41 Top Productivity Apps for Accountants In Busy Season

Client deadlines have been set. Engagement letters have been received. Software has been updated with the latest 2.0 version. A schedule of who is going to get what done, and when, is still up for discussion as your best person just put in their 2 weeks. The relaxed holiday break is now over and your stress levels have suddenly begun to rise.

January must be here already…

To help reduce some of your stress of running a CPA or accounting firm, I have put together a list of the top 41 productivity apps for accountants to implement this busy season.

Let’s get to it.

1. Inbox by Gmail

Inbox by Gmail is a clean and minimalistic take on mobile email that uses gestures to help you quickly get your inbox to zero all while using your same old Gmail account. The app is focused on improving email productivity and organization by allowing the user to snooze messages for a later time, bundle similar emails together, and receive Google Now-style cards for things such as flight times.

Originally designed to help salespeople keep track of their prospects, Yesware has gotten to be very useful in the accounting industry. With the ability to see who opens, reads and clicks in your email, you can start making better decisions about who you are connecting with and what you are saying. With Yesware, you can track email open and reply rates, link clicks, attachment opens and presentation pageviews. It’s all valuable information that will help you identify the best possible message to send, every time.

Ever wanted to wait to send an important email till after your boss wakes up? Well, Boomerang has your back. Boomerang adds scheduled sending and the easiest, most integrated email reminders to Gmail, helping you reach Inbox Zero. Draft an email, click a time when you want it to send and move on with your day. Boomerang will take care of the rest.

Contactually is an app that can help you build and improve the most important relationships in your network. By allowing you to segment your contacts and assign follow-up cycles to each category, this app makes sure you never lose touch with your team or your prospects.

Honestly, every single person typing an email needs this app. With a simple integration, through extensions like Google Chrome, you can now have a widget that picks up spelling and grammatical errors. Nothing says “unprofessional” like content full of errors. So to rid you from sending another embarrassing email, allow Grammarly to catch up to 10 times more errors than your normal word processor. This should make it possible to boost productivity as you no longer will have to worry about hitting spell check before sending your next email.

Project Management

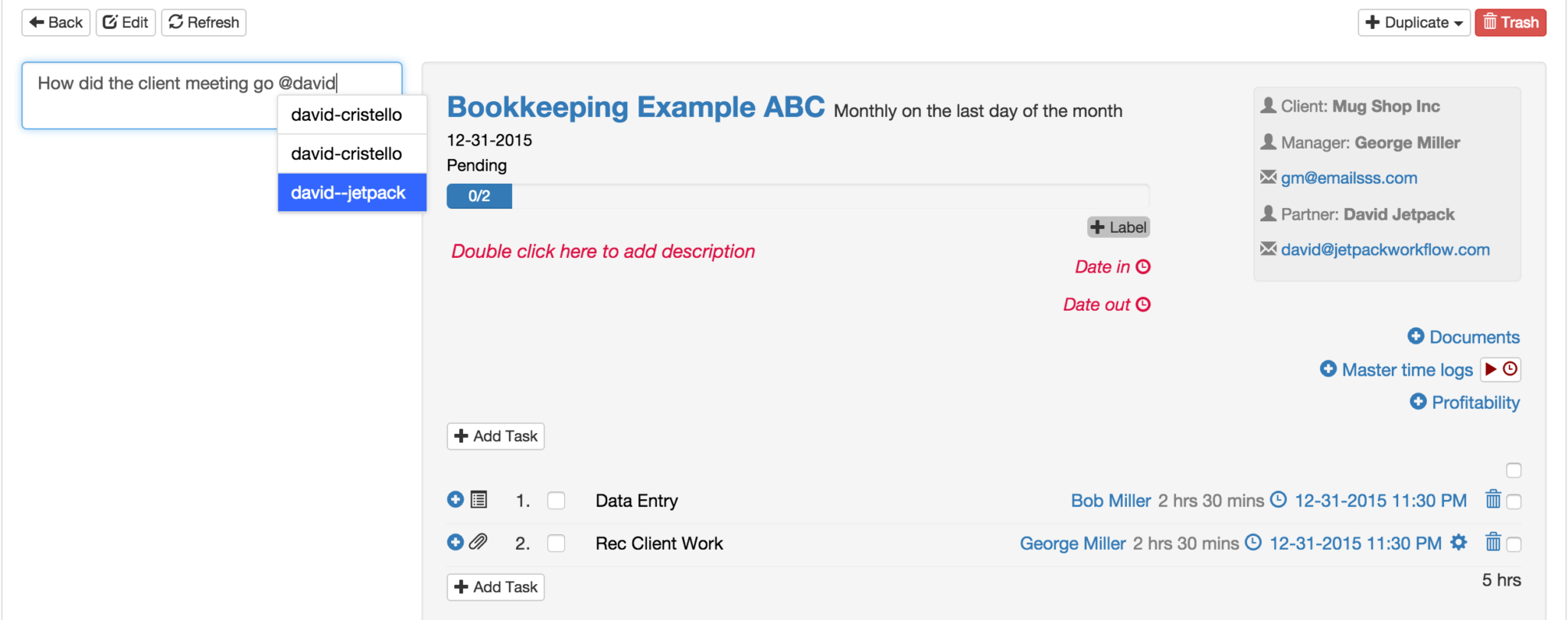

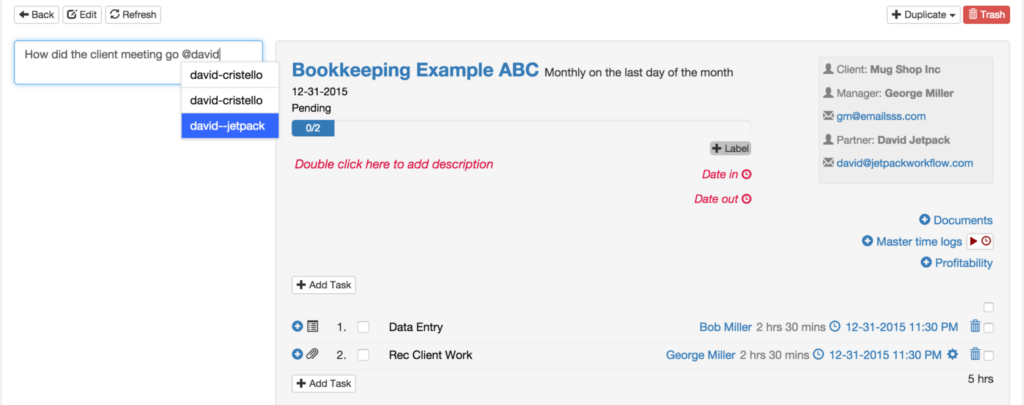

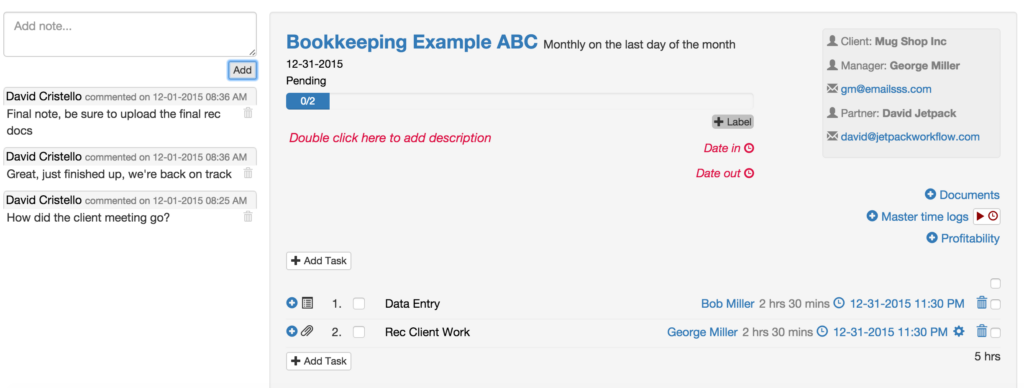

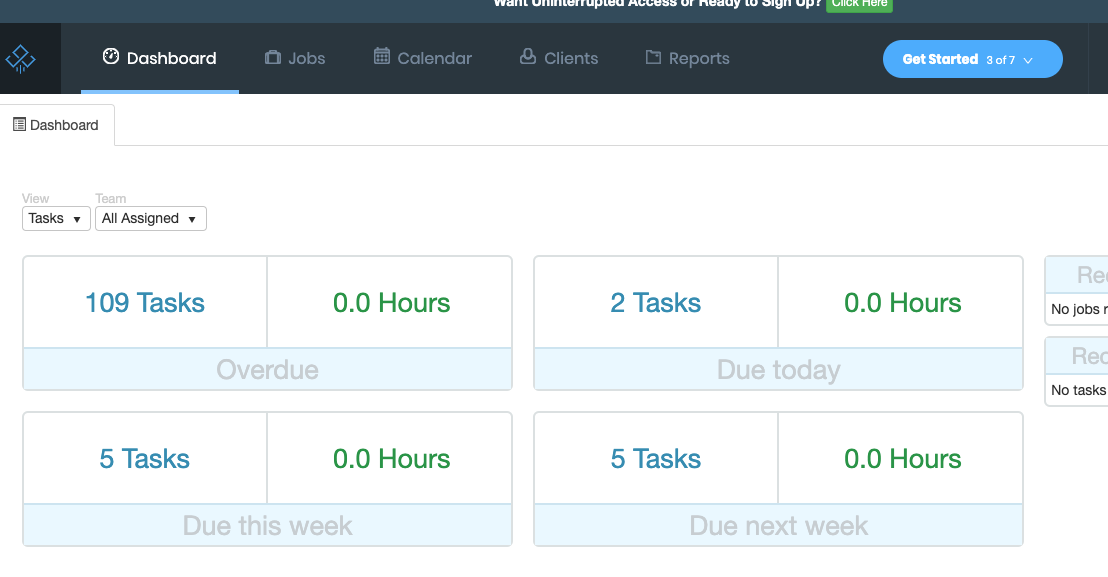

Have a never ending to-do list? Need to remember to close the books for 8 of your 15 clients? Having difficulty in delegating work and staying on top of client deadlines? This is where Jetpack Workflow app can significantly boost your firm’s productivity. Essentially, Jetpack Workflow helps small-medium sized accounting firms manage workflow, repetitive processes and build a paperless office.

Just like its name, this is a note taking app that includes everything you want to remember. Evernote stores photos, web pages, notes, PDF files, audio clips, and to-do lists. Once you add things to your notebook they’re completely searchable and can be accessed on your desktop, the Web, or your mobile device. This making searching through digital sticky notes, so much more enjoyable.

Never find yourself scrambling for a scanner again! With Genius Scanner app on your phone, you can snap a picture, export by email and send signed documents without leaving the house. Equip your employees with Genius Scan and you won’t need them to be back in the office to access their documents.Therefore providing a way to boost productivity and minimize wasted time.

The tagline for Vesper is to “collect your thoughts”. And that’s exactly what it does. Vesper is a note-taking app where you can easily tag each entry so you can search for a specific thought by keyword later, and all your notes will be synced to your Vesper account, free of charge. Reorganizing your notes is made simple with a hold-and-drag motion, and if you want to prevent a cluttered collection, a simple swipe archives your entry.

Hipchat is a great way for keeping in touch with your team at work without sifting through dozens of emails. It is a chat room of sorts, and you can tag users and create multiple channels for smaller team projects. Plus there is a video chat option to connect faster than a phone call. The desktop client sends non-intrusive desktop notifications to the corner of your screen, allowing you to stay on top of what’s happening while keeping your eyes on your work.

Imagine accessing all of your accounts with just one password. Then tackle on high-tech security features to make it almost necessary for everyone to have 1Password app. 1Password lets you keep all of your log-ins in one place, so you’ll never have to worry about forgetting passwords again. Out of all of the productivity apps for accountants, this should be at the top of your list. You’ll thank me later. I promise!

Staying Awake

We all know that a few upbeat songs, and tunes to follow along with can help with the late night grind. Spotify, it’s easy to find the right music for every moment – on your phone, your computer, your tablet and more. Create playlists, search top tracks and star the best tunes to keep you knocking out those work papers.

This might sound a bit silly, but seriously, Google Timer might just become your next best friend in 2016. I recently read an article on Medium discussing how to work 40 hours in just under 16.7 hours. The way to do this is to set up 25 minute time intervals to knock out a single task, and dominate it. This is where Google Timer comes into play. Pick a task, set the timer to 25 minutes and get to it. You’ll be surprised with your productivity and might just get to leave by 5 o’clock on a Thursday in March. Crazy, I know!

Want to listen to music without having to create your own playlist or pick a song? In comes Pandora to save your already stressful day. Pandora is free, personalized radio that plays music you’ll love. Discover new music and enjoy old favorites. Start with your favorite artist, song or composer and Pandora will automatically create a station surrounding the same type of music/genre. You might just run across a few old school songs that will hopefully keep you moving throughout your day.

As with all iPhones, you can select your podcast app to start searching for things to listen too. The Podcast app is an amazing way to discover, subscribe to, and play your favorite podcasts. Explore hundreds of thousands of free audio and video podcasts in the Featured tab, or browse Top Charts to see what’s hot right now. This will keep help keep you focused and ultimately help boost productivity for you and your employees.

Team & Client Meetings

Skype is a software application that allows users to make voice and video calls and chats over the Internet. Calls to other users within the Skype service are free, while calls to both traditional landline telephones and mobile phones can be made for a fee using a debit-based user account system. They also have a Skype for Business which collaborates with your office apps and sets up professional meetings and collaborations.

Need a quick conference call line that is free to use? Then I recommend signing up for Free Conference Call. Upon registration, you are given a conference call phone number and user password to make setup and use of a conference line almost seamless.

Conference calls on the go can be hit and miss, but not with UberConference. This app lets you see participants’ LinkedIn profiles and record your meetings so you don’t lose an important point.

Business Travel

TripIt is an intelligent travel organizer that helps travelers manage their plans so that their trips go more smoothly. Travelers simply forward their purchase confirmation emails to TripIt and TripIt automatically creates master itineraries with travel plans and other critical information. This way, all of your travel itineraries and calendars are synced and easily accessible from your phone.

Prior to 2008, most business travels occurred through hotel bookings. Now, Airbnb has started to change the game for most business travelers. Airbnb Business Travel is making it easy for corporate travelers to plan their next business trip without sacrificing the comforts and amenities of home. With over 1,000,000 spaces around the world, employees will be able to find a space that helps make after-work feel like a vacation.This way, your employees can recharge and hopefully be able to boost productivity during business travel trips.

This is the best app if you are traveling internationally and might need some help with a foreign language. With the Google Translate app, you can type in sentences, voice record sayings and take pictures of words. All of which will translate into the language you need.

If you are still sold on going with a hotel for business travel, I recommend checking out Hotel Tonight. It’s a great way to book travel at the last minute, while simultaneously getting the best price possible. Hotel Tonight makes it remarkably easy to book great hotels at amazing last-minute rates on your mobile device, for tonight, tomorrow and next week. When hotels have unsold rooms, they load them on the app, which means you get incredible deals.

I’m guessing you have already heard about Uber, but it’s still well worth it to include on this list. Uber is super easy to use, and you no longer have to wait to call a cab. With a click of a button, you will be given notification that your Uber driver is on their way. Plus, all payment transactions occurs on the app so you don’t need to worry about dragging around cash, unlike taking a cab who does not accept credit cards.

Need directions to your new client’s office? What about trying to find nearby places as you are in a new city and have no idea what’s around? I recommend checking out Google Maps. With this app, you can easily find local businesses, view maps of the area and get driving directions from wherever you are.

Client Payments

If you need to send payments quickly and securely, this is your app. With no forms to fill out and no fees for payment, Venmo is a great alternative to solutions such as Paypal. Plus, if you are out to dinner with co-workers, paying with your debit card or bank account is free, and you can transfer money from your Venmo account balance to your bank account overnight.

Whether you need to take payments on the go occasionally or frequently combine work and travel, Square is the app that can make it happen. Square can also help anyone take care of their business. Square’s complete register service is a full point of sale with tools for every part of running a business, from accepting credit cards and tracking sales and inventory to small-business financing

PayPal provides online payment solutions to its users. It enables its users to transact money through their account balances, bank accounts, credit cards, or promotional financing without sharing financial information. To most people, it is the leader of client payments and has been integrated with most popular apps as it’s a subsidiary of Ebay. This is a great productivity app for accountants to utilize when it comes to making your accounts receivable seamless.

Calendar

ScheduleOnce is a powerful meeting and appointment scheduler that works in tandem with your personal calendar and makes it easy to schedule customer appointments, group meetings and one on one meeting. This can reduce wasted time and hopefully boost productivity at your firm.

Timeful is an intelligent calendar app mixed with a to-do list. The app’s algorithm learns how you get stuff done and smartly suggests ways to build new habits and get things taken care of, all on your own terms.The company takes an algorithmic approach to time management, and leverages big data and behavioral science to best determine how people can maximize their lives.

Data Storage

Dropbox lives on your desktop as a virtual folder. You can drag and drop files into your Dropbox and they’ll appear on all of your devices. In additional, there is Dropbox for Business which is trusted to store, sync, and share files securely with the admin tools IT teams need to protect business data. With easy-to-use controls, IT admins can get full visibility over how critical work files are accessed and shared, while letting team members continue to use the tools they know and love.

When it comes to productivity apps for accountants, Google Drive fights for the number one spot. Google Drive is an online productivity suite that can be accessed with any device that’s connected to the internet, either through an app or on the web. You can share and collaborate on documents and presentations, and it’s great when multiple people need to poke around a file at the same time, as you can always see who else is viewing or editing a document.

Box is an online file sharing and cloud content management service offering unlimited storage, custom branding, and administrative controls. Even better, the program’s responsive design allows Box to be effective no matter what device you use.

Microsoft OneDrive is an online file storage that enables users to store and share photos, videos, documents, and more. You are granted 15 GB of free storage when you sign up which makes it worthwhile for not having to shell out any cash. Since OneDrive is a Microsoft service, you’ll always know that your files will play nicely with other Office apps, so you don’t have to worry about if a document will open in Word or not.

Meal Planning (Including Late Night Takeout Meals)

Foursquare is a local search and discovery service mobile app which provides search results for its users. If you are out for business travel, or just looking for a place to grab lunch, the app provides recommendations of the places to go to your current location. Plus add on the reviews and stars to determine ahead of time, if the restaurant is actually going to be good.

This will stop the wasted time trying to determine what to eat, and instead be a helpful productivity app for accountants to utilize.

Trying to find a place to eat for lunch can be difficult. Tackle on a vegan & gluten-free diet, it might feel nearly impossible to find a place for your co-workers. This is where Happycow comes into play. Happycow is a free online vegetarian restaurant guide, sorted by country and region, providing vegetarian and vegan restaurant dining and health food store locations.

A competitor to Foursquare, Yelp mobile app publishes crowd-sourced reviews about local businesses, as well as the online reservation service SeatMe and online food delivery service Eat24. The company also trains small businesses in how to respond to reviews, hosts social events for reviewers, and provides data about businesses, including health inspection scores.

Marketing

37. Buffer

Save time on your social media marketing efforts by managing all of your social profiles in a single app with Buffer. It’s an easy way to take the pain out of maintaining and updating multiple accounts. With this now freed up time, you have availability to boost productivity in other aspects of your firm and career.

Sometimes you use a variety of tools that don’t natively talk to each other. Fortunately, with Zapier, integration becomes simple. Set up as many zaps as your account allows, and watch your tools react to each other easily.

Need a way to stay in touch with your current client and prospect list without having to send personalized emails, one by one? Active Campaign is an email marketing & marketing automation solution for small businesses that will do just that.

Out of the list of top productivity apps for accountants, SalesLoft might be the best app for prospecting new clients. SalesLoft is the simplest way on the internet to build accurate and targeted lists of prospects utilizing its automated follow-up technology. I have started to grow very fond of SalesLoft. With the ability to send personalized follow-up emails, with a click of a button, I stay on top of my prospects as well as current clients that need to be connected with. If you are looking for a way to send more emails, with less time & effort, I highly recommend checking out SalesLoft.

41. Feedly

Feedly is a great RSS Feed alternative for curating content and staying up to date with the most current news, announcements, and mainstream trends applicable for your business. Once you’ve subscribed to a collection of different publications or blogs, the program automatically refreshes the feed and aggregates their content into a cohesive stream you can look at quickly and share on social. This is a great productivity app for accountants who want all of their new content in one place.

**Have any additional productivity apps for accountants that have worked for at your firm? Share with us in the comments below!