Free Payroll Template (Excel, Google Sheets & PDF)

Running payroll is one of the most important responsibilities for any business. Employees expect to be paid accurately and on time, and mistakes can create frustration, legal issues, and compliance risks.

A payroll template provides a reliable system for recording hours, salaries, deductions, and benefits. Instead of starting from scratch each pay period, you can use a structured worksheet that organizes the process and reduces errors.

Our free payroll sheet template is available in Excel, Google Sheets, and PDF. It can be tailored to different pay schedules, whether you run payroll weekly, biweekly, or monthly.

In this guide, we explain how to use the template step by step, share best practices, and provide real-world examples of payroll calculations.

Download Editable Payroll Template

We’ve designed the payroll file in three formats so you can choose the one that fits your workflow:

Why Use a Payroll Template

Payroll can become complex as soon as you have more than one employee.

Between calculating overtime, applying deductions, and keeping up with tax rates, the risk of error increases.

A payroll spreadsheet helps simplify the process by:

- Keeping all employee pay records in one place.

- Applying formulas to automate gross-to-net calculations.

- Reducing the chance of human error in manual math.

- Creating a transparent system that can be reviewed and audited.

Using a payroll template also saves time. Instead of recreating the process for each period, you can duplicate the sheet, update the numbers, and move on.

How to Use the Payroll Template

Step 1: Gather Employee Information

Before entering numbers, prepare a list of employees with their names, positions, and pay structures. The employee payroll template provides fields for this data. Consistency in how you enter names and roles makes the sheet easier to navigate over time.

Step 2: Customize the Pay Schedule

Set the pay frequency your business follows. Some companies pay weekly, others biweekly or monthly. The payroll schedule template allows you to label each sheet by pay period. Clear labeling avoids confusion, especially when reviewing historical records.

Step 3: Enter Hours or Salaries

For hourly employees, input hours worked and hourly rates. For salaried employees, record their fixed pay for the period. If an employee works overtime, list those hours separately with the correct multiplier. The payroll worksheet supports both types of inputs.

Step 4: Add Benefits and Deductions

Include deductions for federal and state taxes, insurance, and retirement contributions. Add benefits like health coverage, allowances, or reimbursements. The payroll ledger template shows gross pay, adjustments, and final net pay, ensuring each change is transparent.

Step 5: Confirm Net Pay and Record

After the sheet calculates totals, confirm that net pay matches the amount to be transferred to each employee.

Features of the Excel Payroll Template

The template is more than a blank spreadsheet. It is structured to guide you through the payroll process with:

- Columns for hours, rates, overtime, deductions, and net pay.

- Automatic formulas that calculate gross pay and net pay.

- Separate sections for different pay periods.

- Compatibility with Google Sheets for online collaboration.

Example: Weekly Payroll

Let’s walk through a detailed weekly payroll scenario for a small business with four employees:

- Employee A: 40 hours at $20/hour

- Employee B: 35 hours at $25/hour + 5 hours overtime at 1.5x

- Employee C: Salaried, $1,000 per week

- Employee D: 20 hours at $18/hour

Step 1: Gross Pay

- Employee A: 40 × $20 = $800

- Employee B: 35 × $25 = $875 + (5 × $25 × 1.5) = $875 + $187.50 = $1,062.50

- Employee C: $1,000 salary

- Employee D: 20 × $18 = $360

Total Gross Pay = $3,222.50

Step 2: Deductions

Assume each employee has 15% withheld for taxes and $25 for health insurance.

- Employee A: $800 − (15% of $800 + $25) = $800 − $145 = $655

- Employee B: $1,062.50 − (15% of $1,062.50 + $25) = $1,062.50 − $184.38 = $878.12

- Employee C: $1,000 − (15% of $1,000 + $25) = $1,000 − $175 = $825

- Employee D: $360 − (15% of $360 + $25) = $360 − $79 = $281

Step 3: Net Pay

- Employee A: $655

- Employee B: $878.12

- Employee C: $825

- Employee D: $281

Total Net Pay = $2,639.12

By entering this data into the weekly payroll template, the sheet automatically calculates these values, saving time and reducing the risk of math errors.

Example: Monthly Payroll

Now consider a company with three salaried employees paid monthly:

- Manager: $5,000 salary + $500 performance bonus

- Administrator: $3,500 salary

- Technician: $4,000 salary − $200 unpaid leave deduction

Step 1: Gross Pay

- Manager: $5,000 + $500 = $5,500

- Administrator: $3,500

- Technician: $4,000 − $200 = $3,800

Total Gross Pay = $12,800

Step 2: Deductions

Assume taxes are 20% of gross pay and health insurance is $200 each.

- Manager: $5,500 − (20% of $5,500 + $200) = $5,500 − $1,300 = $4,200

- Administrator: $3,500 − (20% of $3,500 + $200) = $3,500 − $900 = $2,600

- Technician: $3,800 − (20% of $3,800 + $200) = $3,800 − $960 = $2,840

Step 3: Net Pay

- Manager: $4,200

- Administrator: $2,600

- Technician: $2,840

Total Net Pay = $9,640

With the monthly payroll template, these calculations are automated, and adjustments such as bonuses or leave are easy to enter.

Additional Payroll Scenarios

Payroll can also involve special cases. Here are a few examples to illustrate how flexible the template is:

- Commission-based employees: Add a column for commission earnings based on sales performance.

- Seasonal workers: Use the sheet to track irregular schedules and calculate varying pay.

- Overtime-heavy jobs: Include overtime multipliers for industries where extra hours are common.

- Contractors: Record contractor payments separately from employee payroll to keep compliance clear.

Tips for Using the Payroll Worksheet

To get the most out of the template, follow these best practices:

- Keep it updated: Record hours or salaries promptly to avoid missing data.

- Validate tax rates: Payroll taxes can change annually, so confirm rates before each year starts.

- Secure your records: Payroll data is sensitive, so store your files with proper access controls.

- Export regularly: Save a copy of each pay period as a payroll record template for audits.

- Use as a tracker: Over time, the sheet becomes a payroll tracking spreadsheet that shows labor costs and trends.

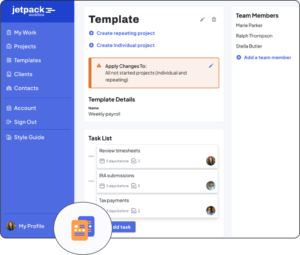

Need Help Managing New Client Projects?

A workflow management system is a great way to keep your bookkeeping firm organized and running efficiently. By automating tasks and keeping track of deadlines, you can be sure that nothing falls through the cracks and your clients are always getting the best possible service.

In addition, a workflow management system can help you to allocate resources more effectively, ensuring your staff is always working on the most important tasks. Ultimately, a workflow management system can save you time and money, making it an essential tool for any bookkeeping firm.

Jetpack Workflow was designed from the ground up with bookkeepers and accountants in mind. The cloud-based workflow management system allows you to start with predefined templates, customize them for your firm, and track progress on all your work.

Jetpack Workflow offers a free 14-day trial which will give you the opportunity to see how much time you could be saving with a full workflow management system.

Final Thoughts

A payroll template simplifies one of the most critical processes in any business. By downloading a ready-made file in Excel, Google Sheets, or PDF, you can process payroll efficiently, reduce errors, and maintain clear records.

From weekly pay runs for small teams to monthly payroll for larger organizations, this template adapts to your needs. With built-in formulas, structured columns, and printable formats, it provides accuracy and reliability.

Download the free template today and explore other Jetpack Workflow resources to make payroll processing and financial management easier than ever.