Why Accounting Firm Owners Burn Out (And How to Fix It with Better Operations)

Accounting firm burnout is rarely about long hours alone. It is usually caused by broken operational systems, unclear processes, excessive rework, and owners acting as the “chief Wikipedia officer” of their firms. The fix is not working harder. It is building a scalable operating system that removes the owner as the bottleneck.

Key Takeaways

-

Burnout in accounting firms is usually operational, not personal.

-

Rework and poor handoffs often consume up to 30% of team capacity.

-

Owners become bottlenecks when systems do not replace tribal knowledge.

-

A structured operations audit can quickly identify profit and capacity leaks.

-

Sustainable growth requires a documented operating system, not heroic effort.

Introduction

Accounting firm burnout happens when the business depends too heavily on the owner. When workflows are unclear, handoffs break down, and decisions route back to one person, exhaustion becomes predictable.

In a recent conversation on the Growing Your Firm podcast, Chase Damiano, Founder and CEO of Human at Scale, explained how operational inefficiency quietly drives stress inside accounting firms. His work focuses exclusively on helping firms build scalable operating systems that improve margins, restore capacity, and reduce overwhelm.

What Causes Accounting Firm Burnout?

Burnout often presents as fatigue, frustration, or stalled growth. Beneath the surface, the drivers are structural.

Common patterns include:

-

Endless internal questions directed at the owner

-

Weak client onboarding and poor handoffs

-

Excessive Slack or Teams interruptions

-

Rework loops between staff

-

No standardized KPIs

-

Lack of documented processes

When asked what he would expect to find in most struggling firms, Damiano summarized it in three words:

“Speed, quality, accuracy. When those three elements are misaligned, the strain spreads across the entire team.”

When any of those break down, stress increases across the entire organization.

How Does Poor Operations Create Burnout?

Burnout is not just about long hours. It is about unsustainable patterns that drain mental energy.

Excessive Rework

One of the most damaging inefficiencies is rework. In some firms, teams spend up to 30 percent of their time in unnecessary back and forth communication.

That includes:

-

Internal clarification messages

-

Re review cycles

-

Waiting for approvals

-

Restarting tasks

-

Correcting incomplete information

Even if someone works 40 hours per week, losing 30 percent of that to friction creates frustration and fatigue.

Rework does not feel productive. It feels like spinning in place.

The CEO Bottleneck Effect

In many accounting firms, the owner becomes the fastest path to resolution.

As Damiano described it:

“The CEO turns into this like chief Wikipedia officer.”

When team members encounter uncertainty, they default to messaging the owner. It works quickly. It feels efficient. It reinforces the habit.

The pattern looks like this:

-

Problem arises

-

Team pings owner

-

Owner answers immediately

-

Work continues

-

Behavior repeats

Over time, the owner becomes overwhelmed. The team becomes dependent. Growth slows because leadership attention stays down and in the business.

Broken Client Onboarding

Another hidden burnout driver is weak onboarding.

Sales teams collect partial information. Handoffs lack clarity. Cleanup teams discover missing accounts or incomplete documentation after work begins.

This leads to:

-

Restarted engagements

-

Client frustration

-

Team confusion

-

Escalations back to the owner

Operational gaps between sales and delivery multiply stress.

How Can Better Operations Reduce Burnout?

The solution is not adding more people. It is creating clarity.

Damiano’s approach begins with an operations audit.

Conduct a 360 Degree Operations Audit

A comprehensive audit typically includes:

-

Leadership interviews

-

Frontline team interviews

-

Financial margin analysis

-

Client profitability review

-

Tech stack evaluation

-

Practice management adoption review

The goal is to identify operational blockers in priority order. Fixing one often unlocks the next two.

Clarity reduces chaos.

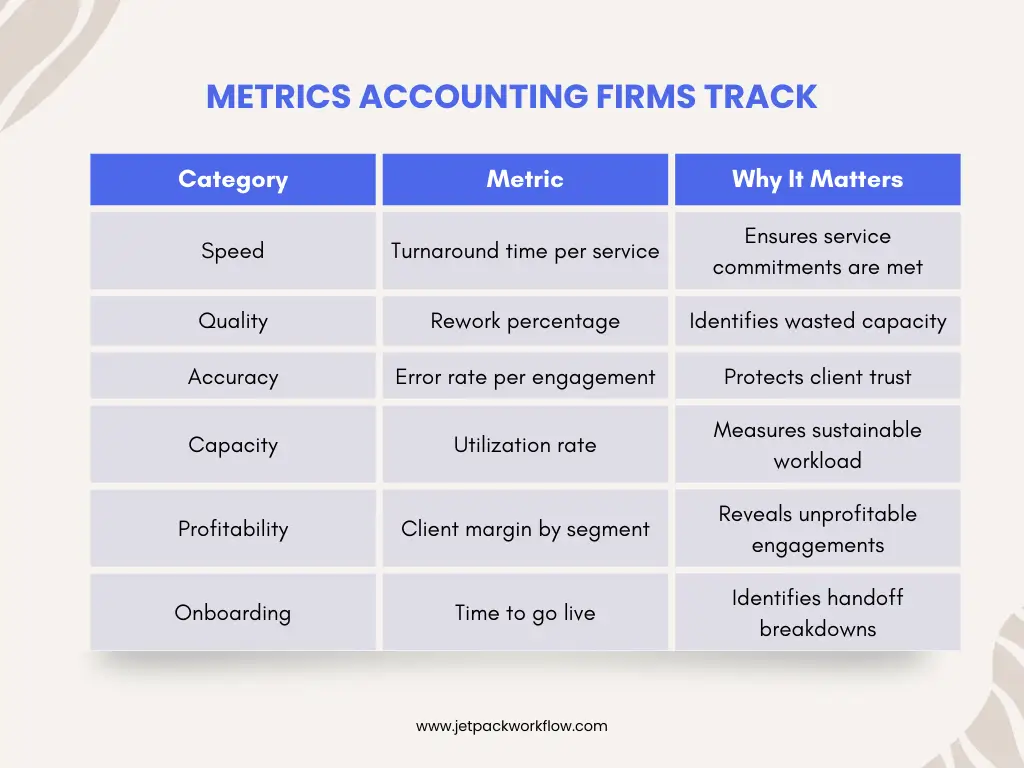

What Metrics Should Accounting Firms Track?

Burnout often correlates with weak operational visibility.

Firms should measure:

Service level agreements should not live only inside engagement letters. They should be reviewed consistently.

How Do You Break the Ask the Owner Habit?

Behavior change requires structure.

Damiano recommends two shifts.

First, reference the system. When a question comes in, ask whether the documented process has been reviewed. This reinforces autonomy.

Second, delay immediate answers.

Nine times out of ten, the team member resolves the issue independently before the meeting. The owner is no longer the path of least resistance.

When solutions are documented, future interruptions decrease.

As Damiano put it:

“Solve them one time.”

That mindset transforms recurring questions into permanent operational assets.

What Is an Operating System for an Accounting Firm?

An operating system is not software. It is a management framework.

It includes:

-

Defined KPIs

-

Structured meeting rhythms

-

Clear role ownership

-

Documented client workflows

-

Standardized onboarding

-

Shared dashboards

An operating system reduces dependency on personalities and increases organizational stability.

It allows the owner to shift from reactive problem solving to proactive strategy.

High Impact Fixes That Reduce Burnout Quickly

Firms can implement these improvements immediately:

-

Document recurring decisions inside your workflow platform

-

Standardize client onboarding checklists

-

Measure and report rework monthly

-

Consolidate redundant technology tools

-

Run weekly KPI meetings with defined agendas

-

Delay instant Slack responses to reduce dependency

-

Remove or restructure unprofitable clients

Small efficiency gains compound across teams.

Saving 15 minutes per day per staff member equals more than 50 hours annually.

Signs Your Burnout Is Operational

Look for these signals:

-

You answer the same questions repeatedly

-

Staff wait for approvals to move forward

-

Engagements restart mid process

-

Sales promises exceed delivery capacity

-

Team morale drops during busy season

-

You feel constantly interrupted

These are not personality flaws. They are system design gaps.

Burnout Is a Leadership Design Issue

Many firm owners believe burnout is the price of growth. It is not.

Burnout often reflects a firm that depends too heavily on the founder’s memory, availability, and constant review.

Sustainable firms build systems where:

-

Processes outlive personalities

-

Documentation replaces tribal knowledge

-

Metrics guide decisions

-

Meetings replace message chaos

Operational maturity protects leadership energy.

Frequently Asked Questions

Why do accounting firm owners burn out?

Most burn out because they become the central hub for decisions, approvals, and problem solving due to weak operational systems.

What is the biggest cause of burnout in accounting firms?

Excessive rework and owner bottlenecks are major contributors.

How can I reduce burnout in my accounting firm?

Conduct an operations audit, document workflows, measure rework, and implement a structured operating system.

What is an operations audit?

It is a comprehensive review of leadership processes, financial performance, tech stack usage, and team workflows to identify inefficiencies.

How do I stop being the bottleneck?

Delay immediate answers, reinforce documentation, and turn recurring questions into permanent process updates.

Conclusion

Accounting firm burnout is rarely about effort. It is about structure.

When owners become the center of every operational decision, exhaustion follows. By implementing a documented operating system, reducing rework, and reinforcing autonomy, leaders regain clarity and capacity.

The goal is not to work more. The goal is to design a firm that works without constant intervention.

Related Articles

- The First 100 Days After an Acquisition: Ashley Rhoden’s Integration Framework

- Questions Every Firm Leader Should Ask Before Taking Private Equity: Jennifer Wilson’s Guide

- How to Finance Accounting Firm Acquisitions: SBA Insights from Sarah Sharp and Shannon Hay

- I Sold My Accounting Firm: A Panel Discussion on the Process and Lessons

- Inside the Minds of Firm Buyers: Lessons from Accounting M and A Leaders

- The Future of Accounting Firms in an AI Driven World with Ryan Lazanis

- How Coaching Transforms Accounting Leaders: Lessons from Douglas Slaybaugh

- What is CAS Accounting? Services, Benefits and Growth

- How Tailor Hartman Took His Accounting Firm to 200K in Year 1

- Why Outsourcing plus Workflow Software is the Future of Accounting Firms

- AI Tools That Help Accounting Firms Scale Faster

Fix Operational Bottlenecks Before They Burn You Out

If your firm is stuck in rework, constant approvals, or leadership overload, it is time to redesign your workflows. Clear processes and real-time visibility reduce burnout and restore capacity.

See how Jetpack Workflow helps accounting firms build structured systems that free owners to focus on growth.