Sample Letter to Terminate Accounting Services with a Client

When it comes time to end your professional relationship with a client, you can find yourself at a loss for words on how to communicate this with them.

If you’re too easygoing, the client may think you don’t appreciate all the years you worked together. However, if you’re too harsh, it could leave a bitter taste in their mouth.

Striking the right balance between being firm and understanding as you terminate your client’s contract is never easy, no matter the reason. Luckily, we have some helpful tips you can utilize to write a termination letter that’s both effective and professional.

This article will walk you through how to write a client termination letter and provide you with a termination letter example you can use in your firm.

A Letter to Terminate Your Accounting Services with a Client (Free Template)

When you need to end your professional relationship with a client, you can craft a termination letter of your own or refer to the free client termination letter template provided here.

If you use this sample letter, personalize the details so they correspond with your reason for ending the relationship.

———————–

[Date]

[Company Name]

[Street Address]

[City], [State] [ZIP Code]

Dear [Client Name],

Over the last [time you’ve been working together, i.e., 2 years], we have worked diligently to provide you with quality service and value your loyalty to our firm. However, we are writing to inform you that we will no longer be able to provide you with bookkeeping services as of [termination date].

We have been forced to make the difficult decision to discontinue our monthly bookkeeping service for all clients. After careful consideration, we have determined that it is no longer feasible to continue providing this service and are focusing on other areas of our practice instead.

We understand that you will need to seek a new bookkeeper going forward, so we apologize for any inconveniences or disruptions this may cause.

At the time of this letter, our firm has the following work in progress for [client name] that will be completed by [date]:

[Description of the work in progress that the firm will still complete for the client]

Outstanding fees in the total amount of [$XXXX] should be made payable to the firm 30 days following the termination date.

We are required by law to maintain your records for a certain period of time. Please inform us if you would like us to transfer these records to another firm, and we will make those arrangements.

We kindly request that you respond to this letter to confirm you have received and read it thoroughly. You can reach us at [phone number] or email us at [email address] if you have any further questions. We appreciate your understanding and are committed to making this transition period as smooth as possible.

We wish you the best of luck in your future endeavors, and we thank you for the opportunity to have served you.

Best regards,

[Your name]

[Firm’s name]

———————–

Download Your Free Template

Click the link below to download the letter template. Select “File” at the top left-hand corner of the page, select “Download,” and then choose your preferred document format.

BONUS: Simplify Your Accounting Workflows with This Free Resource

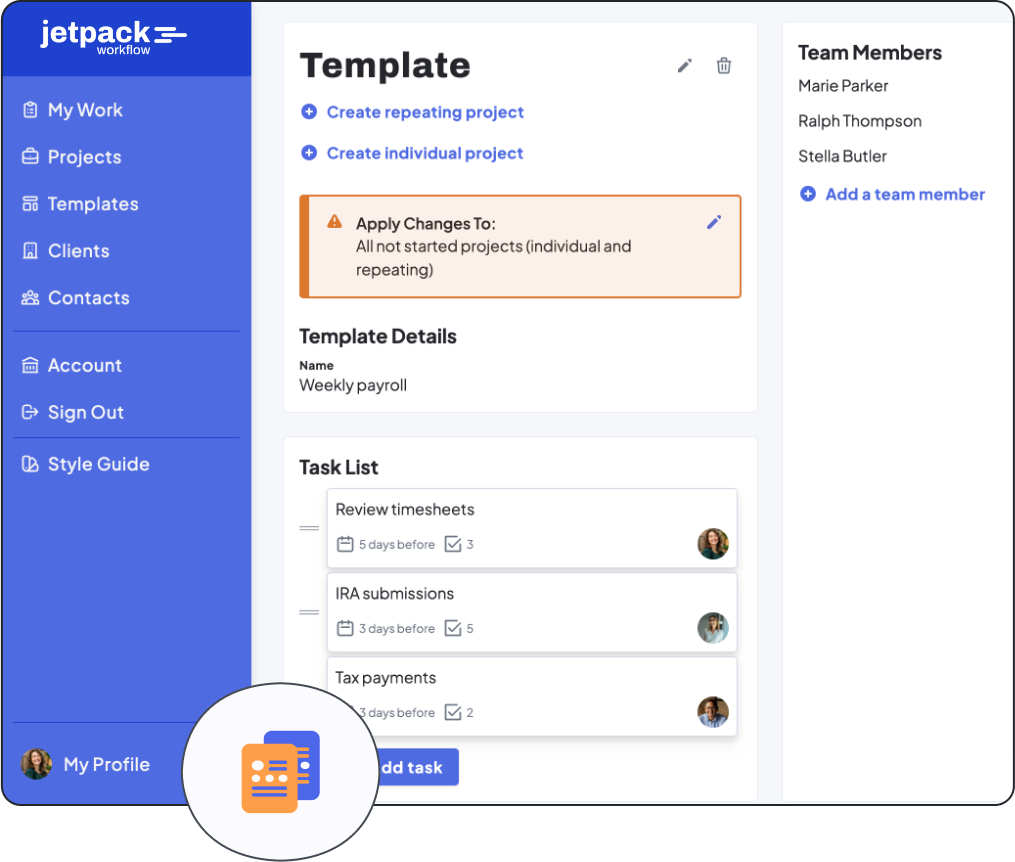

If you’re looking for simple workflow templates to stay on top of your projects and tasks for clients, access our collection of 32 customizable accounting workflow templates and checklists. This free resource includes a ton of the most popular accounting templates including monthly bookkeeping, weekly accounting analysis, client onboarding procedures, and common tax return forms.

4 Key Elements to Ensure Your Termination Letter Is Received Well by the Client

No matter your reasons for doing so, informing clients you will no longer work together is never easy for either party.

Therefore, how you write the termination letter can largely determine how your client responds to this transition. To effectively handle this communication, incorporate the following elements into your termination letter.

Give Ample Notice

Provide your clients with enough notice before terminating the business arrangement. You’ll need to give them enough time to find another provider. Sending the termination letter out last minute not only comes off as inconsiderate to the client but can also make you look unprofessional.

Once you’ve made the decision to no longer work with a client, you should inform them as soon as possible.

If you give your client a few months’ notice that you will be terminating the contract, they should have plenty of time to make different arrangements for their accounting services.

Be Professional and Respectful

Maintain a professional and respectful tone throughout your termination letter, even if there was a negative reason for ending the relationship.

You will help maintain your firm’s professional reputation despite dealing with something complicated and challenging. If appropriate, you can even thank the client for all the time they’ve worked with you and share how much you have appreciated their loyalty.

Understand the client may have frustrations about their contract ending, so be sure to reflect this sentiment in your termination letter without focusing too much on the negative.

| “We understand that this period of transition may be difficult for everyone. We’ve appreciated your loyalty to our firm for the past 8 years, and we don’t make this decision lightly.” |

Provide a Reason Why

You should also include your reasoning for canceling the business contract or engagement with the client. If possible, avoid being harsh with the client, even if they’re the bad actor.

Don’t make your clients guess why you’ve ended their contract. Whatever the cause, be direct with your message. Being too vague may only confuse the client or lead them to use their imagination to figure out the reason.

| “We will no longer be able to provide you with our monthly bookkeeping services effective [date]. We are pivoting the direction of our firm and discontinuing this service for all existing clients.” |

Summarize the Next Steps

To finish your letter, detail any of your firm’s outstanding obligations or payments that need to be fulfilled by the client before ending the relationship. Make these details extremely clear so there is no confusion across the board.

Be sure to inform them how long you will retain their documents and information for recordkeeping purposes and how they can transfer those records to a new firm when necessary.

Lastly, request confirmation from the client that they’ve received the letter and understand its contents. Include your contact information should they have further questions about the letter and the next steps.

| “Your final invoice will be due 15 days following the termination date of service, [date]. If you have any additional questions about the contents of this letter, you can reach us at [phone number] or email us at [email address].” |