Is Trello The Right Tool for Accounting & Bookkeeping Firms?

If you start researching different project management software, it won’t take long before you hear about Trello.

It’s at the top of many lists for general project management software and seems like it might be a good fit for your team. However, is it the best fit for an accounting or bookkeeping practice?

If your firm is growing and you need a better solution to manage workflows and tasks across your team, this article was made for you. Let’s look at the benefits and drawbacks of using Trello as your project management software.

Why You Need a Project Management Solution

Accounting firms juggle multiple projects simultaneously with overlapping timelines and impending deadlines. It’s the nature of the business.

While you could rely on notebooks or simple spreadsheets, technology has made it easier to manage projects and allocate your team’s resources. Pen and paper might have worked well for you if you started out on your own, but as your team grows, so should your project management system.

The right project management software allows you, the owner, to monitor various client engagements and ensure your team is assigned to the right projects. Each of these items adds to your bottom line by either cutting out wasted time or preserving your client relationships (and thus, minimizing the time you spend looking for new clients).

It also makes it less likely that things fall through the cracks and deadlines get missed. The right tools allow you to create recurring tasks and workflows that give you full visibility into what each person on your team is working on.

So how does Trello stack up as a project management tool for accounting and bookkeeping firms?

A Quick Overview of Trello

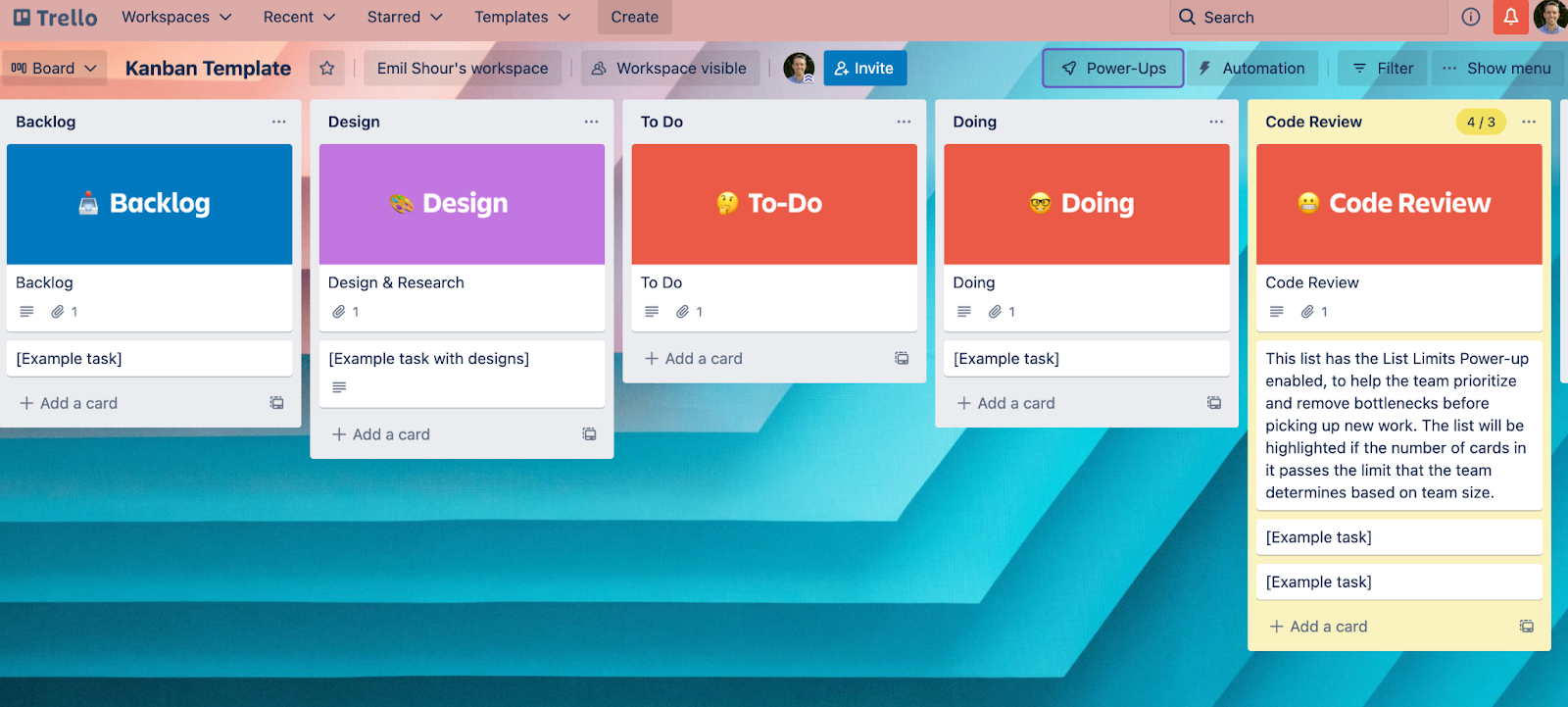

Trello is built on the idea that teams need a transparent way to work together and monitor projects.

Each project is assigned a Trello board where you can invite different team members. Tasks can be set to various buckets, tagged with different labels, and team members can see where each project falls in the workflow. Each client can be assigned its own card so you can see what projects are outstanding for each client.

It seems like it could work, but will it work well enough for your team? Consider the pros and cons of using Trello as a project management solution for accounting and bookkeeping firms.

Benefits of Using Trello for an Accounting or Bookkeeping Firm

1. Used by many businesses

If your team members have worked for businesses outside of the accounting world, it’s possible they already have experience working with Trello. The benefit here is your team will be able to hit the ground running without the time commitment that comes with learning a new software. However, there are numerous project management programs out there, making it just as likely your new team members have been using a different solution.

2. No coding experience needed

Trello does not require any coding experience. You don’t need to dive into backend systems to create tasks and tasks can be moved to different buckets with a simple drag and drop. The drag and drop system also unfortunately makes it easy for tasks to be moved by mistake.

3. Built-in templates

Trello has hundreds of predefined templates for various industries. Though there might be many options for premade templates, a quick search reveals there are no accounting or bookkeeping-specific templates available in the template search. You could adapt templates for other business processes to your accounting workflow, but this isn’t ideal for firm owners.

4. Web-based

Trello is web-based, making it ideal for remote or dispersed teams. You don’t have to download or install any software, but you also need a constant Internet connection to access the program.

5. Repeating tasks

Trello allows you to create recurring tasks so you can reuse your templates from month to month. Once you’ve created templates, they can be used for various projects. However, you need to remember to roll out new templates to all of your clients when you’ve adjusted your workflows.

Drawbacks of Using Trello for an Accounting or Bookkeeping Firm

1. Not built specifically for accounting and bookkeeping firms

Similar to other project management tools like Asana and ClickUp, Trello was built to serve businesses in a variety of fields so there aren’t any customizations for accountants built into the program. Why does this matter? The subtle differences between a review and an audit might be missed when planning your project if you grab the wrong templates.

2. No premade accounting and bookkeeping templates

As stated above, Trello does not have any predefined accounting templates. Unfortunately, you’ll be starting from scratch on each project. You’ll need to spend time creating and refining your project workflows for each client request.

3. Tasks can only be assigned to one board

If you organize your board by the team, you can’t have tasks assigned to multiple teams. Each task can only be assigned to one board. If you have a task that needs to be worked on by both bookkeepers and CPAs, you’ll need to create two separate tasks. If you’re trying to follow the complete project through to completion using a single task, this can be frustrating,

4. Doesn’t integrate with email

Trello does not come with any email integration. Some tools offer email client integration allowing you to gain visibility into things such as when a client was emailed in regards to a specific job or project. In the end, you may not capture all the relevant project information through Trello.

5. Tags have to be predefined

You can’t create tags for projects on the fly. You need to flip back and forth between the tag creation screen and the task to create new tags. This is not the end of the world, but it can be annoying when you’re trying to quickly create a new category.

Best Trello Alternatives for Accounting and Bookkeeping Firms

Best for Seamless Integration and Project Management

Jetpack Workflow is an all-in-one project management solution built from the ground up with accountants and bookkeepers in mind. The software comes with accounting-specific templates for various projects from bookkeeping to taxes to audits.

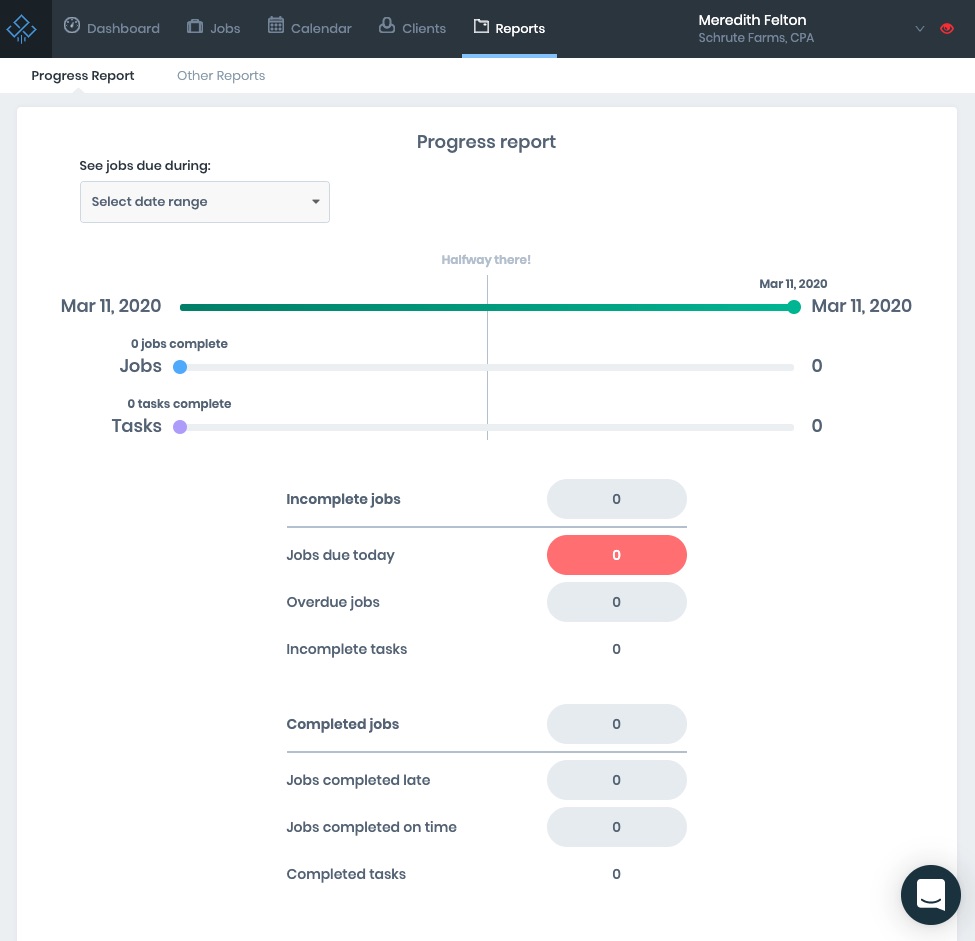

Jetpack Workflow’s platform allows you to monitor the progress of your team in real-time and evaluate the allocation of your most valuable resource – your team’s time. Additionally, Jetpack Workflow provides the ability to review upcoming due dates, create recurring tasks, and assign staff members with the click of a button.

Though the software comes with many predefined templates, you can also customize templates easily for your team’s workflow. Jetpack Workflow was designed to maximize profit and minimize the time spent allocating work for small- to medium-sized accounting and bookkeeping firms.

Best for Budget

If budget is your primary concern, then using email, spreadsheets, or pen and paper are your best bets. The cost of these solutions is minimal, but the cost in terms of time can be substantial. Balancing the cost of a tool versus the cost of your employee’s time should be carefully factored when considering each of these budget-friendly options.

Best for Large Companies with Other Departments

If you work for a large company with many departments not limited to accounting or bookkeeping work, Monday.com is a solid option. It has a user-friendly interface and takes very little time to learn. Various departments can create tasks, message each other, and create workflow templates through this tool.

How to Decide Which Project Management Solution is Right for Your Team?

Finding the right solution for your team often involves a lot of trial and error. Though you want to do your research before investing your team’s time in adopting a project management solution, it’s wise to find a program that allows you to test the waters before onboarding your entire company.

Jetpack Workflow offers a free 14-day trial for your team, which is enough time to see for yourself just how much time and hassle you can save with the right project management tool.