Compliance Isn’t Dead…Here’s What Is

Summary

- Compliance in the Present and Future

- Compliance and your Clients

- Do More for Your Clients

Resources

- If you have any questions for David, email him at david@jetpackworkflow.com

- David recommends this book (for free!): Double Your Accounting Firm

- https://jetpackworkflow.com/blog/questions-to-get-your-firm-ready-for-2023/

- https://jetpackworkflow.com/blog/how-this-firm-owner-went-from-0-70-clients-in-10-months/

- https://jetpackworkflow.com/blog/how-to-quickly-build-trust-online/

In this solocast, CEO and founder of Jetpack Workflow, David Cristello, touches on compliance. Compliance isn’t dying, but some factors of the artform are going away.

As technology becomes more present in firms and businesses, some people are fearful that automation and other technological systems/softwares are destroying accounting practices.

David thinks that this anti-tech mindset is nonsense. Learning more about compliance will help you understand more about your practice and the direction of your business.

Compliance in the Present and Future

First things first: compliance isn’t going anywhere. You will always have to do compliance work in your business. Compliance is helpful regarding:

- Accurate financial reporting

- Correctly following laws and regulations

- Maintaining a good reputation

- Defines your business

- Why are you running this business? How are you leading your firm?

- Reducing errors

- Positive consistency

- Motivating you to keep running a respectful business/firm

If you feel like there’s any part of your firm that can live or thrive off of compliance work, you need to think again. Look back at your resources and read books that you’ve understood in the past. These resources and books are not giving you signs to stray from compliance–in fact, they want you to look forward. As you think more about the future, you will start to realize how compliance comes to play in your business.

When you complete compliance work on time, you can use this information as a springboard to enable you to make future decisions for your business.

You can use compliance as a tool through:

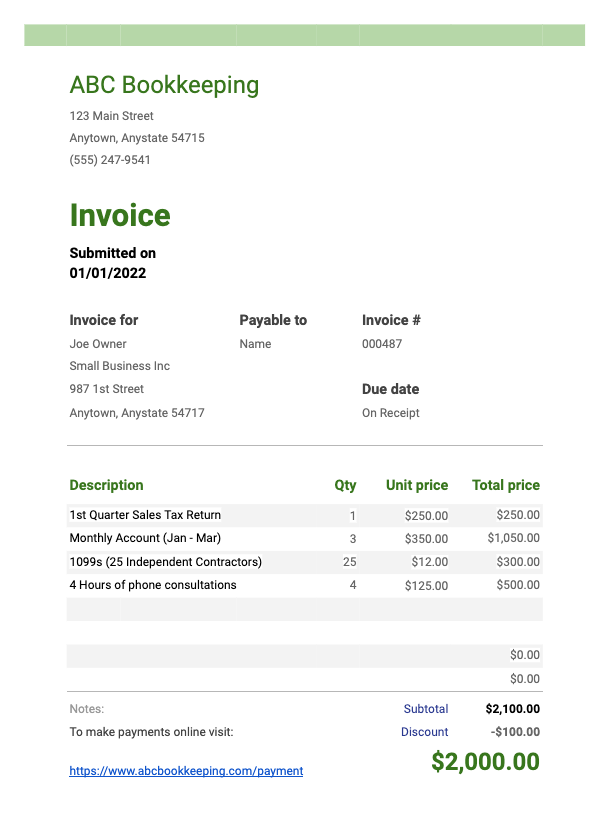

- Tax Returns

- PNLs

These tools can help you understand where your business has been and how it’s progressing. You can look through your progress and see where you’re going to eventually meet a critical point.

As you move forward with compliance work, keep this in mind:

- Leading with compliance is a dying art form. Compliance is important for the service mix, but it is not important for the value proposition.

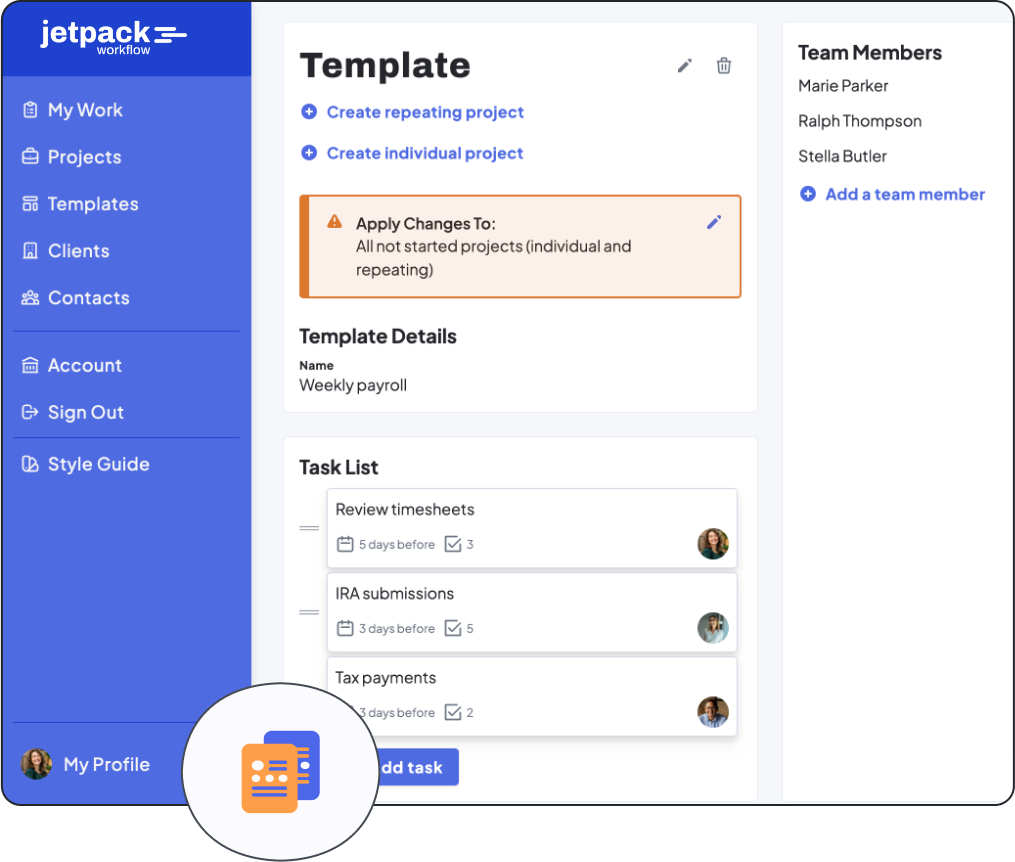

Get everything you need to manage projects and meet deadlines.

Subscribe to our weekly newsletter, and get 32 free accounting workflow templates today!

sign me up!

Clients might approach you at first seeking compliance needs. As you work with them more, you realize how these clients are becoming your dream clients. They are eager and thoughtful about the future.

Compliance is a great way to attract clients. Although compliance assessments might make them nervous, clients want to know if they are running their businesses according to your standards. These clients generally end up being your best clients because:

- They care about their businesses

- They want to know if they’re doing something right or wrong

- They are open to constructive criticism

- They are striving to be better business owners

- They indirectly help you practice your skills in compliance work

- Eventually, you’ll have more in-depth and interesting conversations with them as you both work together to create better business strategies

David shared a scenario where “We know compliance is a low margin bloody battle. We don’t want to compete with one price. We might offer it at a cost or a loss in order to attract our initial client acquisition. We’re not going to spend it on ads, Google, Bing, or networking.”

The acquisition of your firm is going to be based on how competitive you are regarding compliance. You can be thoughtful about compliance when thinking about ways to attract a broad lead base or the opposite. You most likely don’t want any undedicated leads or negative clients.

You can attract your dream clients by charging your compliance services at premium. You can also eventually upgrade your packages for your clients as well. If potential clients desire your compliance services, they will pay any amount you seek.

Don’t aim at making a good margin on compliance. This practice is a losing battle. If that is the service line item that your clients mainly work with you on, you will quickly lose their interest.

Do More for Your Clients

You want to do more for your client. Take a moment to think more holistically about your services. How will you charge your clients? How will you offer the services in question?

David mentions the idea of charging a premium offering with a fixed fee that you can do monthly. You can also use it as a breakeven or loss lead on the front end to attract a large client base.

From there, you can selectively curate and pull up upgrade packages for your ideal client at an acquisition cost. You’re not spending five or ten grand a month on ads–you’re spending that money in margins to attract more firms or businesses on the compliance end.

The compliance industry is not going anywhere, but compliance as a valued proposition is a disappearing art form. Compliance is still important, and you need to use it as a springboard for bigger and better relationships.

If you enjoyed this information, leave a five-star review and share it with a fellow firm owner that needs to learn more about compliance. To understand more of what David has said, listen to the full solocast above!