How Workflow Improvements Helped This Firm 2X Clients and 3X Revenues!

One of the things we do at Jetpack Workflow is to reach out to our clients to see what we can do better. Today’s guest on the Grow Your Firm podcast told us he managed to double his clients and triple his revenues by improving his workflows. Once we heard that, we had to get him on the show to tell our listeners how he did it!

Russ Cowen is the president of Money Smarts Inc., a Nebraska firm that focuses only on small business clients. They do bookkeeping, payroll, taxes, sales tax, and income taxes for their clients. They’ve grown to around 200 clients and around $680,000 a year in revenue. If you want to see how his team did it, listen to the podcast or read our summary below!

Summary

- How Money Smart Inc. was started

- Why the first hire didn’t go so well

- His amazing growth numbers since then

- How Russ uses Jetpack Workflow in his firm

- Why his office manager is awesome

- And more!

Resources:

- The firm’s website: https://www.moneysmartsinc.com

- Russ Cowan’s LinkedIn: https://www.linkedin.com/in/cowanruss

- The firm’s Facebook page: https://www.facebook.com/moneysmartsinc/

- Russ’ email: russ@moneysmartsinc.com

- Interview with Jackie Meyer: https://jetpackworkflow.com/how-to-add-revenue-tax-planning-services/

How It Was Done

Money Smart Inc. was formed in 2007. For the first few years it was a side gig for Russ. He had about 30 monthly clients. Like many new firm owners, much of the day-to-day running of the business was kept in his head.

Eventually, he had to hire another person to keep up. After a couple of years, the firm had grown to 65 clients, but the type of clients the hire was bringing in were not the ones he wanted to serve. He was bringing in large clients, but the clients were too big to handle, needed a full-time accountant, or were lower quality. Some of them wanted 20-30 hours a week of accounting done, which drew away resources from the other clients. It was unsustainable.

Eventually, he had to let his hire go but he didn’t leave him high and dry. He told several of the clients that the person who brought him in was leaving and they could choose to go with him. After the fallout from that was processed, he continued to niche down on the kind of client he wanted to serve. See our interview with Jackie Meyer linked up in the resources section for more about the power of this technique.

By 2014, the firm had a small handful of members, 3-4, and they were billing out $8528 a month. But now, in 2019, he has 18 members and 200 clients. He bills out $36,733/month just for contracted monthly services. That’s not including tax work and one-off tasks. How did he turn things around?

Finding Efficiencies

The key was to get more efficient and to use technology to move information out of Russ’ head and into a place where everyone could be on the same page. At first, he used spreadsheets to help out. It took him about two hours to get a client entered into the system he built. When these got to be too unwieldy as he scaled the firm up, he tried Jetpack Workflow. Once the software was configured, it only took him a half hour to add a new client.

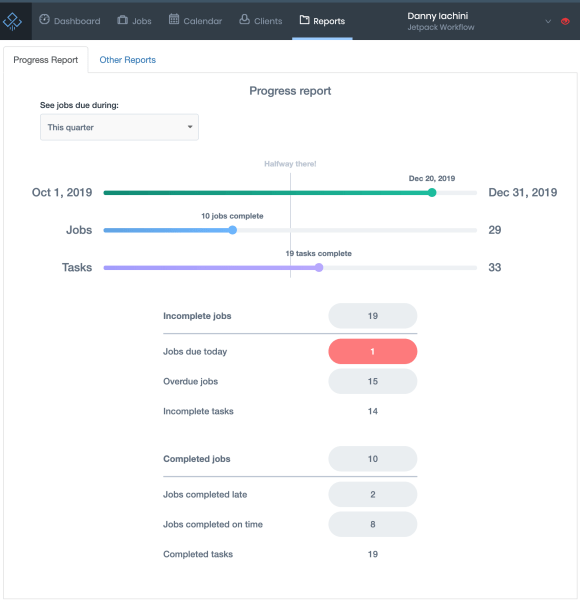

He also leverages the reporting features of Jetpack Workflow. One of the regular reports that he pulls through the software is how much time each client takes per month. If it is taking too long to complete a client’s needs, that’s a sign that something in the workflow needs to be tuned up. This is how they’re able to increase the margin for each client.

According to Russ, 9 times out of 10 a time problem is rooted in a problem with their workflows. For instance, maybe they need to set up a bank download instead of manually entering data. However, this report does sometimes catch a client that needs to be charged more.

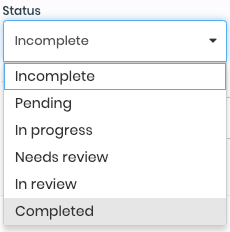

To get his team to use the software, he made Jetpack Workflow the one-stop-shop for everything they need to do their piece of the package. Every piece and step has a name attached to it. By using the dashboards, it’s easy to see who is behind and who is not. Furthermore, he runs his time tracking through the program and uses the scheduling features so that his team always knows what to work on next.

Additionally, by tracking time, he can see which team members are spending too much time on admin time. This is something his office manager tracks and brings up in a monthly meeting. The team then brainstorms how to reduce the time for the next month.

Motivation

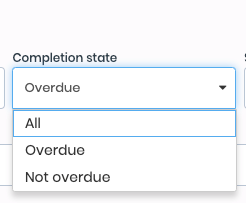

Another thing this firm does is use simple motivation techniques and incentives to get workers to raise their efficiency. For instance, his office manager came up with a game for the workers. If they get their current queue down to zero at the end of the week, they get a point. If they get rid of ten of their overdue jobs, they get three points. If they got rid of ten jobs from someone else’s queue, they got five points. At the end of the month, the people with the most points receives about $500 in prizes, along with stickers and chocolate.

This game started when the team fell deeply behind after last tax season. They divided up the tasks among all the team members then played the game over the summer using Jetpack Workflow to handle it. All Russ had to do was ask her how they could reduce the number of overdue tasks and she ran with it.

The full story of how he found his awesome office manager can be heard in the interview around the 31 minute mark. You can also hear how he manages to get one new client per week through his referral system. If you like what you’ve read here, listen to the whole podcast and let him know through the email above what you thought of it!