How to Retain Millennial Accountants in Today’s Firms

Deb Defer, the Managing Director of Business Services and Outsourcing at BDO, sees how hard it is to retain millennial accountants in today’s fast pace society.

The older generation blames the millennials, millennials blame the older generation. It’s a back-and-forth battle that may not end for another decade or two. Deb isn’t here to make waves, she’s here to help older partners retain the future of their firms.

In this episode of the Growing Your Firm Podcast, David Cristello and Deb Defer dive into:

- How to retain millennial accountants in today’s firms

- The best way to project manage a client and develop solutions so to do your most efficient work

- Her viewpoints on the importance of Artificial Intelligence (AI)

How to Solve Your Client’s Problems Right Now:

Deb Defer, Managing Director at Business Services and Outsourcing at BDO (one of the largest firms in the US) was a Top 100 ProAdvisor in 2016 and 2017. Part of the reason she got there was she knows how to take care of her clients.

At BDO, they have branches for assurance and tax. Now, they’re growing out their consulting side and Deb gets to spearhead that. With her job, she gets to build relationships with future clients and also gets to study the new technologies bubbling up. 20% of her work is project-based. Here she is discovering client problems and designing solutions that she then helps implement.

This has made her an expert in solving your client’s problems right now.

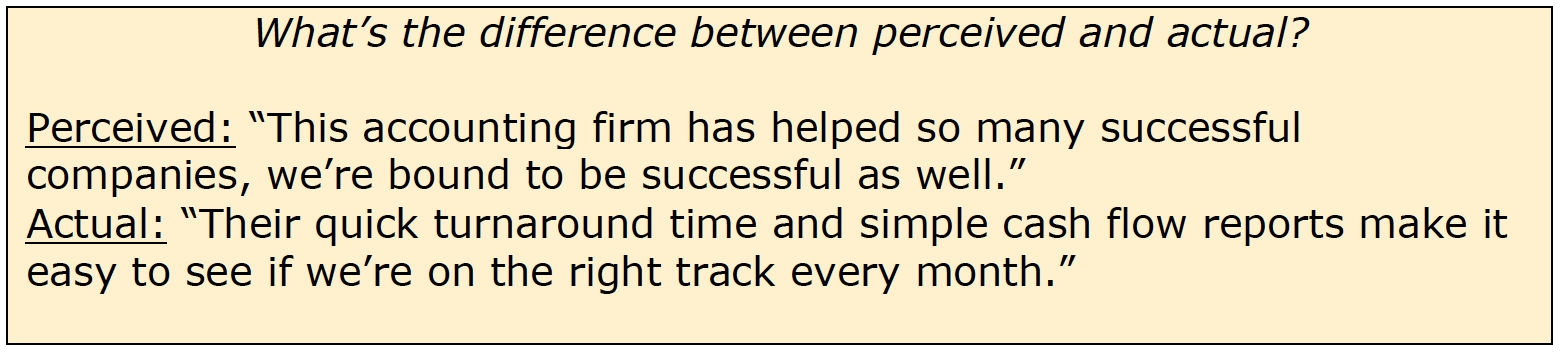

Her best piece of advice is somewhat a gut punch…she recommends taking a ‘listening course.’ While we like to think clients all need what you’re selling, it’s not so. The very first skill you should build is understanding where your client is at this moment, then what does the client understand about their own business. After that, they need to know how to utilize systems to get better.

Notice, none of what was listed has anything to do with talking about your services or firm.

What may seem like common knowledge for you, isn’t for your clients. Deb reports 32% of business owners have little to no automation in their business. That’s 1/3 of businesses in the country that need help implementing solutions.

DAVID’S TIP: It’s tempting to think ‘inward’ when developing solutions, but really, to solve your client’s problems, you need to look ‘outwards.’

Deb’s admitted she learned these valuable tips from mistakes she’s made herself.

Her steps to begin a client relationship and listening go like this:

- Ask: “What are your pain points?” — listen to the answer without trying to solve them

- Ask: “What do you feel is keeping your business from moving forward this year?”

- Ask: “What’s keeping you up at night?”

- Know that it takes time to get comfortable asking these questions and listening without judging

How to Develop the Right Solution for Your Client:

There’s an easy way to uncover the right solution for your client after you actively listened.

First, Deb shares a story. She had a woman walk up to her and ask about helping with the lady’s daycare she ran. This woman needed a timestamp for each child to report to a state program. The problem was: this woman was doing it all manually and it was hard to organize. Parents had to sign things…it was a mess. Deb didn’t know a specific system, but she had a software in mind that she recommended. Turns out, the software was a perfect fit.

Now, the moral of this story is the answer to developing the right solution for your client…KNOW THE END RESULT BEFORE YOU DO ANYTHING.

If the woman asked “how do I manage a daycare?” She would’ve received much different recommendations than if she had a specific result in mind. That specific result focuses your search for a solution to problems. Too many times, we get sucked down rabbit holes thinking we have a solution when it doesn’t address the main pain points.

Define the pain point…define the ideal outcome before you do anything.

This approach might be most prudent when it comes to finding out how to retain millennial accountants in today’s firms.

How to Retain Millennial Accountants in Today’s Firms

Deb works at BDO…one of the largest firms in the US. She gets a good view of all the talent that comes in then goes out. Millennials right now are the talk of the town as they don’t seem to stick around much.

Deb reports 60% of millennials are looking to jump jobs right now. 21% have already changed jobs in the past year. Most will have 4 jobs by the time they’re 32.

This goes without saying…the job market has shifted incredibly in the past 20 years. Loyalty to a job and firm is thinner than ever in history.

Deb starts with an obvious misconception: Millennials are packing their bags due to money. They may claim it is, but that’s not the main issue.

Here’s what they need…they need to feel their work makes a difference. To start, you need to give them the equipment that will help them succeed. If they feel they don’t have the right tools, they’ll become unhappy fast. Make sure you’re giving praise as tasks are completed. In accounting, it’s easier to stay stuck in only looking at the ‘wrong’ things done. Mention the right things done correctly.

Business owners run into problems because they don’t understand the millennial talent pool. These are the future of your firm. You can’t go wrong investing in new processes and products, but ultimately, the people will pull your firm through the hard times.

Millennials need to feel they are improving and learning at their work. It’s tempting now to avoid hiring them as the average is to spend $5,000-$8,000 the first year of a new hires tenure. Don’t shortcut on those training dollars, Deb recommends.

At BDO, they have “BDO U” which is an online locker of courses and ways to gain educational credit. They can get leadership training, new management training and more.

They also get access to a career advisor. These advisors provide checkpoints along the way. Having this open communication is important to millennials as it gives them a hope for a better future plus they feel they’re in charge of their destiny.

It’s not easy by any means. It also doesn’t mean to entirely ‘cater’ to the new generation. But it would be prudent to accept that things will change.

You must be ready to accept them when they do or else risk becoming obsolete.

Artificial Intelligence (AI):

We will touch on this briefly as Deb discusses it during the interview.

Deb believes AI is coming fast into the accounting world. Those who don’t adapt will die. Lack of embracing change can be a struggle for sure.

However, Deb reports that 90% of the data in the world has been created in the last 2-3 years. Machines are going to be helping us. It will be the norm in the next 10 years.

To help with the volume of data, you’ll need to uncover the right tools that will help you analyze said-data most efficiently.

Make sure you look for tools with the end in mind.

If you want to talk more with Deb yourself, send her an email at ddefer@bdo.com.

She will also be speaking at “Scaling to New Heights” in 2018. Check her out there.