How to Effectively Handle Difficult Accounting Clients

Dealing with difficult clients is one of the more challenging aspects of being an accounting business owner.

A client may be excessively demanding, disrespectful, or simply hard to work with, so you want strategies in place for managing these relationships successfully.

In this article, you’ll find 15 tips for dealing with demanding clients or stressful situations and examples for putting each recommendation into practice.

15 Tips for Dealing with Difficult Accounting Clients

1. Communicate Clearly and Regularly

Frequent communication is key to managing any client relationship, especially when working with more challenging clients. Make sure to clearly communicate your expectations, deadlines, and any changes to your processes or policies.

Keeping an open channel of communication promotes transparency while also helping prevent misunderstandings.

Example: If you’re working with a client who consistently misses deadlines, consider scheduling regular check-ins to ensure you’re on track and address any issues causing the delay.

2. Be Patient and Understanding

Clients may not always be aware of the impact their actions or behaviors have on you and your work. In some situations, a client may be having a bad day or be worried about another issue that has nothing to do with you.

Be patient and try to understand their perspective, even if you disagree with it. Try not to take it personally. By thoughtfully talking through the situation, you demonstrate your knowledge and care for a client’s concerns.

Example: If a client is struggling with a new accounting process, offer additional guidance and support to help get them up to speed. Schedule some extra time to review the process with them so you can answer any questions they have and see where they’re getting stuck.

3. Set Boundaries

Setting clear boundaries is essential for ensuring clients value your time and effort and treat you with respect. You can limit how often you’re available for questions, the time you’re willing and able to devote to certain tasks, and the amount of work you do for a client.

Example: If a client makes excessive demands on your time, it may be necessary to tell them they have to schedule a call in advance if they have questions. You can let them know you’re only available at specific times because it allows you to better manage your workload and serve all your clients’ needs.

4. Use Technology to Your Advantage

Several tools and tech-based platforms are available to help you streamline your work and communicate more efficiently with clients. Consider using project management software like Jetpack Workflow, online document-sharing services, and scheduling platforms for client meetings.

Example: If you have a client in another city or state, use video conferencing software or messaging apps to stay connected and communicate more easily.

5. Seek Support

If you’re struggling with an ongoing client dilemma, don’t be afraid to seek support from colleagues, mentors, or professional organizations. An outside perspective can help you see the situation in a new light and uncover a unique solution.

Create a support system for yourself comprised of accountants, bookkeepers, and other professionals. Include lawyers, bankers, and coaches, to name a few; they’re all in professions that manage clients on a daily basis and can offer insight when you need it.

Example: If you’re having trouble setting boundaries with a difficult client, reach out to a trusted associate. Ask them for suggestions or how they handled a similar situation in the past. You’re sure to walk away with more than one option.

6. Offer Solutions

When a client shares a problem they have with your work, focus on finding solutions rather than getting caught up in the issue. You’ll help move the conversation forward, resolve the issue more quickly, and build trust with your client.

Example: If a client is unhappy with the speed at which you are completing a project, collaborate on coming up with alternatives to get it done faster. It may mean increasing the number of team members working on the project or adjusting the timeline.

7. Document Everything

Keep detailed records of all your client communication and work. Tracking your work progress and correspondence provides the evidence you need should any disputes or misunderstandings arise.

It also helps to have an engagement letter for every client. This document details the services you will provide, the fees you charge, and the time you anticipate spending on their financial records. It’s a helpful reference when clients have questions or ask for more services than are outlined in the letter.

Example: If a client is disputing the charges on an invoice, take time to review the invoice with them. Show them documentation of the work you completed and the hours you spent on the project, which can help resolve the dispute more quickly.

8. Be Proactive

Try to anticipate potential issues or concerns and address them ahead of time. You’ll prevent problems from arising or escalating and demonstrate to your clients how proactive and proficient you are.

Example: If a client is slow or late when providing necessary documentation, request the paperwork in advance and suggest a delivery deadline well before you need it. If it’s late, you can send them a reminder knowing you still have time to collect it and avoiding the stress of any delays.

9. Seek Feedback

Ask your clients for feedback regularly to get a sense of how you’re doing and where you can improve. Seeking feedback demonstrates how much you care about a client’s business and addressing any issue they may have. You not only identify ways to strengthen your business, you strengthen your client relationships as well.

Example: If a client has a complaint about your work, ask them, “Could you share what you’d like done differently? I’d like to know what would be more useful or helpful to you.” It shows you value them and want to provide the best service possible.

10. Employ a Mediator

If you’re unable to settle an issue with a client on your own, consider using a mediator to help facilitate a resolution. This allows both parties to feel heard and can lead to a more mutually satisfactory outcome.

Example: If you and a client can’t agree on the scope of a project or the terms of a contract, a mediator can help facilitate a resolution that works for both parties.

11. Use Positive Language

Choose your words carefully when communicating with clients. Using positive language and framing issues constructively can help defuse tension and encourage more productive dialogue.

Example: If a client is unhappy with the progress of a project, try saying, “We understand you have concerns about the project’s progress. How can we help address those concerns and move forward?”

12. Always Remain Professional

No matter how difficult a client may be, it’s vital to maintain a professional demeanor. Remaining calm and focused can help de-escalate the conflict and demonstrates your willingness to find a solution.

Example: If a client is being disrespectful or argumentative, calmly address the behavior rather than getting upset or responding in kind. Suggest rescheduling the meeting to give yourself and your client time to come up with productive solutions or be prepared to professionally set a boundary around how you prefer to communicate.

13. Practice Active Listening

When communicating with clients, try to listen actively to what they are saying. Pay close attention, ask clarifying questions, and show you’re listening by making eye contact and nodding. Active listening builds trust and understanding and can help you find common ground with your clients.

Example: If a client expresses frustration over an aspect of the accounting process, listen to their concerns and show empathy by saying, “I understand how that can be frustrating for you.” Ask questions about what’s bothering them, and repeat what you hear them saying so they know you understand.

14. Take Breaks

If you feel overwhelmed or frustrated when working with a particular client, it can be helpful to take a break. Give yourself a chance to regroup, refocus, and return to the situation with a fresh perspective and a clear head.

Example: If you’re working on a stressful project with a demanding client, suggest hitting the pause button and picking up the project later that day or the next. Let the client know a break will give each of you a chance to return to the project with renewed energy and ideas.

15. Get Legal Assistance

In some cases, it may be necessary to seek legal assistance if you can’t resolve an issue with a client. Consulting with or hiring an attorney may be required if a client threatens you or you believe they have violated your rights or business interests.

Example: If a client refuses to pay an invoice and threatens you personally or with legal action over it, seek legal advice to help resolve the issue. You can also reach out to your support system for legal referrals.

Keep Clients Happy with a Project Management System

No matter how well you do your job, every business encounters challenging clients. However, you can avoid many problems by providing top-notch customer service and managing your business efficiently.

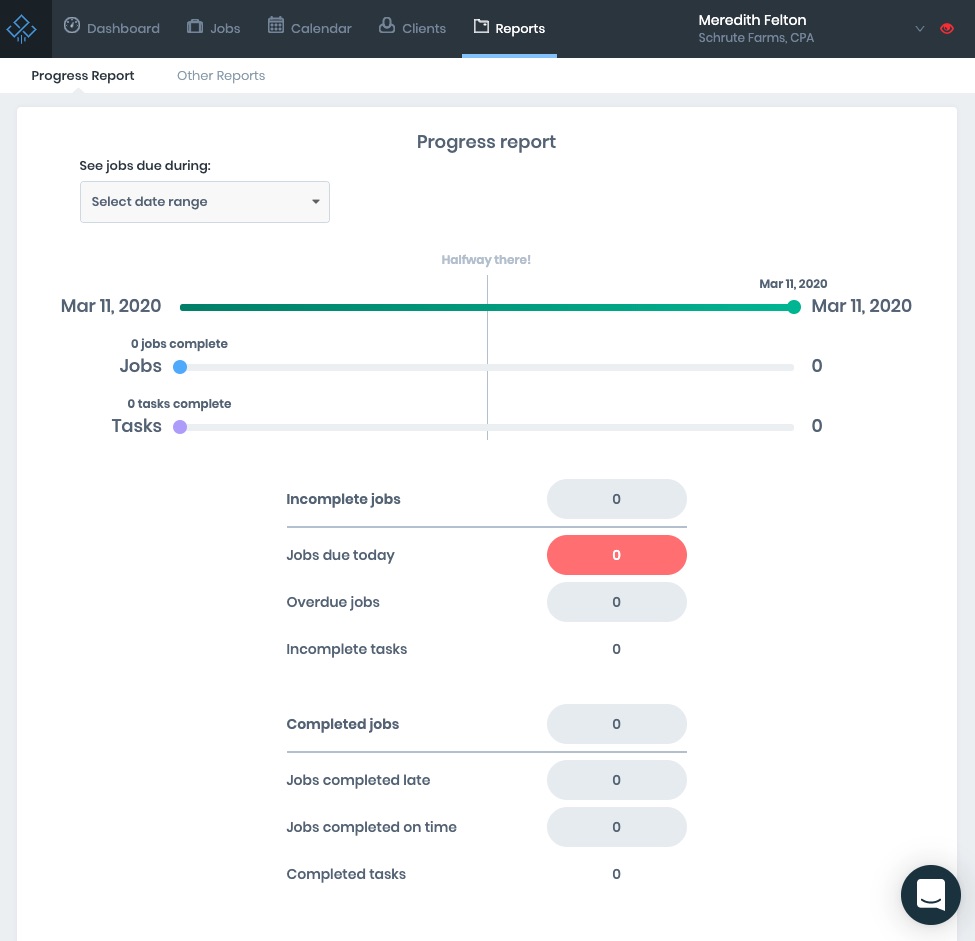

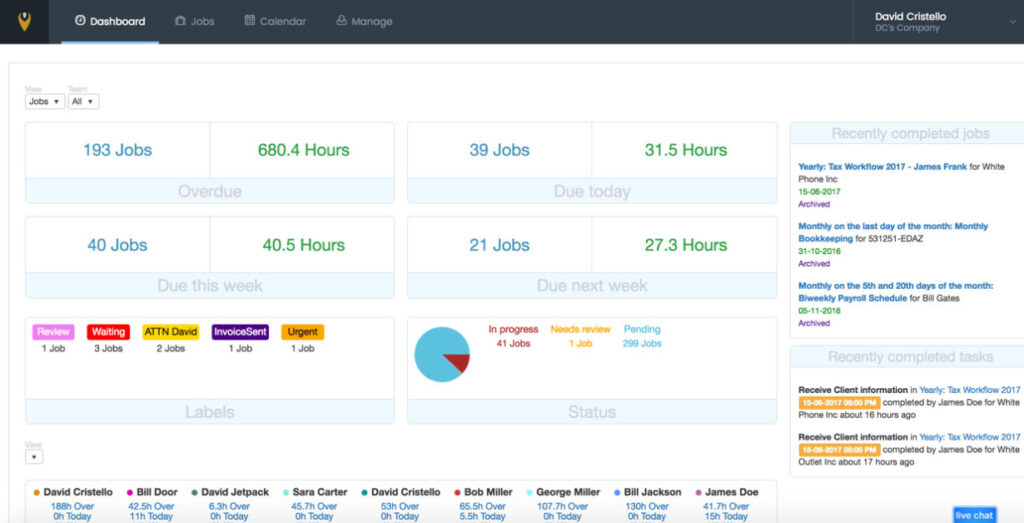

Jetpack Workflow offers an intuitive workflow management system designed for bookkeeping and accounting firms. The platform helps you stay organized, streamline your workflow, and easily track your tasks and client projects.

You’ll have everything you need at your fingertips to keep your business running smoothly and your clients happy. Start your trial today and experience the Jetpack Workflow difference!