15 Smart Marketing Strategies for Accounting Firms in 2024

If you’re looking for strategies to build your accounting firm, you’ve come to the right place.

Marketing is one of those things that all firm owners know they need to do, but it can be hard to know which strategies and channels to focus on. In this article, we’ll explore 15 different strategies for increasing your client base and creating opportunities for your firm to grow.

#1: Spend Time Building Your Brand

Who are you, and what can you offer? Before you start any marketing plan, you need to know the answers to these questions. Knowing your competitive advantage, whether it’s a better price point, more accessibility, a niche area of expertise, or a proven track record, will help you understand where to focus your marketing efforts.

You may already know what your firm has that stands out. If you’re unsure about your strengths, feel free to reach out to your current clients. Ask them what they love about working with you. It might also be an opportunity to ask about what areas they feel are your weaknesses allowing you to address those issues.

Get Started: Sit down with your management team (if you have one) and decide what areas you want to focus on and what your company’s mission is. You can decide what your brand is, who your target audience is, and how you want to reach them.

#2: Be An Authority In Your Niche

Potential prospects don’t look for an accountant or tax preparer who’s “good enough.” No, they want the best in the field (or at least in their price point). Positioning yourself as an authority in your field can attract clients seeking assistance in your specific niche.

But how do you become an authority? Sharing your knowledge with other people. Authority can be bolstered through lectures, podcasts, articles, or networking. The more you can help others in your field or related fields; the more work will come to you. If someone has heard your speech about taxation issues for contractors, they will think of you when they have a contractor who needs help with their taxes.

Getting Started: Consider your personal brand and be willing to put yourself out there. Sign up to speak at industry events, attend networking events, or start writing. Being visible lends credibility, and doing good work will cement the impression.

#3: Create Content In Your Niche

You know you possess a vast amount of knowledge in your specialty. How can other people find out what you know? Sometimes, people are scared that posting content about dealing with an issue or tackling a certain kind of project will give away their secrets or enable potential clients to do the work themselves. This is rarely how it plays out. Potential clients want enough information to determine whether you know enough to solve their issues, and then they want to hire you to do it.

Content can be ebooks, website content, blog posts, or podcasts. Be creative! Look for opportunities to work with other firms or tangential accounting products for cobranding.

Getting Started: You can start by writing yourself. If writing isn’t your forte, you can always hire a writer on Upwork to create content (just make sure you review it if you’re going to put your name on it!). Someone in your firm may also want to tackle content creation – ask around, and you might be surprised what hidden talents your team has.

#4: Take SEO Into Consideration

Creating content for your website is a great way to drive more traffic. You can’t just create content without considering search engine optimization (SEO). Even the best content needs help moving up in the Google search results, so it doesn’t get buried under hundreds (or thousands!) of other results.

You can either hire an SEO consultant to evaluate your site and recommend changes or use online tools (such as SurferSEO or Clearscope), which allow you to use keywords to optimize your content on your own.

Getting Started: It’s essential to understand SEO basics and how it affects your ultimate ranking. If you choose to work with an outside consultant, carefully consider what claims they are making and the timeline for seeing results. In general, you should avoid anyone who makes guarantees of rankings.

#5: Provide Free Resources On Your Website

Articles and podcasts are helpful, but are there other free resources your firm can provide for clients that won’t eat into your business? Obviously, you don’t want to publish your proprietary spreadsheets and internal tools as part of your content marketing. What are some other ways you can help your clients?

Examples might be timesheet templates, IRS forms, or links to HR-related sites with helpful information. Publishing a tax planner your clients can use to gather their information at tax time might actually save you time. If there are tools you wish your clients would use that would make your life easier, put them out there.

Getting Started: Consider what tools you could give your clients to make their lives easier or questions you often get from clients that don’t need an individualized answer (such as calls asking for tax return refund updates that are redirected to the IRS website). Once you’ve come up with the list, consider publishing free resources for your clients to use. For example, webinars addressing commonly asked questions are always a good idea.

#6: Use Social Media

Most accounting firms rely on word of mouth to grow their firm and have been slow to embrace online marketing activities such as email marketing, advertising, and social media. However, it’s a missed opportunity to identify potential new clients and bring more visitors to your site. Linkedin, Facebook, Instagram, Twitter, and other social media sites have advanced targeted marketing features that allow your ads to reach only the potential customers you want.

Social media marketing is a cost-effective way of reaching your audience and boosting your online presence. It may take some sweat equity to get your firm’s audience to grow by posting regular, high-quality information. However, the potential growth can make the effort worthwhile.

Getting Started: Set up your firm or personal presence on each site you want to advertise or create content on. Start networking by reaching out to current contacts. Next, get started with creating content. If you’re not sure you want to run your firm’s social media presence, you can hire a social media consultant to manage it for you.

If you’re looking for some extra help with social media, here’s an interview from the Growing Your Firm Podcast where Stephen G. Pope (CEO of SGP Labs) explains how firms can be using video content on social to grow their audience:

#7: Create An Inbound Marketing Funnel

What is an inbound marketing funnel? It’s a way of thinking about marketing and the journey from stranger to client. The marketing funnel allows you to visualize the process of landing new clients and strategize ways to increase your conversion rate.

An inbound marketing funnel might be as simple as having a standard timeline for following up with new potential clients. Examples include:

- Send an email after initial phone call to provide your contact information

- Follow up with a call 3-5 days after initial conversation

- Add client to the mailing list for your newsletter

- Add client to client list to keep them on your radar

Getting Started: Review the steps taken when you have successfully landed clients in the past and the appropriate level of follow-up after initial contact. Create a standardized workflow for potential clients, including who is responsible for each step of the process.

#8: Run Marketing With a Strong Point of View

If you are seen as just another accounting firm, your voice will be lost in a crowd. Accounting is a crowded marketplace. You need to have strong opinions to stand out.

This isn’t to say you need (or should) have a vocal opinion about everything. Consider what you have to say about accounting, something unique or unexpected. Find something that differentiates you and your firm, and publish it.

Consider Jason Blumer, a CPA who has a very active Twitter presence. He focuses on providing actionable advice for his audience through personable videos.

Getting Started: Work on identifying what unique experience or insight you possess and how those things can help your audience. Once you’ve figured that out, consider how best to present the information to your audience and engage them.

#9: Add Chat To Your Website

If you’re just getting started, you may have time to respond to chat messages on your website. For medium-sized firms, it might be harder to devote time to responding since you already have a significant amount of work to do. The appeal of adding a chat feature on your site is that it easily allows potential clients to start engaging with you.

The easier you make it to initiate contact with a real person within your firm, the more likely potential clients will be to reach out to you. You can also outsource the chat feature to a third party that gathers the initial intake information on your behalf and forwards it to you, so you don’t have to devote your own resources to respond.

Getting Started: Decide if you want to answer website chats internally or externally. Once you’ve decided, you can work on integrating the chat feature into your website.

#10: Create A Newsletter (And Maintain It!)

The basics of accounting don’t change very often, but the rules and regulations do! Consider creating a weekly or monthly newsletter for your clients that provides valuable, up-to-date information about changes which could affect their personal finances or their businesses. There’s a vast amount of information on various financial and tax topics people can use to make wiser choices throughout the year.

Having a regular presence in your clients’ inboxes will have you at the top of their minds when they have an accounting-related need or someone asks them for a recommendation.

Getting Started: Determine who is responsible for distributing your newsletter and who will create the content. Discuss how frequently you want to distribute the newsletter, what should be included, and who should receive it.

#11: Use Review Websites

Most people rely on recommendations from friends and family when it comes to accounting services. If they don’t know someone already using an accountant, they will turn to the internet. You can’t ignore your reviews on websites such as Google or Yelp. While you can’t get a bad review removed, you can provide excellent customer service to encourage good reviews.

Getting Started: Asking for good reviews is a violation of the terms of service for most review websites. However, you can make your presence known on these sites to your current clients, which might inspire a few favorable reviews.

#12: Apply For Local Awards

This one involves a lot of self-promotion, however it is a great opportunity to get local exposure. Many small business awards and leadership awards ask for applications or nominations. Some people may feel uncomfortable about self-promotion, but consider that anyone else winning the award would have been nominated in the same manner.

Getting Started: Do some research online for local business organizations or scour news sites for articles about local awards and then find out how to apply. Even if you don’t win, it can be a networking opportunity.

#13: Networking

The majority of accounting firms are small businesses that serve other small businesses. By networking within your community at entrepreneurship meetings, local small business meetups, or volunteer activities, you’ll have the opportunity to meet potential new clients.

Though most networking events involve an uncurrent of marketing, you want to remember that the reason for these events is to meet other small business owners and learn from shared experiences. Think of these events as an opportunity to get your name out there. Potential clients will think of you when they’re in the market for accounting services.

Getting Started: Check out Linkedin or Meetup for meetings in your area. You can also reach out to the local Chamber of Commerce for networking events.

#14: Have Professional Marketing Material

The business card is not dead! Having several on hand saves you from the embarrassment of jotting down your number on the nearest post-it note or napkin. Having business cards at the ready presents an air of professionalism. Though things like business cards may seem trivial, they help present your firm as established and high-end.

Other simple marketing materials include promotional items like branded pens, notebooks, coffee mugs, and reusable water bottles. Check out SwagUp if you’re looking for a good vendor to get swag for your business.

Getting Started: Evaluate your current marketing material and consider whether you can create new marketing material in-house.

#15: Volunteer

While it shouldn’t be viewed as a marketing channel, one often-overlooked opportunity for marketing is getting involved in local charities. You can volunteer your services (as an accountant) or volunteer in other capacities. Local volunteer organizations present many opportunities to get your name out there and meet other people interested in the same causes.

Local charities tend to do a lot of local marketing and may include your firm’s name as a sponsor depending on what services or financial support you provide for the organization.

Getting Started: Determine what local charities you feel strongly about supporting and reach out to see what support and services you could provide. Ideally, you want to form a long-lasting relationship with a small number of charities.

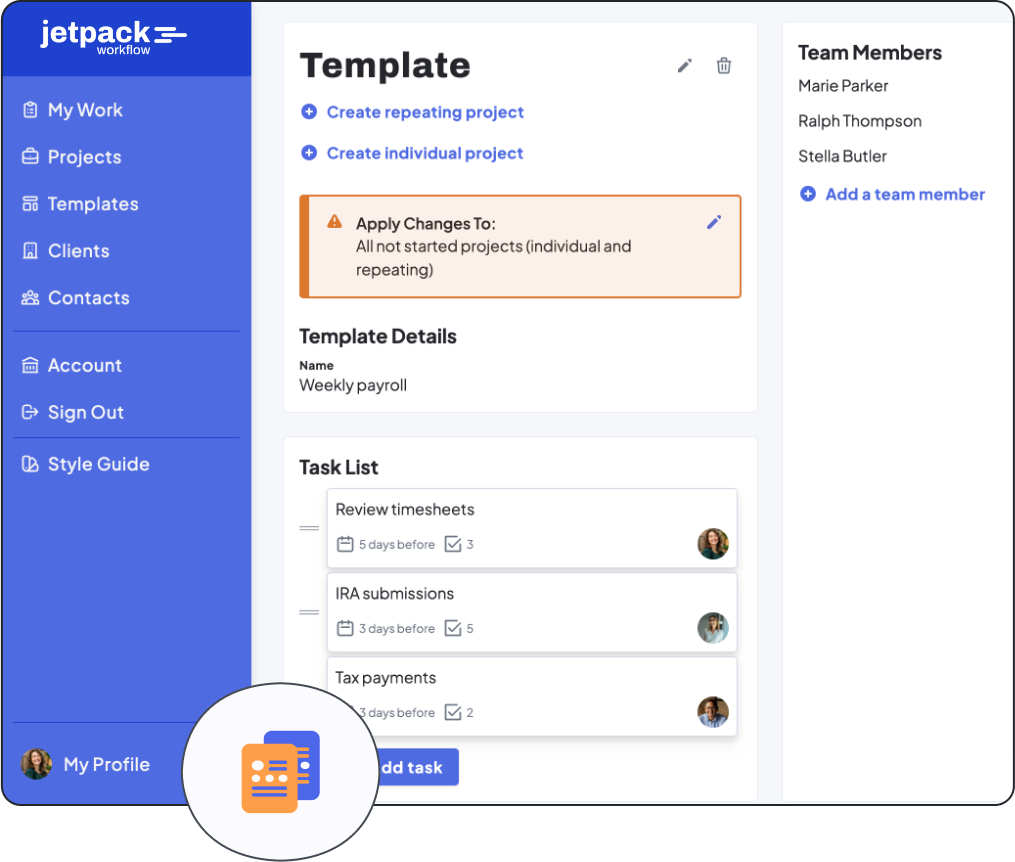

How to Better Manage Your Growing Firm

Tired of spending endless hours manually creating and building workflow and process templates for your firm? Simplify your workload with our customizable accounting workflow templates. This free resource includes a ton of the most popular accounting templates including monthly bookkeeping, weekly accounting analysis, client onboarding procedures, and common tax return forms.