11 Key Items for a Month-End Close Checklist (Free Template)

While the year-end closing process is familiar to most due to tax reporting, it’s not the only necessary period-end process a business should have.

The month-end closing process is just as essential, especially if you want to avoid the headache and overwhelm of last-minute error corrections spanning months during tax seasons.

Closing the month can be overwhelming due to the sheer number of tasks that must be handled. Discrepancies in your financial reports could lead to inaccurate data for future decisions, a mistake that could quickly spell disaster for any business.

Fortunately, you can avoid missing details or making mistakes with proper planning and organization. A checklist is essential during the monthly closing process. This article will share why having this checklist is important, the key items to include, and a free template to get you started.

11 Key Month-End Tasks to Include in Your Checklist

A period-end process refers to the end of every accounting period, monthly or annual, when a business generates financial reports to help analyze its financial health. For this to happen, it must organize and perform account reconciliations for the period.

Once you execute this process, you lock or mark the period as completed, ensuring no other transactions can be performed. Because the period-end process has many moving parts, a checklist becomes a vital tool.

A month-end close checklist helps bookkeepers, accountants, and business owners take charge of their business accounting procedures and itemize tasks needing completion before closing the period. In addition, it helps ease the closing process, reducing the chances of mistakes, errors, and missed deadlines.

The contents of a checklist vary between companies and industries. However, the following list outlines the general items your checklist should include.

1. Complete Reconciliations for All Bank Accounts and Credit Cards

A typical reconciliation process for bank accounts and credit cards includes looking for discrepancies between each account and its general ledger counterpart. The two must have the same closing balances. However, this frequently doesn’t happen due to a lack of reconciling items.

The discrepancies could range from uncleared checks and processed payments yet to be debited from your bank account to incorrect or missed transaction entries into the accounting system. Whatever the cause of the difference, the next step is to process the necessary journal entries to make adjustments.

This process helps capture errors in bank or credit card statements or ledger accounts. It also enables you to understand your business’s cash situation and usage and catch any fraudulent activities before they get out of hand.

2. Reconcile The Loan Balance to The Statement

Most businesses use credit to run their operations, especially when purchasing assets for investing in capital-intensive projects. These loans create a liability for the company appearing in its balance sheet.

Since businesses pay more than they borrow, you must record the interest expense as it accrues or gets paid. You must also record the principal repayments promptly to ensure your business reports the proper balance it owes.

That’s where reconciling a loan ledger to the balance in the statement comes in. The process will allow you to stay on top of loans and interest repayments, ensuring you are reporting the correct liabilities of the business.

3. Secure Copies of Receipts for Capital Items

Capital items are an intensive cash outflow for the business. As such, reconciling the assets account allows you to confirm the balance and post the necessary transactions.

One of those transactions is the depreciation expense, which helps you recover the cost of the item over its life. The second transaction is posting and recognizing newly acquired assets into the company’s accounts.

This process ensures the impact of such a transaction reflects on financial statements, such as the balance sheet, cash flow statement, and income statement.

4. Confirm the Suspense Holding Account

A suspense account temporarily holds transactions yet to be classified or discrepancies you need more information about. Because it is a temporary account, any transactions here should not sit in this account for extended periods.

During your month-end closing procedure, take a moment to confirm the entries sitting in this account. It allows you to reconcile and post entries to their correct ledgers.

5. Reconcile the Payroll Account

A payroll account helps the finance or Human Resources team keep track of employee details, such as their names, positions, pay rates, benefits, hours worked, and gross and net pay. Reconciling this account involves confirming its balance with the payroll register.

The goal is to ensure payments to all employees are correct, including bonuses, commissions, and other benefits. It also allows you to confirm that all payroll entries, including accruals, are posted to the accurate ledgers. Finally, it ensures the correct posting and payment of payroll taxes and other statutory deductions.

6. Reconcile the Operating Account

An operating ledger account constitutes the business’s operating expenses, such as marketing, research and development, office supplies, and insurance. Reconciling this account involves verifying the expense transactions for the period, creating the expense report, and posting it in the relevant period.

Doing this ensures you capture the correct expense details, including the amounts and dates. Then the balances in the profit and loss statement will accurately reflect the cash outflows for those operating expenses.

7. Reconcile The Accounts Payable Balance

The accounts payable (AP) balance shows up on your company’s balance sheet for the period as a liability. That figure is simply a representation of any money your company owes to its suppliers and vendors. It’s essential to reconcile the AP ledger and ensure your figures are current and correct.

The process involves getting the AP ledger and comparing its balances with the AP aging report. The details in these accounts must match, including the vendor invoice details, like the invoice number and amount.

Next, investigate any discrepancies and post relevant journal entries to correct the errors. You can also process payments for overdue supplier payments you might have missed during the month.

Reconciling AP helps you discover errors, such as incorrect transaction amounts posted into your system or missing documentation, and allows you to resolve them on time. It also lets you record pending invoices not posted into the accounting system.

If you incurred an expense, but the supplier has yet to send their invoice for payment, you can accrue the transaction and still be current in your financial reporting. Plus, it ensures you maintain a good relationship with your suppliers.

8. Reconcile the Accounts Receivable Balance

The accounts receivable (AR) ledger is the opposite of accounts payable. It shows the money your customers owe your company. In short, it reflects the cash for products or services you sold or delivered and have yet to receive payment from your customers. The period’s balance in the AR ledger appears in your balance sheet as an asset.

To reconcile AR, you can start by requesting customer statements and comparing the data and balances to your AR aging or specific customer account ledger balances.

Next, investigate the cause for these variances, and reconcile them by posting those transactions in the relevant journals. Some common reasons for these variances include incorrect entries, short pays, and unapplied credit memos.

In addition to confirming the accuracy of the balance, reconciling the AR ledger ensures your financial reports are also accurate. It allows you to report correct tax deductions, curb fraud, and maintain a good relationship with your customers.

9. Review Profit and Loss Statements for Proper Class Tracking

The profit and loss account summarizes the company’s income and expense transactions for the period. Its bottom line, the net income, indicates the company’s profits after all expenses, including loan interests and tax payments.

Because of this, it’s crucial to get all the transactions right. Reviewing it allows you to confirm that all transactions were posted in the proper ledgers and that the bottom line correctly indicates your company’s profitability.

10. Review Profit and Loss Month-Over-Month and Investigate Large Variances and Changes

Besides reviewing the proper class tracking of transactions, reviewing the current and previous month’s profit and loss balances is imperative. This exercise helps you uncover significant changes in the profit and loss line items, which could indicate any significant underlying issues such as increased spending, lower earnings, and incorrect transaction entries.

11. Review the Balance Sheet Month-Over-Month and Investigate Large Variances and Changes

In addition to the previous step, you must conduct a month-over-month review of the balance sheet. This process allows you to confirm the balances in the balance sheet line items, which are the assets and liabilities plus the owner’s equity accounts.

Significant changes in the balance sheet line items indicate incorrect or missed postings. It could also signal trouble in your business, especially if the liabilities balance has increased significantly, exposing the company during a downturn.

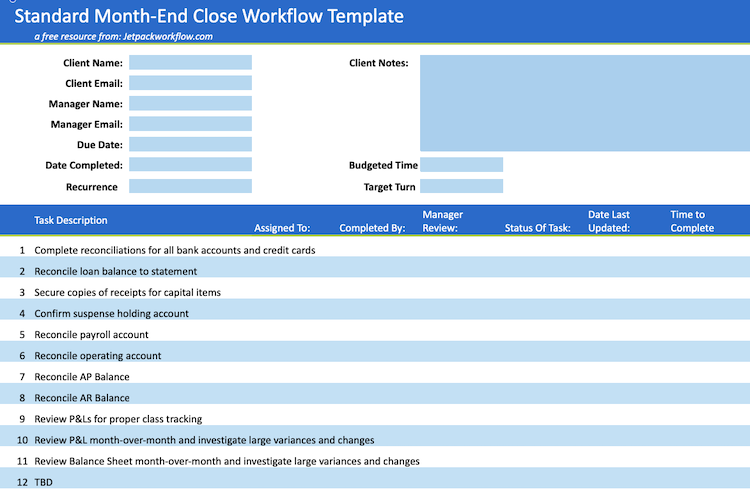

Free Template: Month-End Close Checklist

Creating a month-end close checklist from scratch can be a tedious task. That’s why we put together a free and easy-to-use template for you here, which also includes 31 other customizable accounting workflow templates and checklists.

This free resource includes a ton of the most popular accounting templates including monthly bookkeeping, weekly accounting analysis, client onboarding procedures, and common tax return forms.

Options for Month-End Close Checklist

A month-end close checklist does not come in one form, which leaves you with an array of options for choosing the best format for your business needs:

- One option is a manual pen and paper form. It’s ideal if you’re a small business owner with few transactions. However, doing everything by hand can be time-consuming and tedious.

- The second option is a spreadsheet, such as the above Excel checklist template. Needing less manual labor than a pen-and-paper system, it can be ideal for small to medium-sized businesses. But, it can still be overwhelming to use and manage as your company grows.

- A third option is automation, which is ideal for any business size. Using accounting-specific software with month-end close checklists will take repetitive tasks off your plate, saving your business time and money and improving efficiency.

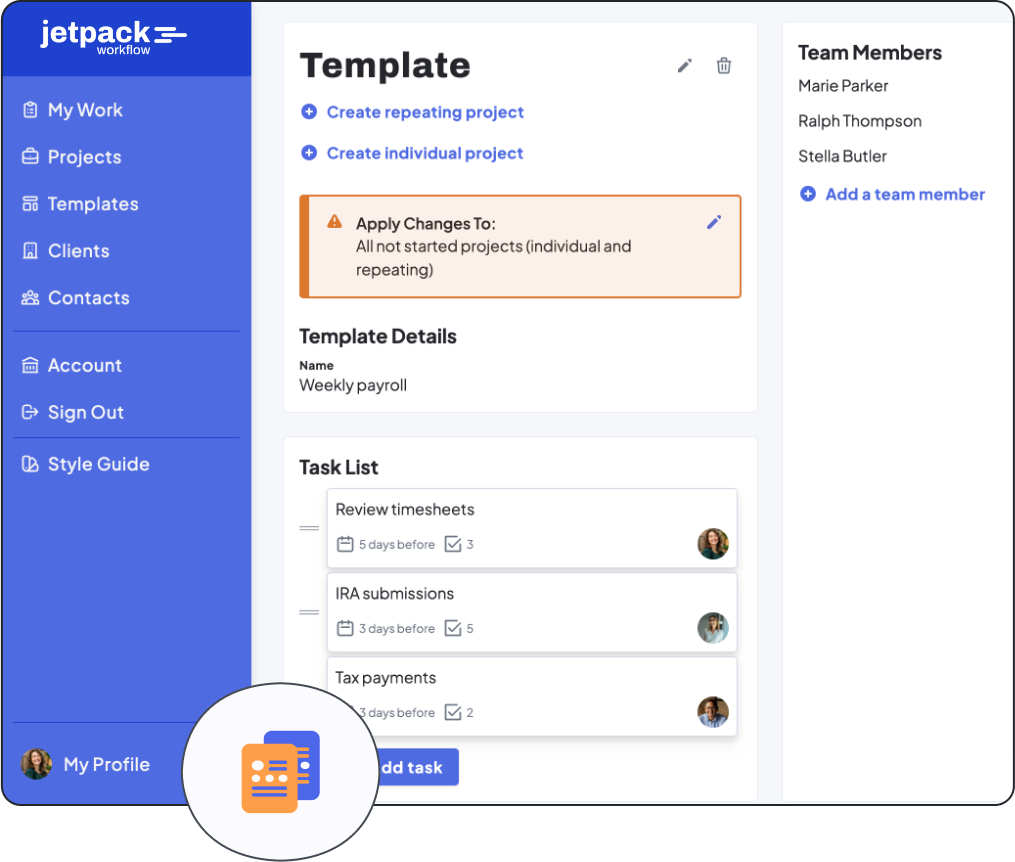

Jetpack Workflow is the ideal solution for businesses seeking to automate repetitive tasks and work more efficiently. Their software offers a comprehensive and affordable suite of tools to simplify the month-end closing process.

In addition to bookkeeping software, Jetpack Workflow offers numerous templates, daily reminders, collaboration tools, detailed reports, and customer service support. Their integrations are virtually unlimited, too, helping streamline the transition for your business.

Learn more about Jetpack Workflow to discover how you can save regain control of client work, save hours of admin time, and make sure critical tasks are never missed again.