Is Wrike a Good Tool for Accounting & Bookkeeping Firms?

Managing projects for accounting and bookkeeping firms can be a daunting task. After all, you work with multiple clients on many small- and medium-sized projects with overlapping timelines.

Theoretically, clients are aware you have other clients. However, that doesn’t change that a client only cares about getting their projects completed and aren’t interested in excuses for missed deadlines or unfinished tasks – even more so if they are a new client.

It’s up to you to ensure your team is on task, job tickets aren’t overlooked, deadlines aren’t missed, and every required step is completed. How do you accomplish this without hiring a full-time office manager or putting in extra hours to track every project yourself? You’re a CPA, not a Chief Operating Officer!

You need a blueprint, a project management software, that can monitor projects from start to finish and track assignments and responsibilities for your team. Wrike is one of many project management systems available to you, but is it the right solution for your accounting or bookkeeping firm?

Options for Accounting Project Management

When it comes to project management systems, you have options ranging from piecemeal systems to fully-functional solutions out of the box. Which type of solution your firm needs will depend on what you’re trying to accomplish, size of your firm, and number of concurrent projects you’re managing.

Piecemeal Systems

When working alone, you can often manage your task list with a notebook or spreadsheet filled with items you need to complete, e.g., accounting tasks, phone calls to return, and proactive client outreach. You can use your calendar notifications to remind yourself of important due dates, track client meetings, and project how much time you have available for specific tasks.

As your firm grows and tasks increase, these simple solutions become more unwieldy, and the task management front becomes overwhelming. You’ll need to check the calendars of each of your team members, agree on who will add tasks to shared to-do lists, streamline the task assignment process, and find a way to coordinate client communication.

Piecemeal processes can work. However, they quickly become complex and take up a lot of your time which could otherwise be spent on client tasks and impact your firm’s internal success. Many piecemeal systems lack system time trackers and an automation process, requiring you to enter the same information in multiple places, making them very inefficient.

Accounting and Bookkeeping Workflow Programs

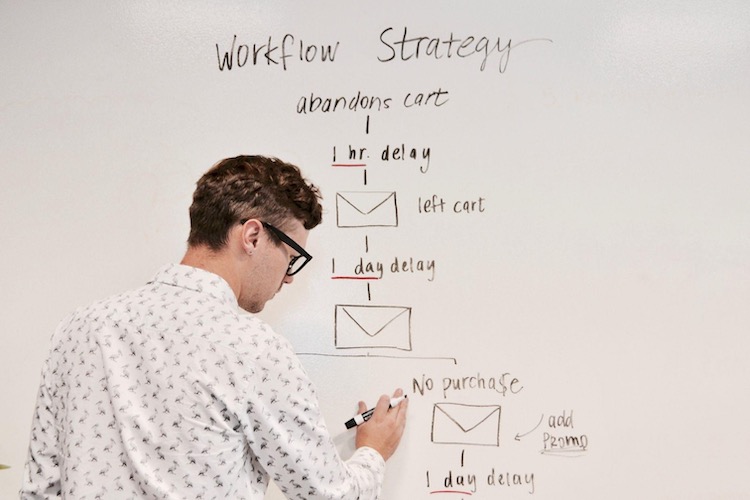

Workflow solutions combine many of the piecemeal tasks into a single program for accounting and bookkeeping teams that manages your calendar, client task list, and due date tracking for clients’ everyday deliverables. Out-of-the-box solutions will allow you to assign tasks to team members and monitor several projects in a single place.

Programs designed for workflow management will allow you to monitor the tasks assigned to team members, let team members check to see what’s on their plate, and provide updates to the entire team without having to send emails.

While there might be some initial time invested into learning a new workflow system, the long-term productivity gains will ensure the initial investment pays for itself.

Wrike for Accounting and Bookkeeping Firms

Wrike is a workflow management tool used by businesses in various industries. Wrike was built with the idea that project management shouldn’t be a struggle whether you’re a public accounting firm or an online retailer. Though they claim it can work for any company, is it the right solution for an accounting firm?

Wrike includes a visually appealing timeline workflow management dashboard where you can monitor the stage of multiple projects in real-time. The dashboard will work for a large number of projects; however, it becomes unwieldy as your number of projects grows.

Accounting and bookkeeping projects are also unique in their reliance on client-provided information, which will require preset timelines to be updated frequently. Wrike does not provide a simple solution for updating due dates for later steps because it will not automatically update due dates for future tasks based on a delay in an early stage.

Wrike is also very focused on photographs which are unnecessary for most, if not all, accounting projects.

How Wrike Works

When you start using Wrike, you’ll set up paths for every project, including each step in a project. Every step is given a due date and assigned to a specific team member. Each team member is responsible for checking off the task when it’s complete. At that point, the project is assigned to the next team member in the chain.

While you can create templates with original job information for projects you will do regularly, Wrike does not come with any predesigned templates for accounting or bookkeeping firms, i.e., you’ll spend a lot of time setting up your initial tasks. Wrike does have the option to make tasks recurring which can save you time in the future.

Once you’ve set up your tasks and assigned them to team members, you’ll need to set up timelines for each of your external clients. Wrike does not integrate with any major tax or accounting software. You’ll need to create tasks for each client manually. For accounting firms, you would need to manually enter each client which can be a daunting task for firms with hundreds of clients.

If you’re looking for a solution for client management, you’ll need to use a secondary program since Wrike does not provide customer management within the program. Wrike does integrate with Salesforce, but that comes with learning another system and paying additional subscription fees for another product.

Another drawback is Wrike does not assist with billing and time tracking for billable work. Since many accounting and bookkeeping firms bill clients based on hourly rates, the need for a separate program to track time spent on projects is another huge drawback.

Customer support is a phone call away, and there is live chat as well.

Best Wrike Alternatives

While Wrike might work for some accounting and bookkeeping firms, it’s probably not the best solution for most. We’ve identified the following options as a potentially better fit.

Overall Best Accounting Bookkeeping Firm Tool

Jetpack Workflow was built from the ground up with accounting and bookkeeping firms in mind. The online system is perfect for remote or in-house teams. It comes with preloaded project templates for accounting, tax and audit projects. Jetpack Workflow also allows for complete customization of your workflow and has an adaptable interface.

Jetpack Workflow’s robust system allows managers to monitor task allocation by team members to identify underutilized resources or overwhelmed team members, which can help with the reallocation of work.

The system also allows you to import client lists from various accounting software programs, which will make the initial setup process painless.

Best for Large Companies Who Need to Project Manage Across Departments

If you work for a large company or one who needs a tool that works across several departments, Monday.com or Airtable are two well-established tools to consider. Their intuitive and easy-to-use platforms allow various departments to create tasks, message each other, and create basic workflow templates for each unique project.

Best for Accounting and Bookkeeping Firms on a Small Budget

While not an ideal solution for managing internal processes and not missing deadlines for a client’s deliverables, especially during the busy tax season, spreadsheets or pen and paper are still the best tools if you’re a small business and watching expenses and costs are your number one concern. Keep in mind these methods cost you more in terms of your team’s time and productivity.

If you are looking for spreadsheet workflow templates, check out our free accounting workflow templates and checklists resource here.