5 Tools That Help Delegate Your Accounting Tasks This Year

Delegating accounting tasks should lighten a firm owner’s workload and remove bottlenecks, not add complexity and extra work to an already busy schedule.

It takes trust to delegate tasks to your team members or outside contractors without having to oversee the work. You also need software you can count on to ensure every task is accounted for and completed on time.

Finding and using the right tools can make delegating simple. They can give you peace of mind that your team members have all they need to complete tasks and meet critical deadlines.

Here are 5 helpful and trustworthy tools successful accounting and bookkeeping firms can rely on to pare down their to-do lists and get more time back in their day.

1. Loom

Loom is a messaging tool that allows users to create shareable videos of themselves and their screens. You can use Loom to provide clear instructions, share project guidelines, or send constructive feedback on completed work when delegating specific tasks.

With Loom, you can demonstrate how to complete a delegated task. Providing clear directions to employees through a video eliminates some of the confusion or ambiguity of written instructions.

To save even more time in the future, you can create detailed tutorials or explanations on everyday accounting tasks. This way, your team can refer to the videos whenever they need a refresher.

Pricing: Three plans are available on Loom: the Starter, Business, and Enterprise packages.

The Starter package is free for one user. However, most accounting teams need the Business plan at $12.50/user per month, billed annually, which supports unlimited video creation and length. Larger firms can speak with Loom directly for custom pricing with the Enterprise plan.

You can view all Loom pricing details here.

2. Zapier

Zapier is a tool that lets users integrate thousands of web applications and automate workflows without needing a developer to code and build a custom integration.

For an accounting practice, you can set up Zapier integrations in QuickBooks, Excel spreadsheets, Google Sheets, or other programs for easier task delegation.

Use Zapier to automate the delegation process. Tasks can be automatically assigned to employees when a specific trigger action takes place. This way, Zapier helps accounting teams free up time spent on administrative tasks, allowing you to focus on client work.

For instance, if a client fills out an onboarding form, this action can instantly prompt them to schedule a meeting with their new account manager at your firm. You no longer need to coordinate with the client and manager yourself.

You can also set up “zaps” that automatically send an email or message to the appropriate person for review, such as when a customer enters a new expense in QuickBooks.

Pricing: While the core features are free, accounting firms likely need access to the more advanced tools found in Zapier’s 4 paid plans.

The Starter plan is $19.99/month, the Professional plan is $49/month, and the Team plan is $69/month, all when billed annually. Accessing more features and adding more tasks, users, and app integrations costs extra.

The Company plan is for businesses with more robust automation needs, which comes with custom pricing.

Click here to access Zapier pricing details.

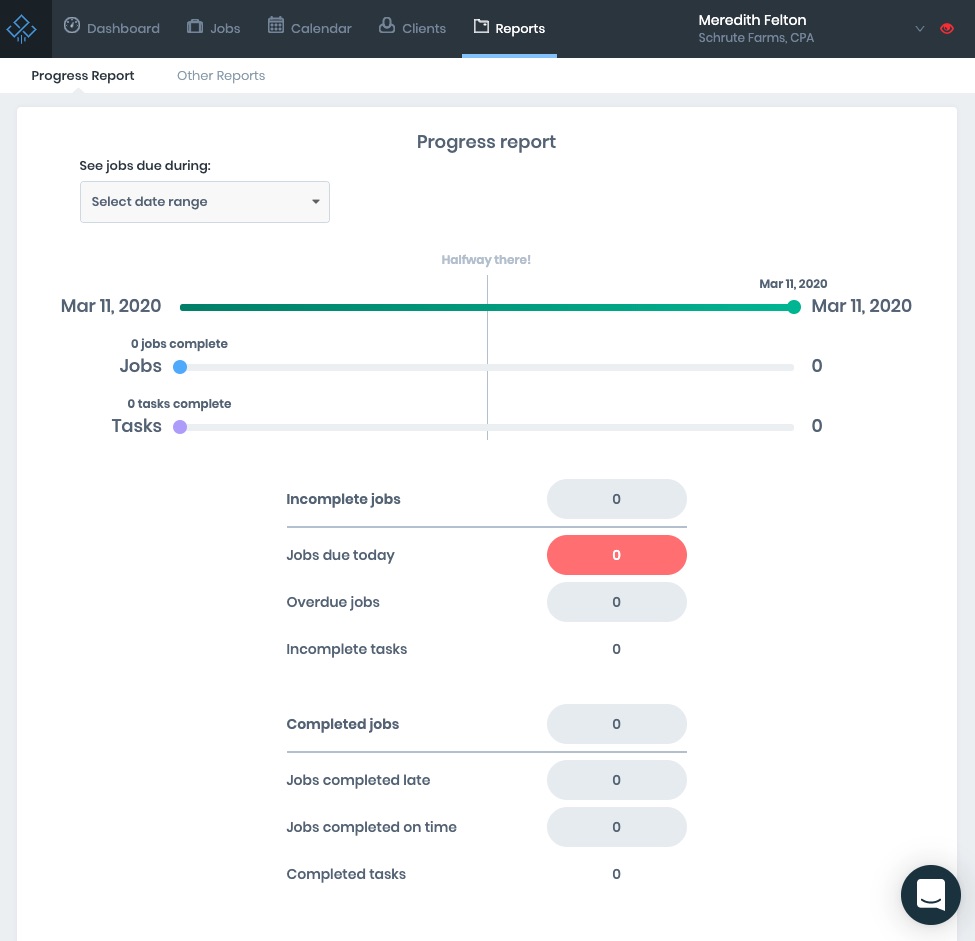

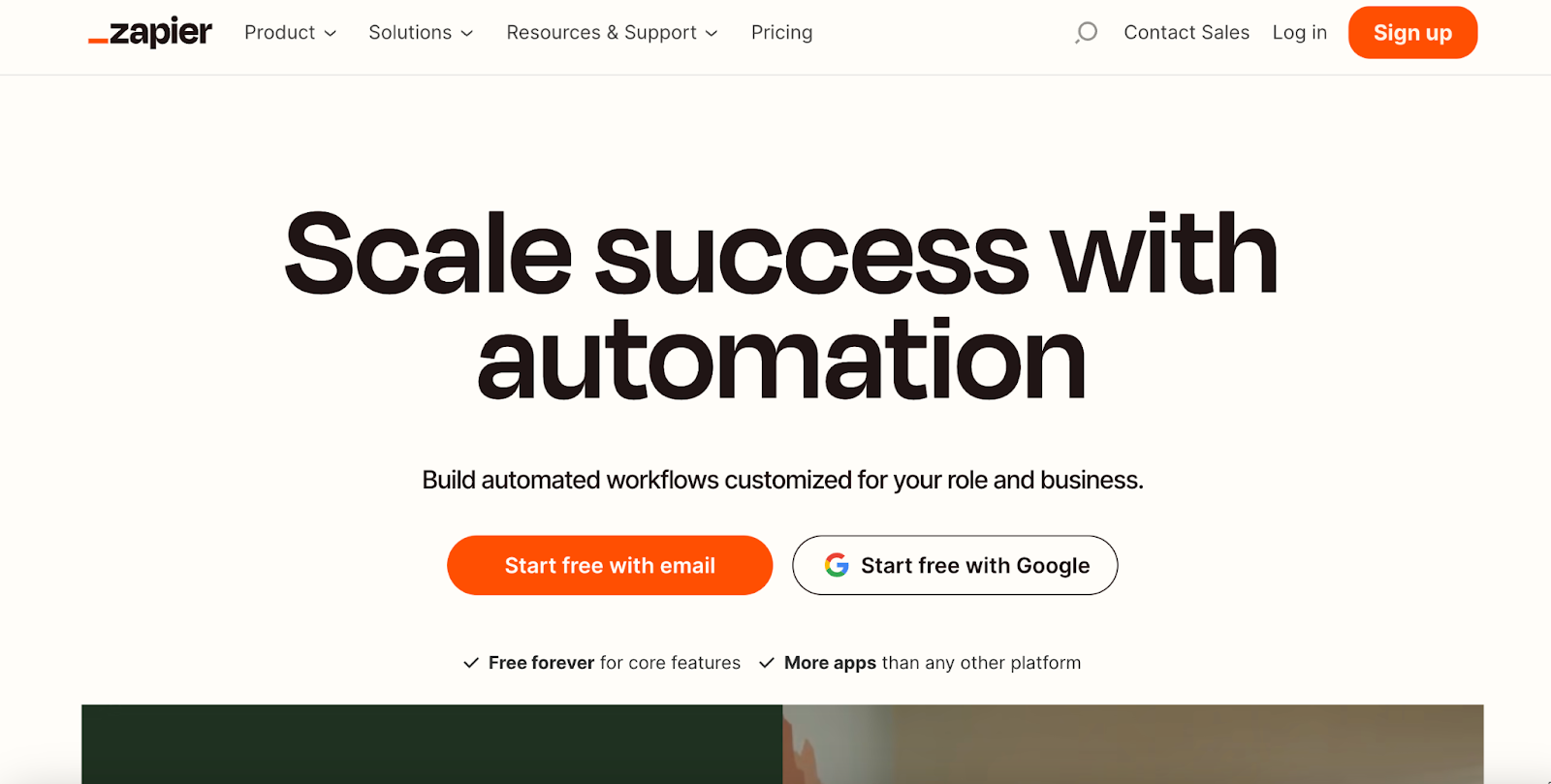

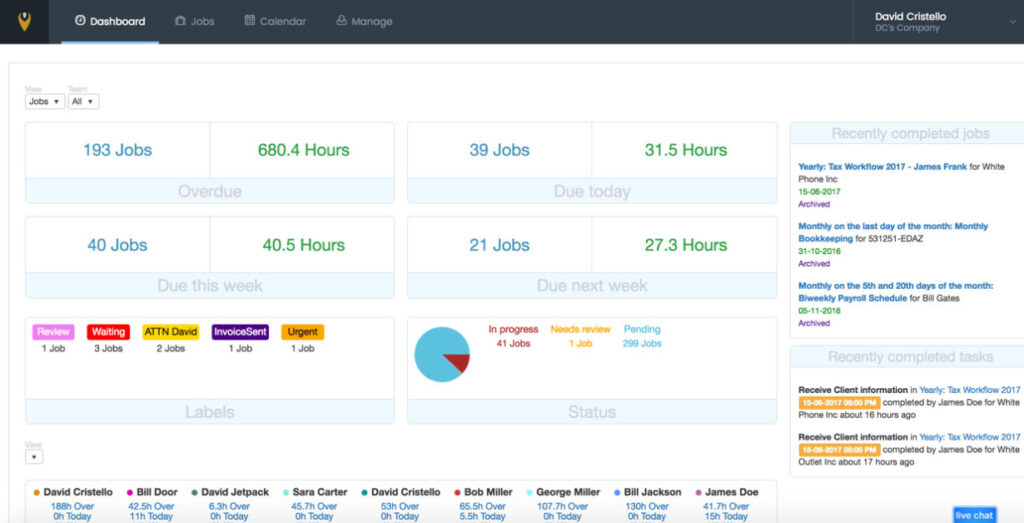

3. Jetpack Workflow

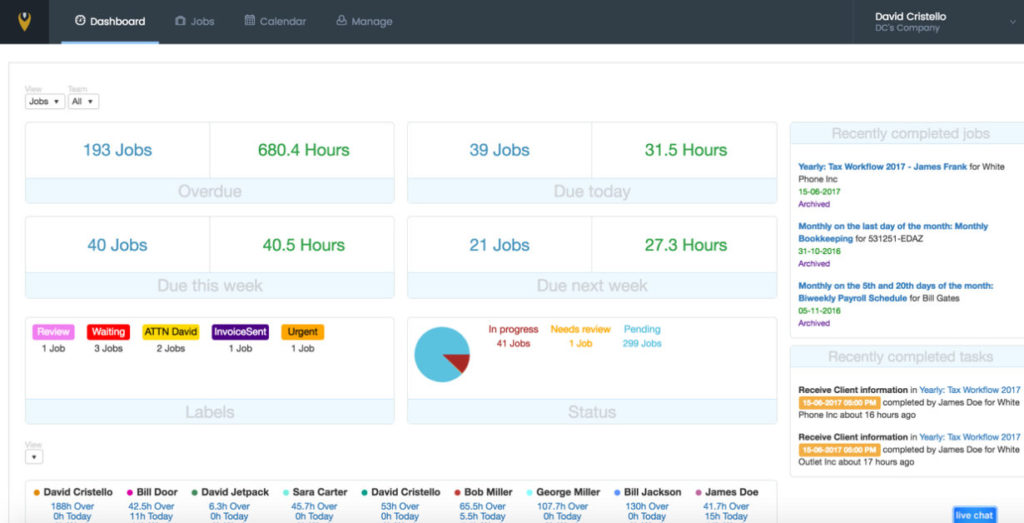

Jetpack Workflow is accounting workflow management software that helps you track critical client tasks and automate deadlines. You can monitor what each team member is working on and identify deliverables that are urgent or at risk of being missed.

Easily assign or delegate tasks to team members with Jetpack Workflow, including any relevant information about the work and its due date. The “My Work” tab within the platform lets users see all their assigned jobs sorted by deadline to help prioritize time-sensitive tasks.

Jetpack Workflow does a great job of flagging overdue jobs, and users can see any upcoming tasks delegated to them. The platform includes easy-to-use checklists and templates to quickly create and assign workflows and regular reminders for recurring work.

Use Zapier integrations in Jetpack Workflow to further organize task delegation. Set up “zaps” to assign jobs to specific team members when a particular trigger is activated.

For example, when a client receives a new invoice in QuickBooks, you can automatically delegate the task of reviewing it to a team member in Jetpack Workflow.

Pricing: Jetpack Workflow offers 2 paid plans and a 14-day free trial for each. The Organize plan starts at $45/user per month, and the Scale plan is $49/user per month, both billed annually. The Scale plan includes additional features for capacity management and team scheduling.

Check out Jetpack Workflow’s pricing details here.

4. Virtual Assistant Sites

If you have a small team with limited resources, outsourcing websites like WoodBows, Wing Assistant, and Upwork allow you to delegate tasks externally to virtual assistants (VAs).

Simply create a job posting, select the best candidates, and hire them directly through the site.

Accessing talent through these sites makes scaling up or down and matching your workflow demands easier, like during tax season.

These platforms give you access to a global talent pool, helping you find individuals with relevant skills, typically for less than hiring a new employee internally.

Virtual assistant platforms can help streamline task delegation because you use just one channel to hire and collaborate with VAs. Some sites, like Upwork, have a built-in mobile app to make hiring independent contractors even more convenient.

Pricing: Woodbows pricing starts at $499/month, billed annually, for 40 hours of VA support each month. Wing Assistant pricing begins at $599/month for 80 hours of VA support. Upwork varies depending on the individual rate of the freelancer or contractors your firm hires.

5. Slack

Slack is a messaging app teams can use to communicate and collaborate on client work.

Slack makes it easy to keep in touch with your team, using real-time notifications to inform employees about any new responsibilities or projects.

You can set up dedicated channels for group discussions on tasks or projects or for one-on-one communication between two team members.

Within the platform, you can delegate tasks to an entire group or one individual based on the employees’ strengths.

Share relevant file links, documents, instructions, video call details, or other information to coordinate work and ensure it gets completed accurately and efficiently.

Pricing: Slack has 3 paid plans: Pro, Business+, and Enterprise Grid. The Pro plan costs $7.25/user per month, and the Business+ plan costs $12.50/user per month, billed annually. Large organizations can contact Slack for Enterprise Grid’s custom pricing.