but could there be clients from your prior firm who aren’t getting all the accounting services they need? While we never recommend stealing clients, these companies may simply need additional services your previous firm doesn’t provide.

As a bonus, they already know you and your work, which makes for a much easier sales pitch. However, be sure you’re not violating any non-compete agreements from a former employer.

How to Set Rates for Your Services

You may think the best option is to set your rates based on each client, but it’s best to start by understanding how you value your time and want to bill.

Stricker decided to work with clients on a retainer, but that’s not your only option. You can charge by project, by billable hour, or by retainer.

Each of these options has positives and negatives, but any of these billing methods can work. Depending on what your clients are comfortable with, you may use more than one method.

Option #1: Flat Fee

On a flat fee project, you quote the client a project price, and once they agree, the price is set. These projects make your cash flow projections easier and, unless you lose a client, give you a good idea of where your money comes from each month. On flat-fee projects, you also get to skip tracking your time.

The drawback is you take on all the risk if the project runs longer than expected. To offset this risk, you can include a maximum number of hours for the project so the cost of project creep doesn’t fall entirely on you.

Option #2: Billable Hour

The billable hour has long been the scourge of lawyers who are often required to bill in 6-minute increments. If you decide to bill by the hour, you need to figure out how much you want to make each year and the number of hours you’re willing to work to determine your hourly rate.

If you work with multiple clients, you may want to bill differently depending on each team member’s experience or expertise. When billing by the hour, keeping records of time spent on various projects is vital to provide your clients with itemized bills.

Option #3: Retainer

A retainer charges clients a regular weekly, monthly, or quarterly fee. Before commencing your work, determine the services covered under the retainer. Like a flat fee, this billing method means accurately assessing the amount of work involved for a client.

Stricker provides all accounting services, payroll, and tax returns for a fixed monthly fee. Before quoting a price, she meets with each client to determine the level of service they need and how often they expect her to interact with their books.

Keep Profit Margin Targets in Mind

When setting your prices, consider your profit margin. Stricker achieved an 85% profit margin on the first 6 figures of her revenue.

Unless you’re paying other team members, the cost of providing accounting services is minimal, but you should determine the value of your time when setting your rates.

To maximize your profit margins, make sure you’re working efficiently. Even on hourly projects, clients want to see you’re billing a reasonable number of hours.

You can increase the efficiency of your practice by implementing a standard workflow for each client.

While you may decide to create your workflow system with spreadsheets, companies such as Jetpack Workflow have created free workflow templates and online accounting software systems to help you get organized faster and streamline your CPA practice.

How to Set Client Expectations

The quickest way to disappoint your clients is by not having clear expectations for your services. The initial quote you provide for your potential client should clearly lay out the services included, the expected time frame for completion, and the estimated cost (if hourly) or total cost if flat rate.

Having a client sign and return your quote ensures everyone is on the same page. That prevents any questions later about which services you’ve included in the project scope.

Additionally, unless you want to be available to clients 24/7, you should provide standard operating hours.

Share when you’re reachable and typical response times to voicemails or emails. This policy allows you and your clients to come to an understanding of your availability.

If you want to be available to your clients at any time, be sure to highlight that feature in your sales pitch.

How to Manage Multiple Projects

Once you land multiple clients, keep track of your accounting projects. Each client has specific requirements and deadlines.

Paper to-do lists may work for a while, but as your firm expands, you’ll probably need to upgrade to a more robust tracking system, such as an online platform like Jetpack Workflow.

Setting up these systems in the early days of your firm (when you have more time) lets you develop the habit of using your system.

With a solid system in place for monitoring due dates and allocating resources (and time!), your accounting business launch will be successful.