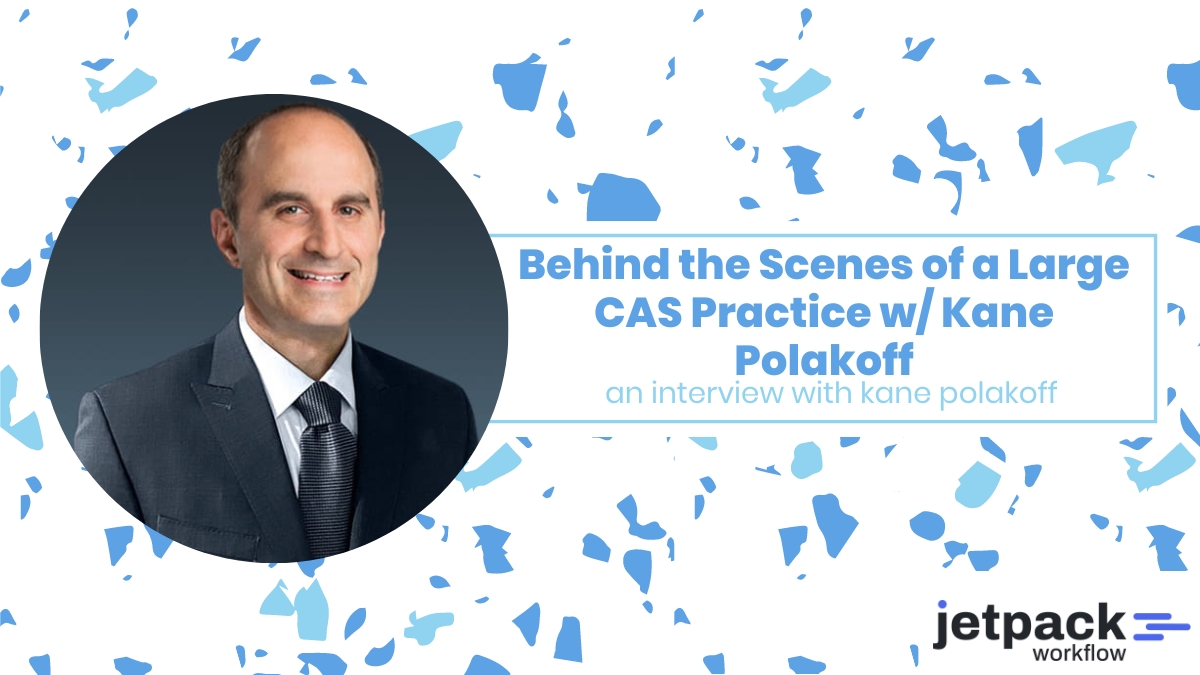

Behind the Scenes of a Large CAS Practice w/ Kane Polakoff

Podcast

Summary

Today on the Growing Your Firm Podcast, David Cristello sits down with guest Kane Polakoff, a principal client advisory services practice leader at CohnReznick. They delve into the world of client advisory services, discussing how to scale it, the tech stack involved, and the execution for high performance.

Kane’s extensive experience working with various organizations in advisory capacities brings a wealth of knowledge to the conversation. Join them on this exciting journey into the realm of client advisory services.

What you’ll learn

The listener will learn about client advisory services, scaling, tech stack, executing in a high-performance manner, focus on verticals, building proposals, collaborating with clients, communication, coordination, capacity building, API automation, financial metrics, resource allocation, talent crunch, and industry insights.

Guest Bio

Kane Polakoff is a seasoned professional with over 28 years of experience in the consulting industry, specializing in business process outsourcing and client advisory services.

Throughout his career, Kane has demonstrated a deep commitment to providing innovative solutions to clients by leveraging accounting platforms, talented individuals, and efficient processes. His focus on the mid-market sector, particularly in verticals such as real estate, hospitality, not-for-profit, and renewable energy, has allowed him to establish himself as a leader in the field.

Kane’s extensive experience includes working with prominent organizations such as CPA.com, Intuit, and Bill.com in advisory capacities. As a principal client advisory services practice leader at CohnReznick, Kane has played a pivotal role in driving the growth and success of the firm. His involvement in various industry alliances and boards showcases his dedication to staying at the forefront of industry trends and technologies.

One of Kane’s key philosophies revolves around the idea of building strong client relationships and providing tailored solutions that meet their specific needs. He emphasizes the importance of understanding each client’s unique challenges and goals, whether it involves deploying new technology, enhancing automation, or improving financial processes. Kane’s approach to client advisory services goes beyond traditional bookkeeping, focusing on driving automation, financial statement reporting, and decision-making support for clients.

Kane’s leadership style is characterized by a focus on talent development and capacity building. He believes in hiring and training top-tier professionals, empowering them to deliver exceptional service to clients. By creating a collaborative and supportive work environment, Kane ensures that his team is equipped to handle the dynamic demands of the industry and provide innovative solutions to clients.

In navigating the talent crunch and evolving industry landscape, Kane has demonstrated a keen ability to adapt and thrive. His commitment to continuous learning and staying abreast of industry developments has positioned him as a thought leader in the client advisory services space. Kane’s reputation for delivering high-quality services, building strong client partnerships, and fostering a culture of innovation sets him apart as a respected and influential figure in the industry.

Overall, Kane Polakoff’s career trajectory and achievements underscore his deep expertise, strategic vision, and unwavering commitment to excellence in client advisory services. His philosophy of driving automation, leveraging technology, and prioritizing client satisfaction has solidified his reputation as a trusted advisor and leader in the field.

Synopsis

Leveraging Industry-Specific Tech Stacks for Optimal Client Advisory Services

In a recent podcast episode, Kane Polakoff highlighted the importance of utilizing industry-specific tech stacks to enhance efficiency and effectiveness in client advisory services.

Here are key takeaways from the episode that underscore the advantages of leveraging industry-specific tech stacks:

- Tailored Solutions : Kane emphasized the need for tailored software and tools to meet the unique requirements of different industries. For instance, real estate clients may benefit from using Yardi or AppFolio for property management, while manufacturing clients may require specialized manufacturing ERPs. Customizing the tech stack to the industry enables firms to deliver more effective solutions.

- Increased Efficiency : Industry-specific tech stacks facilitate streamlined processes and improved efficiency. Automation tools designed for specific industries can reduce manual tasks, enhance accuracy, and save time. For example, implementing automation in accounts payable or bank reconciliation can significantly boost efficiency in transaction handling.

- Enhanced Client Experience : By utilizing tech stacks tailored to specific industries, client advisory services can offer a more personalized and effective experience to clients. Tailored solutions aligned with industry requirements lead to better outcomes and increased client satisfaction.

- Expertise and Knowledge : Demonstrating a deep understanding of industry-specific tech stacks showcases expertise and knowledge in client advisory services. It reflects a commitment to providing specialized solutions that address the distinct challenges and opportunities within different sectors.

- Scalability and Growth : Industry-specific tech stacks support scalability and growth within client advisory services. With the right tech tools in place, firms can efficiently manage and serve diverse clients across various industries while upholding high service standards.

In conclusion, leveraging industry-specific tech stacks is essential for optimizing efficiency, delivering tailored solutions, enhancing the client experience, showcasing expertise, and supporting scalability in client advisory services. By aligning technology with industry needs, firms can provide exceptional service and drive success in the dynamic landscape of client advisory services.

Building and retaining a strong team is crucial for scaling and achieving success in client advisory services.

In the podcast episode, Kane emphasized the importance of hiring the right leaders, managers, and staff to establish a solid foundation for growth. He suggested hiring leaders capable of overseeing different verticals within the client advisory services practice. By having industry-specific managers, the team can cater to the unique needs of clients in sectors such as real estate, manufacturing, or not-for-profit.

Kane also discussed the significance of capacity planning and maintaining a balance between workload and team size. He stressed the importance of staying ahead of the game by ensuring sufficient capacity to handle the workload, especially in a rapidly growing field like client advisory services. This involves scheduling weeks in advance, monitoring utilization, and taking a proactive approach to hiring and training new team members.

Moreover, the episode touched on the challenges of talent acquisition in the industry. While there may have been a talent shortage in the past, Kane noted that the market is evolving, with a growing interest in client advisory services among professionals from other accounting disciplines. This shift presents an opportunity to attract experienced individuals, including CFOs with years of experience, to join client advisory teams.

The insights shared in the episode underscore the critical role of building and retaining a strong team in the success of client advisory services. By hiring the right talent, maintaining a proactive approach to capacity planning, and adapting to the changing landscape of talent acquisition, firms can position themselves for growth and excellence in the field of client advisory services.

Communication and client satisfaction are crucial elements in maintaining successful client relationships and delivering high-quality client advisory services. In the podcast episode, Kane emphasized the importance of effective communication and client satisfaction. Here are key points from the episode that highlight the significance of these factors:

- Client Needs Assessment : Kane discussed the process of conducting a needs assessment with clients to understand their requirements and pain points. This initial step involves engaging with clients to identify their specific needs, whether it’s deploying new technology, addressing staffing challenges, or providing training and oversight. This communication helps establish a clear understanding of client expectations and sets the foundation for service delivery.

- Client Engagement and Collaboration : Kane highlighted the importance of collaborating with clients to provide tailored solutions based on their individual needs. By engaging in regular communication and working closely with clients, advisory service providers can ensure that they are meeting client expectations and addressing any concerns effectively. This collaborative approach fosters a strong client-advisor relationship built on trust and transparency.

- Client Feedback and Monitoring : The episode emphasized the significance of client feedback and monitoring client satisfaction levels. Kane mentioned the practice of conducting quarterly reviews with clients to evaluate the success of the services provided and address any areas of improvement. By actively seeking feedback and monitoring client satisfaction, advisory service providers can continuously refine their approach and ensure that clients are receiving value from the services.

- Client-Centric Approach : Throughout the episode, the focus was on putting the client’s needs and satisfaction at the forefront of service delivery. By prioritizing open communication, understanding client pain points, and delivering solutions that align with client goals, advisory service providers can enhance client satisfaction and build long-lasting relationships. This client-centric approach emphasizes the importance of effective communication in delivering successful client advisory services.

By prioritizing client needs, engaging in collaborative communication, seeking client feedback, and adopting a client-centric approach, advisory service providers can ensure that they meet and exceed client expectations, leading to long-term client satisfaction and business success.

Timestamps

[00:00:59] Client advisory services evolution.

[00:07:39] Friction between departments.

[00:08:54] Keeping partners involved in the process.

[00:11:51] Crafting client proposals.

[00:15:29] Capacity planning for scaling business.

[00:20:08] Managing client relationships for success.

[00:24:30] Industry-specific tech stacks.

[00:26:25] Replicating the recruiting mindset.