14 Proven Strategies for Growing a Tax Practice

If you’re a new firm owner starting to — or struggling to — grow your tax business, you may wonder what scaling a firm actually looks like in practice.

Do you need to niche down immediately? Should you ask new clients for referrals right away? Can you put your website on the back burner for now?

On Jetpack Workflow’s Growing Your Firm podcast, we recently interviewed 4 expert accountants who once had similar questions.

Each one has since successfully grown their firm and shares with us the key strategies they utilized to grow a strong client base and expand their business profitably, including:

- How to grow a tax practice when you’re starting with zero clients

- Why you might want to wait to niche down

- What you can do to grow beyond your initial clients

- Why you should invest in your online presence

- When you should make your first hire

Growing a Tax Practice from Scratch

1. Cold Outreach to New Local Startups

Sending cold emails or making cold calls to new local startups can be effective for growing awareness of your new firm and building up a client base in your desired niche.

Speaking with Greg O’Brien, he explains how he grew his accounting practice from zero into a million-dollar firm in just 24 months with a similar strategy.

O’Brien states, “I really started, from day one, on cold outreach.” This strategy helped him land 3 of his earliest clients that he continues to serve today.

Cold outreach can help garner interest in your firm before you’re more established and have made a name for yourself. It also enables you to connect with new startups early on before they form a relationship with a tax firm.

Put it into practice: Review local business publications or newspapers in your area to discover new startups and companies. Do some research to find their contact information, and reach out with a value offer relevant to their specific tax needs.

2. Tell Everyone You Know About Your New Venture

Promoting your new tax business to your friends, family, and other personal connections is another great strategy for acquiring your initial clients.

People you’ve already built trust and connections with are more likely to use or recommend your services, even if you’re just getting started.

Luke J. Fletcher grew his practice, Raw Accounting, from zero to 70 clients in just 10 months, partly based on word of mouth.

Fletcher explains, “The very first step I took was I told everyone I knew,” which he notes helped him quickly bring on his first clients.

Put it into practice: Reach out to your personal and professional networks to update them on your recent career change. Tell them the types of services and clients you serve so they can keep you in mind should they know someone who requires your services.

3. Use LinkedIn as a Free Way to Land Clients

Being active on professional networking sites like LinkedIn can work as a free acquisition channel for bringing on new tax clients.

Making regular posts on LinkedIn allows you to showcase your expertise and inform your connections of what types of services you offer.

Fletcher notes he created 3 to 4 weekly posts on LinkedIn letting people know he was offering tax services. His regular presence on LinkedIn helped his firm gain momentum online and attract more clients.

Put it into practice: Grow your professional network on LinkedIn and stay active by regularly posting to keep your connections updated on your new firm.

Focus on building relationships and sharing content that educates the community rather than outright promotion of your firm all the time.

4. Worry About Niching Down Later

Niching down can be an effective growth strategy as your firm scales. However, Fletcher points out that when he began with no clients, he wasn’t worried about immediately selecting a niche.

“I know there are some very different schools of thought,” explains Fletcher. “But, when you have zero clients, which obviously comes with zero income, then you kind of sit there and say, ‘Actually, if someone is looking for support and I’m able to provide it, then I’m going to provide it.’”

Focus on providing any tax services clients need so you can bring in revenue, whether that’s preparing tax returns or tax planning.

Then, you can refine your niche over time as you determine what your expertise or, as Fletcher refers to it, your “bread and butter” is.

Put it into practice: To gain your first clients, maintain a broad approach and be open to niching down later once you have a steady revenue stream. Provide clients with the types of tax services they request, even if that varies from one client to the next.

Growing Beyond The First Few Clients

1. Get Referrals for Delivering Exceptional Work

When you’re ready to expand beyond your initial clients, you can focus on growing your business through referrals.

Kayla Green of Bactrian LLC shares that the primary growth driver of her firm is referrals from current clients. Rather than investing in digital or traditional marketing strategies, Bactrian LLC focuses on going above and beyond for existing clients, and that compels clients to refer the firm to others and grow the business organically.

Green clearly states the power behind this strategy, “It really pays to have a good relationship with your clients.”

Delivering tangible results for your clients helps you boost their satisfaction and retention. Plus, it can drive business growth as they recommend your services to others in their network.

Put it into practice: Reach out to satisfied clients to discuss the referral plan you’d like to implement. Get their feedback on the type of incentive that might be appropriate for making a referral. Then, slowly roll out the program with a few clients to test the plan’s structure.

2. Invest in Your Website to Stand Out from The Crowd

Many CPAs and tax professionals have clunky and outdated websites. Investing in developing and maintaining a good website is a great way to stand out in your niche.

O’Brien explains that this was one of his earliest differentiation strategies to set his new firm apart from his competitors.

“From day one, I knew that the website was going to be important,” states O’Brien. “Just from my industry research, almost every CPA out there has a lousy website, so I saw that as an opportunity.”

Creating an informative and easy-to-navigate website that speaks to your desired clientele can give a positive first impression to visitors who might be learning about your firm for the first time.

Put it into practice: Consider who your clients are and what type of messaging they would respond well to. If you don’t want to do the site-building yourself, find a professional to help you craft a website with a look and feel that aligns with your niche.

3. Gain Trust with Content Marketing

Simply posting general content isn’t enough to grow your new firm.

You want to ensure the content you’re uploading on your website and LinkedIn feed shows you understand your niche to earn potential clients’ trust. As Fletcher puts it, “We want to put out useful content on our blog.”

Try using your content to answer common questions and objections potential clients may have. Create an FAQ page to address frequent client inquiries.

Make your content engaging, and don’t just quote tax law or IRS regulations, but call out your potential clients’ pain points and illustrate how your accounting services can help.

Put it into practice: Reflect on the frequent questions, concerns, and issues you hear from your audience related to taxes. Use these insights to brainstorm content topics for your website or social media. Compose well-crafted and thorough pieces of content that provide tangible value to your audience.

4. Use SEO to Continually Attract New Clients

Once an article starts ranking, it can keep bringing in clients for months or even years after you first post it.

“That’s the amazing thing about content and blogs; you do it once, but they serve you for years and years and years to come,” explains Fletcher.

Creating SEO-optimized content can serve two purposes: educating your audience on tax-related topics relevant to their needs and helping you rank higher on search engines for better visibility.

Put it into practice: Identify keywords to help your content rank for local SEO, like “tax services in {your city}” or “{your city} tax preparation business,” or more general phrases related to the tax services you offer. Be consistent with your SEO-optimized content to start ranking for these keywords, and don’t expect an immediate ROI from your efforts.

5. Use Paid Online Advertising

Investing in digital ad campaigns on Google or social media sites can help you attract more inbound leads for your business.

During our chat, O’Brien revealed that he spends about $1,000 monthly on Google Ads to grow his accounting practice.

O’Brien shares that when set up properly, the number of leads digital ads can provide you with scales with your investment. But, he explains that if the ads aren’t structured correctly, you might attract unqualified leads that drag on the ROI of your overall campaign.

Put it into practice: Research how to structure online ad campaigns targeted to your desired clients. Perform A/B testing on your campaigns to determine which ones provide the best results, and tweak your ads over time to optimize your ROI as you gather more data. Find a reputable digital ads specialist to handle the campaigns if you don’t want to run them yourself.

6. Acquire Other Tax Practices

Acquiring another tax practice can be a quick way to grow your accounting firm by absorbing the clientele of the acquired firm.

If you do proper due diligence ahead of time to find a worthwhile acquisition target, you can set yourself up for meaningful growth post-acquisition.

Be aware that it may take some time to properly onboard the acquired firm’s clients and staff members to your firm.

However, after things have stabilized in the year or so following the acquisition, you can begin optimizing operations and refining service offerings for better profitability.

Put it into practice: Visit BizBuySell or similar brokerage sites to find accounting firms for sale. Vet potential acquisition targets based on factors like cash flow to owner, staff tenure, and service mix to determine if it’s a worthwhile venture and can help your firm grow.

For additional information and tips on acquiring other practices, you can check out our recent article discussing expert M&A strategies for accounting firms.

Tips for Growing Your Team

1. Don’t Delay Hiring Your First Employee

Recruiting your first employee can be stressful, but expanding your team allows you to concentrate on growing your business while they handle client work.

“Employee number one is a tough decision to make for people, but it was probably the best decision I’ve made so far,” claims O’Brien.

O’Brien admits hiring your first employee can require a leap of faith. However, it allows you the flexibility to take a step back from the day-to-day client work and invest your time into scaling your accounting firm.

Put it into practice: Once you have a few steady clients, identify where you’re creating bottlenecks to growth based on your limited capacity. Use online job boards like Indeed to discover qualified talent with the right area of expertise. Expand your search outside your local area and include remote workers to find the best candidates.

2. Get Systems in Place

As your firm grows, build a systemized business that isn’t overly dependent on you or other key staff members to function.

Expert accountant Della Hudson has successfully started and grown sellable firms by only working 25 hours a week. She attributes much of this success to one key factor: systemizing the business so it successfully operates with or without her.

Hudson notes, “My business was highly systemized, and it wasn’t particularly dependent on me.”

As your client base expands and you perform less hands-on client work, it’s essential to have systems and processes in place so all clients receive a uniform level of service, no matter who is working on their account.

Put it into practice: Have systems in place that make it easy for any employee on your team to take over client work if a principal staff member becomes unavailable.

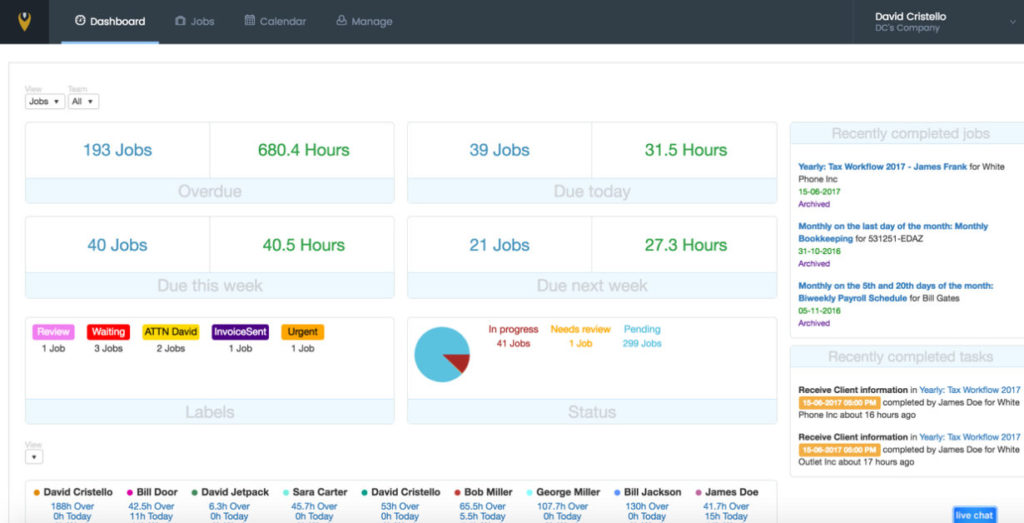

Use an accounting workflow management tool like Jetpack Workflow to create templates or checklists for repetitive workflows you regularly complete for clients. These systems ensure all client work is completed to the same high standard every time.

3. Don’t Wait Until an Employee Is Swamped

After you bring on more employees and continue growing the business, don’t wait until current employees are at capacity to make additional hires. Being proactive with your hiring keeps your team from becoming swamped and overworked, which can prevent burnout and support better staff retention.

A good rule O’Brien uses is to start looking for new hires when employees are at 75% capacity.

Be aware that the hiring process can take a few weeks to a few months. You may not be able to hire new employees to ease your team’s workload as quickly as you’d like.

Put it into practice: Use a points-based system based on the size of clients to estimate staff capacity, not just the number of hours they work. Once your staff has reached a certain capacity level, open up the hiring process so you’re not rushed to make a staffing decision and can find the right candidate.

4. Test the Waters with Contractors

If you’re not quite ready to bring someone on as a full-time employee, start by offering them contract work to ensure they’re a good fit. That’s a model O’Brien used when he brought on his first employee.

Once you determine you work well together, ramp up the work and eventually offer them a full-time position.

As a new firm owner, this helps ensure you’re making the right hiring decisions, as it’s less of a hassle to part ways with a contractor than a full-time employee. It also helps the prospective hire gain trust in your operations as you continue to provide them with steady work.

Put it into practice: Browse platforms like Upwork or Fiverr to find and vet accounting contractors. Start transitioning some of your client work to them on a contract basis to test the waters. Don’t be afraid to test a few contractors until you find the best fit.