Free Cash Flow Statement Sheet Template (Excel, Google Sheets & PDF)

A cash flow statement shows how money actually moves through a business. Unlike profit and loss reports, it focuses on real cash inflows and outflows across operating, investing, and financing activities.

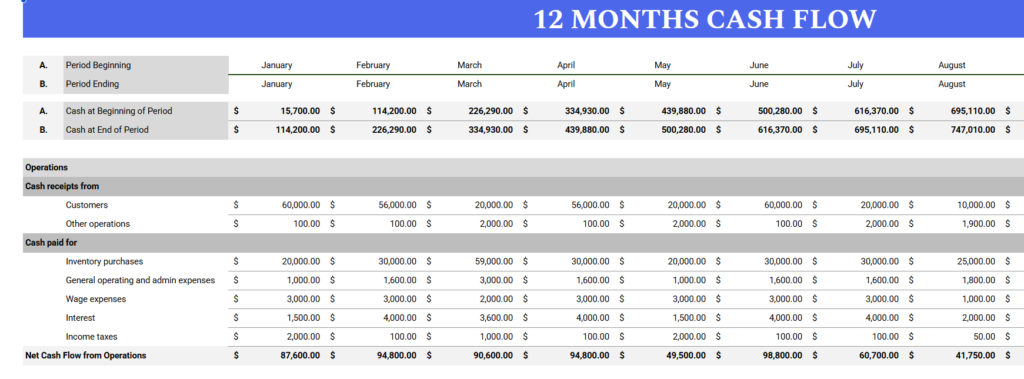

This free Cash Flow Statement Sheet template provides a clear, structured way to track cash movement, monitor liquidity, and support better financial decisions. It is designed for accountants, bookkeepers, and firm owners who need accurate, repeatable reporting.

Download your cash flow statement template here and use it in Excel, Google Sheets, or PDF format.

Key Takeaways

- Cash flow statements focus on real cash movement, not just profit

- Clear separation of activities improves financial clarity

- Templates reduce errors and improve consistency

- Regular cash flow review supports better decisions

- Workflow tools help firms deliver reports on time

Download the Editable Cash Flow Statement Sheet Template

The spreadsheet versions include built-in formulas to calculate net cash flow and ending cash balances automatically.

Template Preview

Why Use a Cash Flow Statement Template?

A cash flow statement helps firms understand when money is coming in, when it is going out, and whether a business can meet its short-term obligations.

Accountants and bookkeepers use cash flow statements to:

- Monitor liquidity and cash availability

- Identify timing gaps between income and expenses

- Support forecasting and advisory conversations

- Prepare reports for firm owners, lenders, and stakeholders

- Ensure accurate financial oversight beyond profit numbers

Firm owners rely on cash flow reporting to avoid surprises and plan for upcoming expenses.

How to Use the Cash Flow Statement Template

Step 1. Enter Beginning Cash Balance

Start by entering the cash balance at the beginning of the period.

Step 2. Record Operating Activities

Add cash received from customers and cash paid for operating expenses such as inventory, payroll, rent, and taxes.

Step 3. Record Investing Activities

Include purchases or sales of equipment, property, or investments.

Step 4. Record Financing Activities

Track borrowing, loan repayments, owner contributions, dividends, or equity transactions.

Step 5. Review Net Cash Flow

The template automatically calculates net cash flow and ending cash balance for the period.

How the Cash Flow Statement Template Works (Simple Example)

If a business starts the month with $25,000 in cash:

- Operating activities bring in $60,000 from customers

- Operating expenses total $45,000

- Net cash from operations is $15,000

The business purchases equipment for $5,000:

• Net cash from investing is negative $5,000

The owner repays $3,000 on a loan:

• Net cash from financing is negative $3,000

Ending cash balance:

$25,000 + $15,000 − $5,000 − $3,000 = $32,000

This shows the business is generating positive operating cash while managing investments and debt.

Features of the Cash Flow Statement Sheet Template

- Clearly separated sections for operating, investing, and financing activities

- Monthly and annual cash flow tracking

- Automated calculations for net cash flow

- Clean layout suitable for client delivery

- Works in Excel and Google Sheets

- Easy to export as a PDF

This structure aligns with standard accounting and financial reporting practices.

Who This Cash Flow Statement Template Is For

- Accounting firms managing multiple clients

- Bookkeepers handling monthly reporting

- Firm owners reviewing cash position

- Advisory teams supporting cash planning

- Businesses preparing lender or investor reports

It is especially useful for firms offering monthly close, CAS, or advisory services.

Tips for Using the Cash Flow Worksheet Effectively

- Keep categories consistent month to month

- Review cash flow alongside the P and L and balance sheet

- Use notes to explain unusual cash movements

- Watch trends in operating cash flow closely

- Use recurring workflows to ensure timely updates

Need Help Managing Monthly Financial Work?

Managing cash flow reporting across multiple clients requires consistent processes and visibility.

Jetpack Workflow helps accounting firms organize recurring financial tasks, track deadlines, and standardize monthly reporting workflows so nothing slips through the cracks.

Final Thoughts

A Cash Flow Statement is essential for understanding how money actually moves through a business. With this editable template, accountants and bookkeepers can streamline monthly and annual cash flow reporting, improve accuracy, and deliver clear financial insights to clients.

Use this template to monitor liquidity, plan future expenses, and support advisory conversations with confidence.

Jetpack Workflow helps you manage recurring financial tasks with ease by providing:

- Automated recurring job schedules for every client

- Clear visibility into who is working on what

- Deadline tracking for monthly close, bookkeeping, payroll, and tax work

- Custom workflow templates you can apply across all clients

- A simple way to standardize your firm’s internal processes

If you need more essential accounting templates, you can also download our other free resources. These include the General Ledger Template, Bank Reconciliation Template, Payroll Template, Balance Sheet Template, Profit and Loss Template , T Account Template and our Bookkeeping Templates collection. Each one is designed to help accountants and bookkeepers complete monthly close work faster and with fewer errors.

Stay Ahead of Cash Flow Reporting with Jetpack Workflow

Cash flow reporting is a recurring task across many clients. Jetpack Workflow helps firms organize checklists, automate deadlines, and track progress so monthly reporting stays consistent and accurate.

Start your free trial or book a product tour to see how it fits into your firm’s workflow.

If you want to spend less time managing spreadsheets and more time delivering high value advisory work, Jetpack Workflow can help you stay organized at every stage of growth.

Frequently Asked Questions

What is a cash flow statement?

A cash flow statement reports how cash moves in and out of a business through operating, investing, and financing activities during a period.

Why is cash flow important for businesses?

Cash flow shows whether a business can pay expenses, cover obligations, and sustain operations.

How often should a cash flow statement be updated?

Most firms update cash flow monthly, though some review it weekly or quarterly depending on needs.

Does this template calculate totals automatically?

Yes. The Excel and Google Sheets versions include formulas that calculate net cash flow and ending balances.

Who should use this cash flow statement template?

It is designed for accountants, bookkeepers, firm owners, and advisory teams.