Bookkeeping Client Onboarding Questionnaire: Free Template & Questions to Ask

Accountants and bookkeepers enjoy nothing better than solving problems. It could be finding the 10-cent variance that keeps their books from balancing or scouring through financial records to save the company a few dollars.

As hard as it may be to believe, sometimes onboarding a new bookkeeping client can be the most challenging thing a bookkeeping firm does.

What should you ask? Will you make a positive lasting impression on the client? Will your firm meet the client’s expectations? How long should the onboarding process take? What questions should you raise?

That’s where having a client onboarding questionnaire comes in handy. It serves as a guide to asking the right questions for better decision-making when structuring the services you can offer the client. It also helps you get right to the point and zero in on opportunities to address necessary concerns.

This article looks at what a bookkeeping client onboarding questionnaire is and provides you with the most important questions to include in your questionnaire. Better yet, we offer you a free downloadable template!

What is a Bookkeeping Client Onboarding Questionnaire?

A bookkeeping client onboarding questionnaire lists the firm and potential client’s questions and concerns before the relationship begins. It allows the firm to gather information about the new client, from the essential bookkeeping bits of the company to the most challenging tax, accounting, and operational aspects of their business.

This way, you are always aware of the needs of your bookkeeping clients before undertaking the onboarding process. These insights will also help you structure the handling of their bookkeeping needs.

Essential Questions to Ask on Your Client Onboarding Questionnaire

Onboarding a new client is very much like an interview. You want to know about them as much as possible within a short span while allowing them to expound more about their business and accounting situation. Having a list of questions ready ensures you achieve each of these goals.

Start With The Basics

As much as you want to know everything about the new clients’ accounting dealings, you should understand their business first. It’s similar to when you are in an interview and are asked about yourself, your career, education, etc., at the start of the interview.

Start with the basic questions and concerns like:

1. What the client’s business entails

The first thing you want to know about the client is the name of their company, address, and what it does. Are they in the manufacturing industry, hospitality, or commercial? It is crucial to keep in mind that this should be an open-ended question, and they can explain what products or services the company sells in detail. If the onboarding process is online, provide the client with an opportunity to type the answer rather than choose from a list.

That said, you can still use a dropdown list of possible answers. This might be more of a hassle for you to write up. Or allow the client to choose from dozens of possibilities. On the other hand, a dropdown list of possible answers could reduce your workload.

2. What is the company’s entity type?

Different types of business entities affect the business’s bookkeeping, accounting, and tax reporting structures. Therefore, it is essential to know whether the new client’s company operates as a sole-proprietorship, partnership, an LLC, C-Corp, or S-Corp.

3. How long has the client been in business?

A relatively new business will have different bookkeeping needs, like setting up the bookkeeping software, payroll software, and inventory management system. Older companies will mostly have a bookkeeping system in place. The aim is to set up a new checklist of bookkeeping items to request depending on the business’s longevity and existing bookkeeping system.

4. Information for the primary contact person

You don’t want to miss your clients’ tax and financial reporting deadlines because you can’t reach someone. That’s why it is critical to have a contact person whom you can call, text, or email whenever you have a question regarding the client’s bookkeeping.

5. Is the client expanding or downsizing?

Most companies have short, medium, and long-term plans. They know whether they want to expand into new territories, launch new products or services, downsize, or perhaps a merger or acquisition is in the works. Possibilities like these allow your firm to act as a financial advisor rather than just a bookkeeper.

For example, you could offer services like:

- Financial forecasting and modeling

- Preparing key financial reports

- Providing needed research about the project

Learn More About Their Current Bookkeeping Situation

Depending on how long the company has been in existence, it might already have a bookkeeping system in place. Knowing if they have a current accounting system and how it works gives you an idea of how well-organized they are or whether you will be spending a lot of extra hours cleaning up books in the coming months. Or, perhaps, setting up a whole new system for a startup.

Your bookkeeping checklist template must have all the necessary aspects of bookkeeping, from payroll to inventory, tax, and banking, to name a few.

Here’s what to include in your questionnaire:

1. Is the client currently using bookkeeping software?

Not all businesses use bookkeeping software. If your new client already uses one, it’s best to know the particular system. For example, if they use QuickBooks, you must inquire whether it’s the desktop or QuickBooks online version.

2. How many employees do they have?

Knowing from the onset whether your client has employees, how many, and whether they provide benefits will allow you to create a bookkeeper checklist that considers all payroll management issues.

While at it, ask the client how they manage their payroll. Is it handled in-house, or do they use subcontractors? Do they have payroll software? What is their payroll schedule?

Apart from understanding the client’s payroll situation, it shows them you are knowledgeable about different payroll systems. It also shows you can adapt to their particular payroll needs.

3. Do they have inventory?

Inventory management can be demanding and requires in-depth skills and knowledge. Understanding your client’s inventory situations helps you provide the best inventory management services, if needed.

However, you need to know more than whether they have inventory or not. You must get more specific answers to various questions, like:

- What type of inventory do they have?

- The volume of inventory – provides you with answers about the expected workload.

- Is inventory part of the balance sheet or an expense?

- Do they use any inventory management system? If yes, which one?

4. What is their sales volume?

It will give you a sense of their accounts receivable situation and workload. It would also be best to ask whether they have a separate system for billing clients. Some companies use different software to manage and send invoices that might or might not be integrated with their bookkeeping software.

5. Are they reporting sales or use tax?

Like inventory management, sales tax reporting requires specialized knowledge and skills. First, not all goods or services qualify for sales tax. Second, the work is demanding; it requires ongoing management of vehicle logs, capital asset activities, and any relevant documentation with sales tax. Finally, the rates can vary between different products and states. During the initial consultation process, it is essential to know this to prepare your team for the workload and match the client’s tax timelines.

Questions to ask regarding their sales tax include:

- How often do they file the taxes – monthly, quarterly, or annually?

- Do they do the filing in-house, or do they already have a third-party accountant for this?

- Are they up to date with their filings?

- Have they ever been audited or received a notice of an upcoming audit?

6. How many vendors do they pay each month?

Every business has vendors to pay. It could be just the utility company, rent for the leased office space, or a car lease. There is a possibility some of the vendors are paid regularly, and others are paid once or twice a year. So, what will be the bookkeeping workload when it comes to the company’s accounts payable? There is only one way to know this—asking about their average monthly vendor invoice processing.

7. How many bank accounts do they have?

Some companies will only operate with one bank account; others will have two or more for various reasons. The more bank accounts, the greater the workload in terms of data entry and bank reconciliations. Speaking of which, how often do they reconcile their accounts? The sooner you know how many accounts the company has, the better your bookkeeping firm can prepare for the workload. It is also essential to see if they have a primary banker in the event of multiple bank accounts.

8. How many credit card accounts do they have?

Second to bank accounts are credit cards. Many businesses use them for convenience and to build credit scores. For example, it is easier to make purchases for some items using a credit card than transferring funds between bank accounts or waiting for a check to clear. In addition, the more the business uses its credit cards and pays the balances on time, the more it bumps up its credit score. It can make it easier for them to access credit when the time comes.

That means the company must be on top of every aspect of their credit cards, from repayments to reconciliation. In addition, if they have multiple credit cards, you will have more work than when dealing with only one or two.

Ask About Their Pain Points

This question helps you know what keeps them up at night regarding their business. Asking the client about their pain points will allow them to expound on their current bookkeeping and business issues, if any, why they require bookkeeping services, and the future they envision for their business.

Some of the crucial questions to ask are:

1. What does success mean to the client?

When they think about success, especially the success of their business, what comes to mind? This is where the clients open up about their dreams, goals, and ideas. While this sounds like a personal question, it helps build a personal connection with the client. It shows you are not just looking to increase your billable hours but that they are a client whose business matters.

2. What are they most proud of in their business?

Apart from building rapport, this question can help you learn more about the company. For example, issues like business operations, its vision and mission, and employee management could come up in such discussions, giving you a better glimpse of what you will be dealing with.

3. What challenges are they facing?

If they are looking for a bookkeeper, they need help with something. Is it data entry, billing customers, recording payments, reconciliations, or payroll management? Keep in mind that while a client might be looking for bookkeeping services, they may also need other accounting services.

Unlike bookkeepers, whose roles are more administrative and transactional, accountants provide more insights into the business’s finances. Therefore, it is best to allow the customer to explain what challenges they are facing. This way, you can gauge whether their needs are also on the accounting side of things and whether you can help. These could range from tax filing and planning to reviewing financial reports, auditing, and business advisory.

4. Are there any regulatory issues pending?

It is not uncommon for companies to have ongoing challenges with various regulatory bodies, from the IRS to labor bodies. Including this question allows you to prepare beforehand to help them sort it out. Believe us; most companies want to pass these headaches to professionals like you. The earlier your client knows you can take this off their plate, the more meaningful your relationship will be should they face any regulatory challenges.

5. What is their debt situation?

Is their business drowning in debt? What is their creditor’s aging report? Understanding a new client’s debt situation allows you to offer more financial advisory services, like debt management, building their credit score, and working on a debt repayment plan that ensures their business stays above water.

A Free Client Onboarding Questionnaire

Creating the bookkeeping onboarding questionnaire from scratch can be overwhelming, considering the amount of information required to onboard a new bookkeeping client. That’s why we have a free downloadable for you.

Download your free client onboarding questionnaire.

BONUS: Free Bookkeeping Client Onboarding Checklist

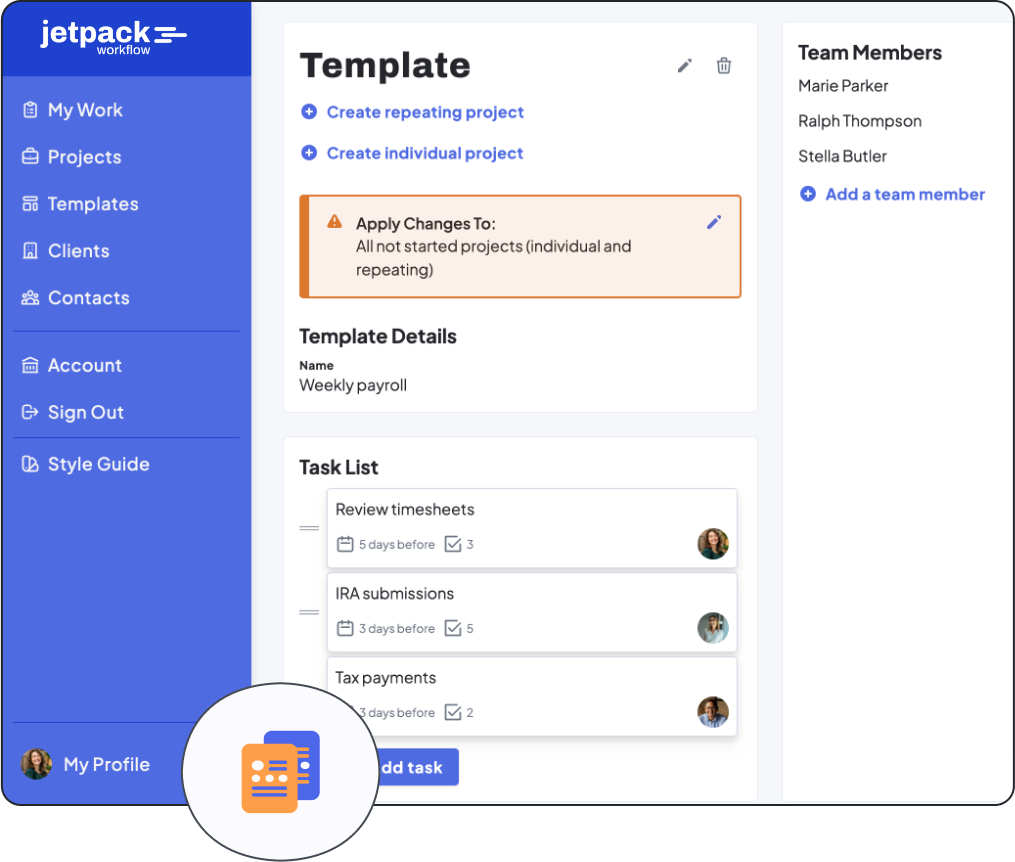

If you’re looking for simple workflow templates to stay on top of onboarding new bookkeeping clients, you can download one for free here. It also contains 31 other free accounting workflow templates to help you run your business more efficiently.

Tools to Make the Questionnaire Completely Digital

Going digital with the onboarding process simplifies the process and makes it straightforward for your potential clients.

Some ways to make the questionnaire completely digital include using software systems like Google Forms and Typeform. These provide online form building services where you can get pre-built templates. Your clients can also choose answers from pre-filled options, reducing the time and energy needed to give you the necessary information without such a digital platform.