The Components of Momentum with Jeff Jacobs

Summary

-

- Today we welcome back guest Jeff Jacobs where we talk through some interpersonal conversation that dives much deeper than the accounting business itself. Jeff and David cover momentum, self assessment, breaking chains, and much more.

From Today’s Episode

Jeff Jacobs

Jeff is a returning guest on our podcast where we previously covered client acquisition, retention, and expansion. Jeff is the Director of Development at Wilkins Miller, where he will tell you he does everything except accounting. Jeff is active in his firm, daily life, and an exciting guest that we’re excited to have back on the show.

Momentum & Energy

David sets the stage from the previous conversation, as he seeks to understand what Jeff considers to be the first step someone may take who is feeling stuck or having lost momentum.

David leads off with, ‘what questions would you ask to start building back energy?’

Jeff follows up with the leadership variable. David’s specific question at its core, pertains to leadership as Jeff will tell us.

He gives us a great analogy about smoking. As a firm leader, if the business is suffering, then it’s safe to say the firm is likely suffering as well.. Jeff tells us, when we’re around others that smoke it affects the smoker, and those close enough to it. The same is true when running a firm. If the firm owner is down and out as a result of the firm’s success (or lack-thereof), then the employees may be feeling this hardship as well – just like smoke from a smoker.

This isn’t a podcast about problems however, we come with solutions too… well Jeff does.

He tells us, when he falls short and feels like he’s in a stuck position, that going back over his goals and understanding where he is trying to go is what helps pull him out of a slump.

Outside of the personal sphere, it’s important to make sure that those around you understand the goals of the firm as well.

Jeff gives us a second nugget for making sure all things are aligned, when he tells us to make sure that people, employees, colleagues, etc. know their expectations.

Put simply:

If everyone is working towards a similar goal and understands their role towards that goal, then the other side is much brighter.

“Momentum and just doing the little things well over a long period of time, that’s really where success comes in both in an accounting firm and in your life.” – Jeff Jacobs

Components of Self Assessment

David takes the conversation deeper when he picks Jeff’s brain on self assessment.

Are the roles and goals specific to a profession? The individual?

Jeff tells us that for him personally, it’s as simple as accomplishing his morning routine. If Jeff’s routine is to wake up early, read his bible, exercise, and have a nutritious breakfast but he fails to accomplish these because of an extra 30 minutes in bed, then of course his day will be off.

“Momentum starts with getting one quick win. For me, it’s the morning routine which flows into getting the work day started. Then it all plays into one big cycle, where you do a few things right and set the whole day into a positive motion.”

If days are much better when we meet our daily routine/expectations, then why would we ever go a day without them?

It’s a simple mindset, yet can be much harder to accomplish day in and day out.

Momentum at home and in our personal lives can lead to great impact and effectiveness in our professional lives. Jeff shares that work can impact home life just as much as our home lives can impact our work, especially for those that are business owners.

Jeff defines success as momentum and doing the little things well over a long period of time. For him, this is what leads to success both at work and at home.

Outside of the personal achievements, David draws us back to how this translates to firms and businesses too. It may be easier to identify if we’re lacking exercise or healthy habits, but when it comes to business it’s much more complex.

Could the business be stuck because of:

-

- Pricing

-

- Clients

-

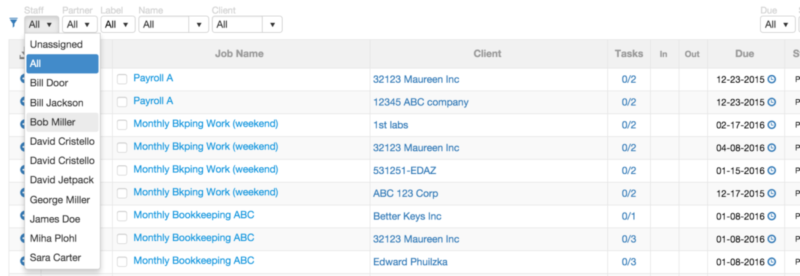

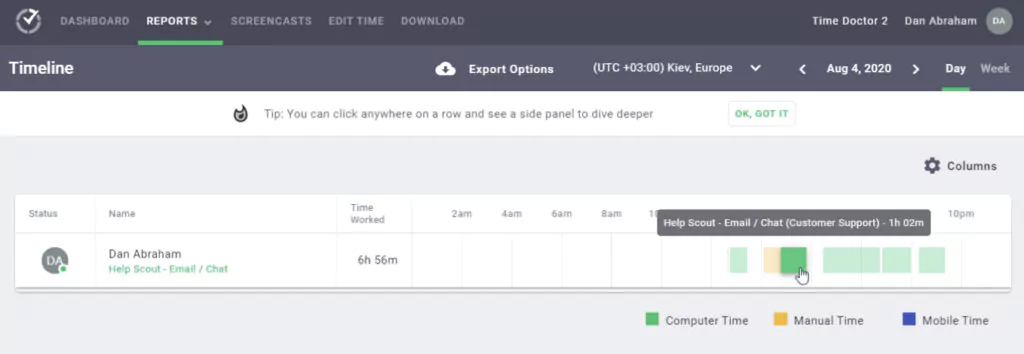

- Workflow

-

- Services

-

- Niches

-

- Marketing

-

- Leadership styles

There are so many different variables when it comes to business, luckily for us Jeff has made a career out of business development. We’ll cover his thoughts in the next section.

Get everything you need to manage projects and meet deadlines.

Subscribe to our weekly newsletter, and get 32 free accounting workflow templates today!

sign me up!

Seasonality of Business

Jeff shares that accounting is the place where momentum goes to die. When asked why, he shares that it’s the seasonality of the business.

100% of the time, accountants are busy 100% of the time. Not literally, but Jeff uses a great analogy when he says that it’s hard for people in the production line to lift their heads up – in other words, it’s nonstop!

Because activity in accounting can be nonstop, it can be hard to build momentum. It’s important to take a step back and do some of these:

-

- Build relationships

-

- Build trust

We love when Jeff shares that in seasons when people feel like they’re working with their heads down and with no purpose, of course it can be hard to work out of that season. However, just like a baseball game that only takes one hit to get things going, so can momentum in business as well.

The recognition of wins is a great way to do this. By recognizing an individual or team’s effort, this can be a great way to build momentum within the firm.

It’s a good first step and positive perspective.

By the achievement of one little thing, one step along the way, business owners and professionals can position themselves for momentum and future success, no matter how small the starting place.

If you want to reach out, say thanks, or learn more about Jeff you can find him on WilkinsMiller’s website or on LinkedIn.

To get the full story from today, make sure to check out the podcast on our website.

If you enjoyed the interview, leave a review. It helps us get the word out. Also, if you really enjoyed it and there is a shift in how you think about the future of your firm, share it with a fellow firm owner that needed to hear something Jeff talked about today.

If you’re looking to grow your firm, check out this free resource with a walk-through on how to double your accounting firm.