How To Build a Better Workflow for Your Accounting Practice: The Jeff Borcshowa Interview

This week, we’re excited to release our latest interview with Jeff Borschowa, thought leader and innovator behind DreamPractice.

Too many accounting firms put their workflow on the backburner as they deal with the day-to-day things. Well, Jeff is going to show you how to do both.

In this interview on the Growing Your Firm Podcast, David Cristello and Jeff Borcshowa cover how to build an efficient accounting practice as well as:

- A quick way to pick up and track competitive intelligence among your competitors

- How to build out operational efficiency and practice workflow without burning out or becoming overwhelmed

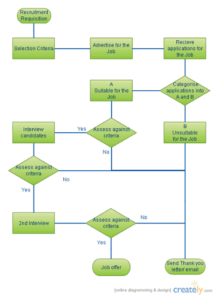

- The system for both mapping out better workflow and how to optimize it through the Eliminate, Automate, Best Person, or Streamline approach

- How to identify which process or workflow needs your attention immediately (and much more)

Click below to listen to the whole interview:

Enjoy the interview? Click here to share a tweet

Action Item of the day: Are you stuck writing the same emails over and over (and over) again? Create an email template! Focus on creating one email template a day and in a few weeks, you’ll regain hours lost in individually crafting the same email over and over again 🙂

ADDITIONAL LINKS:

- Click Here to Get a free copy of Jeff’s Book “8 Pillars of Exponential Growth for Accountants” today!

- Connect with Jeff on Linkedin

- DreamPractice Website

- Followup.cc

- StreakCRM

- XMIND

- JING

- BBFlashback Express

- Retain top talent with better work-life balance (interview)

The Trouble with Partners in Accounting Firms:

Jeff Borcshowa, founder of DreamPractice, came across Jetpack Workflow after we sent him a marketing email of all things. Most folks get sales and marketing messages and immediately delete them.

Jeff welcomes them with open arms. Marketing emails are the shortcut to research. You get to see what other firms and those in the industry are doing. Too often we put ourselves in a bubble and block out what others do.

Or, worse…we simply copy what others do. Keeping your antennas up can provide some huge benefits to your firm.

They can alert you what competitors are doing poorly. Again, most firms are lazy and copy each other, thus if one is doing something poorly, they all likely are.

Put your own spin on it.

Back to Jeff and the email from Jetpack…

He then reached out to us to tell us about his new book, “The 8 pillars of exponential growth for accountants.” He was interested in our approach because most accounting firms and those in our industry are terrible at it.

Worse…they don’t do it.

The big reason being the partners in the firm don’t make it a priority. In fact, Jeff believes the top dogs in your firm are the bottleneck for most changes needed. They are afraid to give up control and don’t trust their staff to execute.

The truth is you can’t build value if you don’t have a system.

DAVID’S TIP: We think as executives that we are the only ones that can solve pain points. That’s what causes the bottlenecks. Instead, what small pain points can your team start taking care of today?

The pushback Jeff sees from partners is when he hears “well, our clients are unique.” In accounting, it’s all an assembly line…

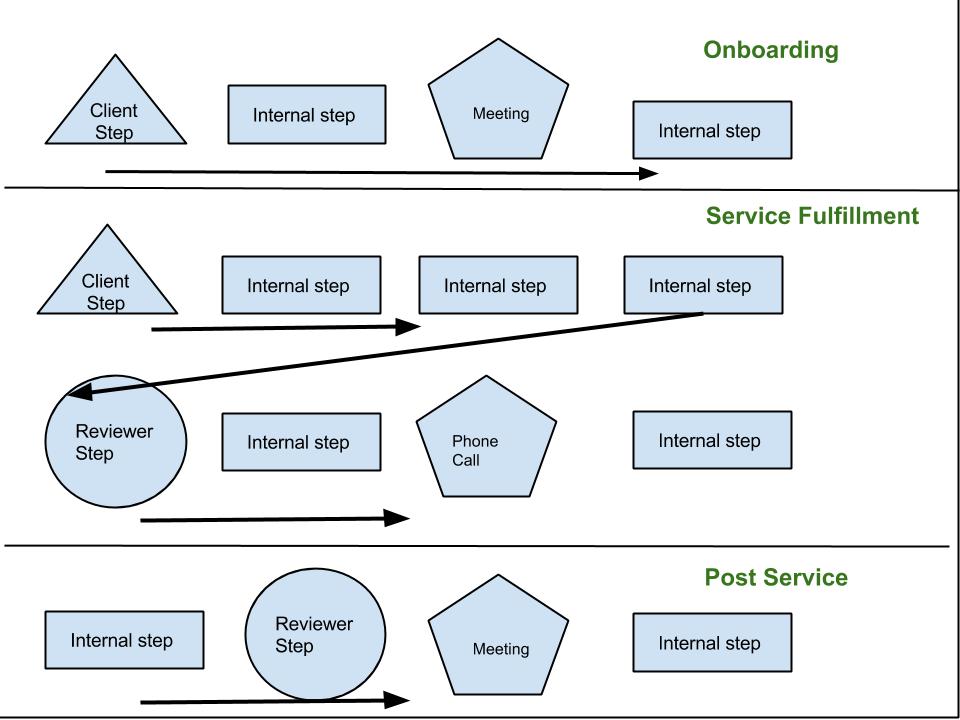

GET WORK —> DO THE ACCOUNTING WORK —> SEND TO QUALITY CONTROL —> SHIP TO CLIENT

No matter how you slice it, this is what accountant’s workflow looks like.

For an executive, they shouldn’t be on the assembly line trying to fix little problems. They should be looking down from a 30,000-foot view and seeing where they can improve the process and workflow. That’s all.

Bettering your workflow can greatly cut down the hours of your team (they will love that).

The Tools That Could Better Workflow in Your Firm Almost Overnight

To better your workflow, it’s going to take some conscious efforts. It doesn’t happen overnight nor does it happen without thinking.

Jeff sees the biggest mistakes firms make is they think workflow will better itself by ‘doing’. Instead, if they took an extra 15 minutes per day to come up with scripts and templates for regular, everyday tasks, they’d save thousands of hours over their lifetime.

A good way to start automating workflow is with your inbox.

You can begin using templates for: missing client information, unpaid bills, finished work, follow up and more.

Jeff recommends Followup.CC. This program pushes emails to the top of your inbox that you need to follow up on. This saves you time sorting through clients to see what to do next, plus finding emails to follow up on. You simply click Followup.cc on a client to remind you of them later.

It also can create templates to ask for the missing items I mentioned before.

With one of Jeff’s clients, their receivables almost disappeared overnight thanks to a template. What they would do is when they sent a templated email about ‘your file is ready,’ they’d also have a blurb with ‘and here is your invoice.’ Thus, the next time the client came in, they were already ready to pay rather than forgetting their checkbook etc. In fact, 20/20 clients they tested on paid their invoice at the next meeting.

DAVID’S TIP: At Jetpack, we use StreakCRM. It has free and paid features. One of features allows you to template an email after sending it. Thus, the next itme you send a similar email to a client, you simply pull up the template and insert it.

Jeff says the point is to save a few minutes per day hundreds of times over in the next year.

Accountants, unfortunately, try the ‘all or nothing’ approach to fixing these issues. Instead, start with the low-hanging fruit and go from there. It gets the ball rolling down hill.

The key point to keep in mind is “how can we automate everyday tasks?”

Because in accounting, you’re typically doing the same thing again and again despite what you think.

Start with mind-mapping all the tasks. Jeff uses XMIND — a mind-mapping software to brainstorm.

Another example is to use video as much as possible. Pictures say a thousand words. If you’re doing training for new accountants, forget the checklists and written outlines. Have your top performers screen record them doing the task with audio on what they’re thinking while doing it. Use BBFlashback Express for this.

Here at Jetpack, we use JING for screen recording software.

You can also use video for your sales presentations.

When most firms meet a potential client, they must spend a long time explaining about the firm and its processes. Then, at the end, you squeeze in a bit of time to talk about the potential client’s business.

What if, instead, you had a professional 5 minute video done talking aall about your firm and your ‘secret sauce.’ Thus, the potential client is pre-sold when they enter the room with you.

Jeff’s found this actually made the close rate for the sale almost 100%.

When you pre-qualify a candidate — in this case through a video because the prospect knows what to expect of your firm — you aren’t wasting time selling to bad clients plus you’re already pre-sold to them when they enter the room.

It all comes down to being more efficient. You can’t run yourself ragged or else you’ll crack at some point. ‘Hustling’ works until it doesn’t. You need your rest, you need your downtime.

Automation of your workflow helps this.

Consistency is what will get you to where you want. You’re a marathon runner. Nothing changes in one day of training. But, over the course of weeks, you see vast improvements.

How have you bettered your workflow in the past?